Calm Before The Storm?

2026 is turning out to be a bewildering year, to say the least.

Last weekend, we saw the world’s most powerful central banker release a video message after being subpoenaed by the DOJ.

This unprecedented action, along with the tensions in Iran and the uncertainty about the Fed Chair, led to wild cross-asset swings.

However, despite a rise in the equity volatility as measured by VIX, there is an uneasy “calm” in the bond markets.

The spreads on Global Corporate Bonds, as measured by the BBG Global Corporate Statistics Index, have reached pre-GFC levels.

“Credit is the air that financial markets breathe, and when the air is poisoned, there's no place to hide.” — Charles R. Morris.

For those who have been in the markets for a long time know that the first warning signs always emerge in the credit markets, and as of now, there is none.

The High Yield (HY) spreads are at post covid lows and can’t get any tighter than they are today.

Thus, any widening in spreads should be watched closely as it would have cross-asset ramifications.

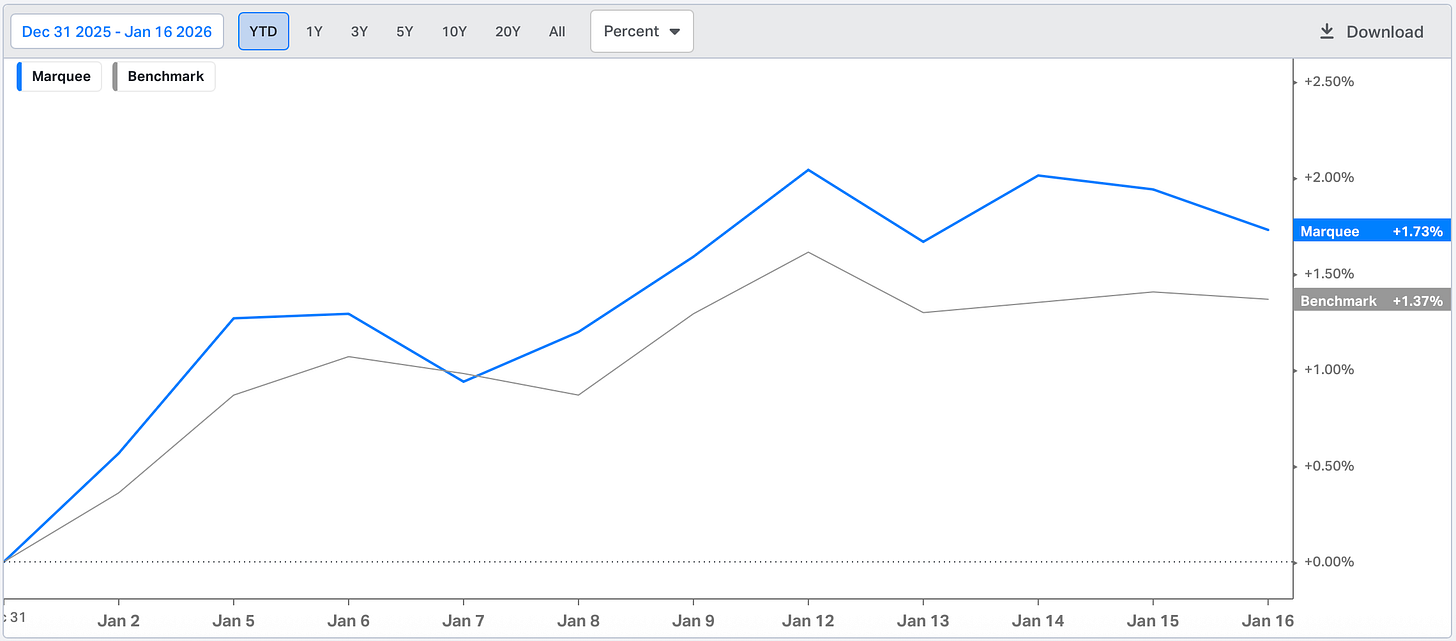

It has been a good start to the year as we are up 1.73% and are outperforming the benchmark by 40 bps.

Let’s dig deeper into the macro universe and analyse the cross-asset moves!

US/Bonds/Equities/Gold/Silver/Oil/Dollar/BTC!

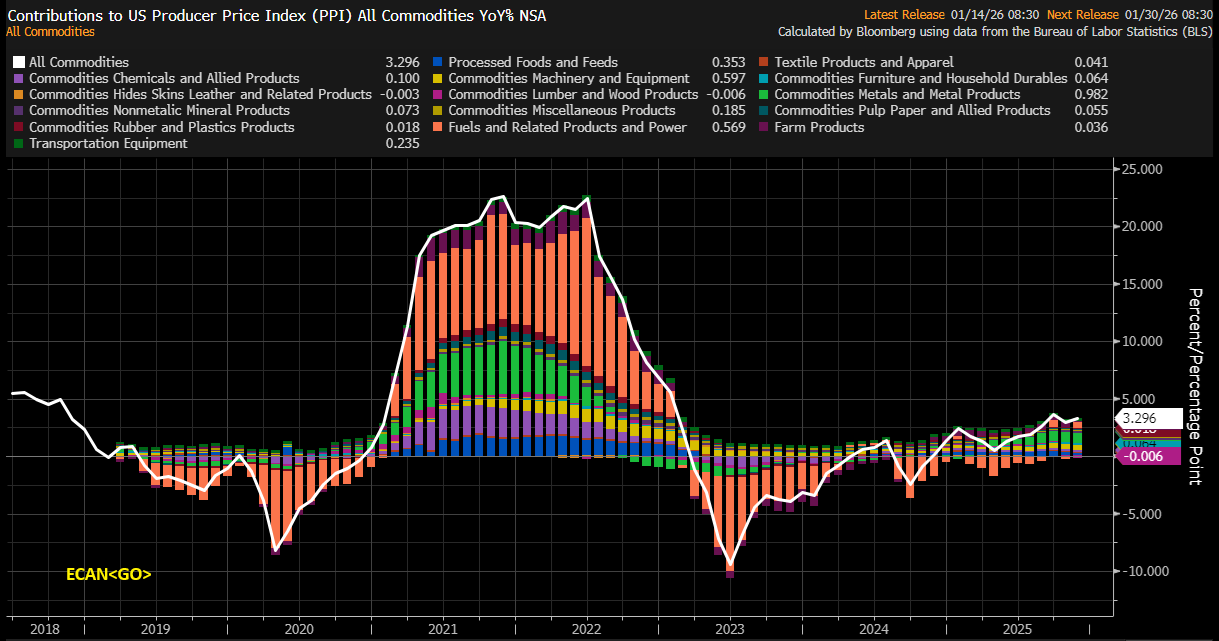

November PPI, which was due on 11th December, came in this week, a long delay due to the government shutdown.

Both Core PPI and PPI came in slightly higher at 3% YoY, against expectations of 2.7%.

When we analyse the internals, higher commodity prices are now leading to higher prices.

Note that we have been flagging the risk that higher commodity prices will spill over into the inflation data in the coming quarters, potentially leading to a resurgence in inflation (especially higher base metal prices).

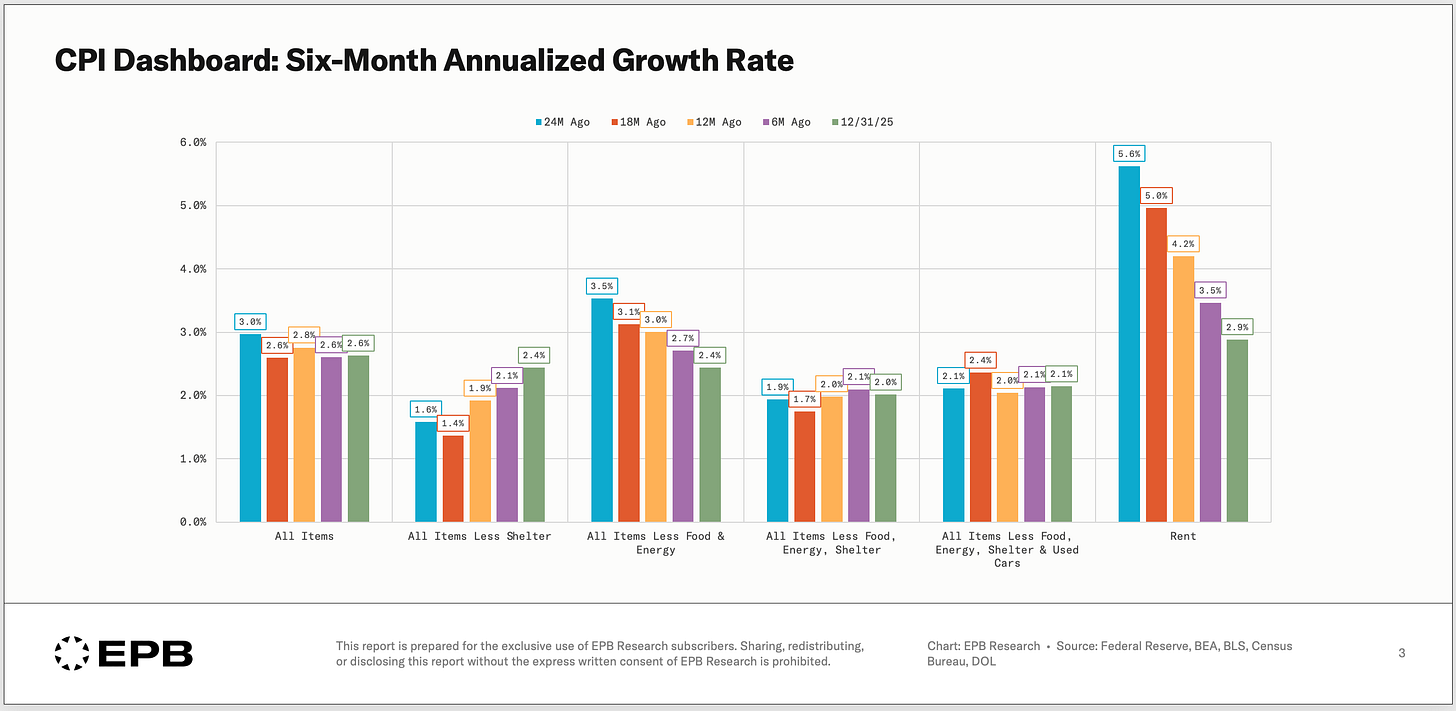

While headline CPI came in line with estimates at 2.7% YoY, Core CPI came in slightly below (10 bps) estimates at 2.6% YoY.

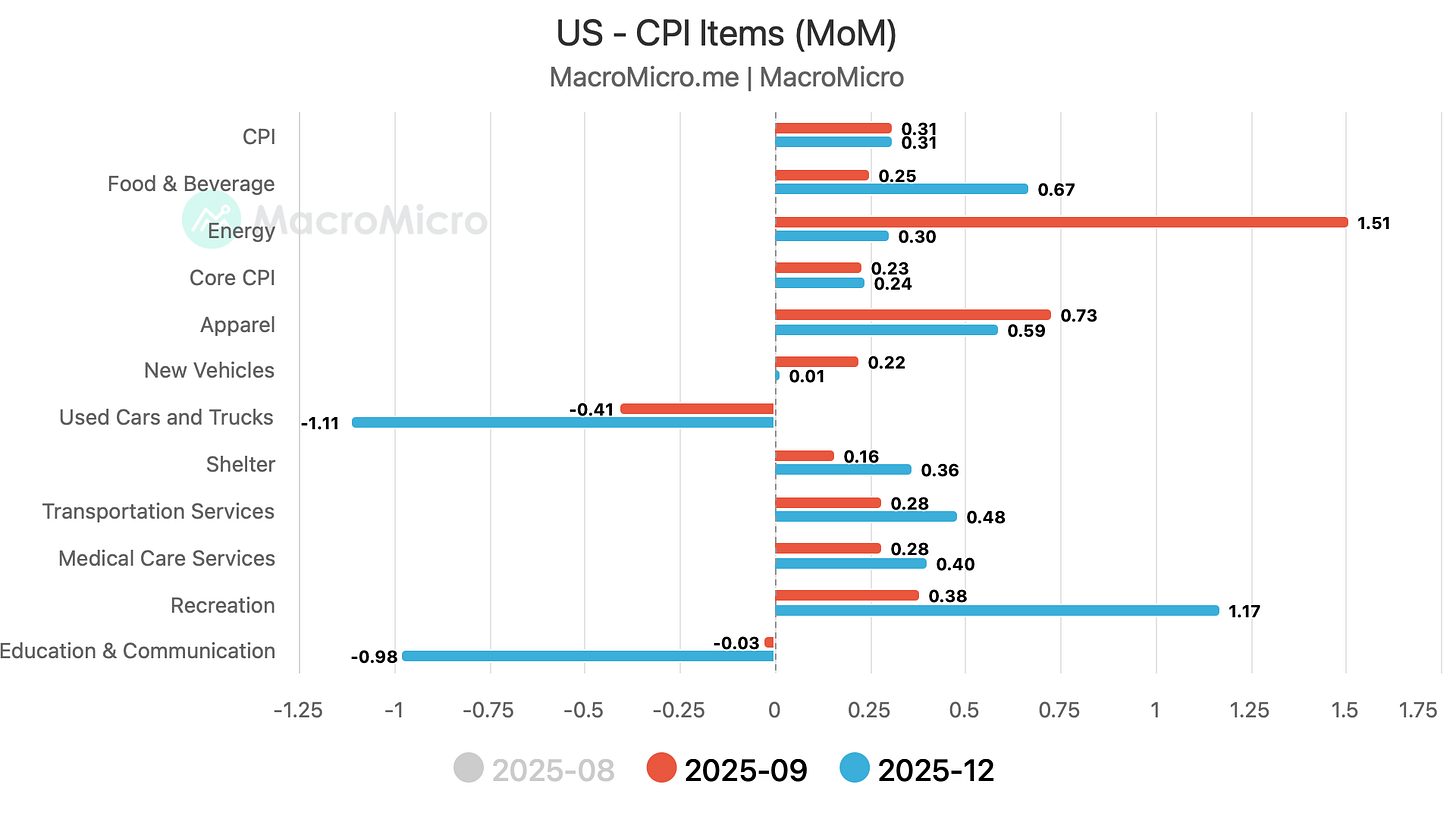

The CPI charts:

Unsurprisingly, the downward pressure on CPI is due to Shelter, which has been in a downtrend. Note that it’s a lagging measure, so we expect it to stop falling by Q2.

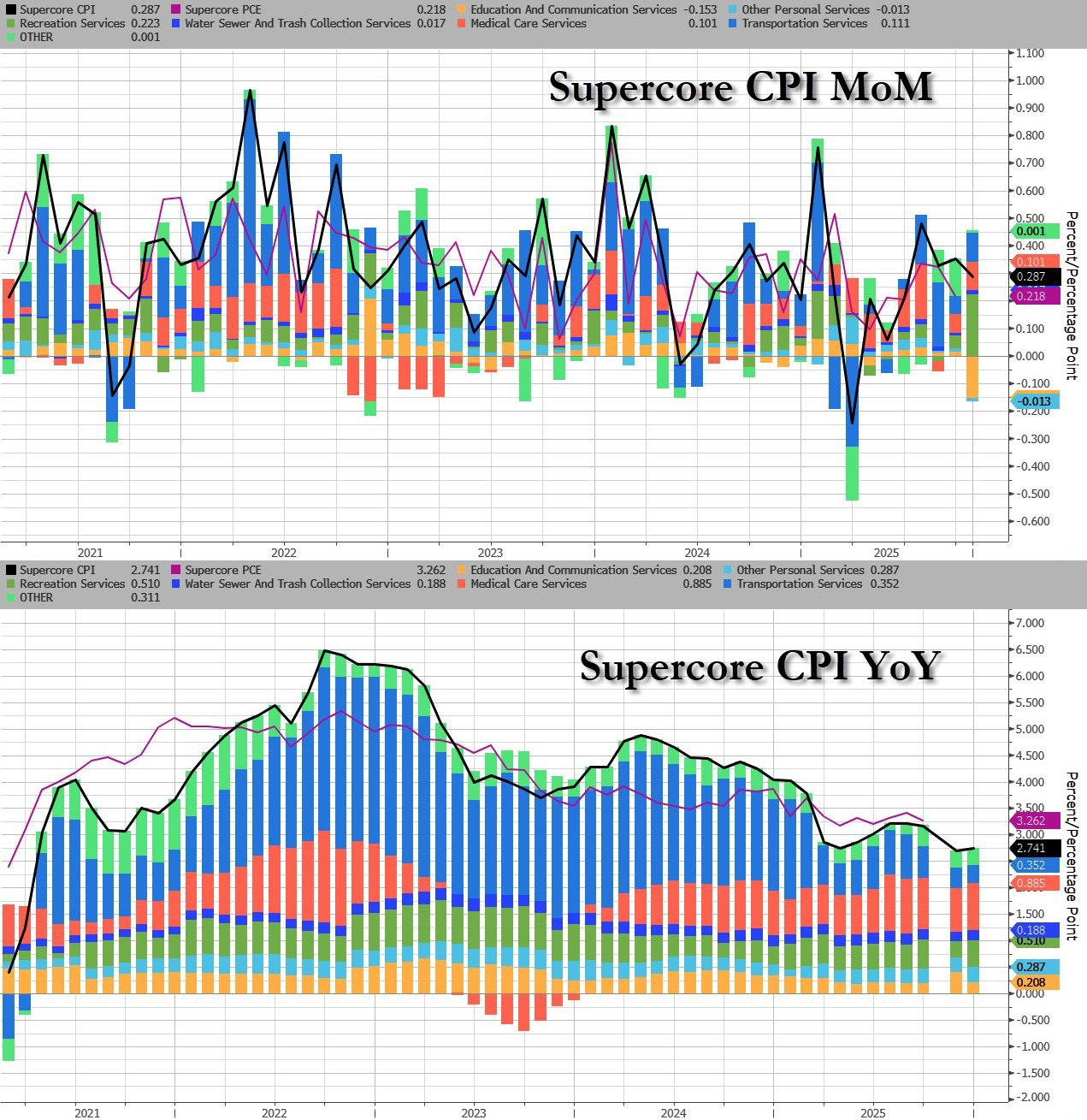

Supercore CPI, or Core CPI Less Shelter, which JayPo post-COVID popularised, is proving stubborn (came in at 3.26% YoY). The latest reading was led higher by recreation services, driven by a surge in admissions prices.

When we dig deeper, a few of the items, such as Used Cars and Trucks and Education and Communication, reported deflation and have been under pressure. Furthermore, the items that faced tariff pressures (goods such as apparel) are also showing signs of moderation.

One of the charts we want to share, and we believe was the reason behind Trump’s inaction on Iran: