Fear, Panic And Chaos!

The last two weeks have seen unprecedented volatility in equity markets, as the launch of Anthropic’s Claude Opus 4.6 has sparked utter confusion and fear.

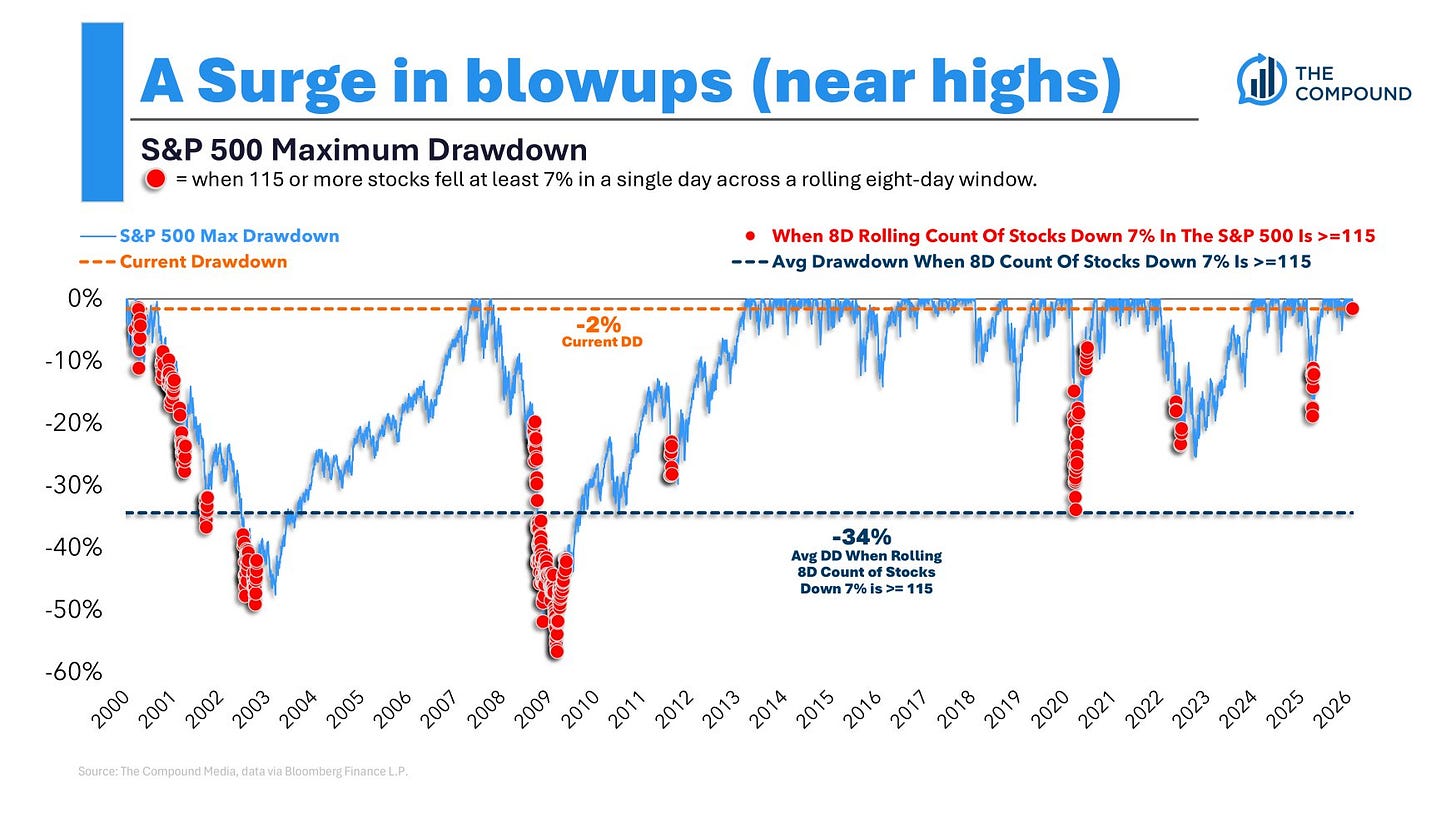

The following stat says it all:

“Over the last 8 sessions, 115 stocks in the S&P 500 have declined 7% or more in a single day.

The average drawdown when that happens is 34%. Right now we're 1.5% below the all-time high.”

Markets are pricing in an AI-led disruption that will destroy well-established multi-billion-dollar businesses “overnight”.

The fear was visible in markets when a little-known former Karaoke Company worth $6 million wiped out billions of dollars in wealth in the logistics sector.

Furthermore, markets are pricing in a scenario in which automation and AI-led adoption will lead to millions of white-collar layoffs, triggering a recession. As a result, we saw massive move in bond markets.

Undoubtedly, portfolios tilted heavily towards tech across the board are in complete despair, comparable to COVID, when the index crashed by upwards of 30%.

Thanks to the bond rally, we hit fresh YTD highs yesterday and are now up 4.85% compared to 2.56% for the benchmark.

Let’s analyse global macro releases and understand cross-asset moves!

PS: A gentle reminder to new subscribers to avoid paying via Apple Pay as it charges enormous fees. Furthermore, one should download the Substack App and switch on the notifications to receive the updates on chat.

US/Equities/Bonds/Gold/Copper/Oil/Dollar!

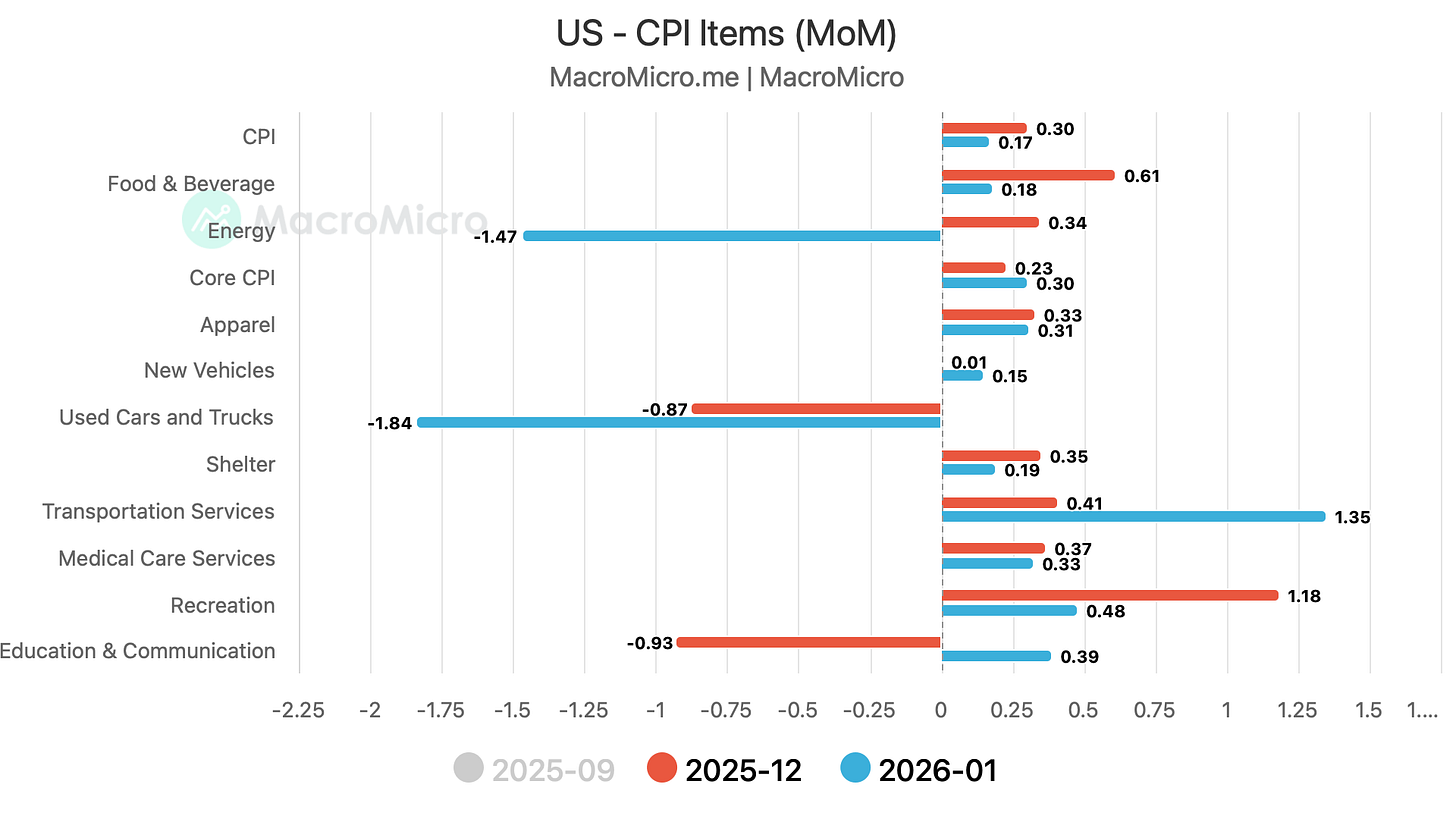

The CPI came in slightly softer than expected, allaying fears of a second wave of inflation.

The headline CPI came in at 2.4% YoY (the lowest since May 2025), while the Core CPI came in at 2.5% YoY (the slowest since March 2021).

When we dig deeper, we observe that energy and used cars were responsible for pulling CPI down, while Transportation services saw a huge jump ( a likely January effect).

JayPo’s favourite metric during the 2022 rate hikes was the Supercore (Services Ex-Housing).

It has been sticky in the past few months, but saw a huge rise in January due to a one-off.

Higher Motor Vehicle Fees and Public transportation led the rise in Supercore.

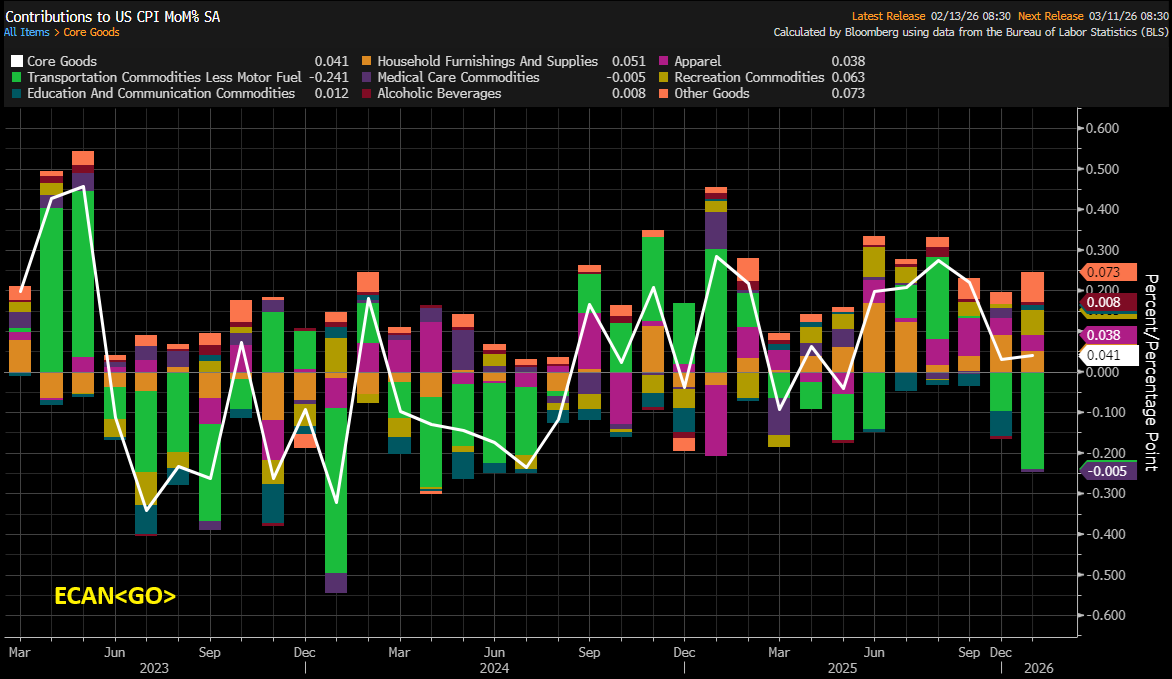

JayPo introduced another CPI measure, Core CPI Ex-Tariffs, in the last few meetings to gauge the underlying CPI rise ex-tariffs.

When we dig deeper, the Core Goods is where we witness the impact of the tariffs.

The Tariff-Sensitive Sectors MoM Inflation:

•Other Goods: +1.07%

•Recreation: +0.63%

•Apparel: +0.31%

Note that these are import-heavy categories and account for a large share of core goods inflation.

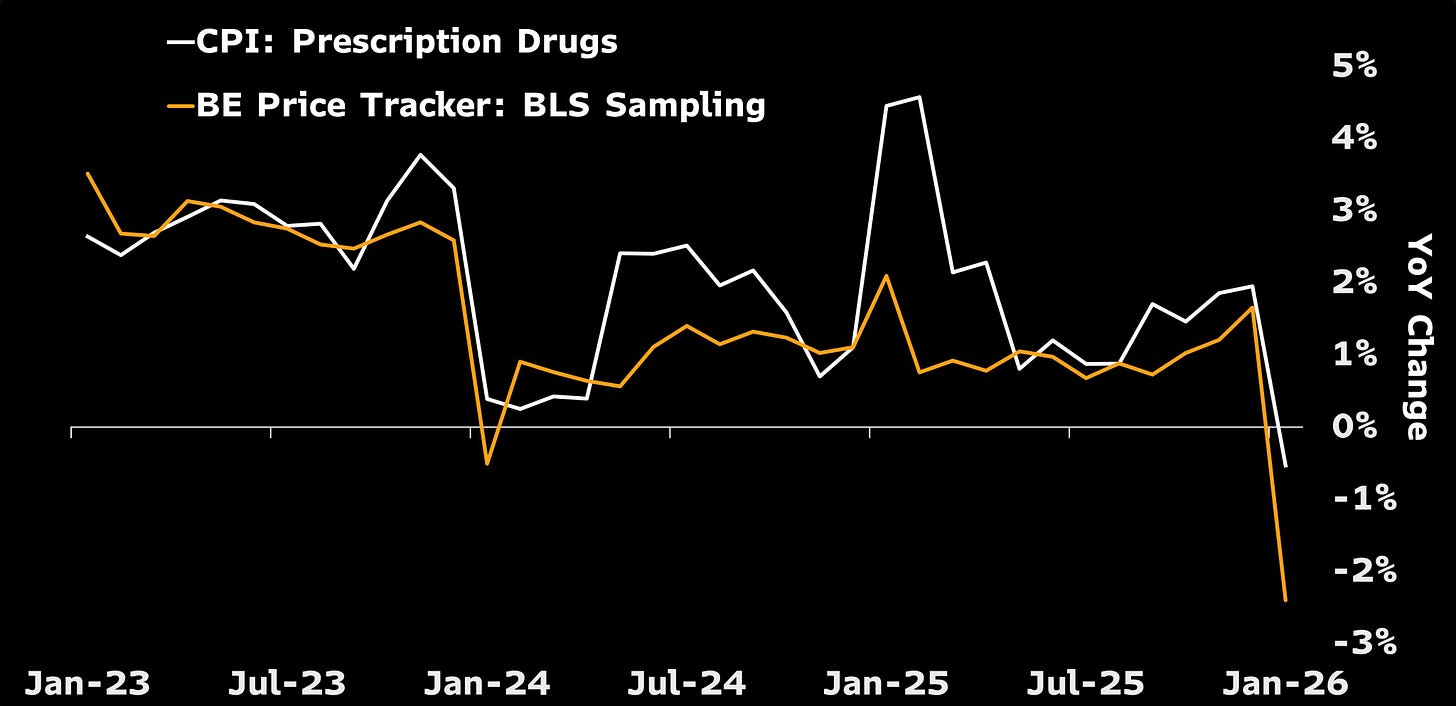

One of the categories which is putting downward pressure on CPI and is expected to be a tailwind for disinflation in the coming months is the Prescription drugs (we all know the reasons for the same).

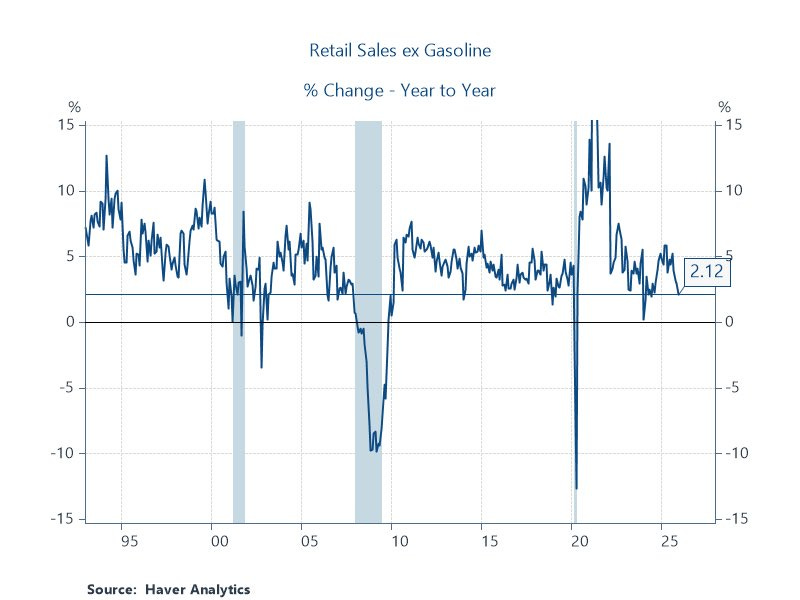

Retail Sales missed by a wide margin, coming in at 0% MoM vs the expected +0.4% MoM.

Retail Sales ex auto also came in at 0% MoM, vs expected +0.4% MoM.

Retail Sales Control Group came in at -0.1% MoM v/s expected +0.4% MoM.

Digging deeper, we discover that many categories saw a MoM decline, led by furniture and clothing.

We believe the Arctic storm that engulfed the US was partly responsible for this, and we need to wait for data in the coming months to determine the extent of the weakness in consumption.

Nonetheless, nominal retail sales have been sluggish in the past few months.

Now let’s jump to the positive surprise of the week: