Is It Time To Be Cautious?

The macro framework we follow entails a detailed scrutiny of the labour market, as recent times have exhibited that the Fed has been more concerned about the health of the labour market than about inflationary concerns.

This makes perfect sense because if the labour market weakens significantly, the demand plunge (consumption) will lead to an economic slowdown (a recession), which will drag down inflation with it.

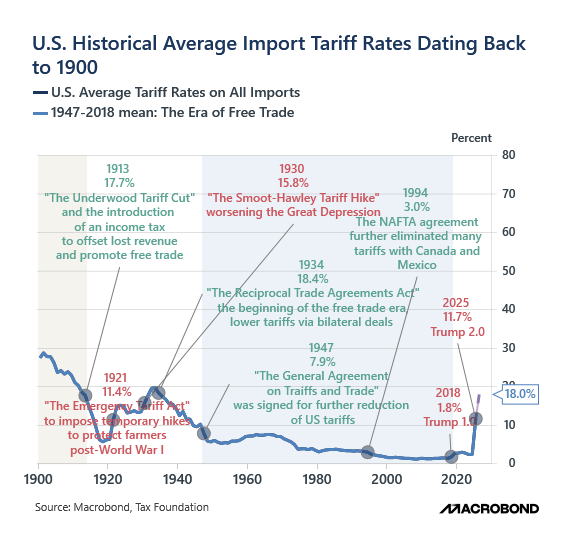

Nevertheless, the current cycle differs from past ones because we are in the midst of a once-in-a-lifetime event, where a global trade reset is being shaped by the highest tariffs in the last 100 years.

Thus, the Fed will likely deliver a balancing act despite extreme political pressure for an aggressive easing of the monetary policy.

Furthermore, the multipolar world, with the world divided into two domains (similar to World War II), will likely support geopolitical risk premiums for certain assets, and we will witness a global portfolio rejig, with SWFs (Sovereign Wealth Funds) and UHNIs (Ultra-High Net Worth Individuals) family offices allocating accordingly.

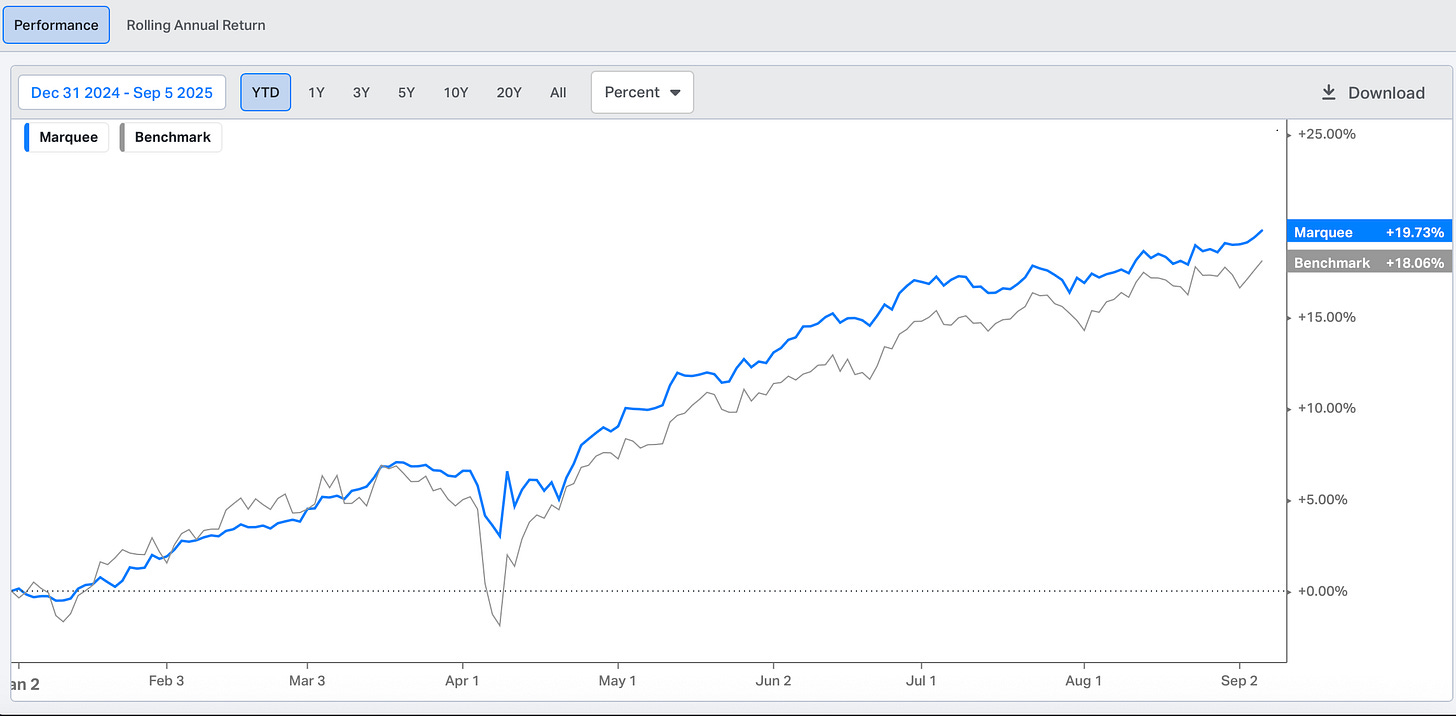

Moving on to the portfolio performance, thanks to our timely “significant” allocation to Gold, we are now up nearly 20% outperforming our benchmark by more than 180 bps.

The performance has been steady this year, and barring any major shocks, we expect exceptional returns this year.

Considering the macro data, we created a stagflationary basket last month, allocating approximately 20% of the overall portfolio to this basket.

We are glad to inform you that the Stagflationary basket is up by more than 4.5% in the last 15 days.

Let us dig deeper into the macro universe and analyse the cross-asset performance.

US/Bonds/Gold/Silver/Oil/Dollar!

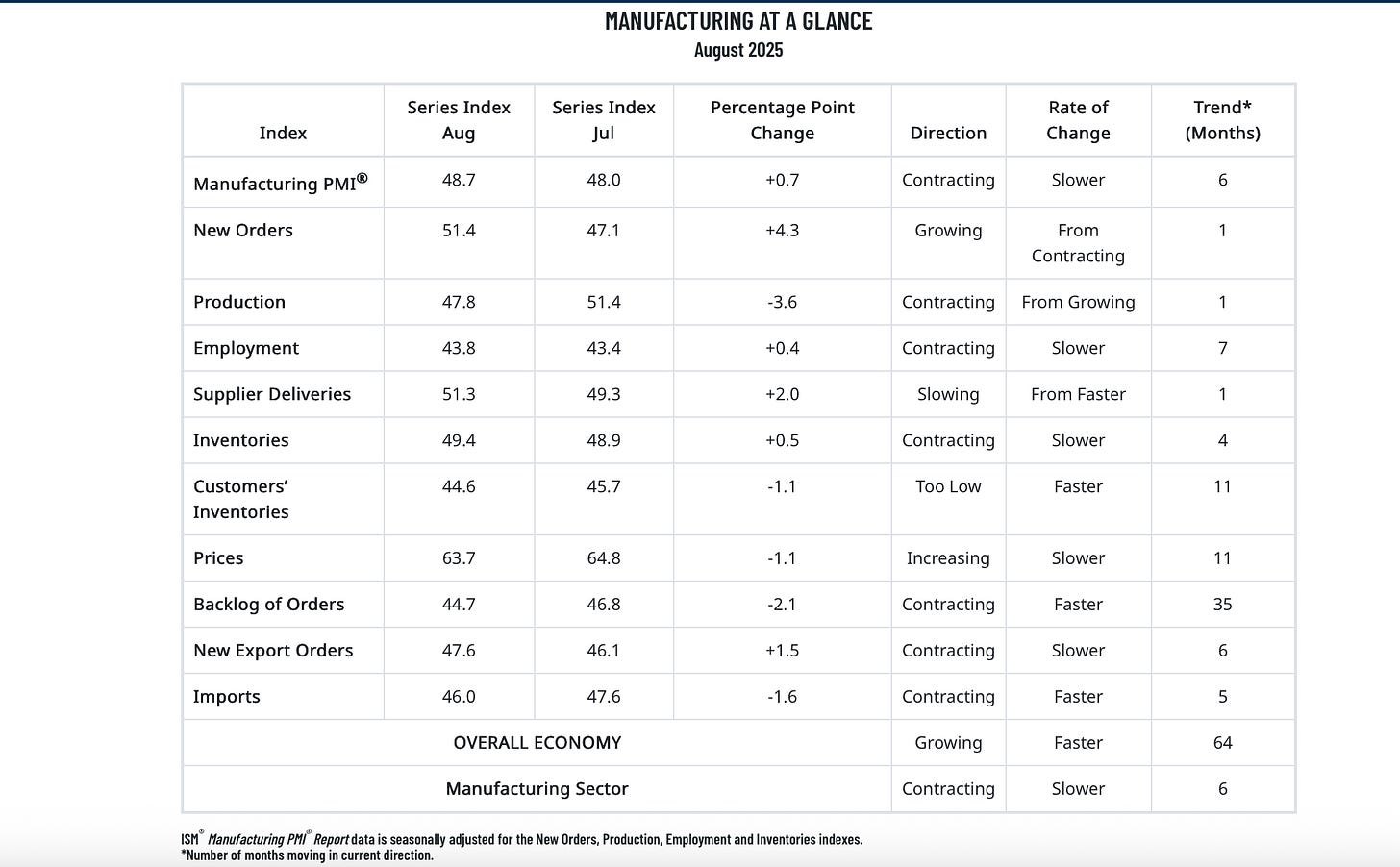

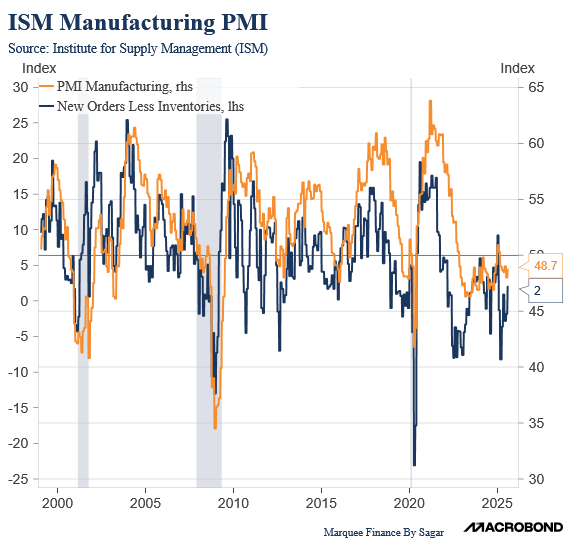

The ISM Manufacturing has been our favourite indicator to gauge the cyclical activity in the US, despite some fake breakdowns in the last few years.

While the headline index is still in contractionary territory (below 50), as always, the devil lies in the details.

New Orders saw a significant jump as the backlog of orders contracted sharply, indicating that we will witness some recovery in the coming months.

New Orders Less Inventories is also indicating a rebound in the headline index in the coming months.

However, one needs to be cautious as ISM data has been highly volatile due to tariff front-loading in Q1.

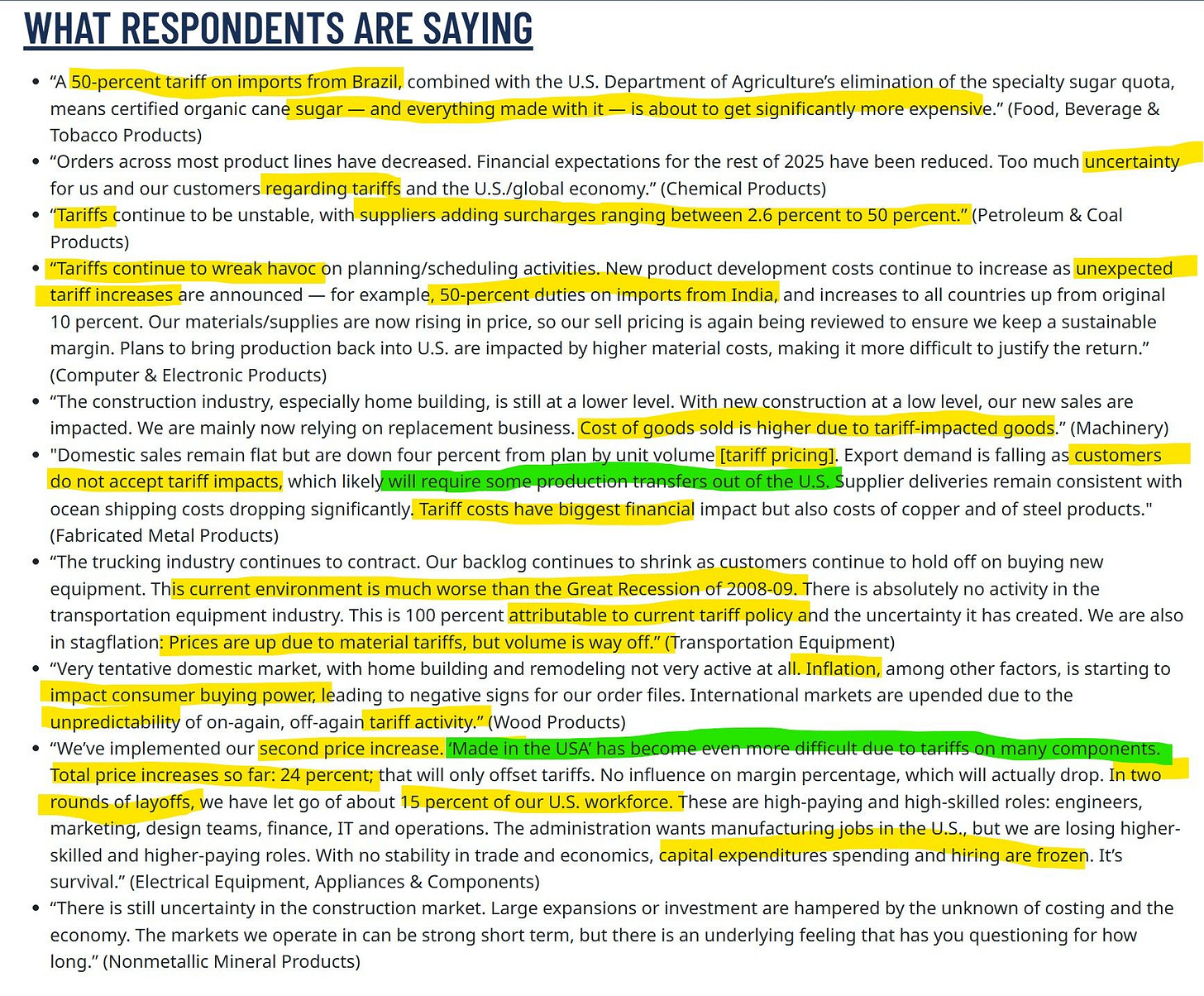

When we analyse the comments from the survey, it paints a scary picture of the situation on the ground.

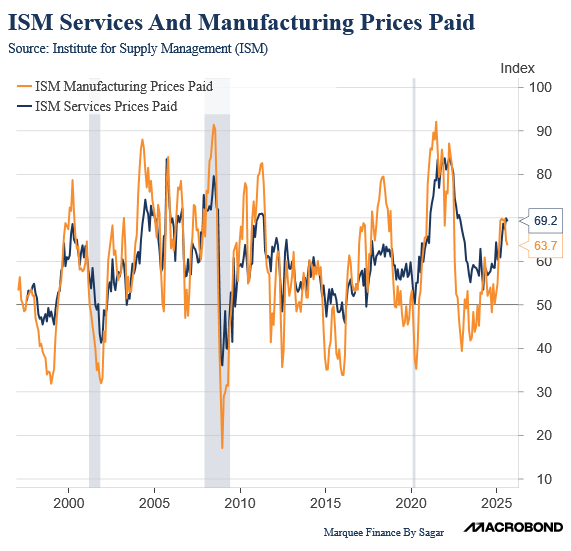

The tariff-induced pricing pressures are visible in both the ISM Services and Manufacturing Prices Paid.

While there is some cooling in the Manufacturing Prices Paid, the Services Prices Paid is still running extremely hot.

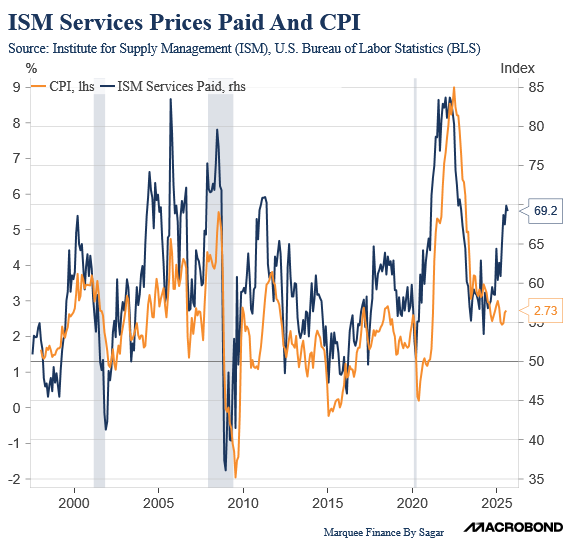

Last month, we also demonstrated how the ISM Services Prices Paid index had a tight correlation with the CPI.

If the relationship holds, we may see a spike in the CPI beginning early Q4.

Nonetheless, the extent and duration of the inflationary spike are still uncertain.

Moving on, the labour market is deteriorating at a rapid pace as the “No Hiring and No Firing” regime is transforming