Has The Music Stopped Playing?

“A further reduction in the policy rate at the December meeting is not a forgone conclusion—far from it. Policy is not on a preset course.”- Jerome Powell.

Once again, the world’s most powerful central banker shattered the market’s expectations despite extreme political pressure and sprung a surprise at the FOMC this week.

We wrote to our paid subscribers early on Monday that JayPo, in the absence of official government macro data, will likely be non-committal on the December cut.

The hawkish touch to the policy came as a knee-jerk reaction, especially in the FX and bond markets, as the bond markets were pricing in more than a 98% probability of a December cut.

We will discuss the cross-asset implications in detail later.

We believe most of you have seen the movie “Margin Call”, an honest account of how the events unfolded in the 2008 GFC and the advantage of moving first.

A particularly famous clip from the movie is often shared on social media whenever concerns about systemic risk arise.

We believe that the time has come to be cautious, as cockroaches are now rapidly emerging from the private credit universe.

This week, we were bombarded with multiple stories indicating that the stress is rising alarmingly, with desperate measures being undertaken by firms to avoid defaults.

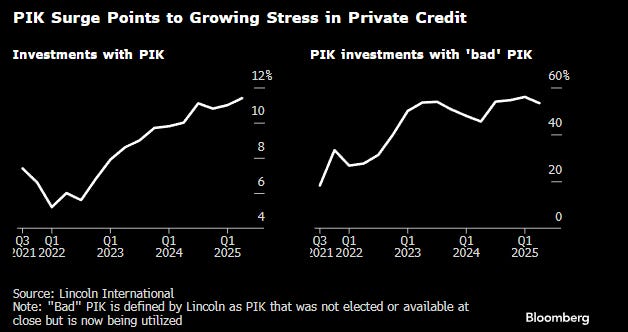

Interestingly, Payments In Kind (PIK) is a way in the industry where investors are paid in more loan units rather than cash. The bad PIK occurs during the loan tenure, which suggests cash flow issues (most likely negative OCFs) and is essentially a shadow default. Investments with PIK have doubled in the last two years, following our initial observation in “The Big Short”.

The second news was the “innovative” method to avoid markdown in funds. The swapping of debt positions for equity stakes buys more time for these lenders to markdown their investments. At the end of the day, if the firm doesn’t have a viable business model, it will either shut down (with an equity value of zero) or investors will continue to pump more money in via equity or debt.

The “fraud” cases, which began with the bankruptcy of Tricolor and First Brands, show no signs of stopping. This week, BlackRock faced another $500 million fraud case, which stunned the street due to a lack of due diligence, and the details indicate blatant misuse of funds by a little-known company.

The newsflow is worrisome and demonstrates that, beneath the AI-fueled gigantic “circular” capex, the economy is struggling as these kind of cockraches emerge only when the liquidity evaporates and the economy slows down.

Moving on, after months of outperforming the markets, this week’s events (especially with some of our stock earnings) led to slight underperformance, with the YTD returns down to 21.26% compared to 21.65% for the benchmark.

Let us discuss the policy decisions of the Fed, ECB and the BOJ, and also decode the cross-asset moves.

US/Bonds/Equities/Gold/Oil/Dollar!

In the absence of crucial government macro data, we will today analyse the soft data released this week.

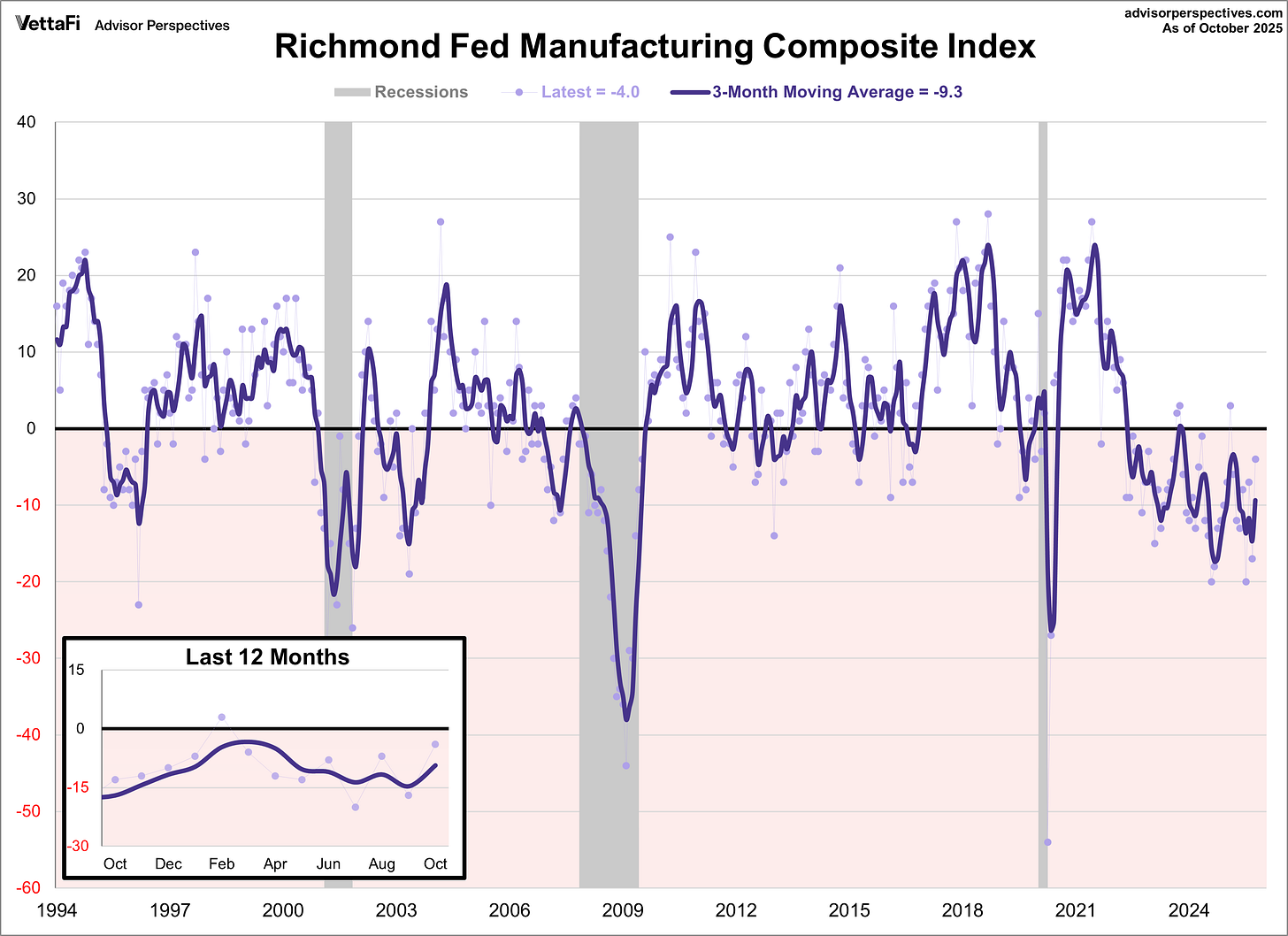

The Richmond Manufacturing Survey has been in negative territory for eight consecutive months.

Compiled from surveys of around 100 manufacturers, the data indicate that manufacturing activity remains sluggish.

Nonetheless, the trend seems to be moving up, which is a positive sign.

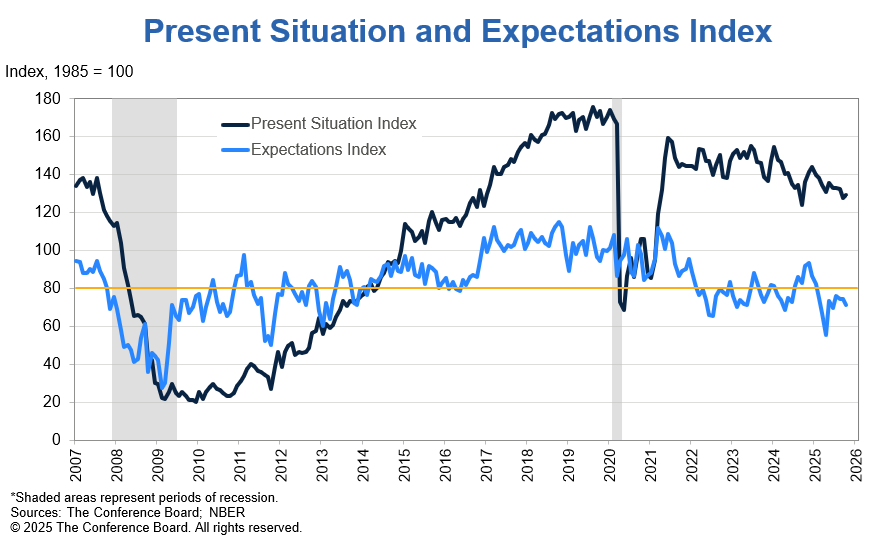

We also got consumer confidence data from the Conference Board.

While the Present Situation Index slightly rose from the previous month, as the appraisal of current job availability improved for the first time since December 2024, the Expectations Index fell, as consumers became a bit more pessimistic about future job availability and business conditions.

When we analyse the health of the consumer, we can’t ignore what’s happening with the earnings in the consumer staples and discretionary sectors.

One interesting earnings call which caught our attention was:

CHITPOTLE:

Earlier this year, as consumer sentiment declined sharply, we saw a broad-based pullback in frequency across all income cohorts. Since then, the gap has widened, with low to middle-income guests further reducing frequency. We believe that this guest, with a household income below $100,000, represents about 40% of our total sales, and based on our data, is dining out less often due to concerns about the economy and inflation. A particularly challenged cohort is the 25 to 35-year-old age group. We believe that this trend is not unique to Chipotle and is occurring across all restaurants, as well as many discretionary categories.”

Thus, unsurprisingly, the consumer-facing stocks have been a disaster this year, further confirming the K-Shaped economy, which we have been arguing for the last few months.

Now let’s move to the most important event of the week: FOMC.

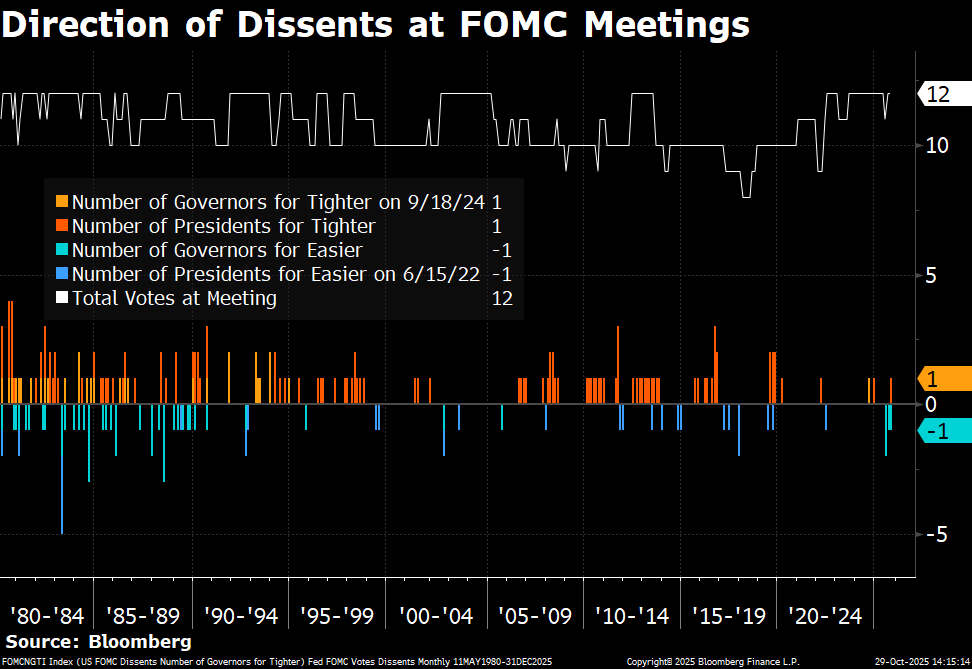

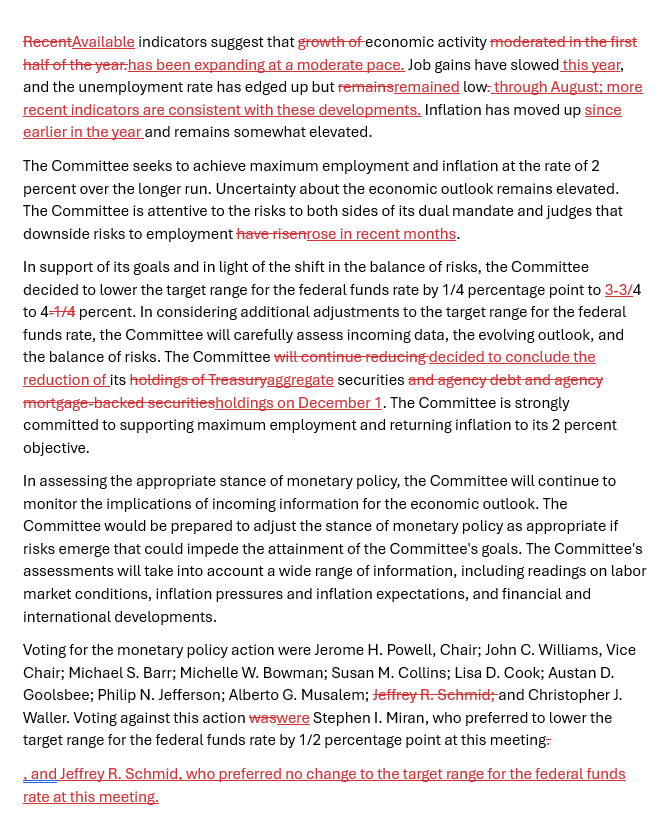

Interestingly, we received two opposing dissents this week, as Schmid voted against a cut, while Miran, as expected, voted for a 50-basis-point cut.

As a result, we are witnessing the most divided Federal Reserve in history, as it becomes increasingly challenging to achieve its dual mandate.

If we ignore the end of QT, there were no significant changes in the policy statement.

Let’s now carefully analyse