"King's" Power!

If you thought that the title of today’s newsletter was about the President-elect, you are wrong, as today’s newsletter is dedicated to “King” Dollar.

Yes, folks, while the crypto shenanigans believe that the highlight of the post-election has been the return of the meme mania and the unprecedented surge in the most volatile asset class: “Crypto”, we have been laser-focused on the swift rise of the greenback.

At the time of writing this (from Cathay’s Pier Lounge at Hong Kong Airport: yes, we are going on a vacation to New Zealand and will miss you next week), King Dollar is at the inflection point (more later on).

While the dollar's rise can be attributed to multiple factors, the biggest takeaway is whether it’s sustainable, which we will also discuss later (Dollar and Gold section).

Nonetheless, this week, we received multiple macro data points, which we will discuss in detail and, as usual, join the dots to project the path of cross-asset markets.

US!

Let’s begin with the week's two most important data points, which raised some suspicions among market participants about inflation's " stickiness.”

However, our paid subscribers will appreciate that we have been crystal clear about the path of inflation and that our guidance regarding the December target has been spot-on.

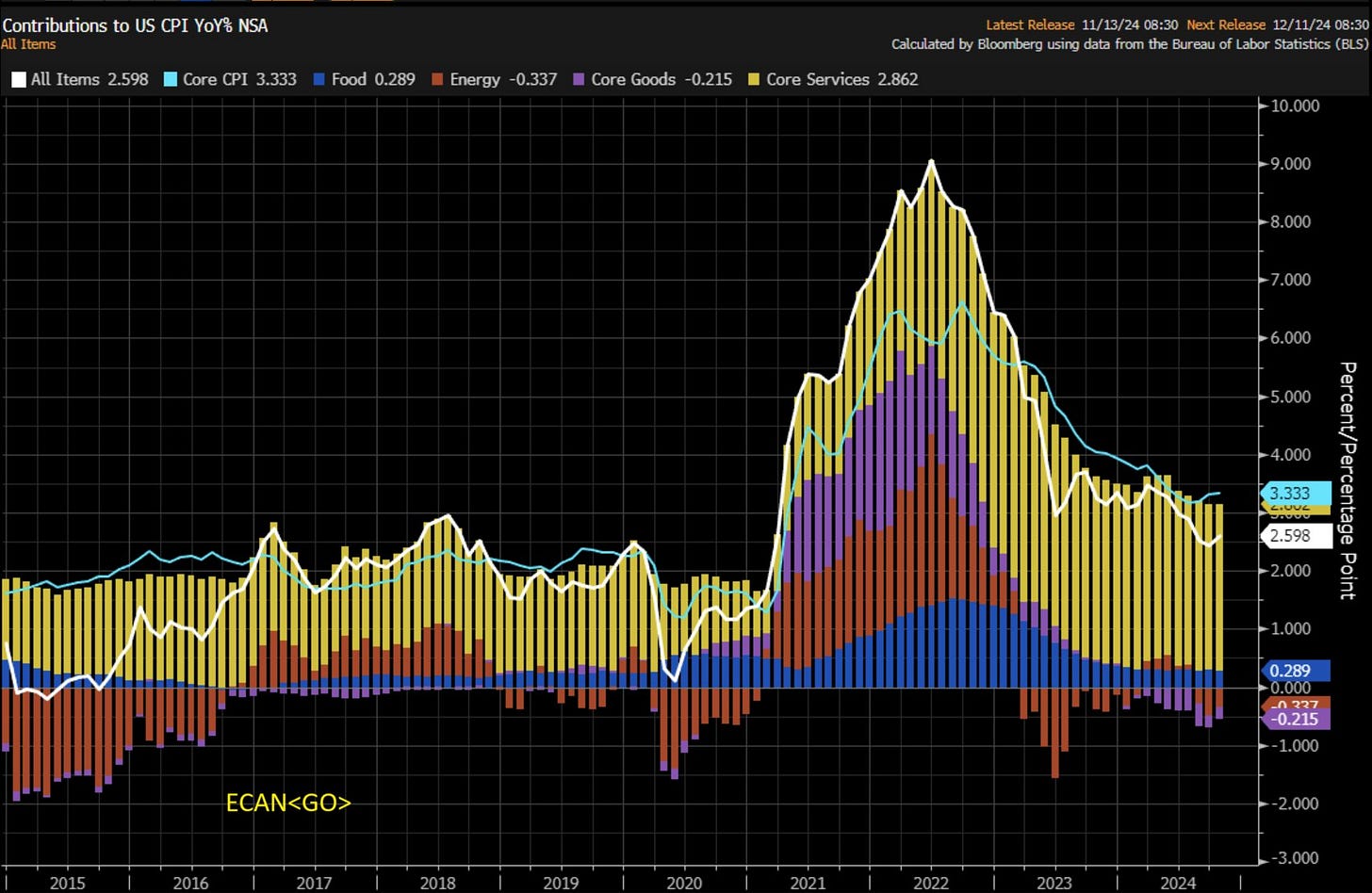

The PPI (Core) came in slightly hotter than expected. Digging deeper, the trend is somewhat higher (bottoming out), led by the stubborn services component. Nevertheless, goods remain subdued with energy, dragging the overall number lower.

Moving on, the CPI came in line with the market’s expectations and what we had been expecting, considering the base effect. The number has been continuously dragged lower by the Core goods this year, which is a significant risk heading into next year if the Trump tariffs exceed what markets have been expecting. Core Services is stubborn, as it has been for the past few months.

JayPo’s favourite measure, Supercore CPI (Services Ex-Shelter), caused a panic attack among market participants last month after the insane MoM rise (annualised 6%+). Note that we have always given weight to the trend, as monthly figures can be noisy due to various anomalies (hurricanes, elections, one-time rises in insurance premiums, etc.). We can confirm that we don’t see an extreme fall in US Supercore CPI unless we get a credit event which leads to a significant recession/ contraction in economic activity (low probability event).

Now, let’s move to our guidance of the CPI by January 2025!