Gradually, Then Suddenly!

“How did you go bankrupt?”

“Two ways”

“Gradually and then suddenly.”- Ernest Hemingway

The explosion of 0DTE options and the gambling frenzy have gripped the equity markets post-COVID. Furthermore, the crypto meme coin mania, where billions of dollars are created out of thin air to defraud the masses, has resulted in financial malaise.

This week, we experienced a Volmageddon event when the Volatility Index (VIX) spiked by more than 70% in just a few hours.

We have flagged the risk of such an event due to the en masse use of the 0DTE options by the retail crowd and the HFTs.

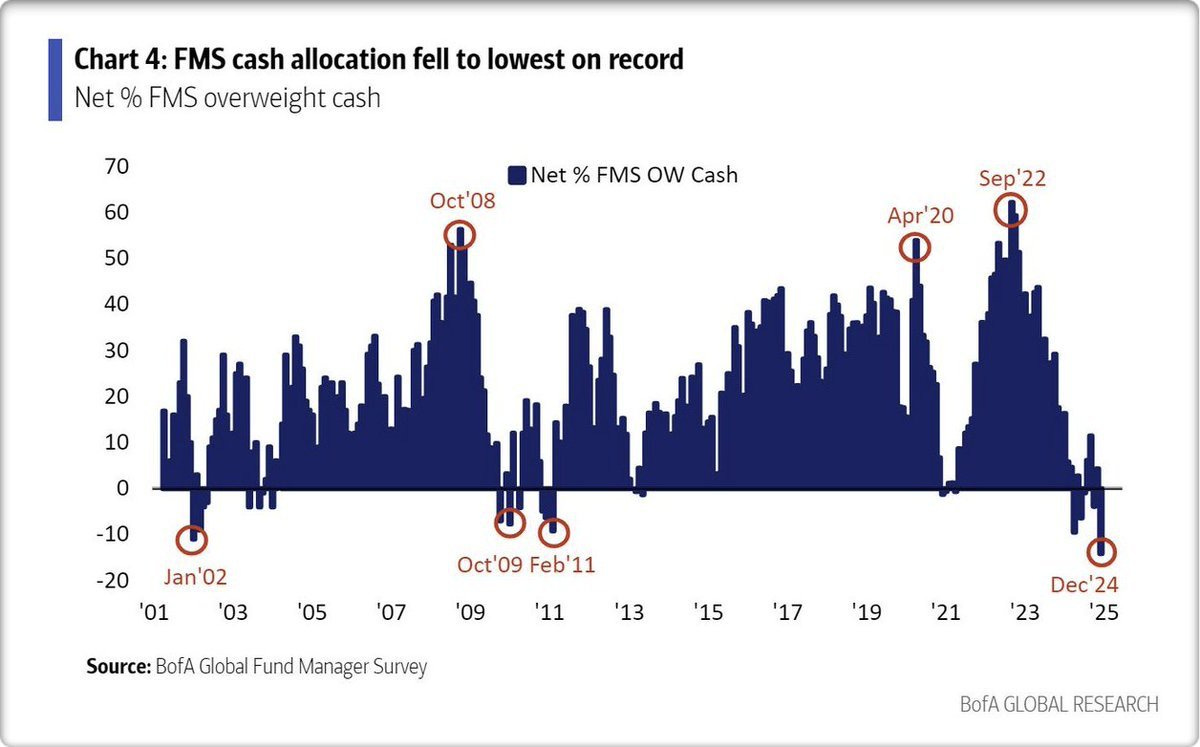

Moreover, the euphoric markets saw one-way positioning, with fund managers' cash allocation at the lowest-ever levels. Everyone chased US stocks, pouring billions of dollars while selling everything else post the Trump win.

Thus, mean reversion was bound to happen.

Nonetheless, today, we dig deeper into the monetary policies of the Fed, BoE, and the BOJ, as there were hawkish reports, except for the contrarian central bank (BOJ).

We will also examine the macro data globally covering the US, Europe, China, and Japan.

US!

As we will talk about in detail, the week's biggest news was the FOMC outcome, which was hawkish on multiple fronts (as per our expectations).

Let’s discuss the dot plots (Summary of Economic Projections- SEP) in detail and examine the “hawkishness”:

Firstly, the Fed raised the 2025 and 2026 rate projections by 50 bps, indicating only two more 25 bps cuts from the current Fed Funds Rate (FFR) next year and only two more cuts in 2026.

Secondly, the year-end inflation forecasts (PCE) rose from 2.1% to 2.5%, demonstrating that the Fed expects stubborn inflation and a resurgence of inflationary pressures (likely core services). Note that JayPo explicitly mentioned that wages were not the source of higher inflation.

Thirdly, the Unemployment Rate was lowered from 4.4% to 4.3%, just 10 bps higher than the current reading of 4.2%. We wish JayPo and the team good luck in achieving it.

Fourthly, though JayPo categorically replied that a rate hike was out of the question, the FOMC statement mentioned:

“If the economy remains strong and inflation does not continue to move sustainably toward 2%, we can dial back policy restraint more slowly.”

Thus, we believe the maximum the Fed can do from here is further delay the rate cuts if the macro data remains resilient, which we don’t think will last long (discussed in the Global Outlook 2025).

Lastly, we didn’t get any tapering announcements on the QT front (the Fed’s balance sheet is down 23% from the post-covid peak), as some market participants expected disappointing the bulls.

Nonetheless, the most significant surprise, as we had previously mentioned a few times this year, was the: