"Doves" Are Flying "Higher"!

“In light of the progress made both in lowering inflation and in cooling the labour market over the past two years, elevated inflation is not the only risk we face. Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”-Jerome Powell, 9th July 2024.

As the world’s largest central banker turns dovish, a marked U-turn from the hawkish policy in June, our stance again got validated this week.

As a result of JayPo’s dovish tone and a very soft CPI print, which was below even the lowest anticipated number on Wall Street, the rate cuts bets soared amid an “intriguing” trend change.

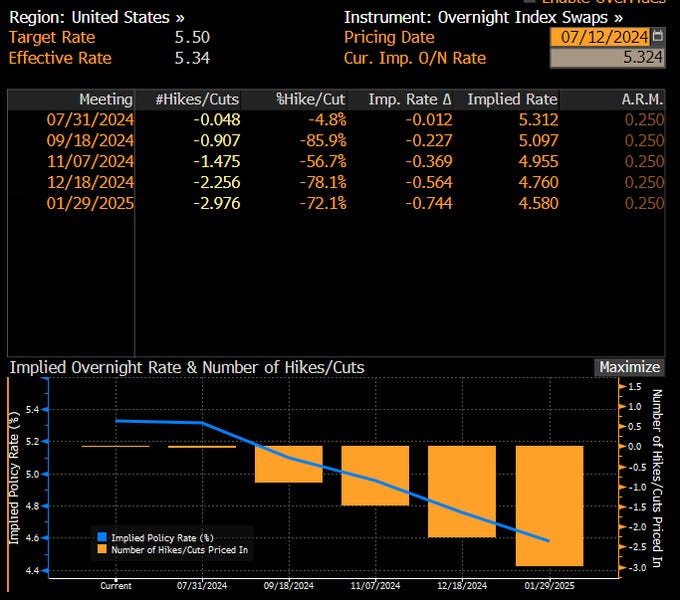

Mr Market is now pricing in two full 25 bps rate cuts in September and December, with a low to medium probability of a November cut.

The number of rate cuts this year significantly increased from one rate cut just a few weeks ago (which was an excellent opportunity for us).

The one-way mega bull run in the giga caps witnessed a shakeout, essentially a reaction to a rate cut (imagine Thursday as the FOMC day when the Fed delivered an actual rate cut).

We had been cautious about the extreme divergence in the large and small caps/ equal weight and the market weight index, which the market is beginning to take note of.

Analysts across the board are now questioning the gigantic $400 billion+ capex by the hyperscalers on AI, which has failed to generate the necessary revenues for the 20%+ RoE these companies have enjoyed in recent years.

Nonetheless, we will continue to focus on macro and megatrends (Thematic Investing) while deciphering the political/geopolitical developments that have the potential to lead to large swings across assets.

Let us examine the macro data and discuss the way forward for bonds, equities, commodities, and FX!

US!

Undoubtedly, the week's highlight was the sharp plunge in CPI MoM (-0.1%), which surprised market participants, including us.

We had hoped for an in-line CPI print because the estimates had already been lowered significantly in the past few days.

Nonetheless, the surprise was entirely due to the sharp fall in the Owner’s Equivalent Rent (OER), which lags the actual rent data by more than 8-10 months.

We get a similar picture when we look at the sticky part of the inflation, which JayPo popularized post-COVID: The Supercore (Services Ex-Shelter).

Led by transportation services, it has now witnessed deflation MoM for two consecutive months, and any further weakness may lead to a “sticky” headline number coming down to 3% from the current 3.5%.

As a result of the macro data, Nick Timiraos from WSJ, also popularly known as “Nikileaks”, have been preparing the ground for the Fed to cut rates in September with his articles and Tweets.

In fact, yesterday’s post-CPI tweet by the unofficial Fed “mouthpiece” excited the markets as he confirmed the two rate cuts and the rising probability of the third rate cut.

Our base case scenario for the July cut looks bleak, and the September cut is in place. However, the quantum can surprise the markets if the economic data deteriorates.

We say so because this chart is an eye-opener: