It's All Over The Place!

Wow!

What a week this has been:

We got multiple trade deals before the August 1st deadline.

We got big tech earnings with diverse reactions (MSFT & META up, AMZN & AAPL down).

We got dissents in the FOMC for the first time since the 1980s as Waller and Bowman voted for a cut, as JayPo remained hawkish and non-committal to any rate cuts.

We got a further crash in the healthcare stocks after Trump’s warning to lower prices.

We got a flash crash in Copper prices as the metal fell by more than 18% in a single day (the largest ever fall on COMEX).

We got the horrendous Non-Farm Payroll (NFP) data revisions.

We got a spat between former Russian President and Trump, leading to the US deploying two nuclear submarines near Russia (maybe the repeat of the Cuban Missile Crisis).

We got the world’s most powerful man firing the head of BLS: the key agency responsible for publishing crucial labour market data.

We got a massive breakout in the Dollar and then a reversal in a single day yesterday.

Well, so much to digest this week, and to be frank, one thing we were sure of was that amid all the chaos, a risk-off move was due (we wrote to paid subscribers on Thursday about it).

Nonetheless, we didn’t anticipate it to be so ferocious and early.

With trade uncertainty largely behind us and the jobs report out of the way, the Russian-US spat could bring the next bout of volatility to equity and bond markets.

We are ready and positioned for it!

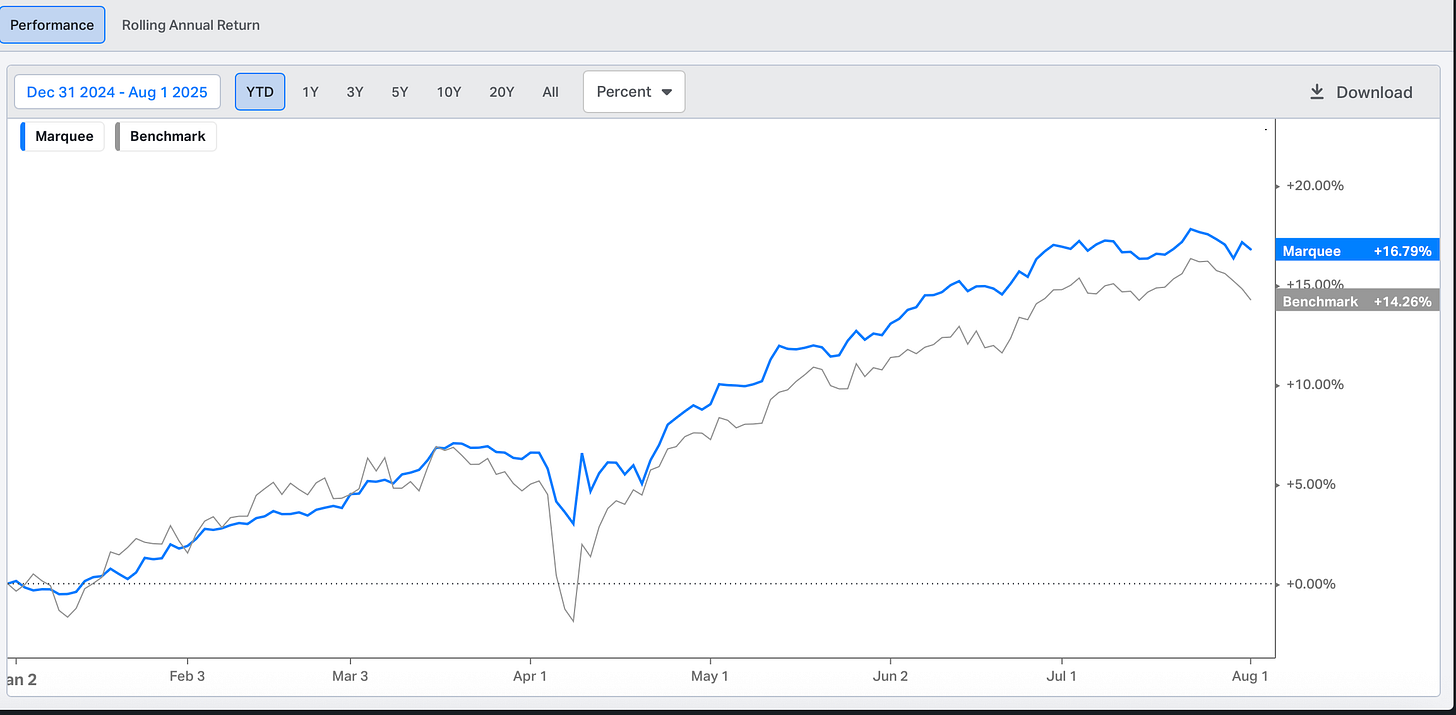

Due to the ongoing drawdown in the equity markets, we are now up 16.79% YTD, less than 64 bps off the highs, which we reached last week.

We were once again successful in limiting our drawdown as we raised cash significantly in the last few weeks and booked profits in the positions initiated in early April.

As a result, our PF is down less than 65 bps compared to 166 bps of the benchmark.

PS: Before we begin, we will increase our paid subscription prices to $29.99/M or $ 299.99/Yr starting 1st September 2025.

Note that subscribers who are currently enrolled or will enrol by September 1st will be subscribed at the mouth-watering current prices ($24.99/$249.99) “FOREVER”.

Furthermore, those who have subscribed at the original price of $14.99/$149.99 two years back will see no change in their plans.

Therefore, anyone who wants to take advantage of a 16% lifetime discount can subscribe until midnight on August 31st at the current prices.

Let’s dig deeper into the macro universe with a special focus on the FOMC outcome and the US labour market!

US/Oil/Gold/FX!

Let’s begin with the PCE data, which the Fed watches closely as it’s their preferred inflation measure.

The Core Goods has risen significantly from the bottom whereas the the Services Ex-Housing has been sticky around the 3% mark. Though, the good news is that the Housing (rents) have fallen off a cliff and continues to be in downtrend.

There are initial signs from the data that inflation has likely bottomed out, as the effect of tariffs will show up in the next few months.

The second data piece released this week was the GDP, which we generally ignore due to its lagging nature.

However, one of the data points in the GDP that the Fed monitors to gauge consumer demand is Private Demand to Final Purchases (PDFP).

The PDFP decelerated to its slowest pace since 2022.

Once again, we can’t extrapolate the one Q data as there are revisions and also seasonality is involved, but the trend is down.

Moving on, the next crucial macro data was the ISM Manufacturing, which we analyse in detail every month due to its historical importance.

The ISM Manufacturing missed estimates and came in at 48 (a contraction).

Furthermore, our preferred measure of New Orders Less Inventories came in at -1.8, which indicates stagnation for the headline index in the coming months.

We will explore the “employment” part of the ISM later on when we analyse the labour market in detail.

Let’s move to the FOMC outcome!

The biggest argument that JayPo made for maintaining the status quo:

“A reasonable base case is that the effects on inflation could be short-lived, reflecting a one-time shift in the price level. But it is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed.”

When talking about the dual mandate: Stable Prices and Maximum Employment, the Fed doesn’t give preference to either but evaluates the risks to both its mandates.

Currently, the committee and most of its members believe that inflation can get out of control if the tariffs are passed fully (note that they already made a “transitory” mistake earlier).

The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals.

The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The last few lines are important because inflation expectations have been a gray area, and since Trump has intensified his attack on JayPo, the inflation expectations have deanchored.

The inflation swaps have been rising, likely as the markets priced in premature cuts, leading to higher inflation expectations.

Overall, a wide set of indicators suggests that conditions in the labour market are broadly in balance and consistent with maximum employment.

If market participants are hoping for multiple rate cuts (market pricing even in 3 cuts this year now), then one must carefully assess what JayPo told us this week.

Firstly, he mentioned multiple indicators (Quit Rates, Job Openings, etc) to gauge the health of the labour market.

Secondly, we believe the most important statement/s from the presser were: