Here We Go AGAIN!

“Leverage thrills, but kills”: Marquee Finance By Sagar.

As the US government shutdown continues, we had been thinking hard about what to write today, as there have been no major data releases from the US.

We were planning to share our thoughts on the extreme speculation transpiring in the US equity markets, as well as discuss the mind-boggling circular deals in the AI universe, which are making long-term investors nervous.

Furthermore, we also planned to delve into the details about the cracks that are widening in the private credit space.

Notably, roughly 28 months ago, we were the first ones to write about the explosion in private credit and the risks that were building in the US financial system.

One thing that we learned from the GFC is that there are several layers of capital conveyor belts guarding the obscure part of the financial system.

Moreover, it takes time for the whole system to blow, and the people running the show try every trick in the playbook to manage until one day the music stops playing.

The bankruptcy of Tricolour and Firstbrands has revealed stunning facts about the negligence of the funds (no due diligence at all) that invested in the subprime loans offered by these companies.

Thus, Wall Street has been sensing something, and the companies engaged in the dubious private credit space have been in a free fall in the last few weeks.

We are not being doomsdayers here, but we must decode the market action. If the relentless selling in private credit names continues unabated, expect markets to become anxious in the next few months/weeks.

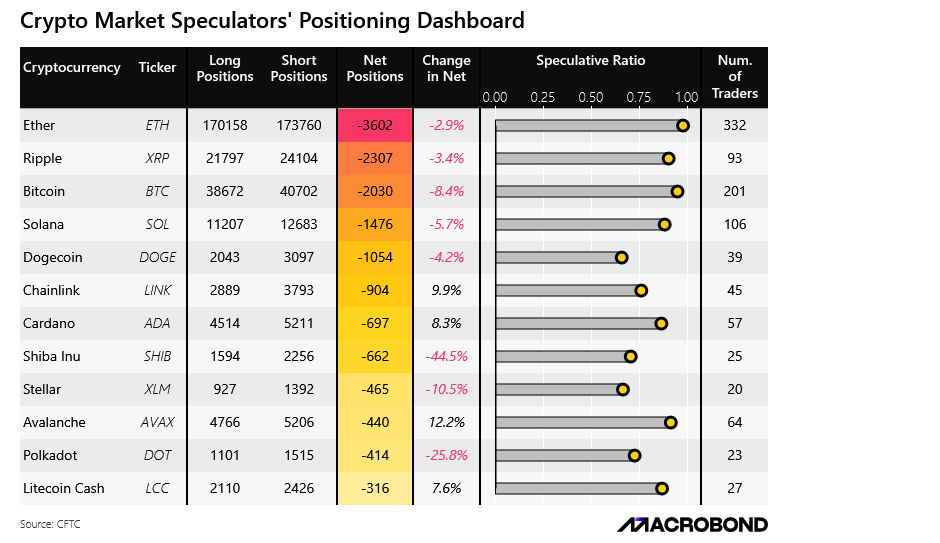

POTUS had other plans, and the fresh escalation led to a dramatic decline and substantial liquidations in the highly speculative cryptocurrency market.

Note that some companies had already started offering 50X leverage on crypto futures, so the ferocity of the fall is not a surprise at all.

Due to our hedges and prudent risk management, we intend to limit the drawdown as we have done in the past, despite 50% of the portfolio being invested in equities (a globally diversified PF).

We are now up 20.53% YTD (officially in a drawdown) against the benchmark’s return of 18.76% YTD.

Let us discuss the market’s performance this year and examine why the next fortnight will be the second most important one of the year, following the liberation day.

US/Equities/Bonds/Gold/Silver/Oil/Dollar!

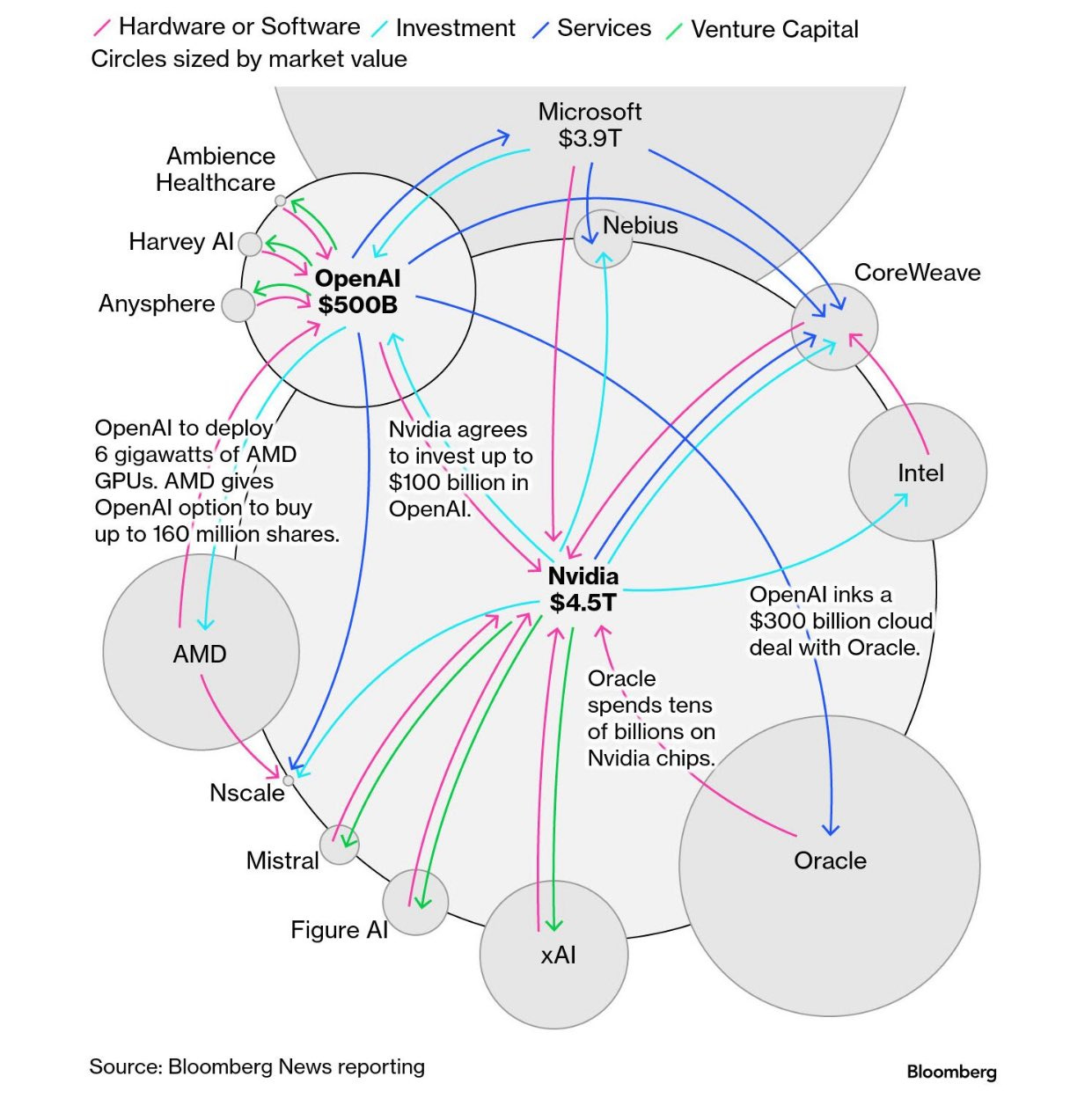

The recent announcements by NVDA and OpenAI have raised significant concerns about the circular deals in the AI universe.

Bloomberg ran a story with an impressive chart.

Furthermore, the kind of financing NVDA is undertaking, especially with its latest deal with xAI, is unprecedented and unheard of.

GPUs have a very short lifespan and become worthless/obsolete after a relatively short period; thus, we can expect a reality check in the next few quarters, if not by early 2027.

Furthermore, the RoI on the trillions of dollars of capex will be minimal, and there will be various accidents where companies will lose billions. So be prepared for shocks.

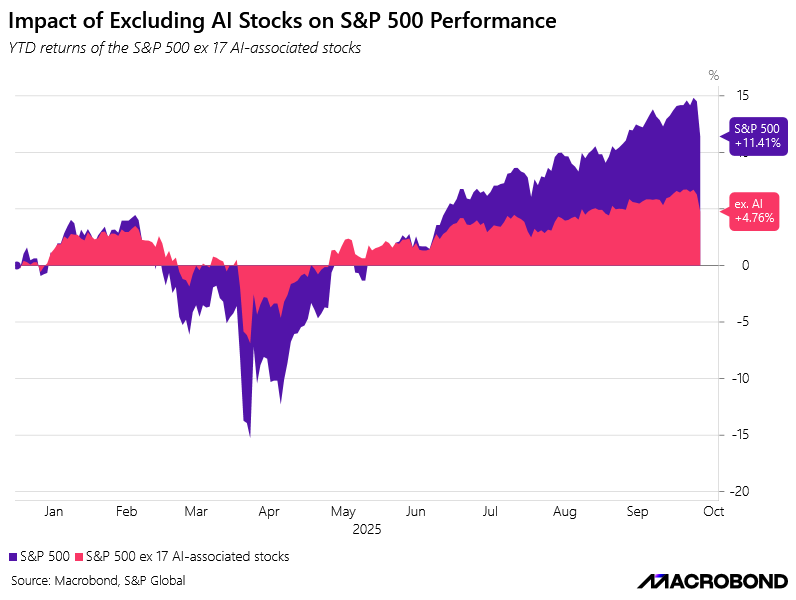

If we exclude the 17-AI names, the S&P 500 is up less than 5% YTD, indicating that without the AI names, earnings growth is poor.

However, the multiples here are significantly cheaper, and if the earnings grow, we can witness a rerating.

Before yesterday’s fall, the froth in “trash” stocks or in other words, the highly speculative part of the equity markets, was unimaginable.

Since the lows of liberation day, Quantum Computing, Drones, Meme Stocks, and Non-profitable tech have soared by more than 100-350%.

However, we can’t say that the peak is in, as it depends on the Fed policy and various other factors, including the liquidity and financial conditions.

Nevertheless, we can safely conclude that an interim peak is in, and if somebody still holds these shitcos, they should book profits and exit.

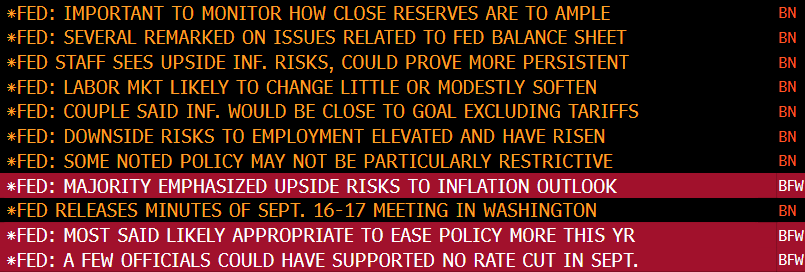

We also received the Fed minutes, which demonstrate that Fed members are concerned about the potential rise in inflation in the coming months.

Thus, it will be intriguing to see what transpires during the FOMC, considering that there are no macro releases, and the shutdown might stretch into late October, given the stalemate in DC (note that some chatter about CPI release in the last week of October).

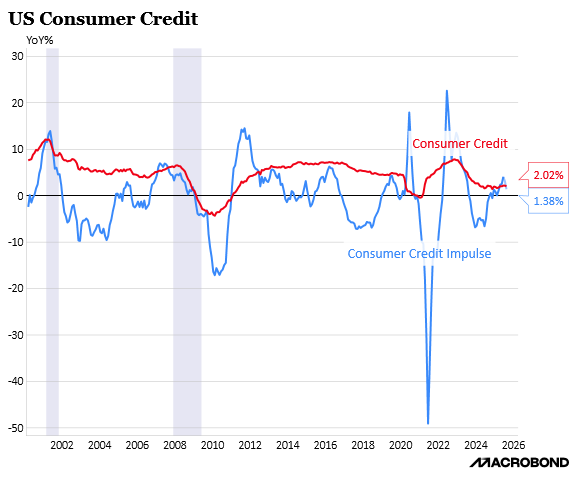

Consumer credit growth slowed to the smallest pace in six months in August due to a decline in credit card balances.

Credit-card and other revolving debt outstanding fell by roughly $6 billion.

Non-revolving credit, including loans for vehicle purchases and school tuition, increased by $6.3 billion.

With credit card delinquencies rising and at a record high for low-income consumers, we don’t expect a material surge in consumer credit, which could ultimately lead to lower real retail sales & a drag on GDP.

Equities!

S&P500:

There are two scenarios in which this can play out.