If It Looks Like A Duck, Walks Like A Duck And Quacks Like A Duck, Then It's A Duck!

“Most people think we are not going back to ultra-low rates of the recent past, but nobody really knows”- Jerome Powell.

The world’s most powerful central banker, Jerome Powell, once again caught everyone off guard with an unexpectedly dovish statement.

In fact, such a statement demonstrates that the probability of a “hard landing” has substantially increased.

We have been in the camp that believes that we are not heading to NIRP (Negative Interest Rate Policy) and ZIRP (Zero Interest Rate Policy) in the coming decade as several headwinds (geopolitics, fiscal dominance) exist.

However, JayPo’s statement raises eyebrows and concerns regarding the health of the US economy.

Moving on to equity markets, our apprehensions about AI are now entering mainstream media. In our May Portfolio Update, we wrote that the AI will be “INFLATIONARY”, contrary to what everybody expects if the big tech plans fructify.

Sequoia concluded with an article mentioning that the tech industry needs $600B in AI revenue to justify the money spent on GPUs and data centres.

So, we think there are two possibilities/outcomes:

Either from the next 2Qs, we will see massive increases in the subscription prices of the AI products at a time when consumers are suffering.

Or, capex plans will suddenly be delayed, and semiconductor companies' order books will dry up.

Considering the macro backdrop, we had a lot of churn in our portfolio in the past few weeks.

Today, we will analyse a wide range of global macro data and examine the state of the global economy in more detail.

US!

Since we had the Half-Yearly review last week, we missed one of the most important indicators the Fed considers when charting the course of its monetary policy.

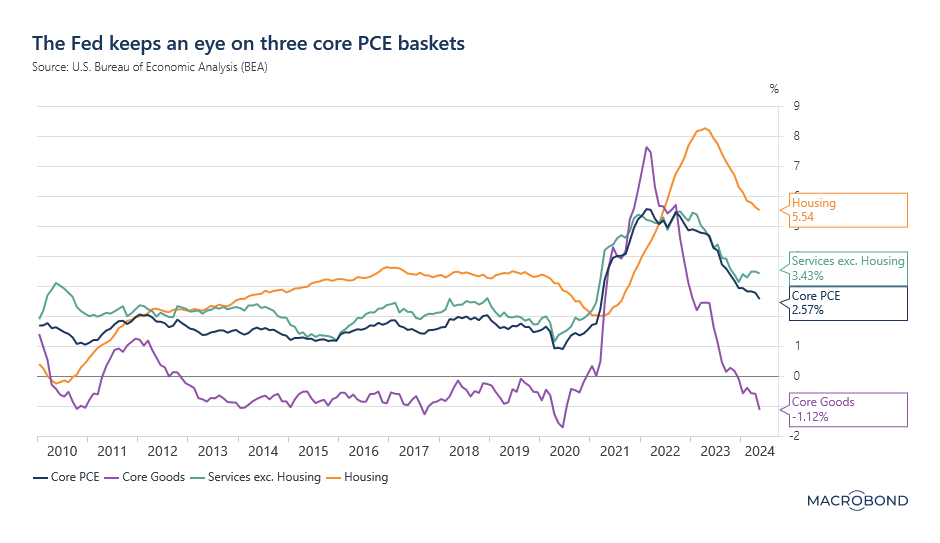

The PCE derived from the CPI and PPI aligned with the estimates. The culprit dragging down the headline number is Core Goods (similar to the CPI).

The Supercore or the Services Ex-Housing is turning out to be sticky at 3.4%. Note that from 2010 to 2020 (pre-COVID), the Services Ex-Housing was stubborn at 2% while the Core Goods were mostly in deflationary territory.

Nonetheless, we must keep a close eye on the inflation trajectory, as various tailwinds may lead to a resurgence in inflation in H2.

This week began with all important ISM Manufacturing data, which we track closely to gauge the cyclical activity in the US economy.

Though the headline number moved back to the contraction territory (below 50), New Orders Less Inventories jumped higher.

While New Orders Less Inventories typically signal a rise in ISM Manufacturing in the coming months, our comprehensive analysis of various macro data points suggests we should await further evidence to confirm this.

While ISM Manufacturing has been weak for the last 12-15 months, the surprise of the week was the Services PMI, which has been the strength of the US economy in the last few quarters.

ISM Chair Miller said in the statement:

“The June Services PMI indicates the overall economy is contracting for the first time in 17 months”.

Well, this is because the composite PMI (ISM Services + ISM Manufacturing) printed below 50 for the first time in 17 months.

When we dig deeper, ISM Services was a complete howler.

Everything except prices is contracting, which, if it continues, questions the credibility of “robust” economic data from government sources.

The biggest concern for us in the ISM Services was: