We are at an inflection point in multiple ways as H2 ends:

Political uncertainty across the West has elevated to unprecedented levels with a likely change of guard in the UK and France. Furthermore, the events of the last 24 hours in the US indicate that H2 will be a deadly political circus for which nobody is prepared, but we are confident in our ability to weather the storm.

Markets are at a turning point across FX, Equities, and Bonds. Given the recent macro data, the soft landing thesis will be tested at length in H2, but it also opens doors for potential gains.

Parts of equity markets are in bubble territory as an “AI” theme, also known as. since the earlyMachine Learning has been used for epic pump and dump across the spectrum.

Until 31st May, the average Macro-based hedge fund YTD returns were 3.63%, while L/S was up 6.86%.

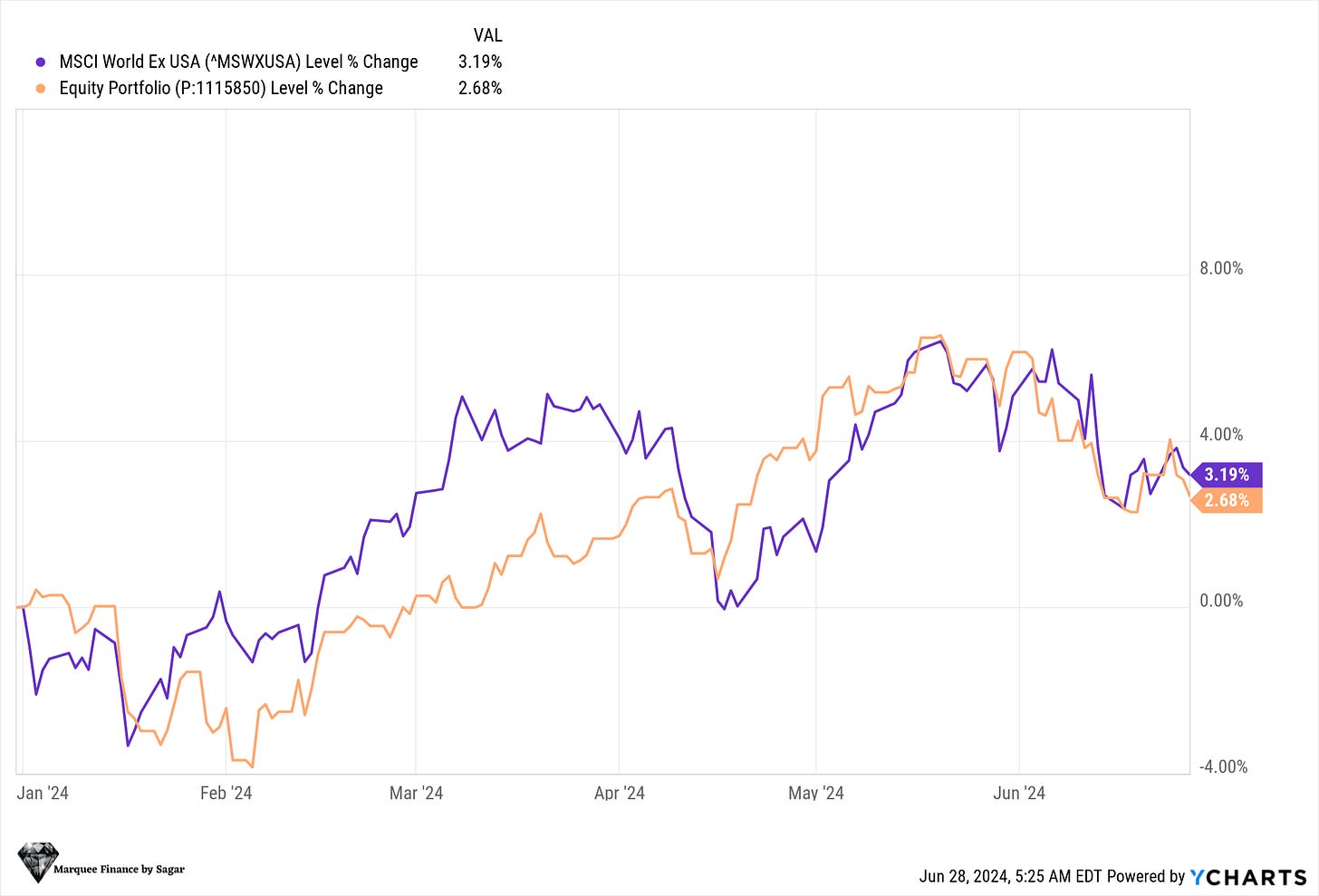

We are glad to inform you that up to 31st May, we were up 3.95% YTD.

However, the PF had a negative return in June as equity markets, except Mag 7, witnessed a substantial drawdown.

Nonetheless, as we have repeatedly mentioned, we will patiently wait and not jump in out of FOMO.

As a result, short-term returns can be subdued if the trend persists. However, we believe that in the long run, 6-12 months, we will generate significant alpha.

Let us look in detail at our trades in H1 this year and our performance across assets.

Equities!

Until 31st May, the YTD performance was 6.14%, marginally below the average Equity L/S Hedge Fund performance of 6.86%.

Furthermore, this month has been poor for us in terms of equity performance as we have been increasing some of our positions, which have been against the tide.

Total Profitable Exits/Trades/Partial Exits:

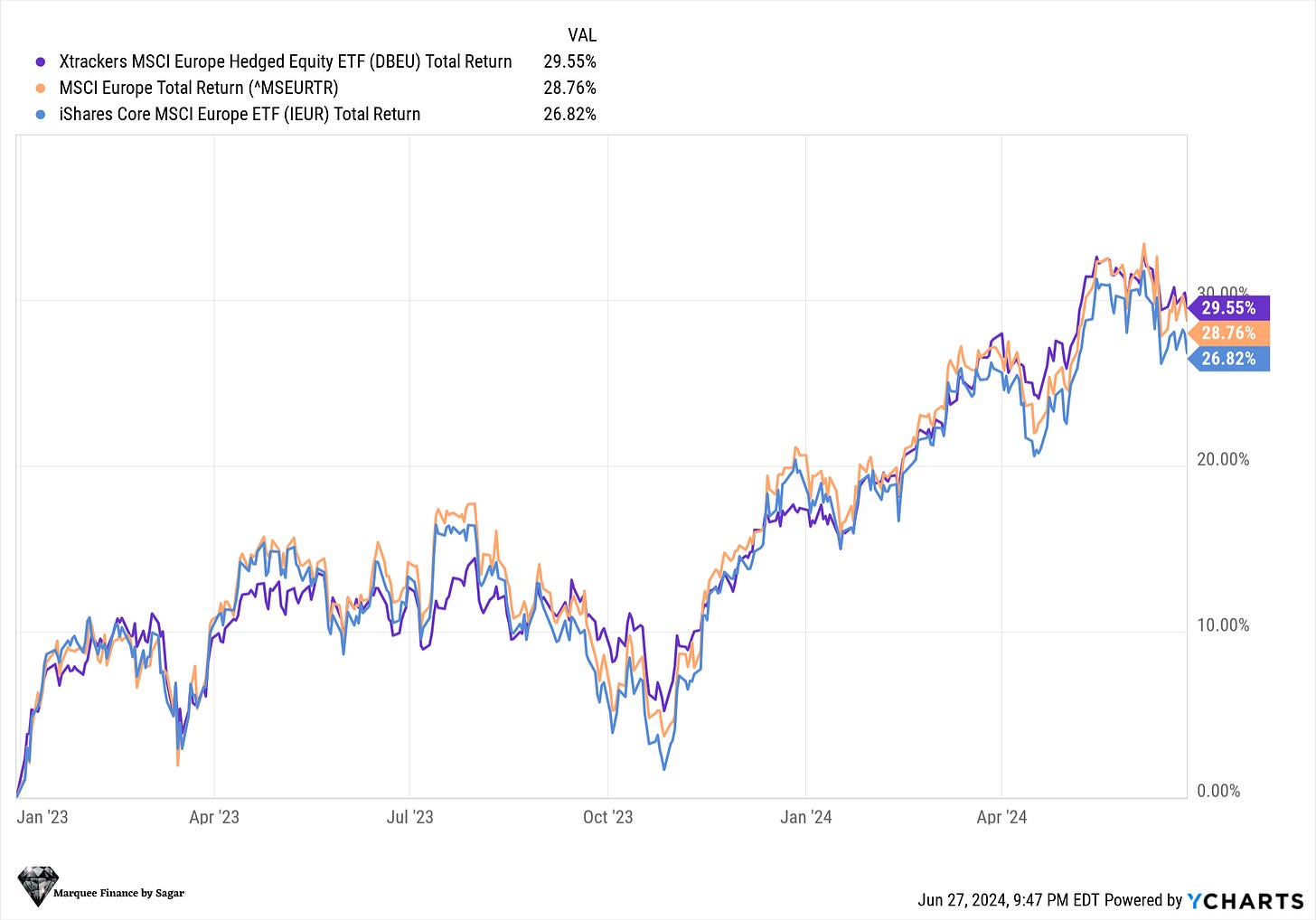

DBEU (European Hedged Equities): Profit of 25% (holding period 16 months)

SIL (Silver Miners): Profit of 22% ( holding period 2 months)

UCO (Long Oil): Total Gain of 19% in 2 trades in Jan/Feb

EWJ (Unhedged Japan): Profit of 15% (holding period 10 months)

BRK.B: Profit of 14% (holding period 7 months)

XOM: Profit of 13% (holding period more than 15 months)

XLU: Profit of 11% (holding period 11 months)

EWY (Unhedged South Korea): Profit of 8% (holding period 5 months)

DXJ (Hedged Japan): Profit of 7% (holding period 3 months)

Some of our best calls this year have been:

Entering the Silver Miners (SIL) just when Silver was ready to take off, we could have played via SLV, but since miners were undervalued, we decided to jump in early April. Booked some gains when Silver touched $31 and some last week.

The long oil trade worked wonders in January/February, as we captured the upmove nicely despite Qatar's fake news. However, despite some early signs, we missed the current rally.

We had been bullish on Japanese equities since the inception of our Model PF, and we rode the whole move higher in DXJ from $64 to $88, again entering at $101 and exiting at $109. Along with EWJ in between, we garnered a sizeable return via Japanese equities (around 50%+).

Europe via hedged ETF (DBEU) has been a stark outperformer, and we had our European exposure via DBEU to avoid currency risks. We logged significant gains before we decided to sell it off.

Anticipating a melt-up in mid-December, we increased our US exposure via BRK.B and added to EWY (South Korea). Both trades worked well, and we received multi-digit returns.