A Generational Opportunity?

Market participants are utterly confused, as carnage in broader equity markets has driven extreme fear, while the index has barely budged and is at striking distance of all-time highs.

The Fear and Greed Index entered the extreme fear zone on Thursday, just before we saw a massive rebound yesterday.

In fact, Dow Jones has been on a one-way up and touched all-time highs.

It’s on a historic spree, as we will likely close up this month, marking the 10th consecutive green candle for the Dow.

Guess what?

This was last seen in 1958-1959.

Yes, what we are witnessing is not a risk-off/risk-on move, but a massive de-grossing of the overowned tech names and a rotation of billions of dollars of capital into value/real economy stocks.

There is a macro reason behind it, which we will explore in detail with charts later.

We were fortunate to be invested in the right place at the right time, and as a result, we have begun the year with a bang.

We are up 3.4% YTD and have beaten the benchmark for the most of 2026.

Let’s begin today’s newsletter and examine the cross-asset movements with a macro lens!

US/Equities/Bonds/Gold/Silver/BTC/Oil/Dollar!

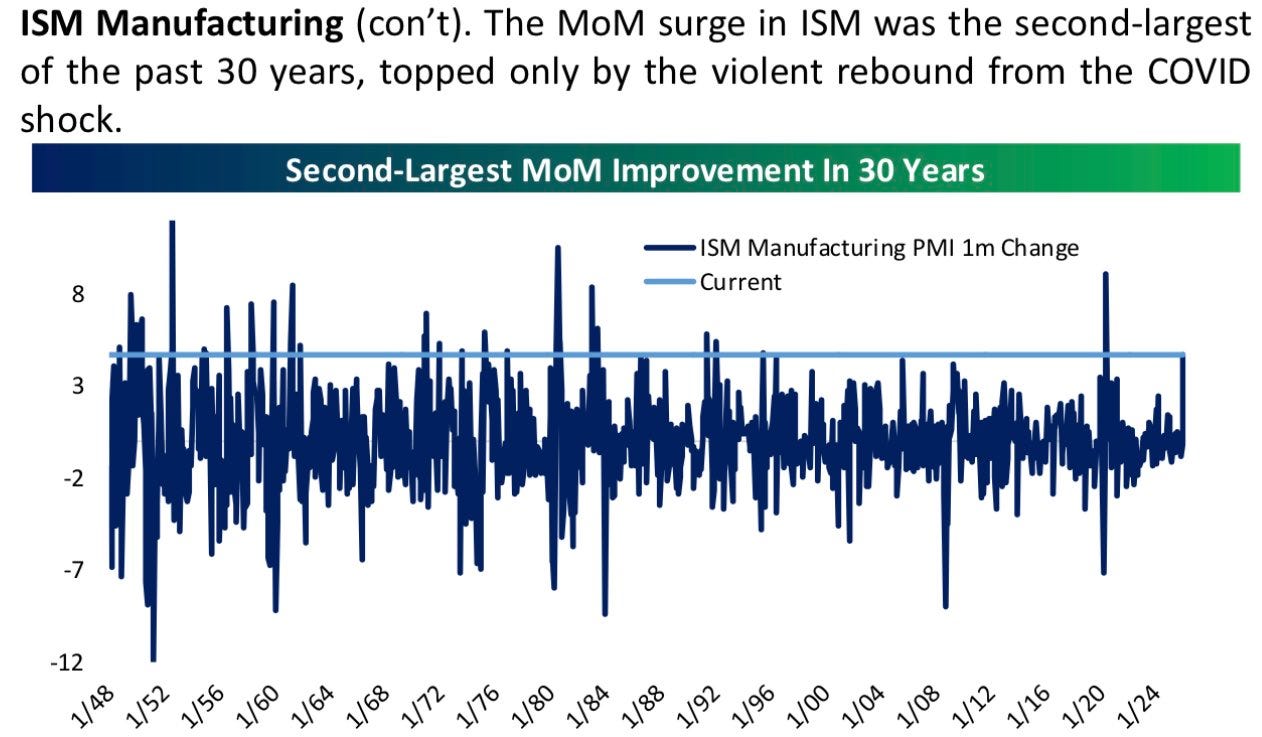

Our favourite measure for tracking cyclical activity in the US is the ISM Manufacturing Index, which has successfully predicted the peaks and troughs of past business cycles.

ISM Manufacturing massively surprised on the upside.

It was an all-around beat with every sub-component (ex- employment & inventories) registering expansion.

Our favourite indicator is New Orders Less Inventories, which had been indicating recovery for the headline index, but such a significant beat wasn’t expected.

If the trend continues (which we expect it to), the cyclical economy, which has been struggling for the last 2-3 years, will lead to significant gains for companies focused on the real/old economy.

In fact, the MoM surge in ISM Manufacturing was the second largest of the past 30 years!

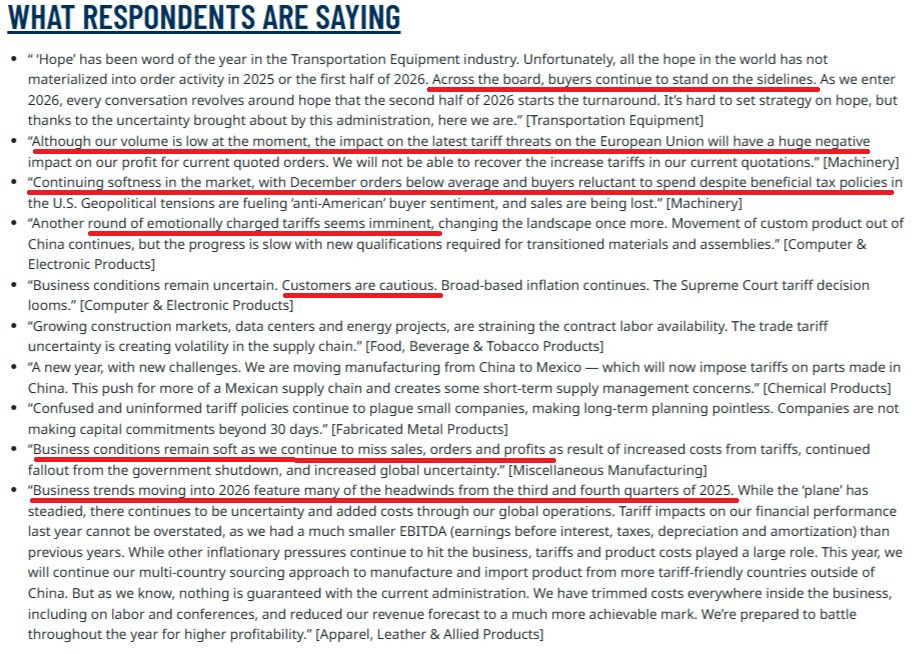

Nevertheless, amid signs of revival, the survey comments indicate that softness persisted across industries.

ISM Services met expectations, coming in at 53.8, indicating expansion.

However, the ISM Services Prices index once again accelerated and remains stubbornly elevated.

If the uptrend here continues, the CPI might rebound and cross 3%, a problematic scenario for the Fed given its dual mandate.

Labour Market!

ISM Employment: A cyclical recovery augurs well for the labour market. This was visible in the ISM Manufacturing Employment data, which saw the highest reading in more than a year. However, the ISM Services Employment cooled a bit but remained above 50, indicating expansion.

JOLTS-1: JayPo’s favourite labour market indicator: