Has The Music Stopped Playing?

"Liquidity is like a cab in New York on a rainy night. It disappears when you need it the most."- JP Morgan.

This week, we were bombarded by unforeseen news across the spectrum:

Blue Owl’s concerns.

The Tariff Saga.

The Geopolitical Drama.

We will discuss the Blue Owl story in detail in the introductory note and the Tariff Saga in the US section. Note that we covered the Geopolitical situation in chat this week.

For the first time since Wall Street raised alarms about issues in the private credit industry, the administration has acknowledged them.

“Don’t want rotten PE Assets dumped into 401(K)’s”- Bessent.

“Our job is to make sure the regulated system is not affected by problems in private credit”- Bessent.

Blue Owl announced a shocker this week, permanently restricting withdrawals from one of its retail-focused debt funds.

Furthermore, Blue Owl sold $1.4 billion in loan assets from three of its funds in a “fire sale” to generate liquidity for redemptions.

Although Blue Owl was able to sell the loans in the recent transaction at just below par, the deal itself was questionable, as one of the buyers was Blue Owl’s insurance arm and thus a RPT (Related-Party Transaction).

Note that the GFC experience teaches us that high-quality liquid assets are sold first, and the “trash” (low-quality, illiquid) assets are sold at enormous haircuts/discounts later, when the situation deteriorates at the industry level, and liquidity evaporates.

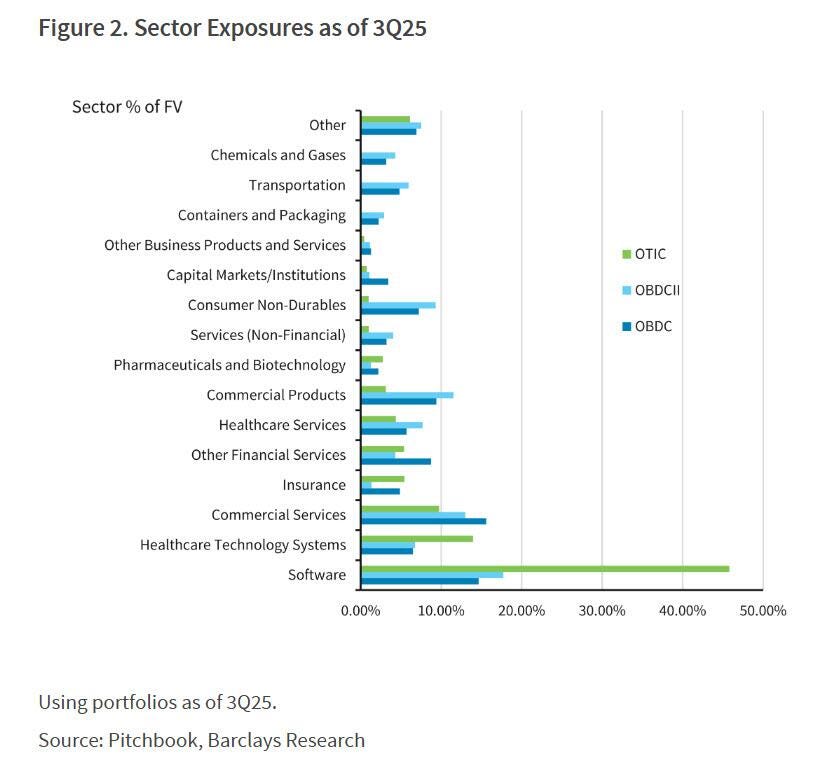

Note that, per management, while some of Blue Owl’s funds have software exposure as high as 30%, the total exposure is 8% of AUM.

Thus, we can expect a halt to redemptions in funds with high software exposure.

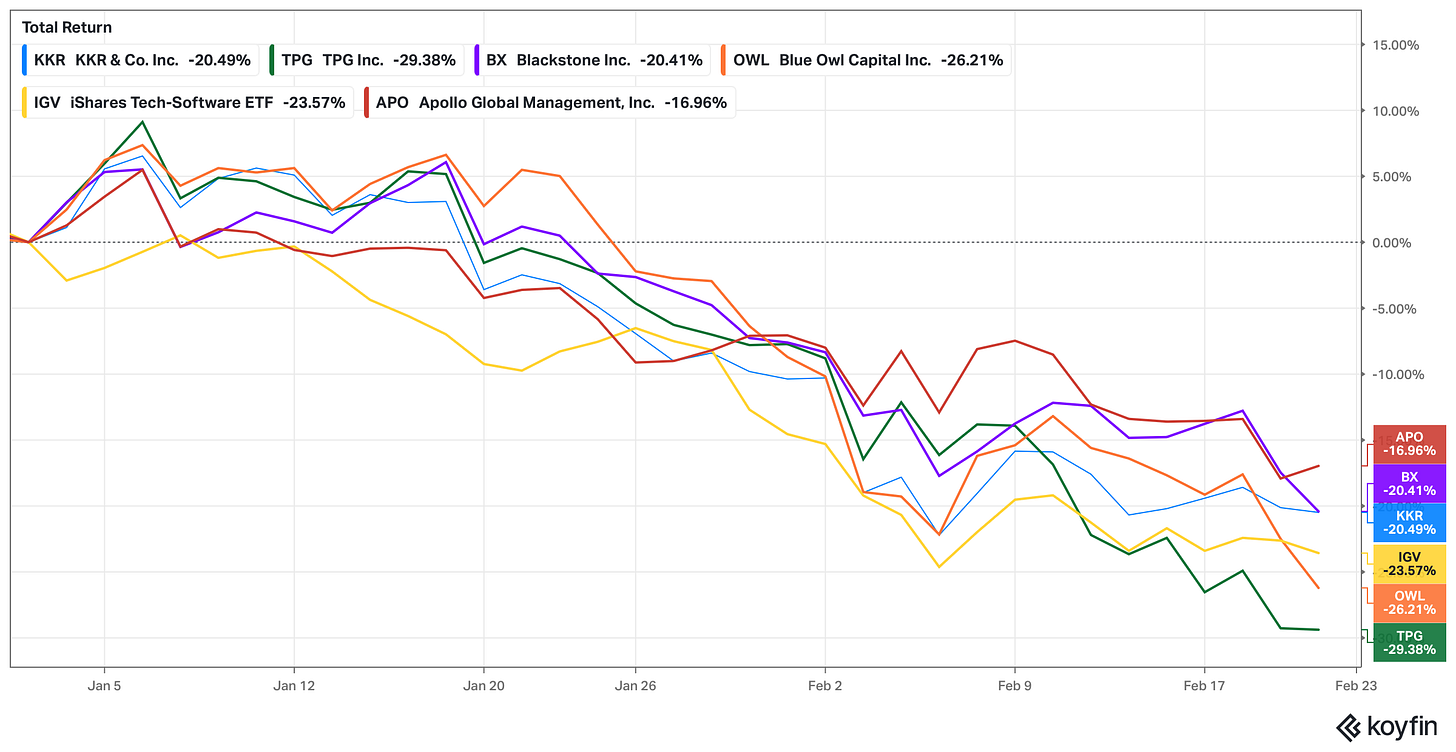

The markets have been sensing trouble in private credit, and as a result, we have witnessed carnage in the industry leaders.

Note that there has been a high correlation with the software sell-off (as shown in the chart via the flagship ETF IGV).

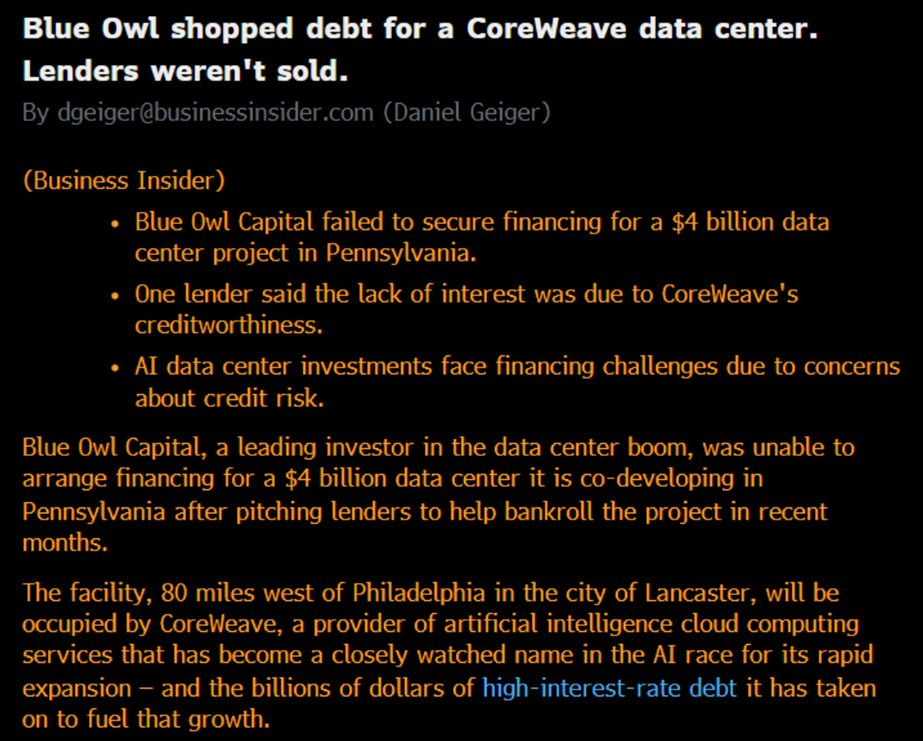

Another quake the market completely ignored was Blue Owl's inability to raise debt for the CoreWeave Data Centre project, indicating that the credit downgrade and the rise in the CDS of companies like CoreWeave and Oracle are derailing the capex plans.

While this might seem an isolated event due to a company-specific issue (CoreWeave), we can’t ignore the fact that the OpenAI ecosystem is a circular financing scheme which might fall apart if even one of the dominoes falls.

While the benchmark closed at YTD highs, we closed just shy of highs (5 bps lower) and are up 4.81% YTD.

Let’s dive into the macro universe and comprehend the cross-asset price action.

US/Equities/Bonds/Gold/Silver/Oil/Dollar!

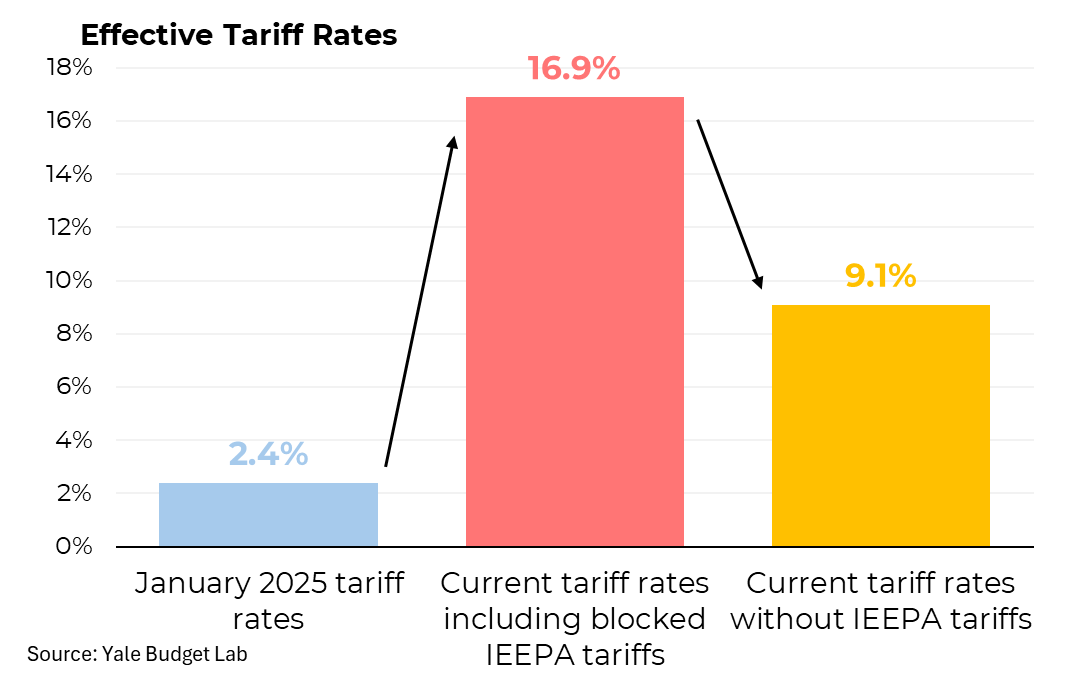

The Supreme Court, after deferring the verdict on IEEPA tariffs multiple times, finally announced it yesterday and, with a 6-3 majority, struck down the tariffs in a historic judgment.

According to the YALE Budget Lab, after the SCOTUS judgment, the effective tariff rate fell from 16.9% to 9.1%.

After the imposition of 10% tariffs under Section 122 of the 1974 Trade Act, the effective tariff rate is around 13% (due to certain exemptions).

Note that we believe we might face further litigation, as Section 122 of the 1974 Trade Act can’t be used in the current macro regime to impose tariffs.

Note that BoP (Balance of Payments) deficits are entirely different from the trade deficits.

On the flip side, Trump refrained from imposing a 15% tariff (the maximum he could have imposed), which is a tailwind for a risk rally.

We believe it’s a measured decision, as Treasury Secretary Bessent confirmed (in prepared remarks) that using Section 122, with potentially enhanced Section 232 and Section 301 tariffs, will result in virtually unchanged tariff revenue in 2026, allaying bond market fears.

Furthermore, as the trade deals are signed, the tariffs will be imposed at the negotiated rates until the above-mentioned sections are enacted.

Thus, we don’t foresee a major disruption, and, as mentioned, an overall reduction in tariffs by roughly 200 bps from the current 16.9% (before the SCOTUS order) will be stimulative and margin-accretive for firms that have fully passed on the tariffs.

Now let’s jump to the macro data.

We received the Fed’s preferred inflation gauge, the PCE, yesterday.

The Headline PCE rose 0.4%, compared with the +0.3% consensus. (2.9% rise YoY, highest since March 2024)

The Core PCE also rose +0.4% M/M, above the +0.3% consensus and +0.2% in the previous month (a 3% YoY rise, the highest since November 2023).

Since the rise was due to Core Goods, we believe that as old inventory replenishes, the tariffs are responsible for the higher reading.

The one risk that we flagged last month as well, and which is now a unanimous concern among market participants, is the: