Inflection Point?

As we enter one of the most crucial days of the first half of 2025, we believe the cross-asset markets are at an inflection point. Furthermore, the market volatility might once again rise significantly as:

Donald Trump executes over 100 executive orders within 24-48 hours of his inauguration on Monday.

The Trump administration decides on implementing tariffs on China, Canada and Mexico as suspense remains on the fate of Greenland and Panama Canal.

The Russia-Ukraine ceasefire talks began with a historic summit between Trump and Putin, as the Israel-Gaza ceasefire deal had already been sealed.

The BOJ will once again decide on the “historic” rate hike on Thursday night US time / Friday morning Asia time.

The Fed gears up for the first FOMC meeting on 29th January

Along with the above, the macro data and the market’s apprehensions were allayed this week after the core CPI slightly missed the estimates.

The reaction was stark on the US 10Y as the relief rally also gripped stocks.

Let us dig deeper and comprehensively analyse the macro data while decoding the moves across assets.

US/Oil/Equities/Gold/!

We got the all-important CPI data in the US this week and other market “moving” macro data.

The CPI was a relief for the markets, which were profoundly worried about the rise in inflation due to the Trump administration's upcoming tariffs.

The core CPI came in at 0.2 MoM/ 3.2% YoY, which was slightly lower (just 7 bps) than the street’s estimates.

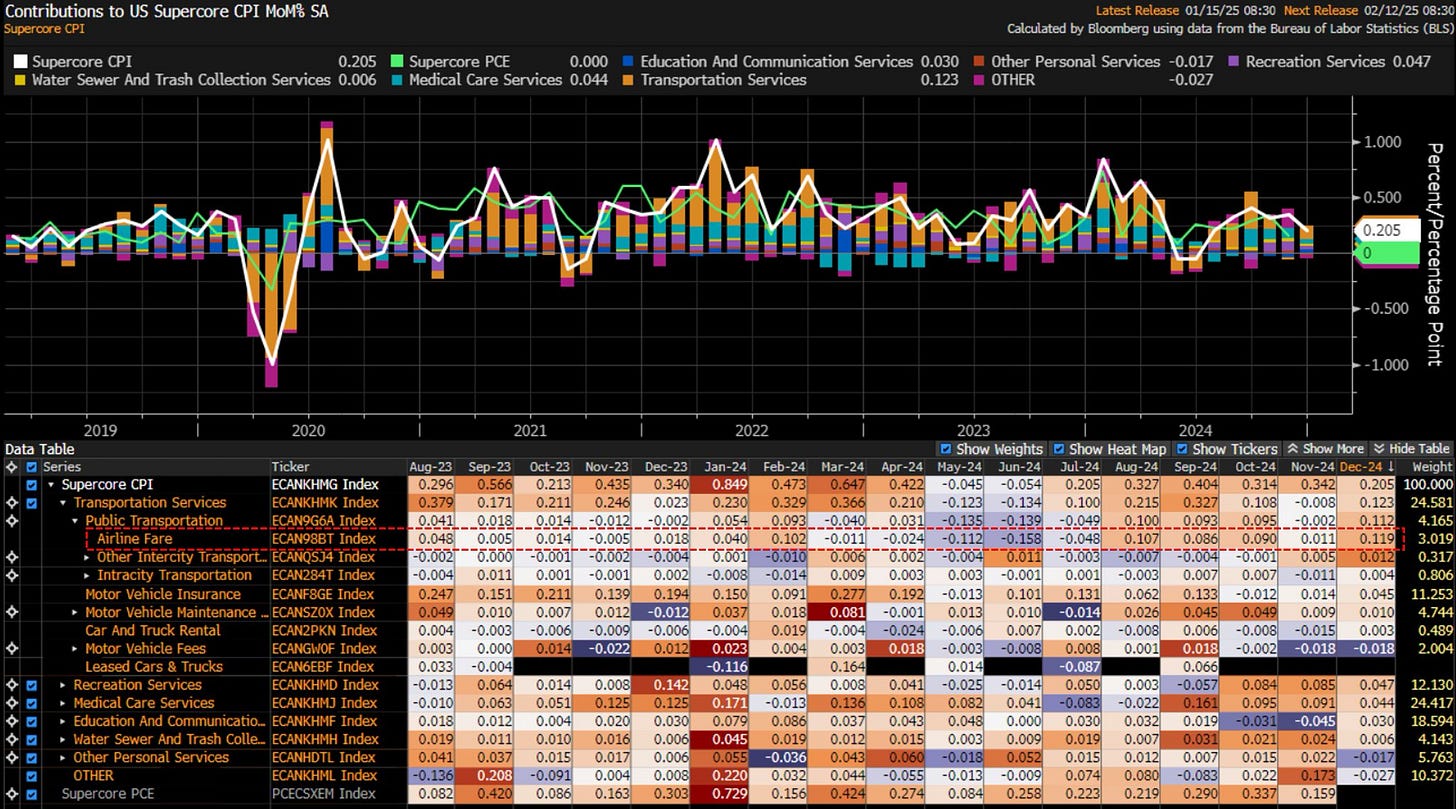

Nonetheless, when we look at the Supercore (services ex-housing), which JayPo popularised to justify the draconian hikes.

The Supercore CPI came in at 0.205 % MoM, a significant decrease from the levels seen a few months ago.

Transportation Services led by Airline Fare was the most significant component of the rise in the Supercore, thus allaying fears about the broad-based rise in the Supercore CPI.

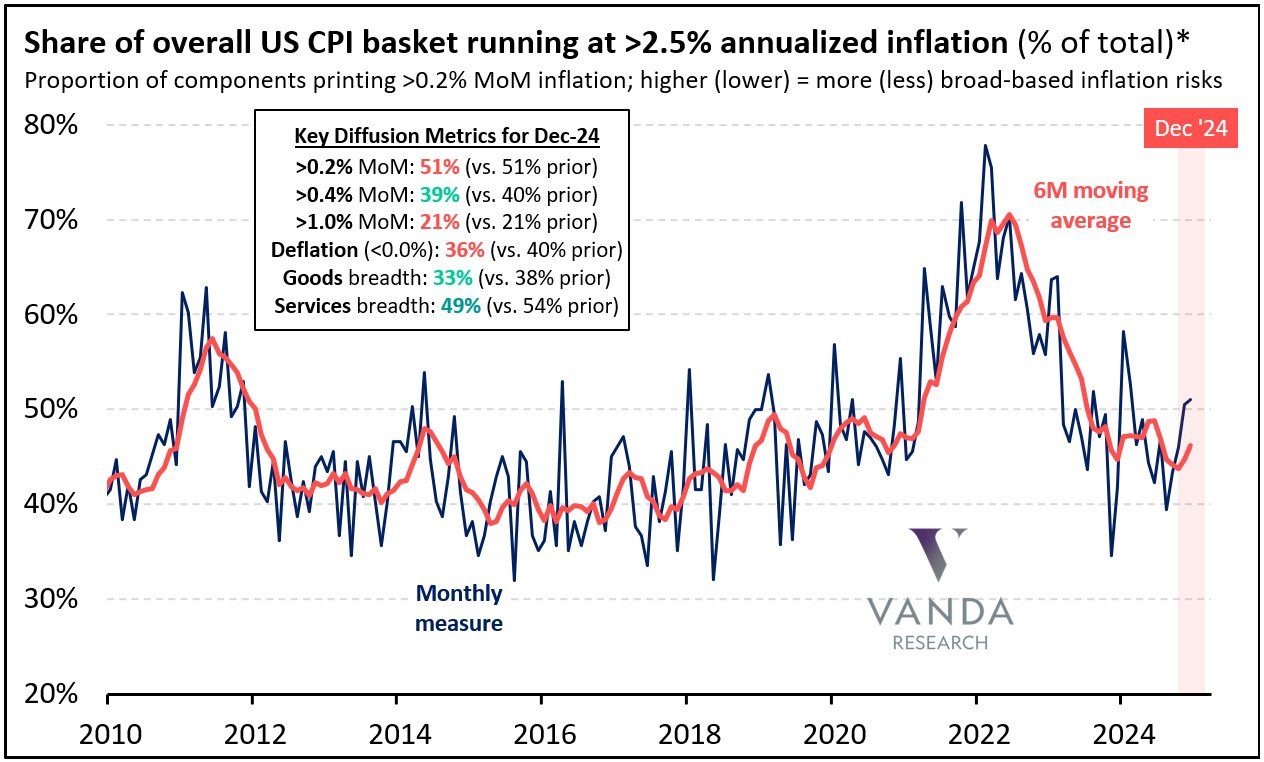

However, when we dig deeper, we can observe that there are initial signs of inflation bottoming out, especially across Goods, as the diffusion metrics indicate that the items running at >0.2 % MoM have bottomed out at 51%.

Thus, market participants believe that inflation will likely remain elevated way above the Fed’s 2% target in the coming months.

As per our guidance, according to the below chart, we believe that inflation will likely print around…