A Perfect Storm?

“I don’t know how long it will take before we can cut rates.”- Jerome Powell, 1 May 2024.

The world’s largest central bank has committed a series of blunders in the last two years. The “transitory” rhetoric in 2021 and the “premature” dovish pivot in December are the most prominent highlights of the erroneous decisions by the Federal Reserve led by Jerome Powell.

This week was super important as the markets had positioned itself for a hawkish pivot due to the result of the “capitulation” that happened a fortnight ago.

Nonetheless, the Fed surprisingly came out dovish with a bigger-than-anticipated increase in the QT taper, thus demonstrating that Janet Yellen holds the wheel of power in an election year.

Furthermore, JayPo clarified that the next move in any scenario will not be a hike.

“Unlikely, the next policy move will be a hike”- Jerome Powell.

As a result, Mr Market now price in only one rate cut in 2024. (2 cuts after the weak NFP a few hours ago)

In the East, the Bank Of Japan (BOJ) has been using its firepower to scare away the adamant speculators who had successfully punished JPY for BOJ’s dovish stance.

However, a dovish Fed ensured that USDJPY was off from its high but still in speculators’ control, as enormous short positions remain open, betting against the JPY rise.

Let us look at the macro data in detail and conclude our analysis about why a perfect storm might be on the verge of hitting the world’s largest economy.

US!

This week, we got a slew of macro data from the US, along with most of the S&P500 reporting earnings. While macro data and the Fed speak led to most of the market movements, earnings shed light on the strength of the “consumer”, which portrayed an alarming picture.

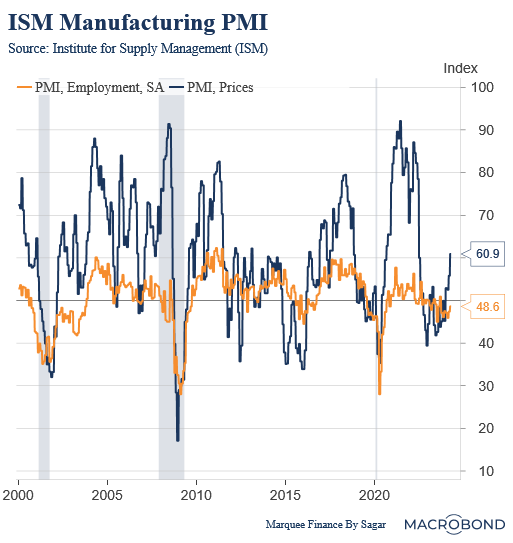

Our preferred data point to gauge the cyclical activity surprised on the downside. While the headline number entered the contraction territory, the ISM New Orders Less Inventories fell sharply.

Plunging Orders Less Inventories indicate that we might see the ISM headline number moving towards the 45-46 mark in the next few months.

Furthermore, the biggest surprise was the ISM Prices Paid, which soared to 60, exhibiting signs that pricing pressures have soared, likely due to the pass-through of higher commodity prices.

Nonetheless, JayPo doesn’t see the “stag” or the “flation” as he referred to the infamous period of the 70s, which was plagued by stagflation.

Well, folks, as we shared last week in the portfolio update, we still believe that there are only two outcomes possible for the US economy: