Exposive Setup Part 3.0?

In January and June of this year, we wrote “Explosive Setup” and “Explosive Setup 2.0,” respectively, where we predicted that the technical and macro setups were indicating outsized cross-asset moves.

Although the magnitude may not be the same this time, there is a high probability that enormous cross-asset moves will occur in the days to come.

We are in that era where not a “single” week passes without jitters from the circular AI economy.

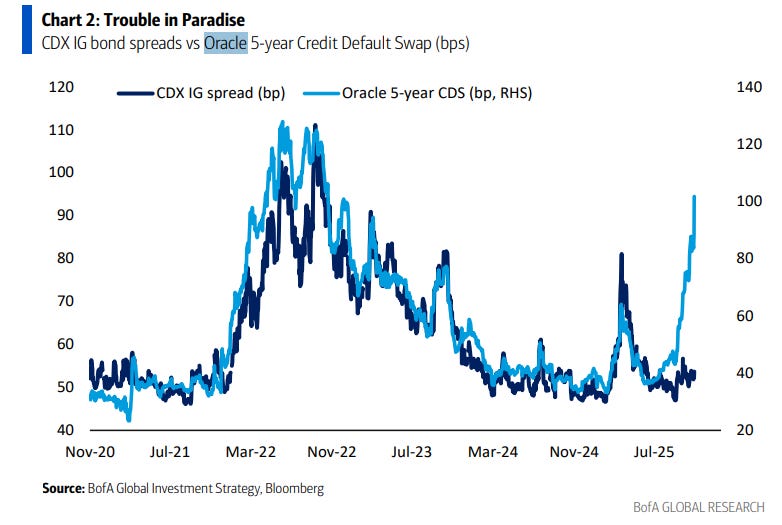

The credit markets are turning extremely bearish on the highly leveraged AI names that have flooded the corporate debt markets in recent weeks.

Oracle is the most indebted tech name out there, and the 5Y Credit Default Swaps (CDS) on Oracle has skyrocketed to 100 bps and is now reaching the 2022 equity bear market highs.

The AI trouble doesn’t end here, as investors' apprehensions are rising alarmingly, as concerns mount about data centres and the OpenAI investment commitments (rising losses as MSFT earnings portray).

Applied Digital struggled to sell junk bonds this week, offering 10% yields to attract buyers. Applied Digital provides data centre services to CoreWeave, which provides data centre services to Nvidia & OpenAI.

Note that in the circular AI universe, even if one leg fails, the whole interconnected ecosystem will come crashing down.

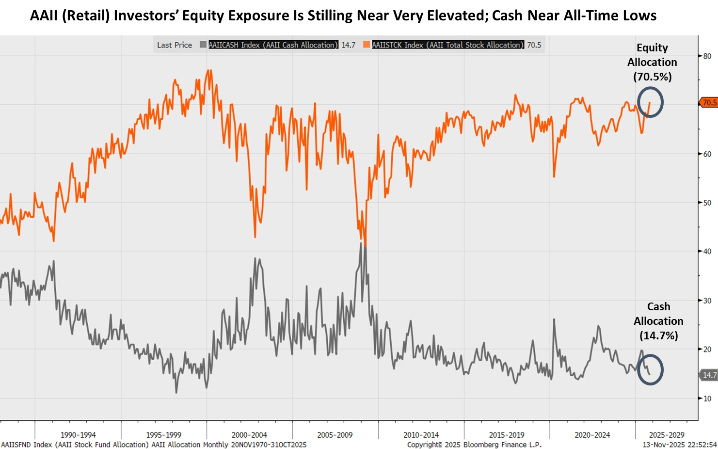

Furthermore, we are now reaching unprecedented levels of Household Equity exposure in the US with near All-Time low cash levels, which should trigger alarm bells for seasoned investors.

Even as the market awaits the NVDA results, the longest US Government shutdown ended this week, and we will be bombarded with economic data this week, which will likely lead to elevated cross-asset volatility.

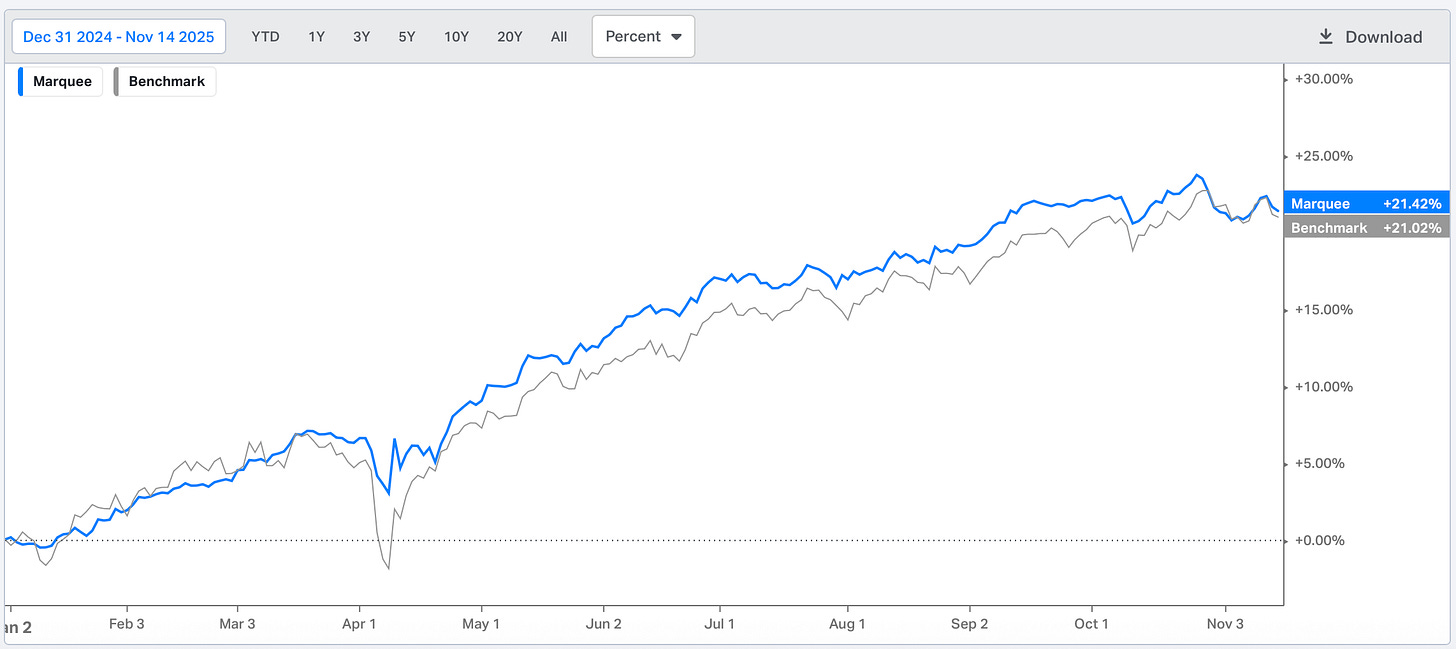

Despite the challenging last few weeks, we managed to outperform the benchmark YTD with 40 bps of outperformance.

Let’s delve deeper into the macro universe and comprehend the cross-asset moves!

US/Equities/Bonds/Gold/Silver/Oil/Dollar!

As the economy struggles beneath the surface, President Trump has removed tariffs on essential food items, as inflation, led by the historic tariffs, squeezes household budgets.

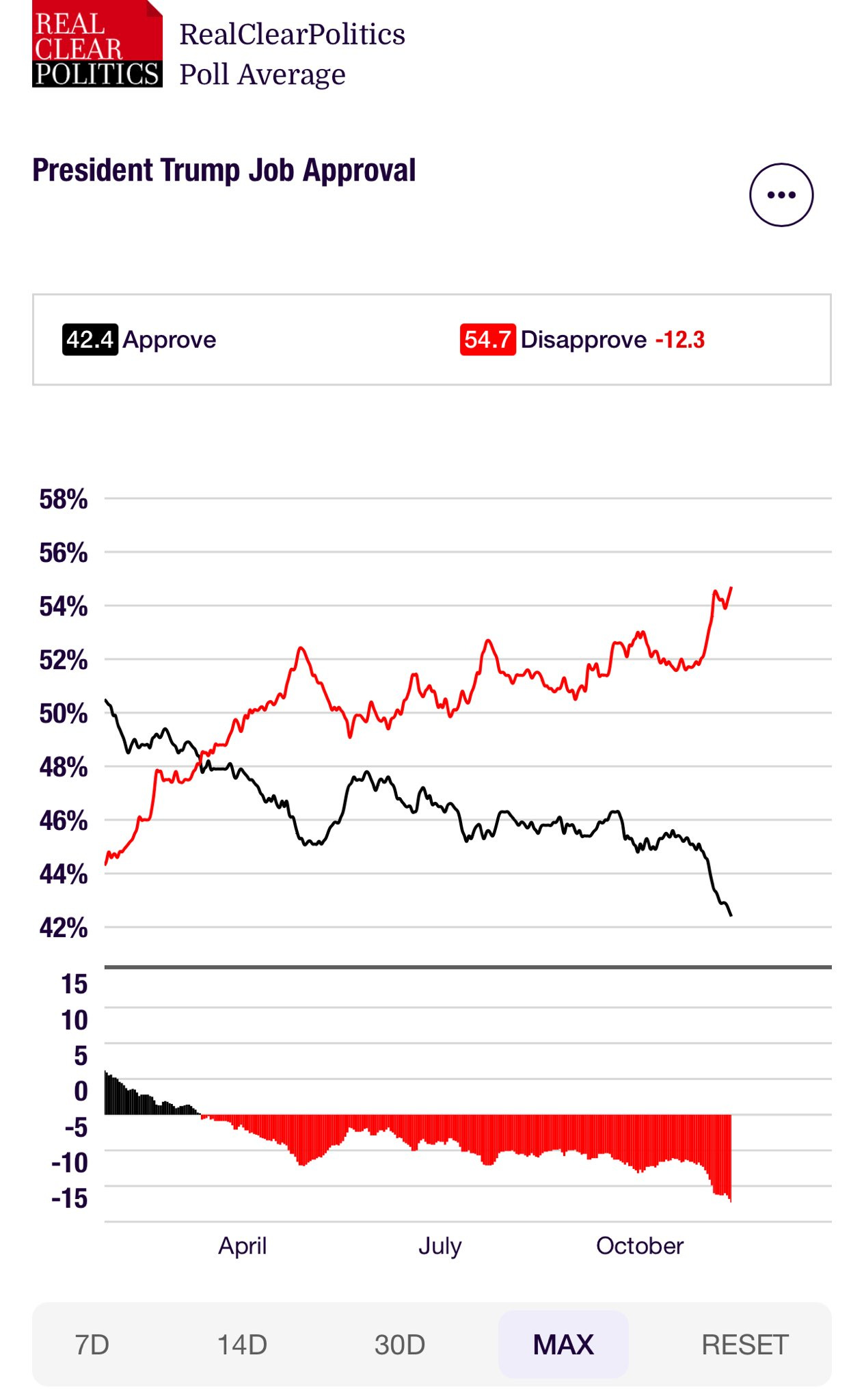

Trump’s Approval rating plunged to the worst on record.

It’s an all-around disapproval as immigration policy hurts small businesses, which were already under extreme financial pressure due to tariffs.

Furthermore, while some might term the exploding layoffs as the “productivity” gains from the AI “revolution,” we believe that the economy (especially the cyclical) is stumbling, and the soft data is illustrating the same.

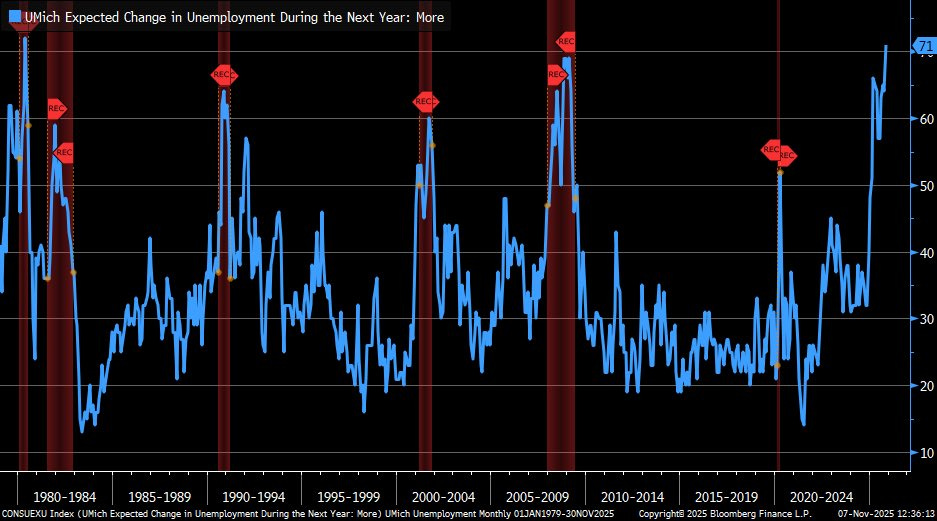

The UMich Expected Change in Unemployment During The Next Year has now climbed to the highest level in the record.

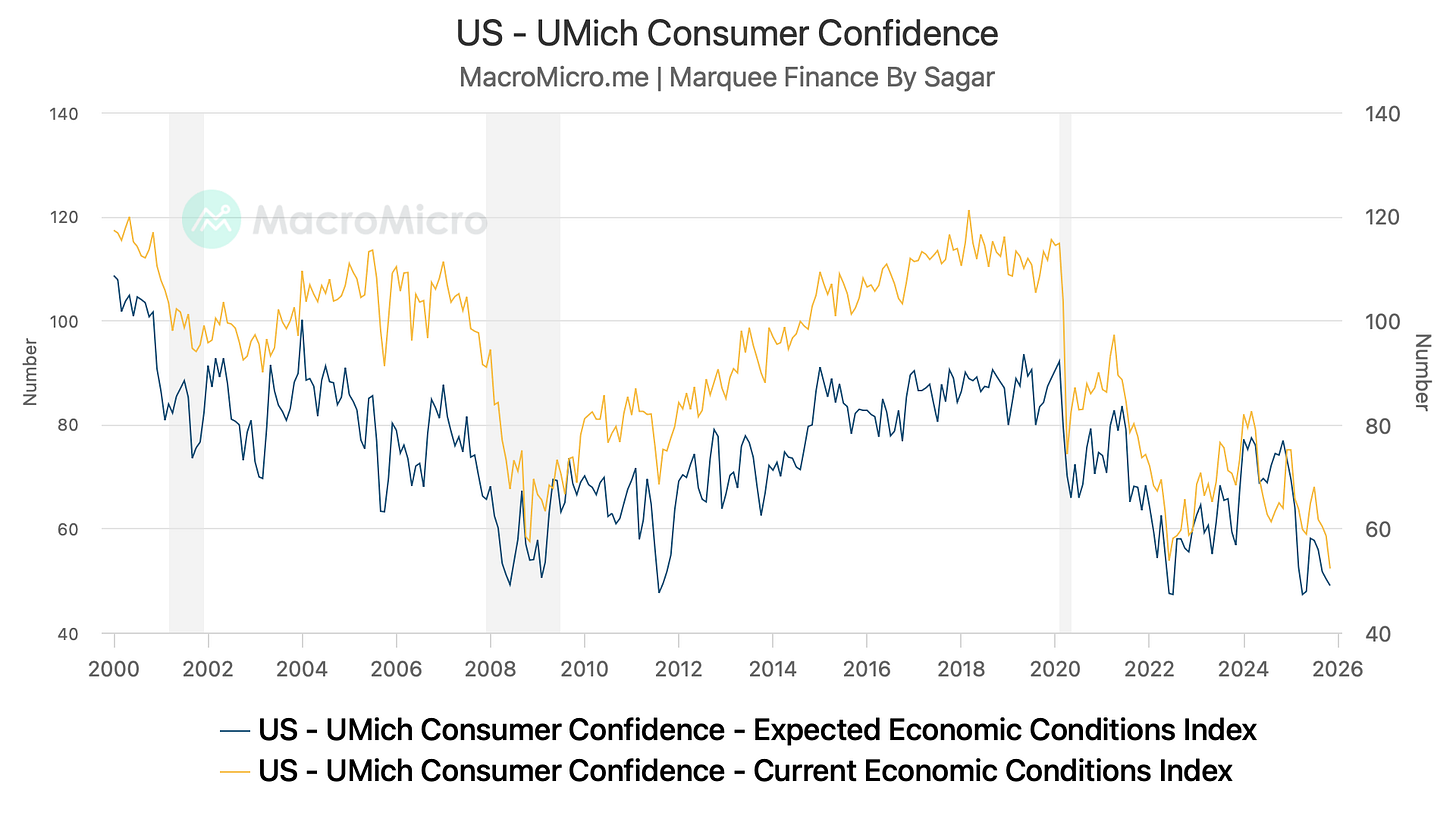

For those who missed, last week's UMich Consumer Confidence plunged to the lowest levels ever.

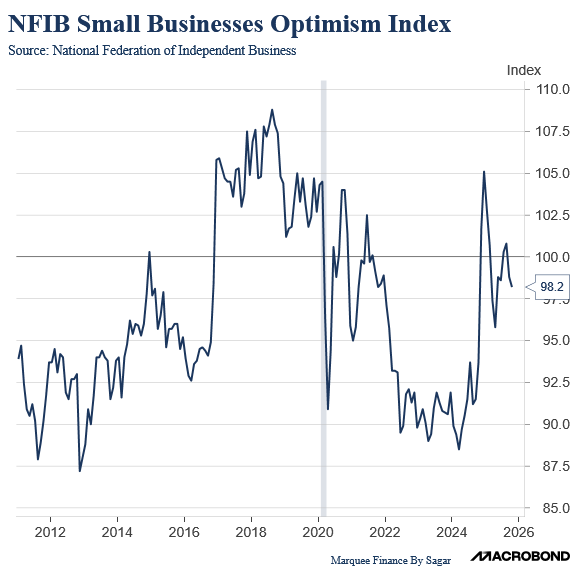

Moving on, as unemployment concerns rise, consumer sentiment plunges, and households face inflationary pressure, small business optimism is waning.

The NFIB Small Business Optimism Index moved down to 98.2.

Furthermore,