Global Outlook 2026!

Welcome to the fourth edition of the Global Outlook, where we discuss our macro view for the year ahead and dig deeper into the expected performance of various asset classes.

Before we begin, in Global Outlook 2025, we predicted the following:

The S&P 500 will touch 200 DEMA in 45 days (it broke 200 DEMA on 6th March)

S&P 500 at 6700 or 5400 (both scenarios were considered, and both targets were met).

We expected European Equities to outperform the S&P 500 massively.

We had a long call on Brazil (one of the best-performing equity markets globally).

We envisioned a scenario where DXY touches 110-112 before Trump’s inauguration and then breaks 100 eventually.

We expected USDJPY to touch 137 (it bottomed around 140).

We expected Gold to cross $ 3,000 and Silver to cross $35.

We gave a sell call on BTC with a target of $80k (low was $76k on liberation day and $80k last month).

Note that we have removed the paywall for Global Outlook 2025, so everyone can take a look!

Undoubtedly, the highlight of 2025 was the global trade reset as the US imposed draconian tariffs in April, only to reverse the decision and execute trade deals/extend the truce with major trading partners.

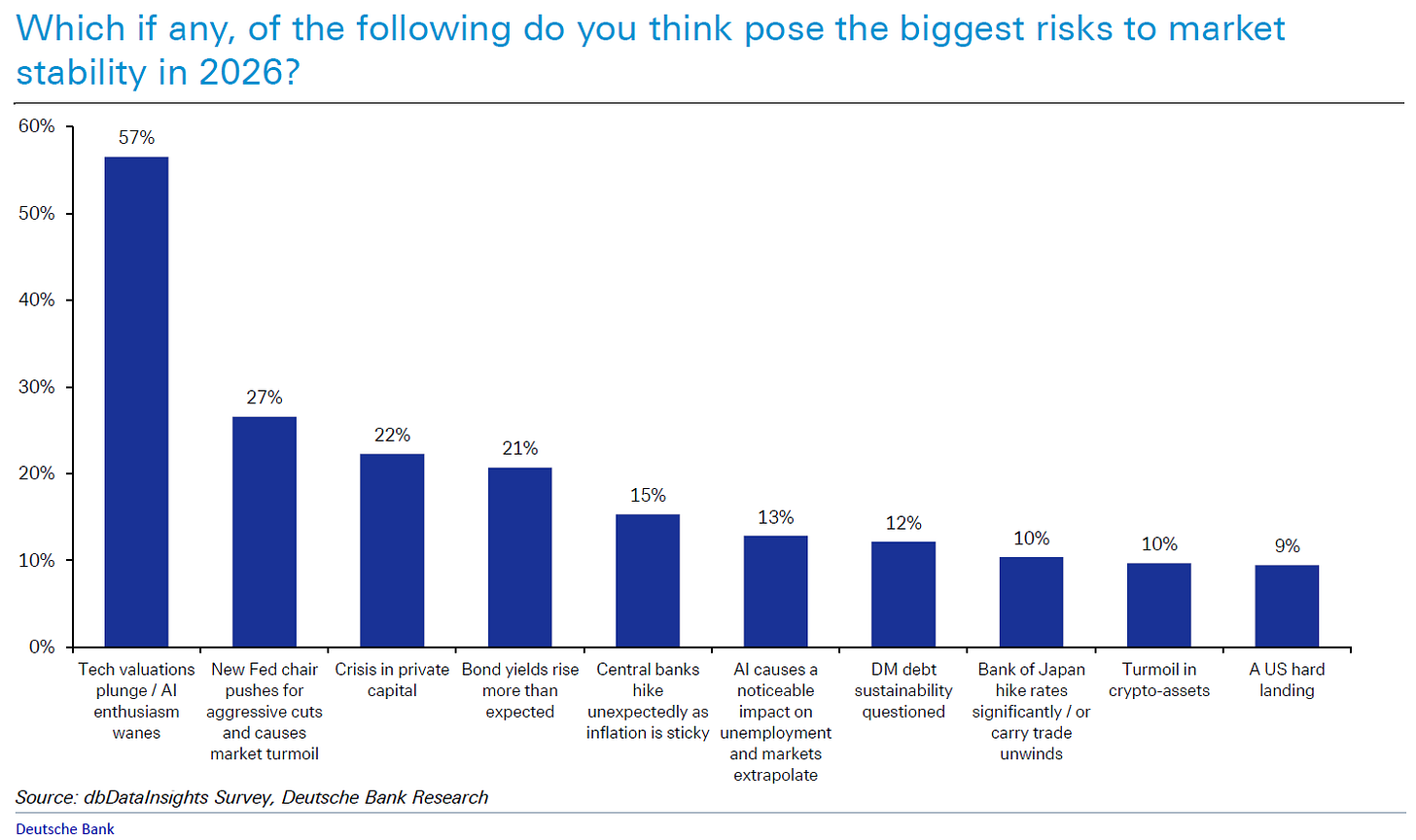

Nevertheless, the risks have been lurking across the board as we end 2026:

Today, we will present a comprehensive overview of the current macro situation.

We will also discuss our top macro trades for 2025, examine the appeal of equities, bonds, and commodities, and comprehend the influential FX markets.

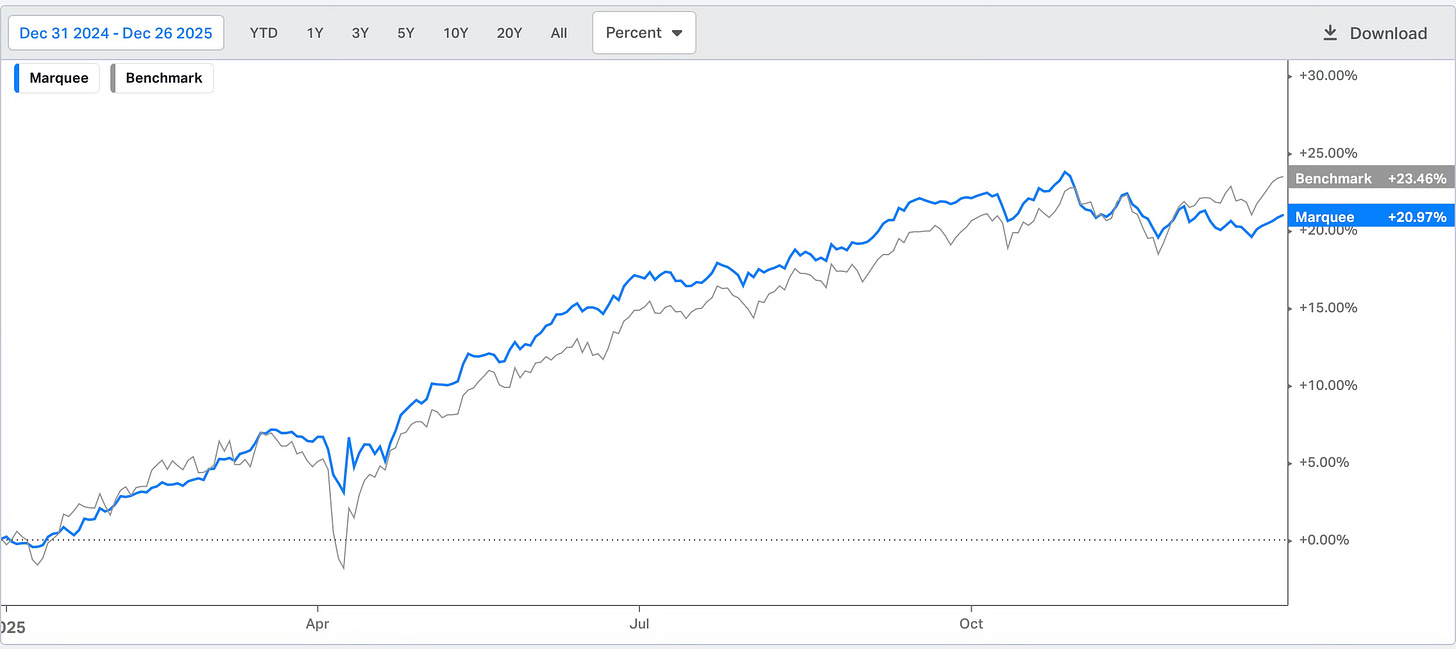

We had a satisfying year, limiting our drawdowns, and we are ending with 21% returns YTD, slightly underperforming the benchmark over the past few weeks after outperforming it for most of the year.

Before we begin, for those who are really interested in venturing deep into the macro universe, can access Macro Micro’s (MM) Prime subscription at mouth-watering prices (original price: $250 annually, available at $10/ month)

The subscriber will receive:

Full access to MM’s global macroeconomic charts and indicators

Country dashboards and data insights.

Weekly macro updates.

Priority access to selected research content.

Access to the 2026 Global Macro Outlook Series.

Note that they have designed the special offer for only the subscribers of Marquee Finance by Sagar (not to be shared publicly).

One can access it by clicking on the following link:

https://en.macromicro.me/promos/369/mrsagar?c=SAGARR

PS: Today’s newsletter is the most detailed we have written since the beginning the publication nearly 4 years ago. We have more than 60+ fundamental and technical charts that support our macro view and help predict the likely cross-asset performance in 2026.

The “Global” Macro View!

US!

Since the 2025 story was all about tariffs, we began by examining what transpired in that story.

Since early 2025, newly imposed tariffs fall into two categories:

Section 232 Tariffs: Targeted at specific industries such as automobiles, steel, aluminium, copper, and lumber — imposed under Section 232 of the 1962 Trade Expansion Act.

IEEPA Tariffs: Targeted at specific economies — including “fentanyl tariffs” on China, Canada, and Mexico, and the global reciprocal tariffs — imposed under the 1977 International Emergency Economic Powers Act (IEEPA).

The IEEPA tariffs will likely be deemed unlawful by the Supreme Court. However, the Trump administration has a backup plan and will likely invoke other bases—such as Section 122 of the Trade Act of 1974 or Section 338 of the Tariff Act of 1930.

Thus, we believe the tariff story is over, and we won’t see further cross-asset volatility driven by tariffs.

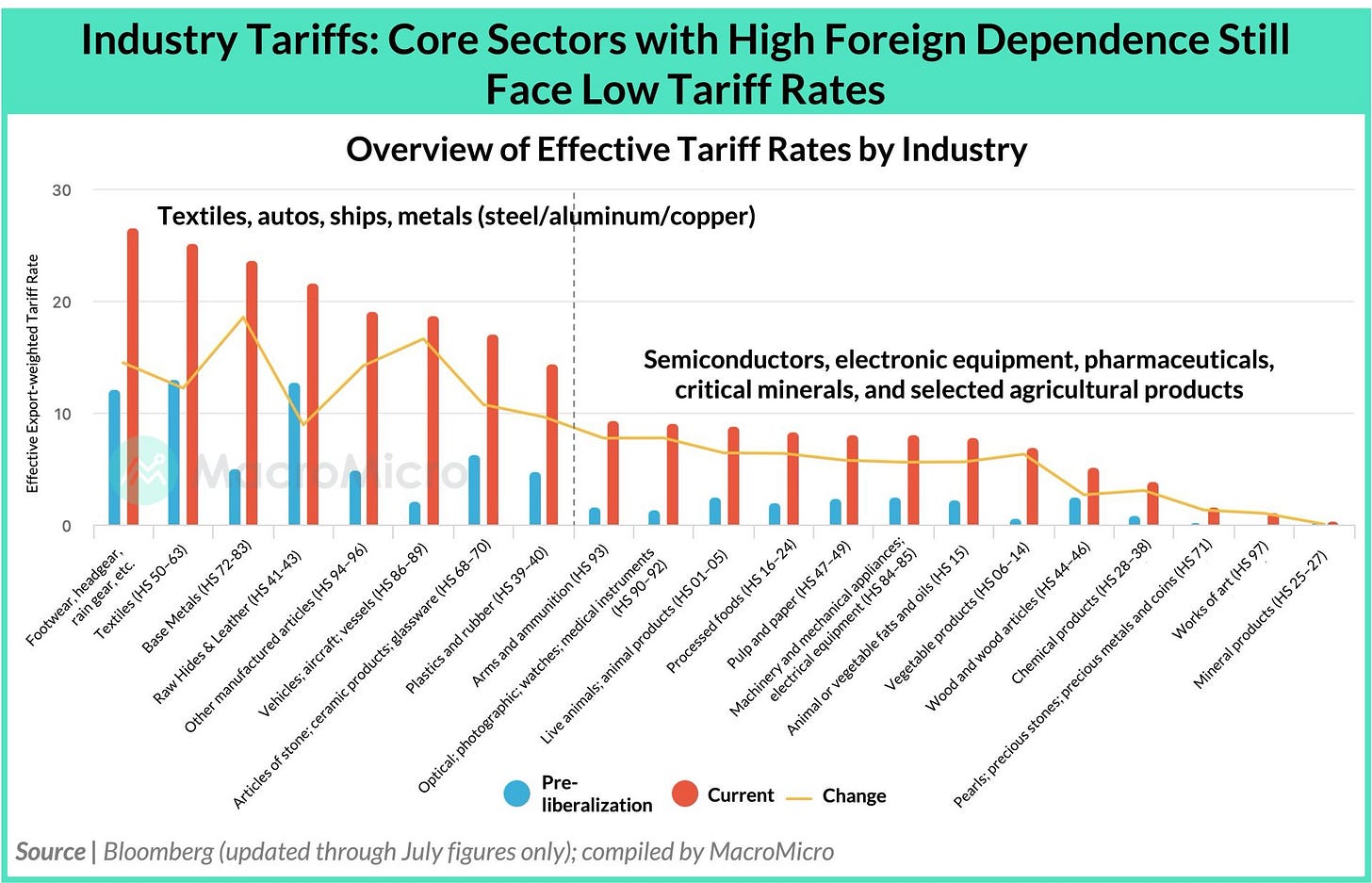

Furthermore, core sectors with high foreign dependence face low tariff rates.

In fact, under the USMCA, about 80% of goods from Canada and Mexico receive duty-free treatment.

As a result of the phased implementation and companies shifting import sources based on tariff levels, the actual tariff revenue reflects a rate rise to only about 11%.

Thus, a tariff-engineered recession was avoided, and a “trade war” has now turned into an AI war.

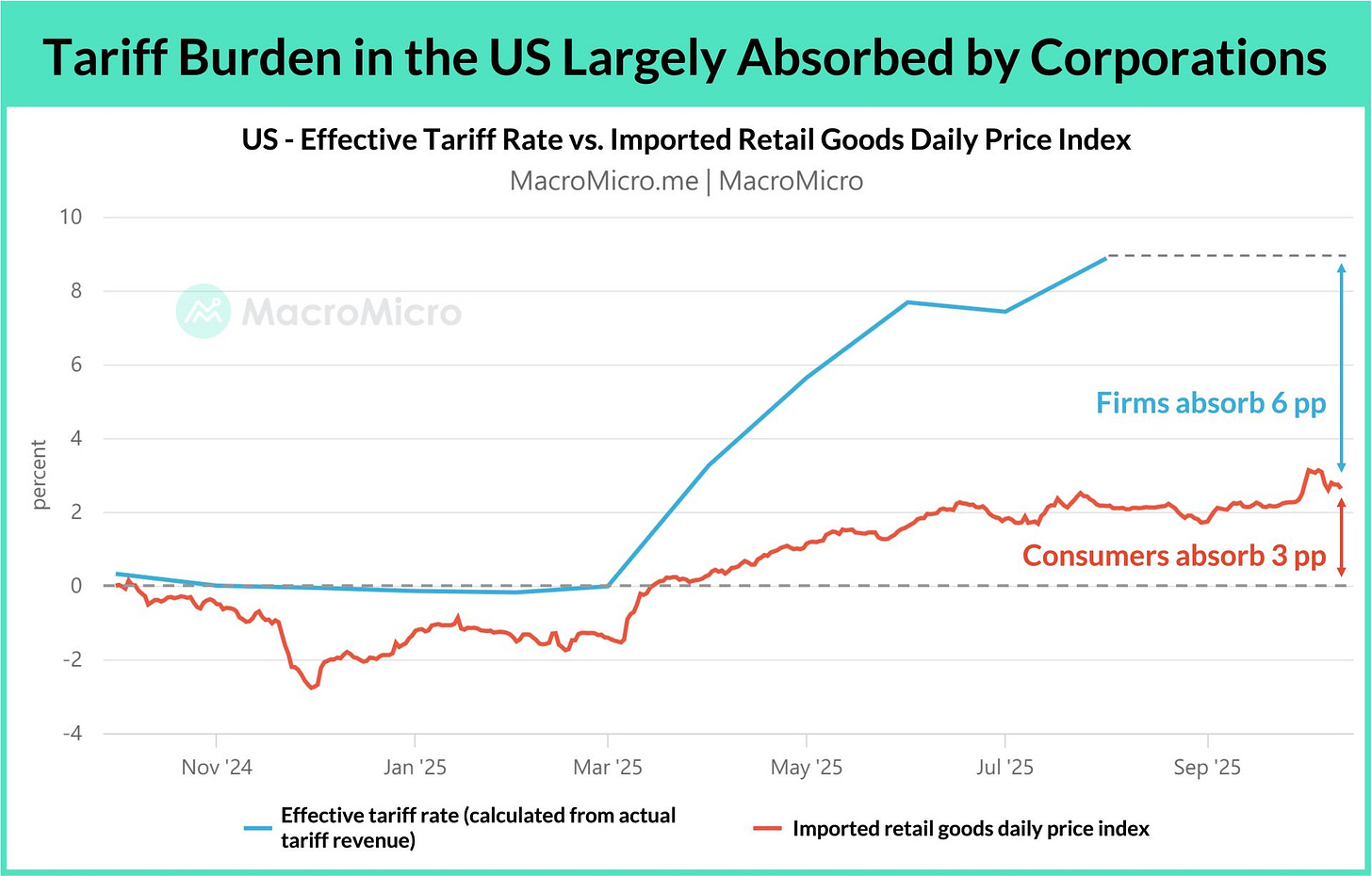

When we discuss the macro, we can’t ignore who absorbed the billions of dollars of tariffs.

According to the data, more than 66% of the tariffs were borne by firms, and the rest by consumers, resulting in lower inflation than market participants expected, given that the tariff rates were expected to be as high as 20%.

As promised during his election campaigns, immigration policy has been totally revamped under the Trump administration.

There have been multiple drastic consequences:

NFP break-even has fallen from 150k to 30- 40k due to a fall in the Labour Force Participation Rate (LFPR).

As illegal immigrants have been deported, the shelter inflation has been in a free fall, which has been putting downward pressure on the CPI.

The soft surveys indicate that although the labour market has cooled considerably, labour quality has declined.

Thus, the immigration policy will have a far-reaching impact even in 2026.

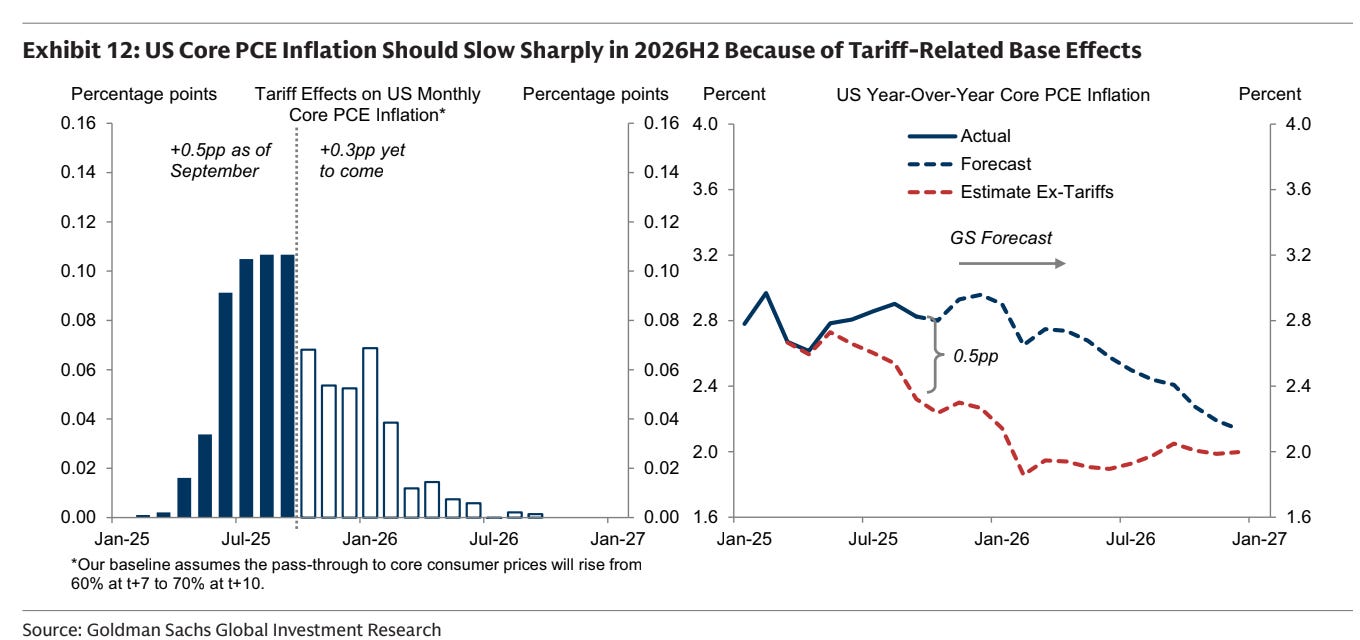

We expect the fall in rents to continue, which will put downward pressure on Shelter inflation, negating the effects of tariffs-induced inflation primarily in goods prices in H1.

Furthermore, according to estimates, the core PCE will decline sharply in H2 due to base effects.

On the contrary, higher commodity prices are the most significant risk to inflation forecasts, as we believe that a commodity bull run, especially in base metals, driven by supply disruptions, a lower dollar, low inventory, and Trump tariffs, can lead to significantly higher prices, especially in H1.

Note that higher commodity prices will be seen in CPI with a lag of at least 3-4 months.

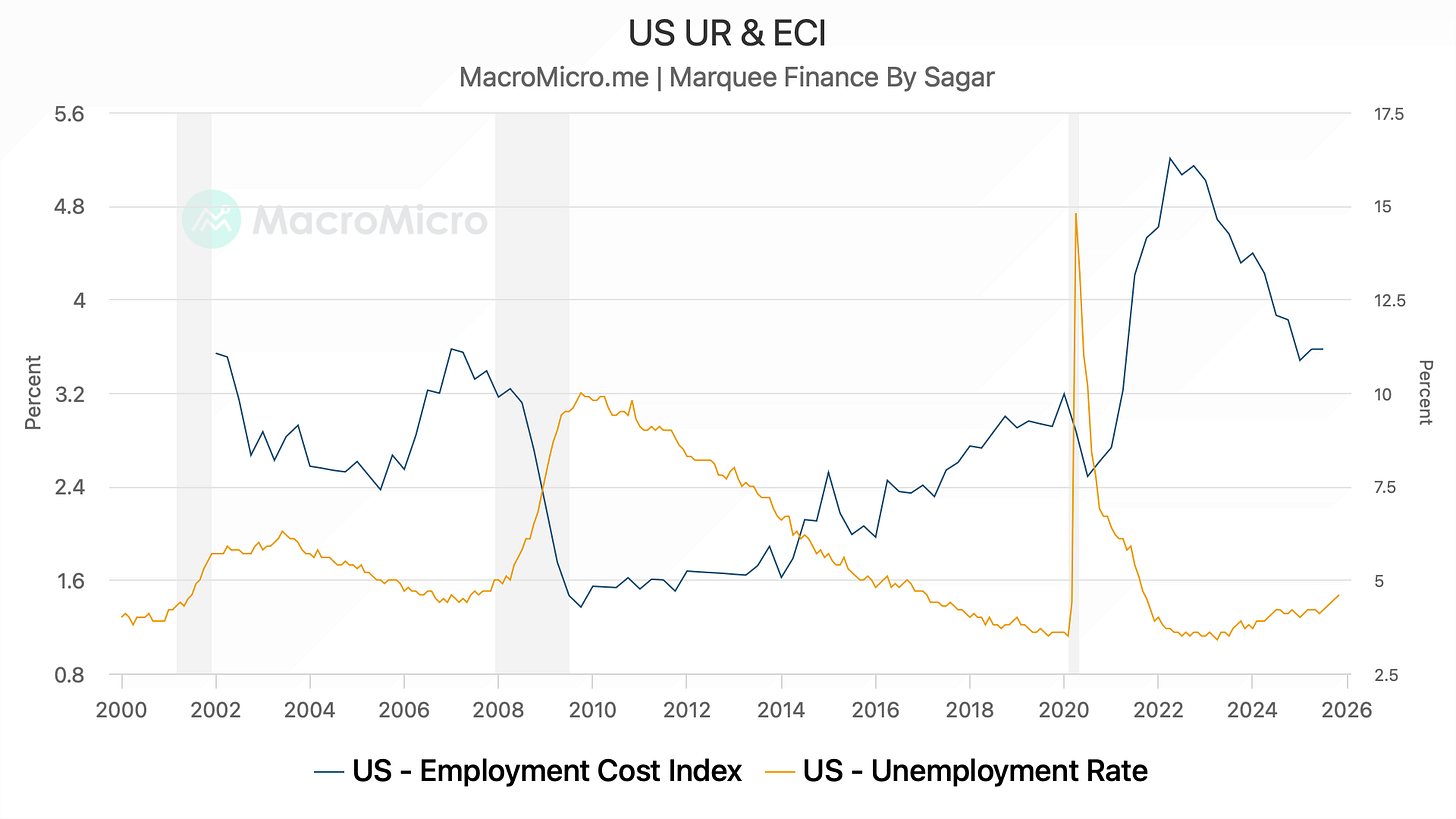

On the labour market, the softeness continues albeit gradually as the Unemployment Rate (UR) hits cycle highs. We expect Sahm’s Rule to be triggered sometime in Q1, which will lead to “recession” concerns.

Furthermore, higher UR will be accompanied by moderation in wages as measured by the ECI.

Nonetheless, we reiterate what we did 12 months back.

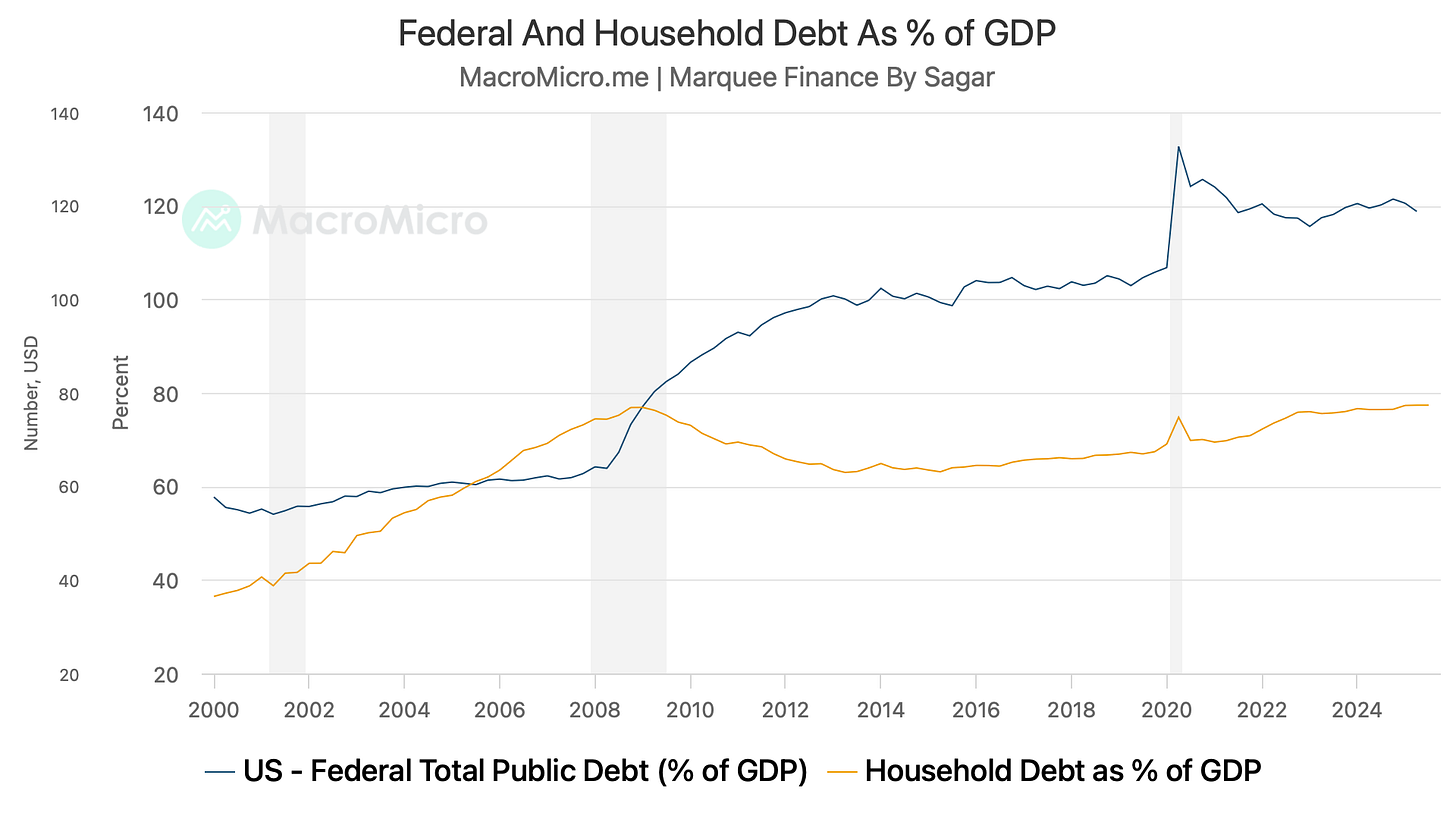

Due to extreme deleveraging in the private sector and the Households (HHs), we don’t foresee a recession similar to the 2008 GFC.

In the last decade, the leverage has shifted from the private sector and HHs to the government sector, a trend which has accelerated post-COVID.

We discuss more about the path that we believe the Trump administration will follow/ is following, to avoid a potential recession, and discuss the beneficiaries of the policy in the equities section.

Before we end the US section and move to Europe, for all those who are ardent supporters of “dedollarization”, we believe that the Dollar’s hegemony is here to stay for decades.

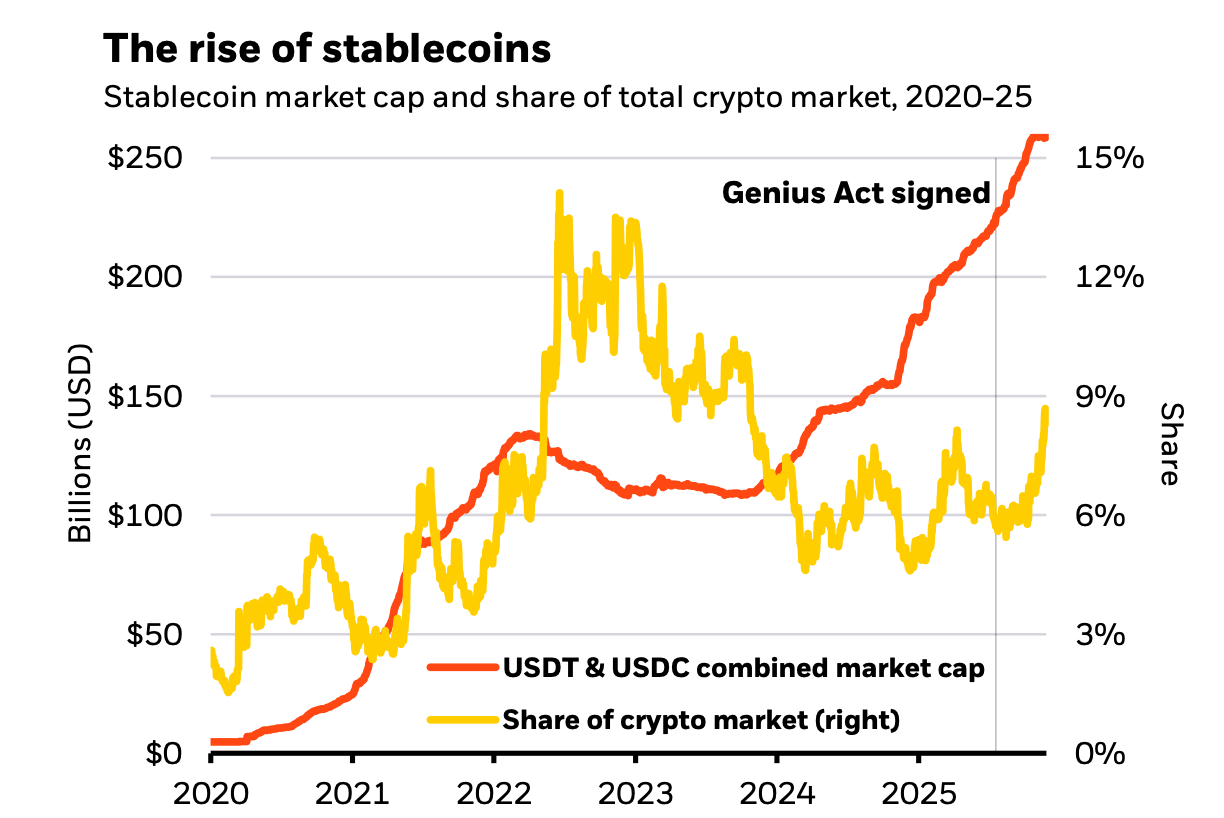

The Genius Act was a step toward further cementing the Dollar’s role in the global payments system.

We are of the view that it serves a dual purpose:

It will be a tailwind for the US Treasury to raise the trillions of dollars it needs annually.

It will maintain the dollar's hegemony for a long time.

Nevertheless, the combined market cap of the stablecoins is around $250 billion, and we need wider adoption before it becomes a sizeable force in global finance, competing with money market funds and banks.

Europe!

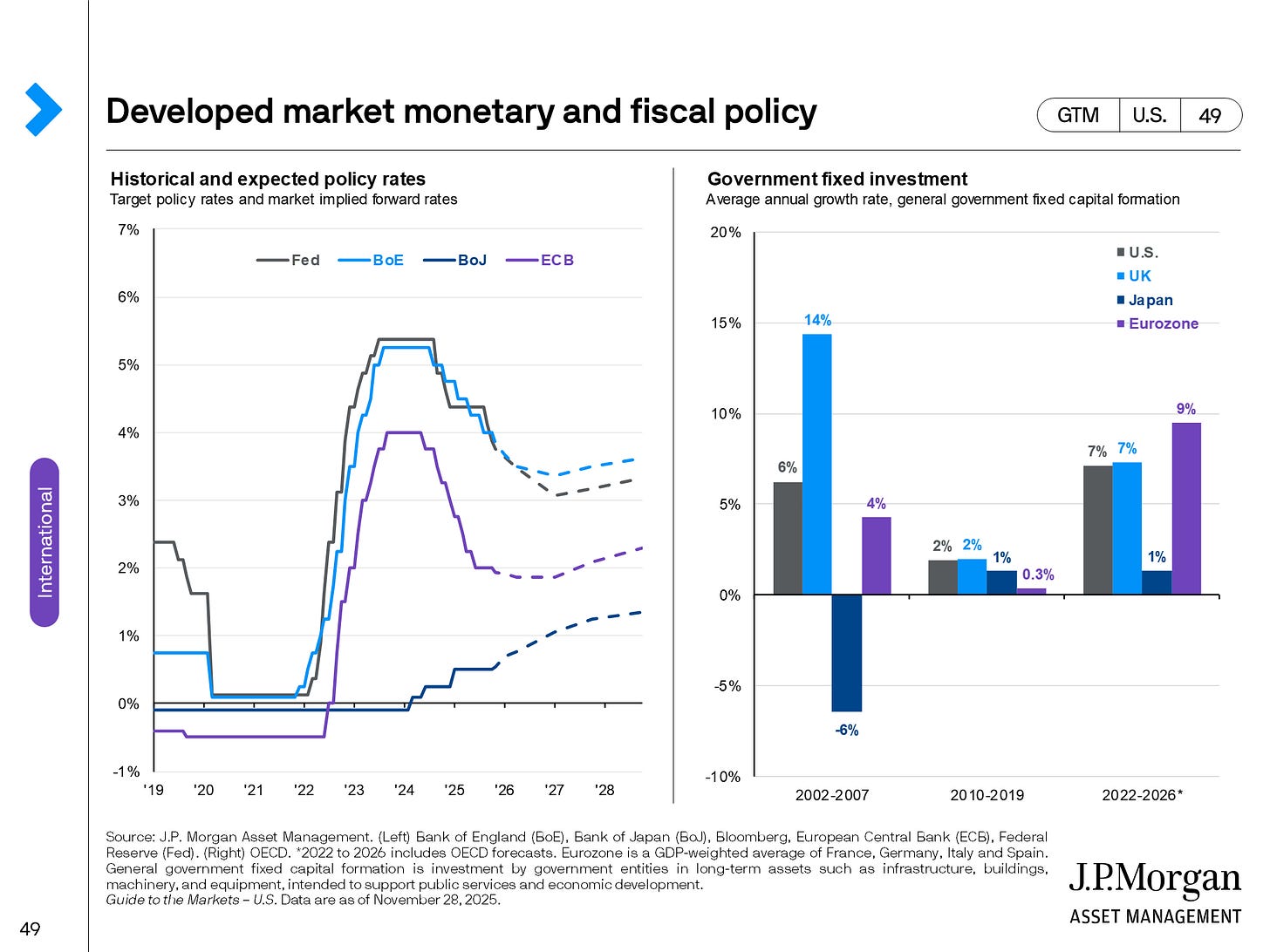

Outside the US, the story is the same everywhere as governments globally resort to fiscal expansion to spur growth.

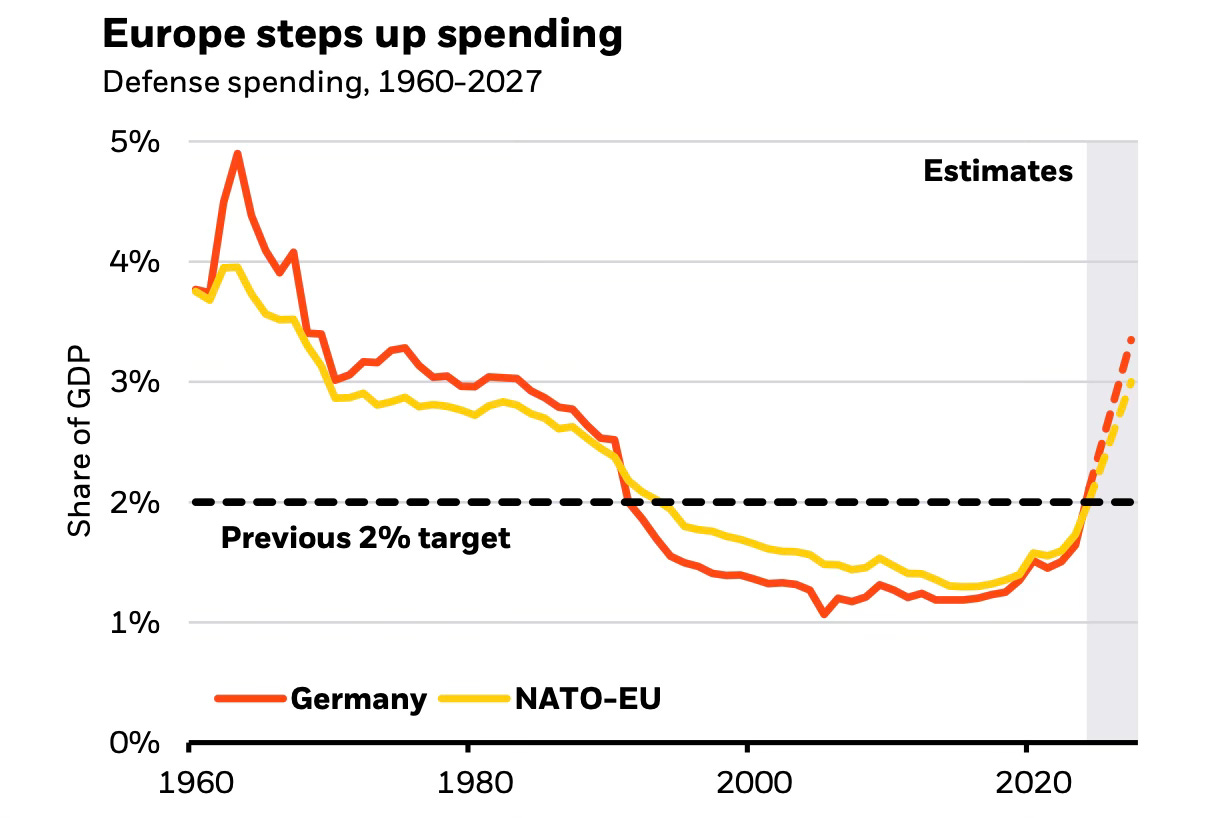

While NATO allies agreed to target defence spending of 5% of GDP by 2035, Germany suspended its “debt brake” to raise defence and infrastructure spending.

Looser fiscal rules are boosting energy investment, predominantly nuclear and gas-based projects.

We discuss later in the equities section the implications of the elevated fiscal spending by the European nations, excluding the UK.

2025 marked the end of the easing cycle for the ECB, with markets pricing in a hike as the next policy decision in 2027.

In the UK, we expect the BOE to cut more than the market expects, as the UK’s macro is the worst among developed economies.

The labour market is deteriorating rapidly, and the CPI is missing analyst expectations as the economy slows amid fiscal tightening by the UK’s government.

China & Japan!

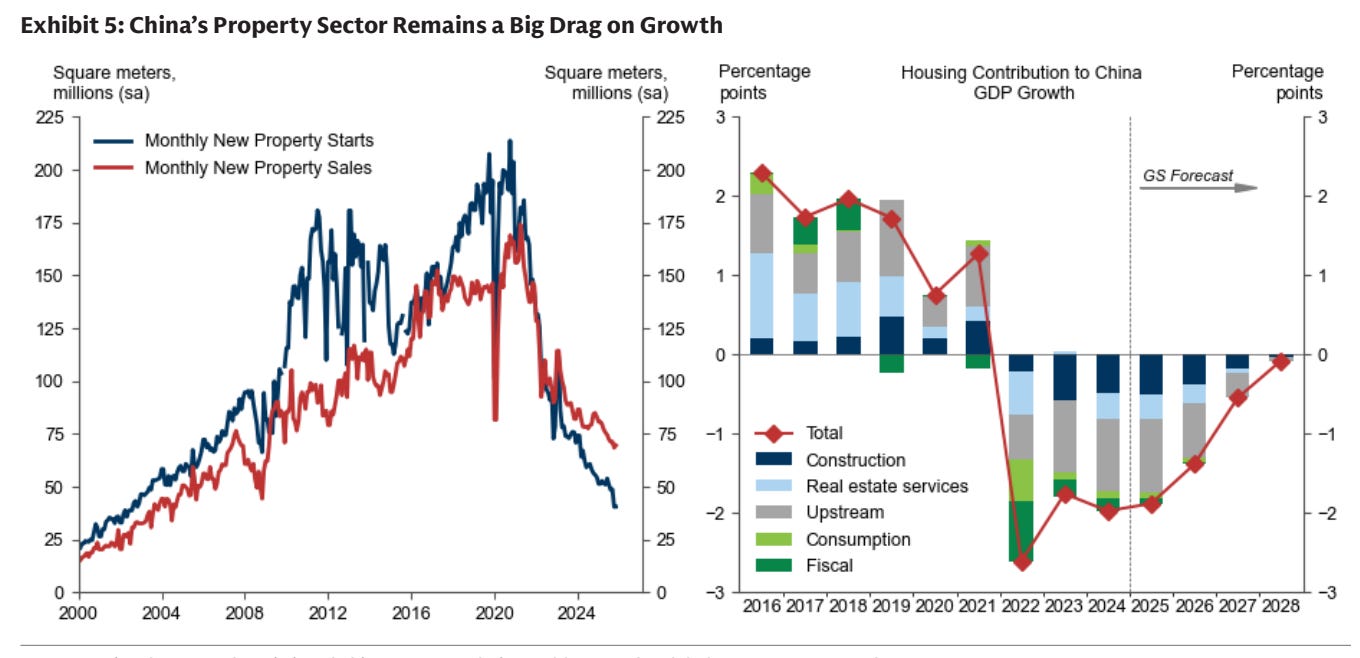

The stimulus measures taken in 2025 by the PBOC and the Chinese government have failed to revive animal spirits, as consumer sentiment remains depressed.

5th Five-Year Plan, revealed a shift in its 2025 policy logic—from heavy regulation to confidence stabilisation, fiscal stabilisation, tech development, and structural adjustment:

Technology & Industrial Strategy: A push to seize technological high ground and transform China from a follower to a leader, with a special emphasis on AI and computing power.

Economic Restructuring: For the first time, explicitly calling for raising the household consumption ratio while continuing the fight against inflation.

Note that the shift is a targeted measure, as China’s property sector remains in a deep “depression” amid a balance-sheet recession gripping the whole economy.

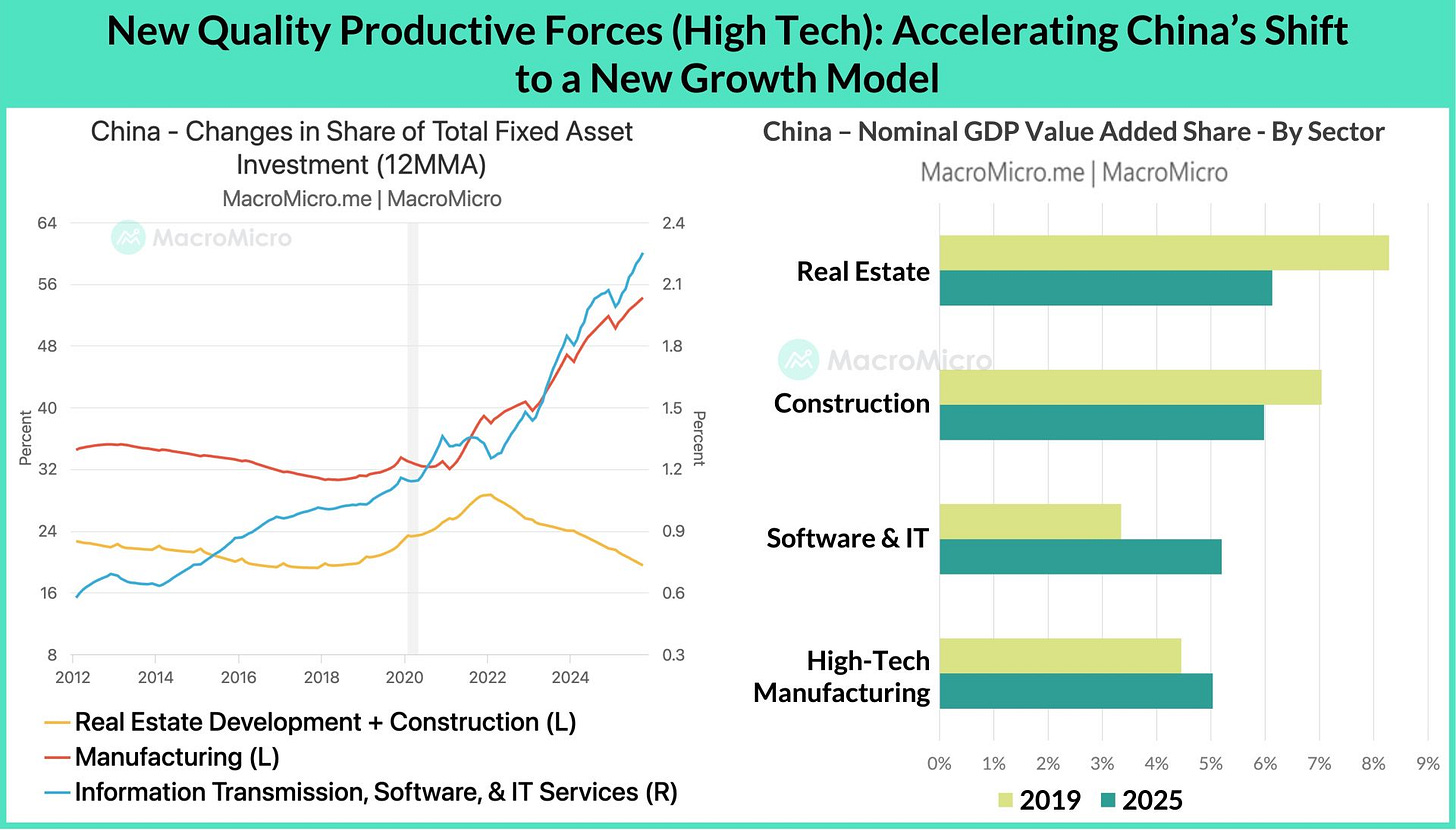

China's shift to high-tech manufacturing and Software services, with strides in AI and robotics, is visible in the macro data.

Furthermore, the policy of allocating consumption-tax revenue to local governments is a move that, if implemented, could motivate localities to prioritise consumption-stimulating policies over pure production/investment stimulus.

This will increase the share of consumption in the overall GDP, a long-standing Goal of Xi.

Note that Bessent has been very vocal about this fact as well.

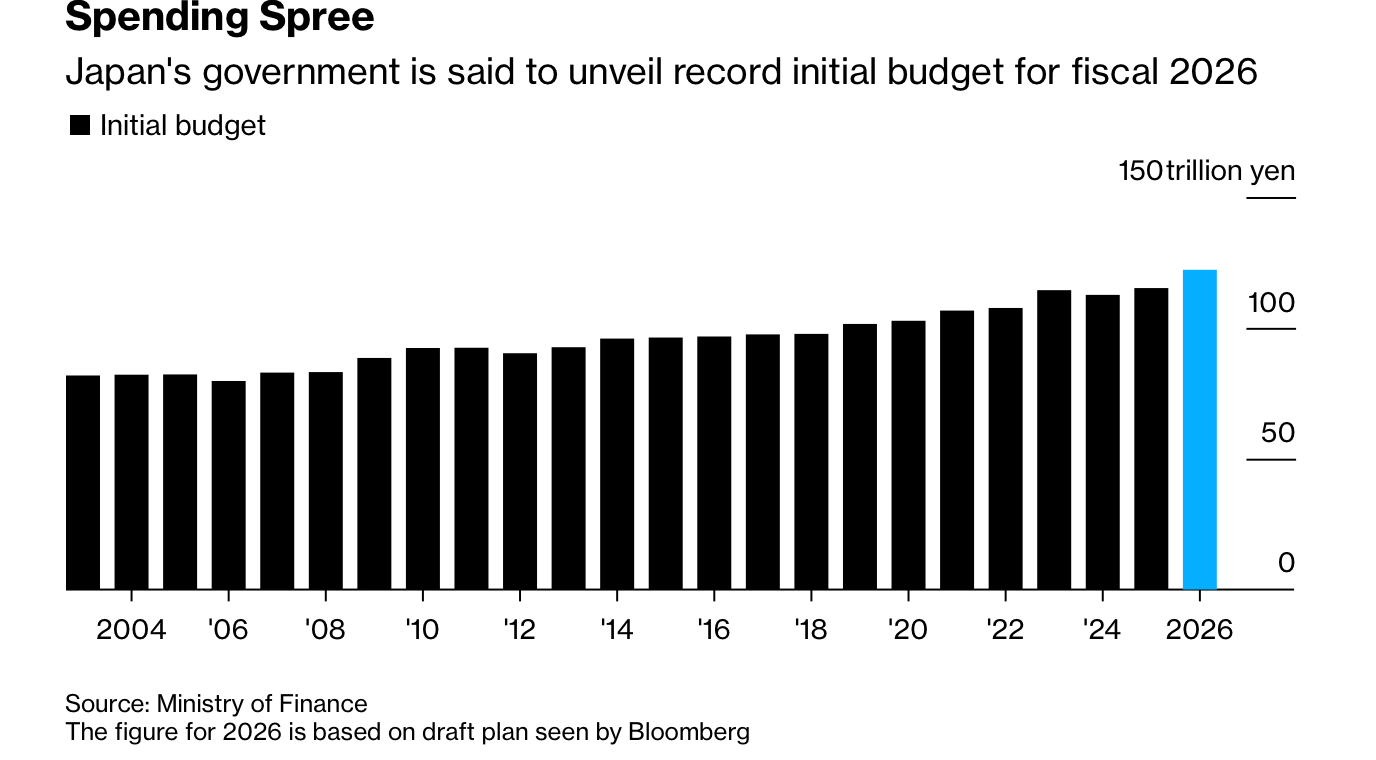

In the land of the rising sun, despite record-high yields, the Japanese government is pushing for a record-high budget.

The budget for the year beginning April 2026 will total about ¥122.3 trillion ($786 billion), Takaichi said on Thursday.

That represents an increase of roughly 6.3% from the ¥115.2 trillion allocated for the current fiscal year, marking the largest initial budget on record.

Thus, we expect that a tight monetary policy will be needed to negate the loose fiscal policy, which might lead to higher CPI despite the base effect.

Also, we will watch out for Shunto wage talks in April. Higher-than-expected wage hikes will seal another rate hike by the BOJ.

Equities!

US!

For US equities, the most important chart for 2026 will be the: