Bad News Is "Bad News"!

“There was a real discussion about the case for reducing rates at this meeting”: Jerome Powell.

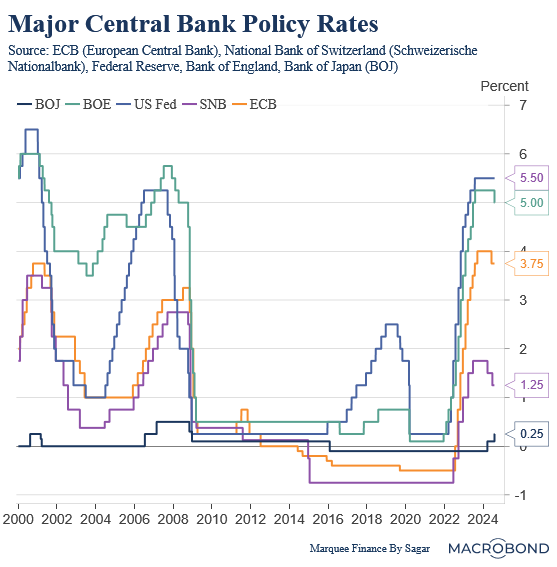

As the economic data deteriorates rapidly in the US, market participants have been questioning whether the Fed's decision to hold rates in the July policy will be termed a “costly” mistake in hindsight.

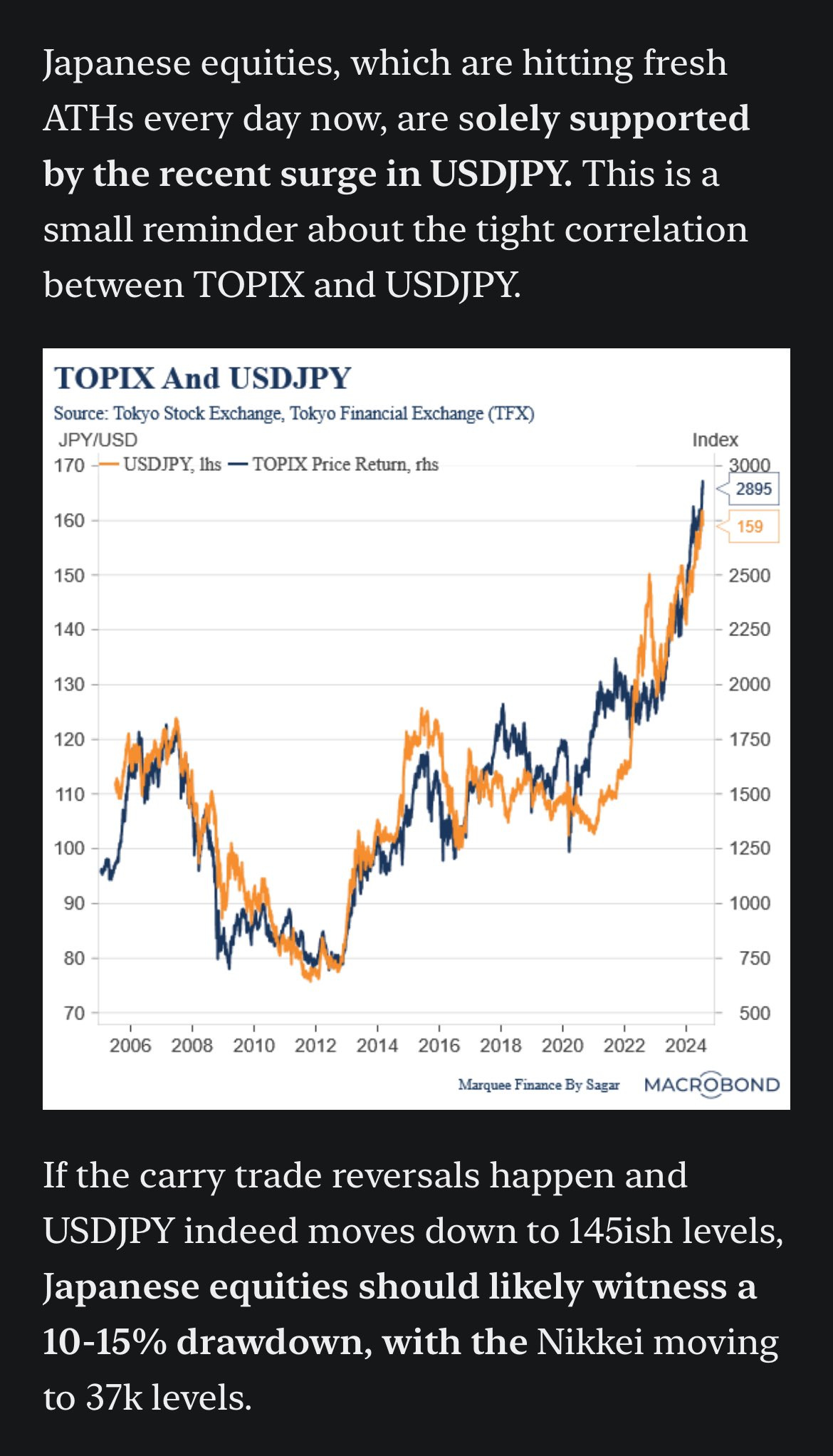

Furthermore, the BOJ’s decision to hike rates and turn hawkish after nearly 18 years stunned the global financial markets and led to an epic short squeeze in one of the most traded FX pairs in the world.

Our 12th July newsletter warned our paid subscribers about the turn of events and the likely upcoming meltdown in Japanese stocks.

In fact, before the bad news (negative economic surprises/deteriorating macro data) became bad news, we had been anticipating the trend change and preparing our PF for it by drastically reducing our equity exposure in the last two months (except for Thematic Investing long-term bets).

Nevertheless, navigating the current market setup is extremely challenging as despite the sell-off in risk assets, equity markets are still up in double digits YTD (S&P 500).

Furthermore, the Middle East is boiling, and a miscalculation can lead to chaos for which the world or financial system is unprepared.

We will continue to monitor the various macro and geopolitical risks and update you in real-time.

Let's examine the macro data in depth and draw inferences from it, along with our positioning and this week’s trades!

US!

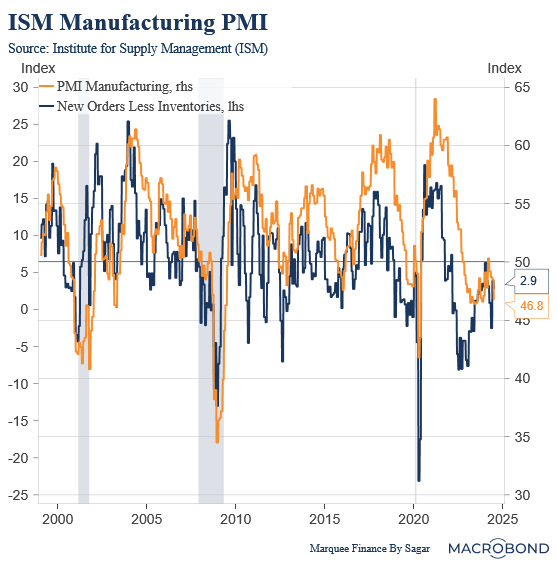

One of the most important macro data points, ironically decoupled from the business cycle dynamics, as per the market participants, remains the ISM Manufacturing data.

We believe it will always remain the best gauge of the US economy's cyclical activity.

The July ISM print surprised on the downside massively with the headline print at 46.8.

Orders Less Inventories is still growing, demonstrating that we are not heading to 40 levels (for the headline number) in the next 2-3 months.

However, one must be watchful as the trend can change in no time, as has happened in the past.

Digging deeper, we can observe that except for two components, Prices Paid and Supplier Deliveries, all of the components are below 50 and thus contracting.

Furthermore, most of the components have seen deterioration in their reading MoM.

New Orders have been a shocker, and is now in the recessionary territory.

However, we will look for more readings in the coming months to confirm the trend.

The most significant negative surprise which confirmed our worst fears was the