Chaos, Carnage and Madness!

“The damage in bonds has been more severe and more sustained than for equities, and you can’t help wondering where the real damage is. You can’t have this much value destruction in bonds without there being some stress somewhere”- Jim Reid, Deutsche Bank.

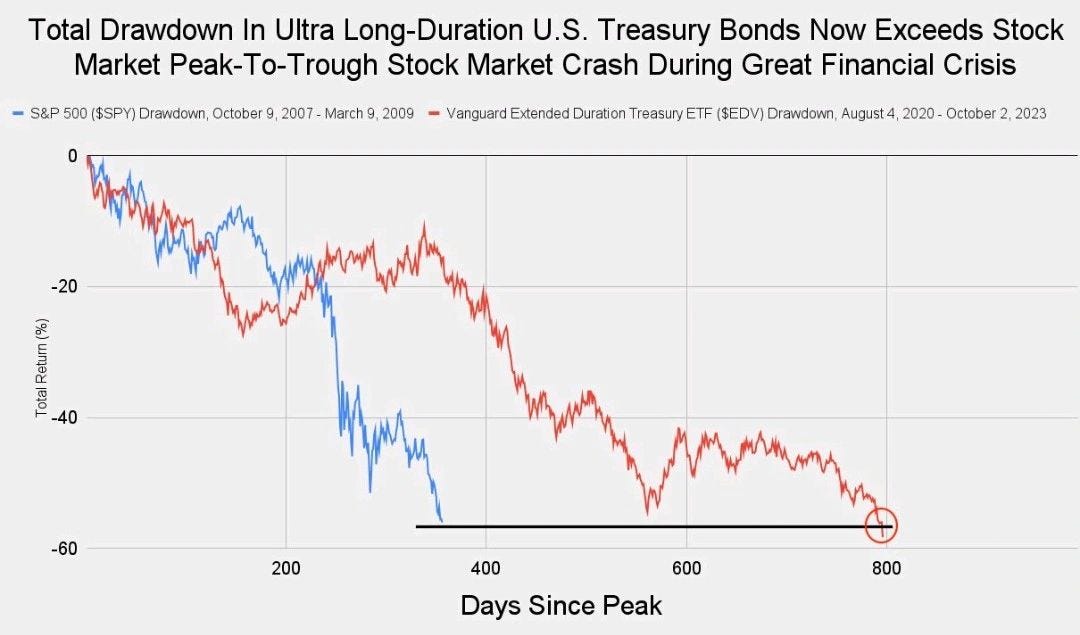

In what could be termed the mother of all the bubbles, the duration sell-off in the bond markets has now reached unprecedented levels. As per the data:

the drawdown in bonds with an average duration of around 25 years (UST) has now surpassed the drawdown that equities (S&P 500) witnessed during the GFC 2007.

The carnage in rates markets has led to fears that capitulation leading to margin calls has transpired deep within the financial system. One can’t overlook last year’s pension crisis in the UK and the unsettling hours when Sterling crashed below parity. If the BoE hadn’t acted in time, we would have seen the collapse of some of the largest pension funds in the UK within hours.

In a nutshell, as Reid says, something has indeed broken in the system by now, and we would get the news sooner rather than later.

The madness is visible across the markets as investors scramble for safe assets. With the US Treasuries, deemed the safest asset on this planet, no longer secure, investors dumped everything from gold to cyclical and defensive stocks and piled onto the big tech Magnificent seven stocks (flight to safety?).

The irrational behaviour of the markets has been intensified by the string of economic data released this week, which portrays the resilient nature of the US economy.

As the UST bleeds, the calls for a YCC in the US have increased. I wrote an elaborate piece in April about the US's burgeoning debt and fiscal problems.

PS: Here is the link. (Considering the circumstances, I have removed the paywall for this one.)

Today, we will look at the crucial economic data across the globe and will also look into the nuances of the bond markets.

Let's go!!