Long Live The Fed!

After years of experience, the biggest lesson that we have learnt in our trading/investing journey is that financial markets are a game of permutations and combinations.

Since there are multiple forces at play in the global financial markets, you can’t be 100% certain about the cross-asset moves.

Therefore, you have to position yourself by joining the dots and factoring in the most probable outcome.

According to us, 2026 will be the defining moment for the AI theme that the market has been riding for the past three years.

In the macro universe, the Fed’s independence will be scrutinised closely as there have been calls by the current administration to revamp the way the most powerful central bank operates.

Internally, despite no changes yet implemented, the Fed is becoming more divided by the day, as the dual mandate becomes more challenging given the new paradigm we entered post-COVID (structurally higher rates, deteriorating demographics, and higher neutral rates).

We witnessed the level of division during the recently concluded FOMC, where seven officials disagreed with the decision amid extreme “political pressure” to cut rates.

Today, we will discuss in detail the Fed policy, the cross-asset moves, the upcoming crucial week as we get delayed government data in the US and the BOJ, which will hike for the second time, a historic move.

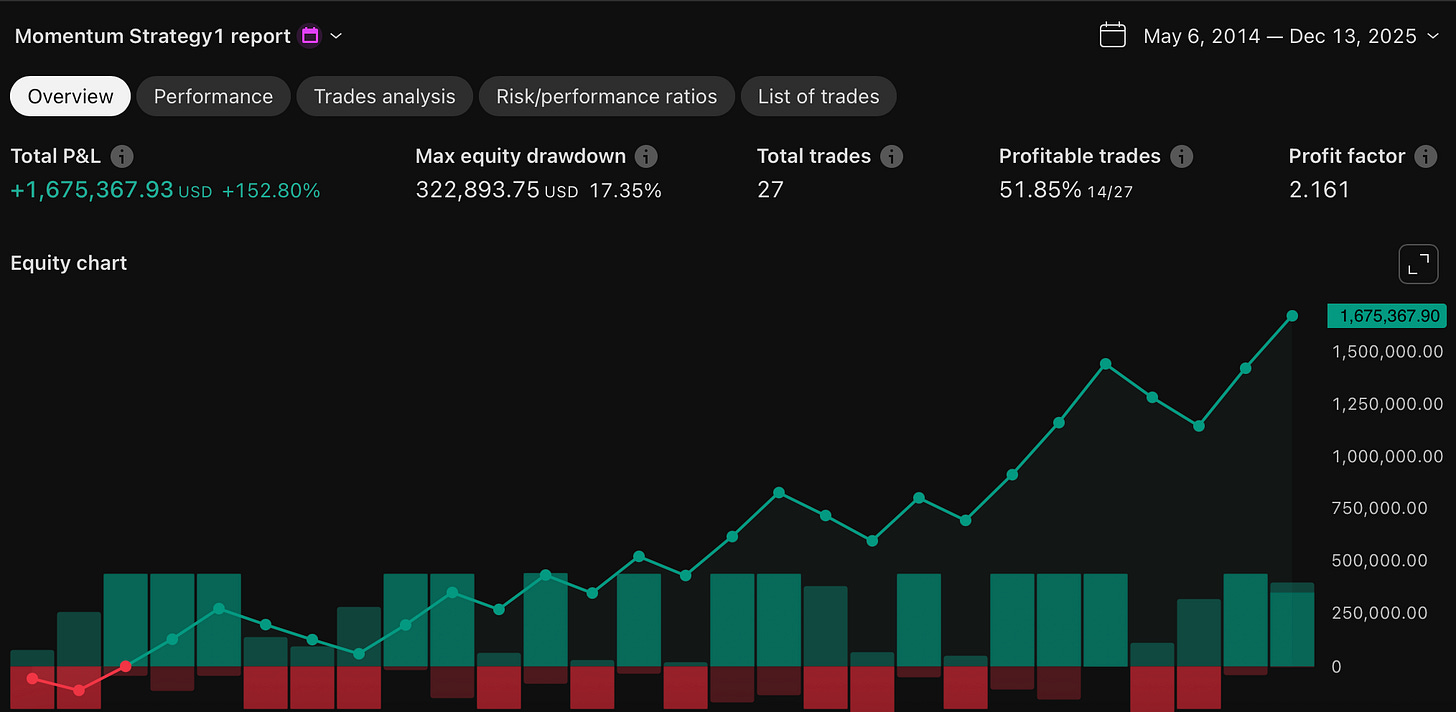

Before we begin, we want to announce that we are now developing proprietary momentum strategies.

This is just an example of a long-only momentum strategy on the S&P 500 (still under development).

We are currently backtesting them, and we believe 2026 will be a blockbuster year for us, especially after generating 20%+ returns this year.

We will extensively incorporate macro and use our trading strategies to enter and exit at the right time to maximise the profitability.

US/Equities/Bonds/Gold/Silver/Oil/BTC/!

The FOMC was on top of everybody’s radar this week as the markets were expecting a “hawkish” cut, a term that we have been hearing off late for the first time in history.

Some market participants are perplexed by the word “hawkish” attached to a “cut”.

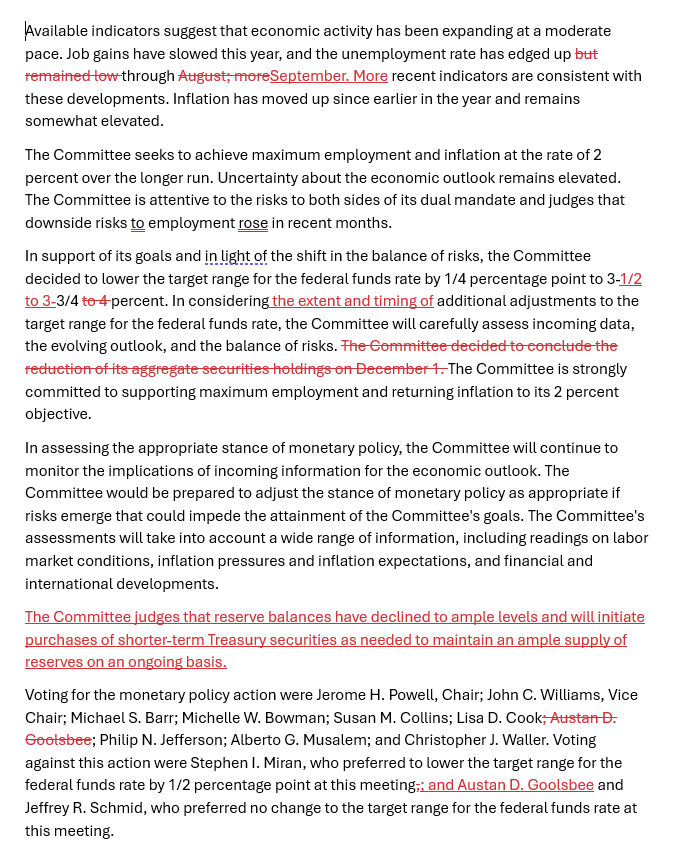

Nevertheless, the FOMC statement compared to the last FOMC is as follows:

Interestingly, we got a new member to the “Hawks” camp.

Goolsbee was the surprise entrant. Notably, Schmid has been a known hawk.

A divided Fed is now becoming the base case, which will lead to fireworks in cross-asset markets in 2026 as volatility further rises.

If others (Ex- Waller and Bowman) enter the hawkish camp, it will be challenging for the new Fed Chair (whoever he/she may be) to forge consensus among the members.

Nonetheless, if labour market data deteriorate as we expect, the rate-cut trajectory will be smoother than most people expect. The consensus-building for the new Fed Chair will become easier than one can foresee today.

Our base-case scenario involves more than two cuts next year (more than the market expects).

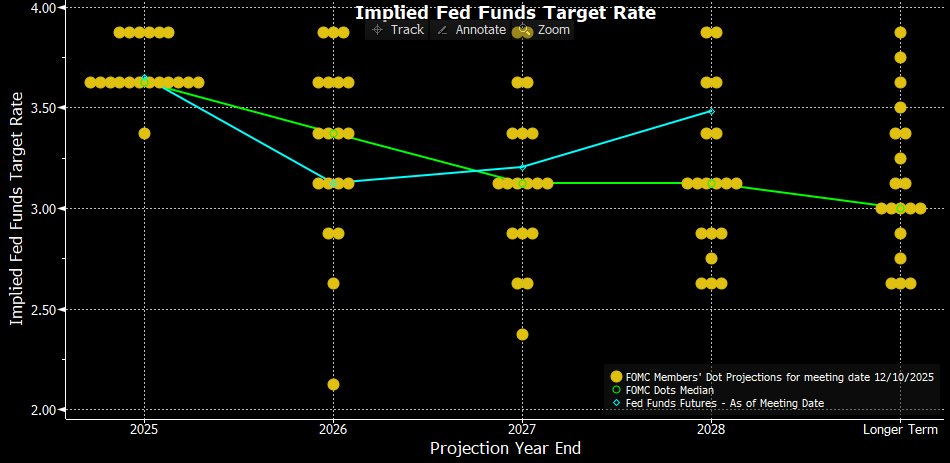

The one revelation this year has been how irrelevant SEP (Summary Of Economic Projections)/Dot plots have become.

In light of a divided Fed, the dot plots are all over the place.

The implied FFR for 2026 as per the dot plots:

3 dots for one hike.

4 dots for status quo (unchanged).

4 dots for one cut.

4 dots for two cuts.

2 dots for three cuts.

1 dot for four cuts.

1 dot for six cuts (Miran, of course).

Nothing can be inferred from the SEP or dot plots, especially considering we will get a new Fed Chair in May and JayPo has only two meetings (max two cuts he can deliver).

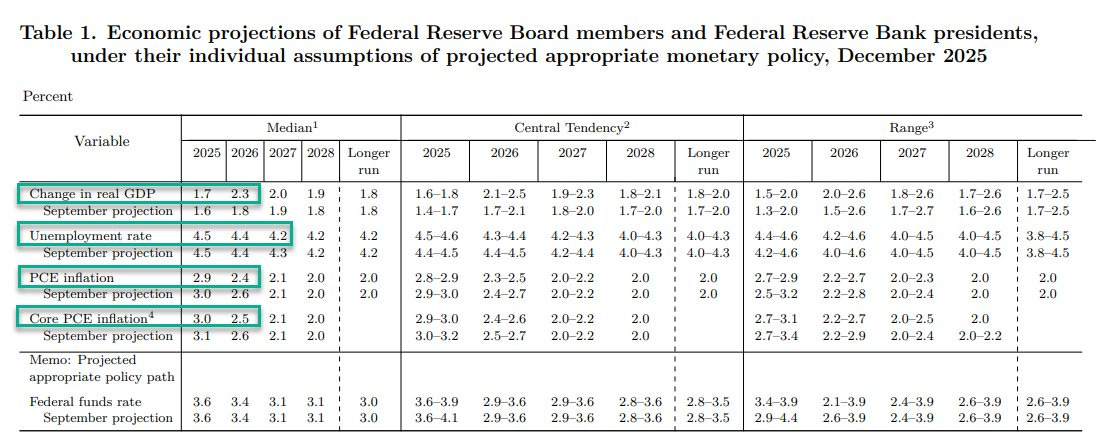

The SEP projects a complete “Goldilocks” scenario, with GDP revised higher to 2.3% for 2026, PCE/core PCE revised lower to 2.4% for 2026, unemployment unchanged, and revised lower to 4.2% for 2027.

We can’t infer anything from the SEP, and it’s best to ignore it for our analysis.

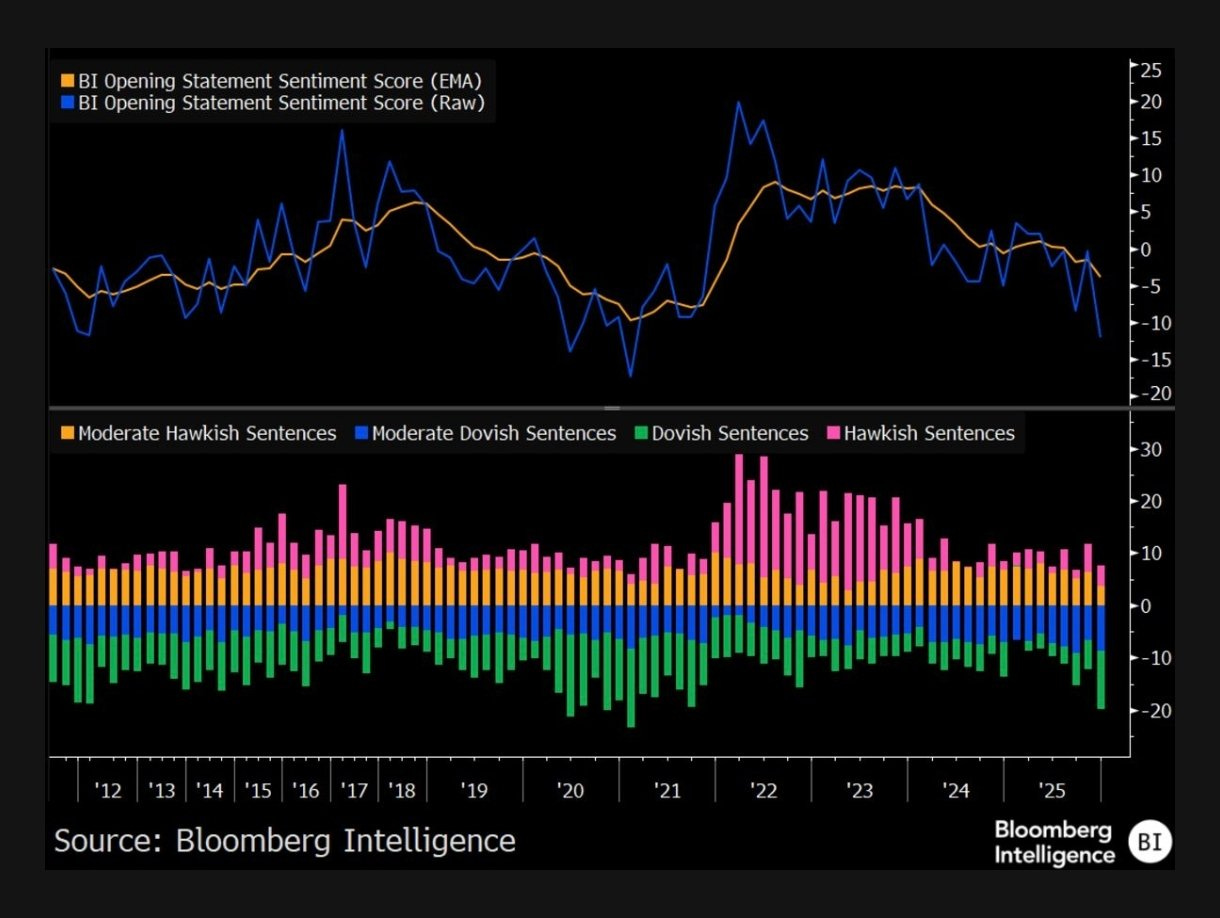

Coming to JayPo’s speech, Bloomberg’s natural-language processing model for Fed sentiment showed that Powell’s opening remarks were more dovish than the October meeting and the most dovish since 2021, according to BI’s Jersey. The comments around the asset purchases were a significant driver of this move.

The liquidity injection was indeed expected, but the tenor of the bond purchases was the surprise factor, turning the policy dovish.

The Fed buying bills is similar to what Yellen did as Treasury Secretary during the last year of Biden’s presidency.

In fact, the Fed’s close integration with the US Treasury will be a key macro outlier for 2026.

Let’s now analyse the world’s most powerful banker’s statements: