Behind The Curve?

As we approach some of this year's major events, the macro has become more significant than ever for generating alpha in the markets.

We have consistently discussed the illusion of a soft landing for the past three to four months. Those in power created the soft landing narrative to benefit disproportionately.

Furthermore, excess liquidity led by persistent central bank intervention over the past 18 months led to various asset-class bubbles.

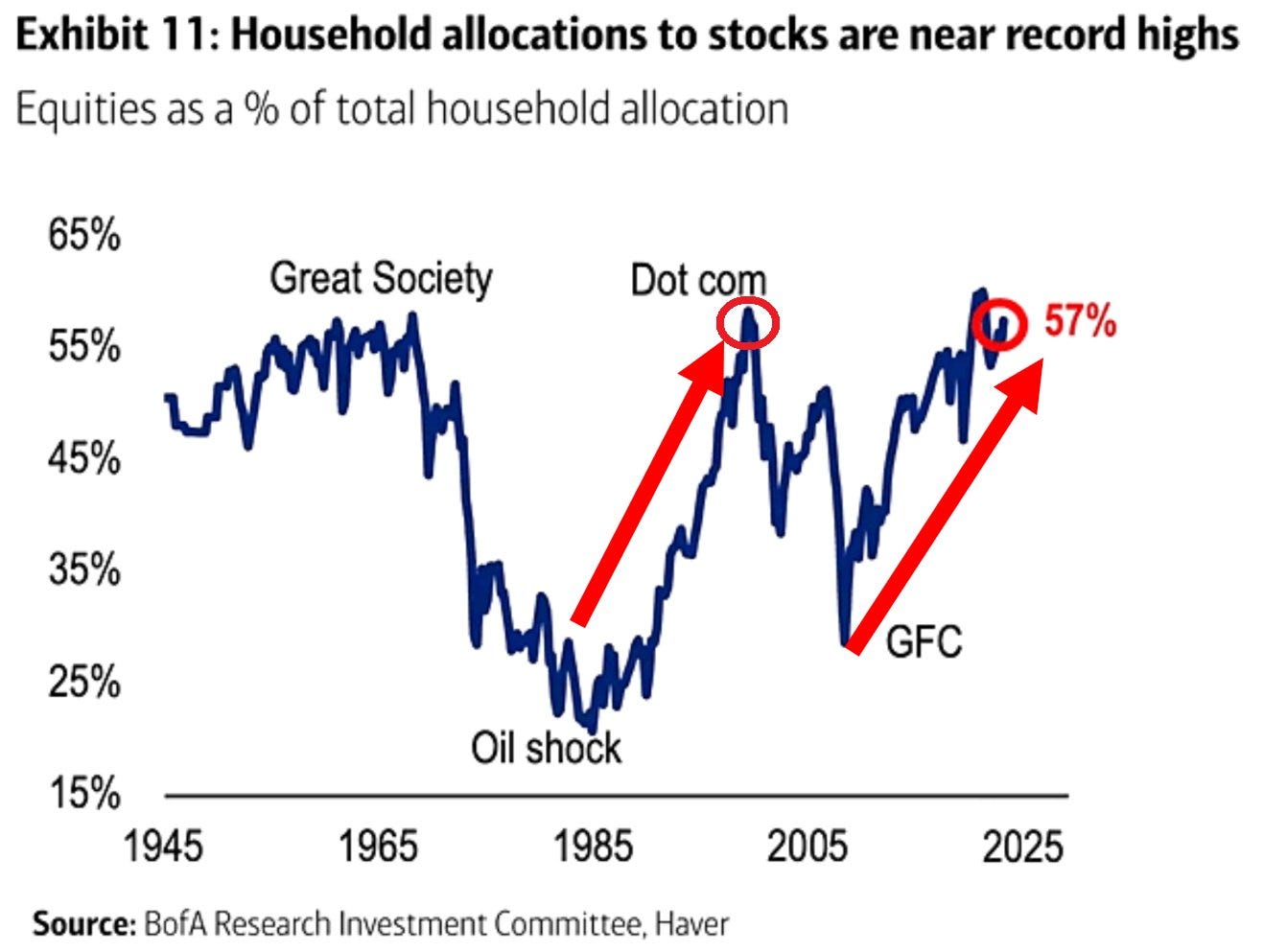

It’s remarkable that despite various valuation metrics signalling red flags, the US Household equity allocation is at record highs, at 57%, even surpassing the Dot-Com bubble.

As the US Households (HHs) go “All-In” in equities, it is a time that demands a signal to revisit your asset allocation and be prepared for tectonic market shifts.

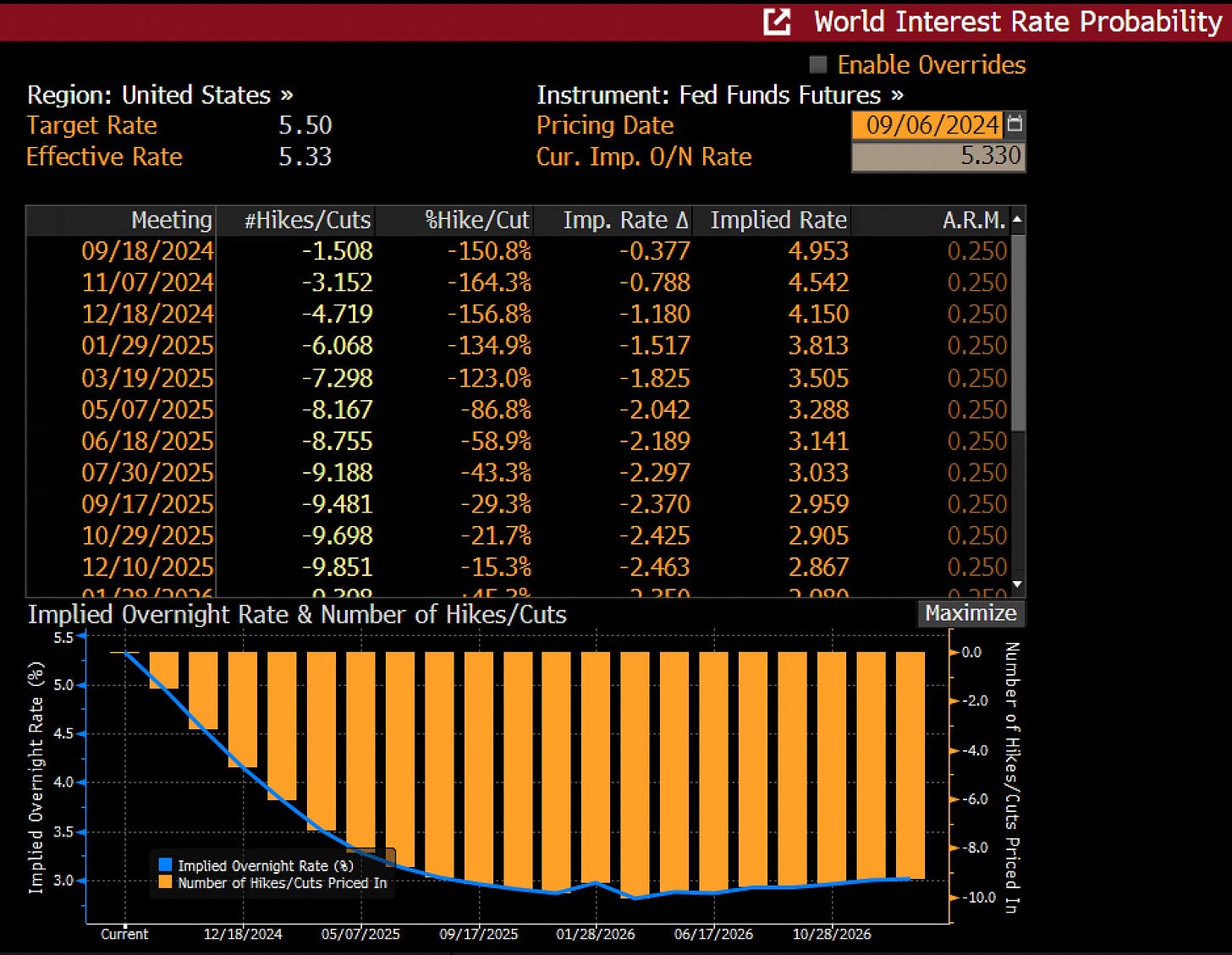

Returning to the macro perspective, we initially communicated to our paid subscribers and later wrote publicly that a 25 bps rate cut in July FOMC was likely. If this didn’t materialize, we predicted a 50 bps cut as a plausible outcome for the September FOMC meet.

NOTE: After the release of NFP data a few hours ago, Mr Market is pricing a 50% chance of a 50 bps cut.

And guess what?

We still believe the Fed is behind the curve, as we will decipher today with the macro data.

Let’s dig in!

US!

Our favourite macro indicator to gauge the cyclical activity in the US came out this week.

Yes, folks, we are talking about ISM Manufacturing, which has long been the preferred macro indicator for economists tracking the business cycles closely.

While the headline index was a tad better than the previous month (still in contraction < 50), the big shocker was the New Orders, Production and Inventories.

When we combine all three, we can easily conclude that the economy's manufacturing sector is on the cusp of a major downturn.

In fact, the press release from the ISM says it all:

“The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.”

Nonetheless, the Orders Less Inventories is the measure for us that foretells the state of future ISM Manufacturing PMI.

As expected, the Orders Less Inventories indicate that the Manufacturing PMI is headed to levels consistent with a “hard landing” in the next few months.

As a result, if past instances are to be believed, we expect ISM Manufacturing to move lower below 45 and even 40 in the worst-case scenario.

Moving on to the most important data releases of the week: