Demystified: Where Are We Today?

First of all, Happy Thanksgiving to all of those who celebrated.

As is the norm on Black Friday, I am glad to announce a discount of 10% on the paid subscription for the next 24 hours.

One can click on the link below to access the same!

One of the biggest questions plaguing the global financial system is: Where are we in the business cycle today?

Last week, we analyzed the business cycle and concluded that we are in the later stages, marked by euphoria and the hopes of a soft landing where inflation comes down to normalized levels without hurting the labour market.

This has been an unusual business cycle which has decimated the consensus multiple times and surprised everyone from central bankers to economists.

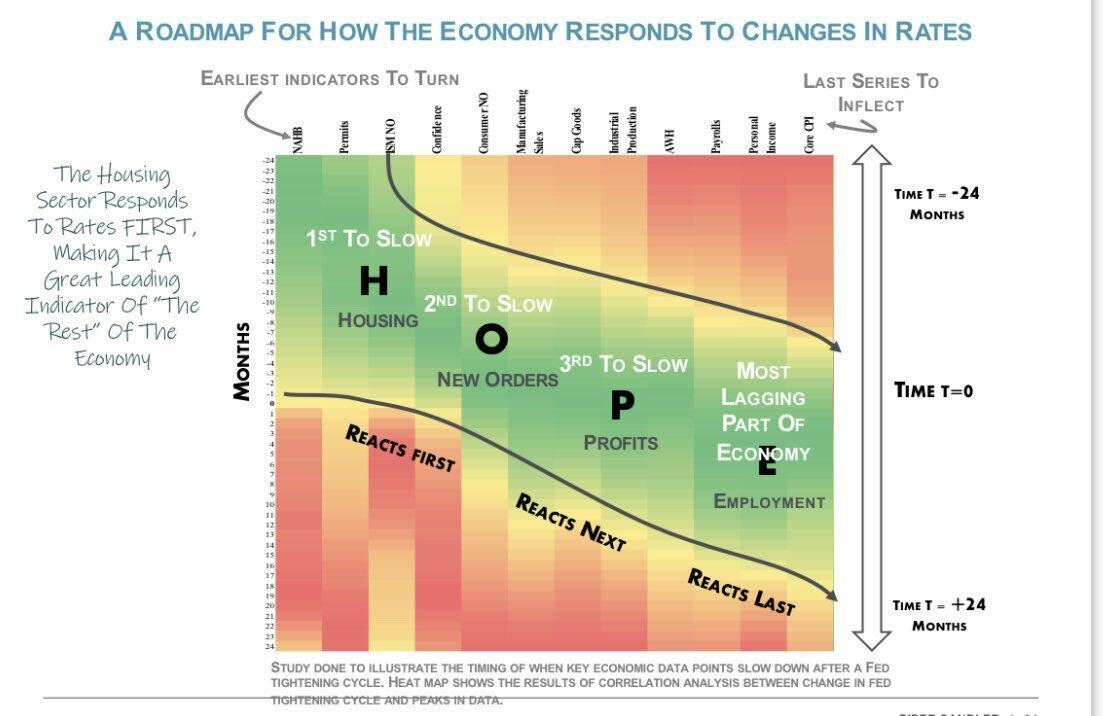

This week, we will look in detail at the economy's leading indicator and conclude the recession date.

Nonetheless, it’s nearly impossible to pinpoint the exact date of the recession, but we can come close and benefit by positioning accordingly.

Let us begin!

US!

Long-time readers reckon that I am a big believer in the HOPE Model (Housing→ Orders→ Profits → Employment) due to the high multiplier effect of the Housing sector on the cyclical economy.

Last year, we had a false flag when the housing sector indicated that a slowdown was imminent, but the remarkable strength of the labour market and the resilient consumer flushed with excess savings ensured that the housing sector did a U-turn in H1 this year.

Nonetheless, in the last ten days, we have received crucial housing data and as usual, social media has been floating in narratives focusing only on one data point.

Today, we will look at various variables to gauge the housing sector's health, which is imperative to our study of the business cycle and macro allocation.

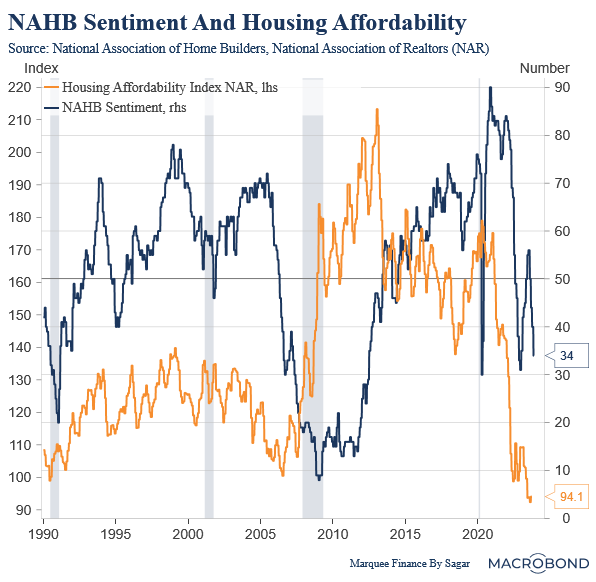

We will cover: Affordability, Sentiment, Volumes, Price and Inventory.

Focusing on all the variables and connecting the dots is the best way to analyze and reach a material conclusion rather than focusing only on one variable.

Note that I will be as simple as I can so that one can comprehend the complicated nuances of the housing sector.

Let us begin with:

Affordability And Sentiment!

It’s a no-brainer that the steep increase in home prices post-COVID and the sky-high mortgage rates have led to the least affordable real estate market since 1990.

Furthermore,