"Orchestrated Chaos!"

For the first time in the history of the financial markets, the risk assets were burnt to hell in such a short period, not due to a black swan event or a technical trigger (Black Monday 1987) but due to a proposal by POTUS to alter the global trade by imposing draconian tariffs across countries.

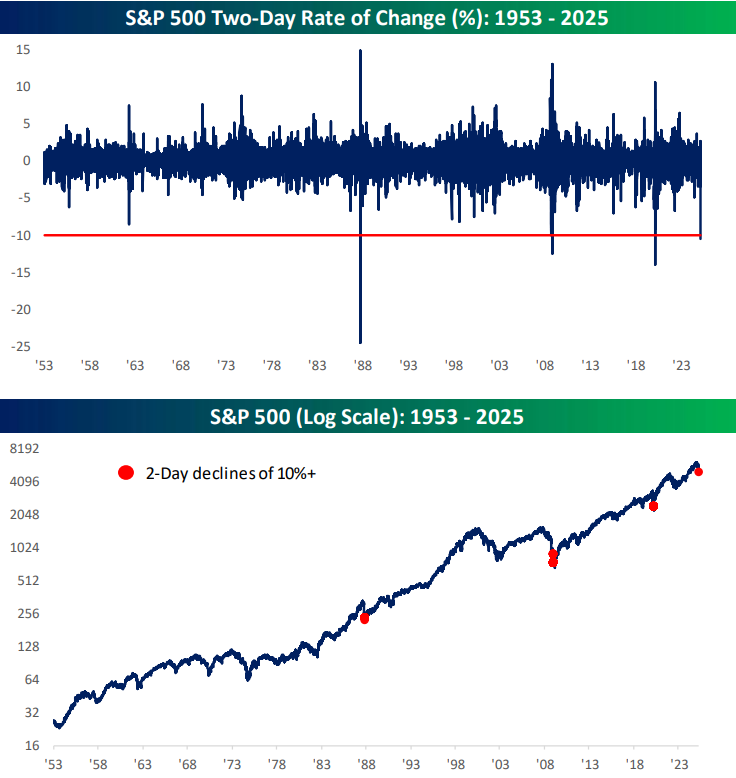

The result was an unprecedented 10% decline in two trading sessions for the S&P 500, just the fourth time since 1952: October 1987, November 2008, March 2020, and April 2025.

Thus, this is the first time in history that the stocks were purposely crashed so that we get lower bond yields (as a flight to safety) and pressurise the world’s largest central banker to cut rates.

However, the plan has its repercussions, and Trump would have never imagined in his wildest dreams that China would retaliate with a 34% tariff imposition on US goods.

Furthermore, the Fed Put is dead, as JayPo mentioned yesterday:

“Feels like the Fed does not need to be in a hurry.”

“We have time.”

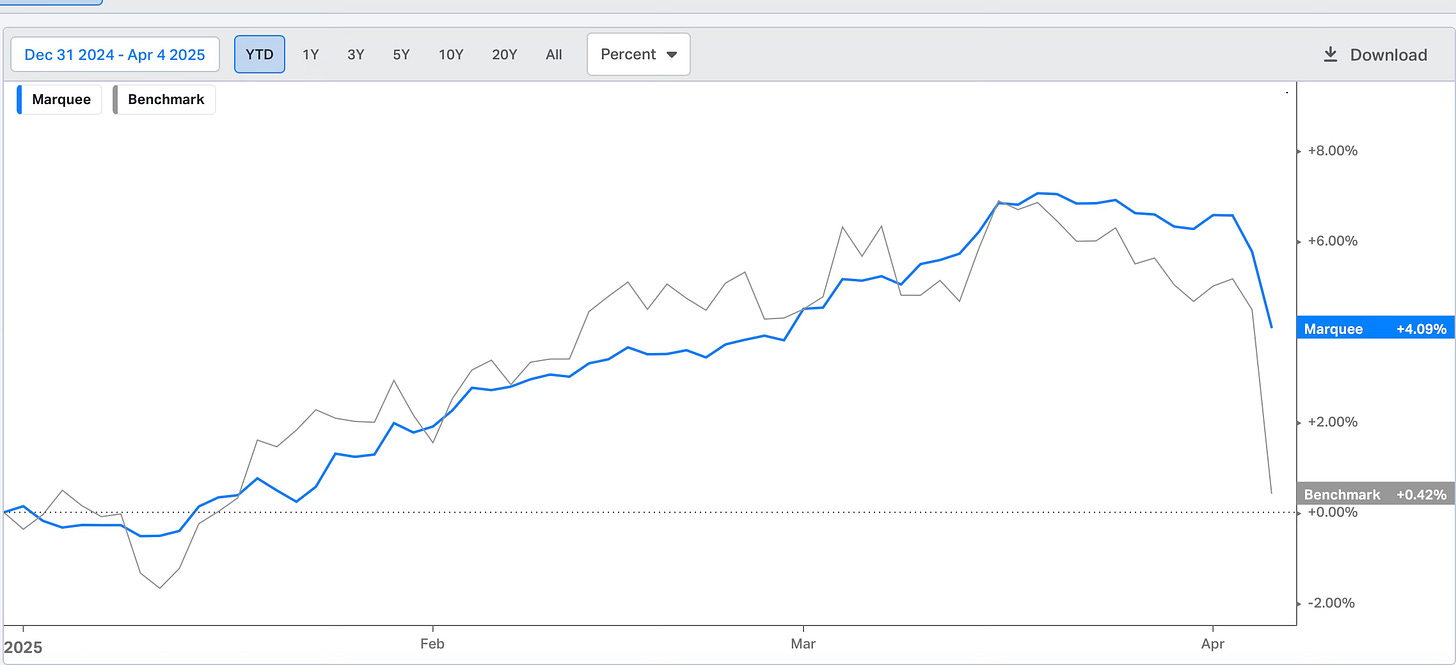

Nevertheless, we have successfully emerged from the event unscathed (until now) due to our high cash allocation and extremely underweight equity stance, which is gradually changing.

Let’s begin one of the most important newsletters of our journey on Substack.

US/ Trump Scnearios/Gold/ FX/ Oil!

Let’s begin with the macro data overshadowed by the chaos Trump unleashed on “Liberation Day.”

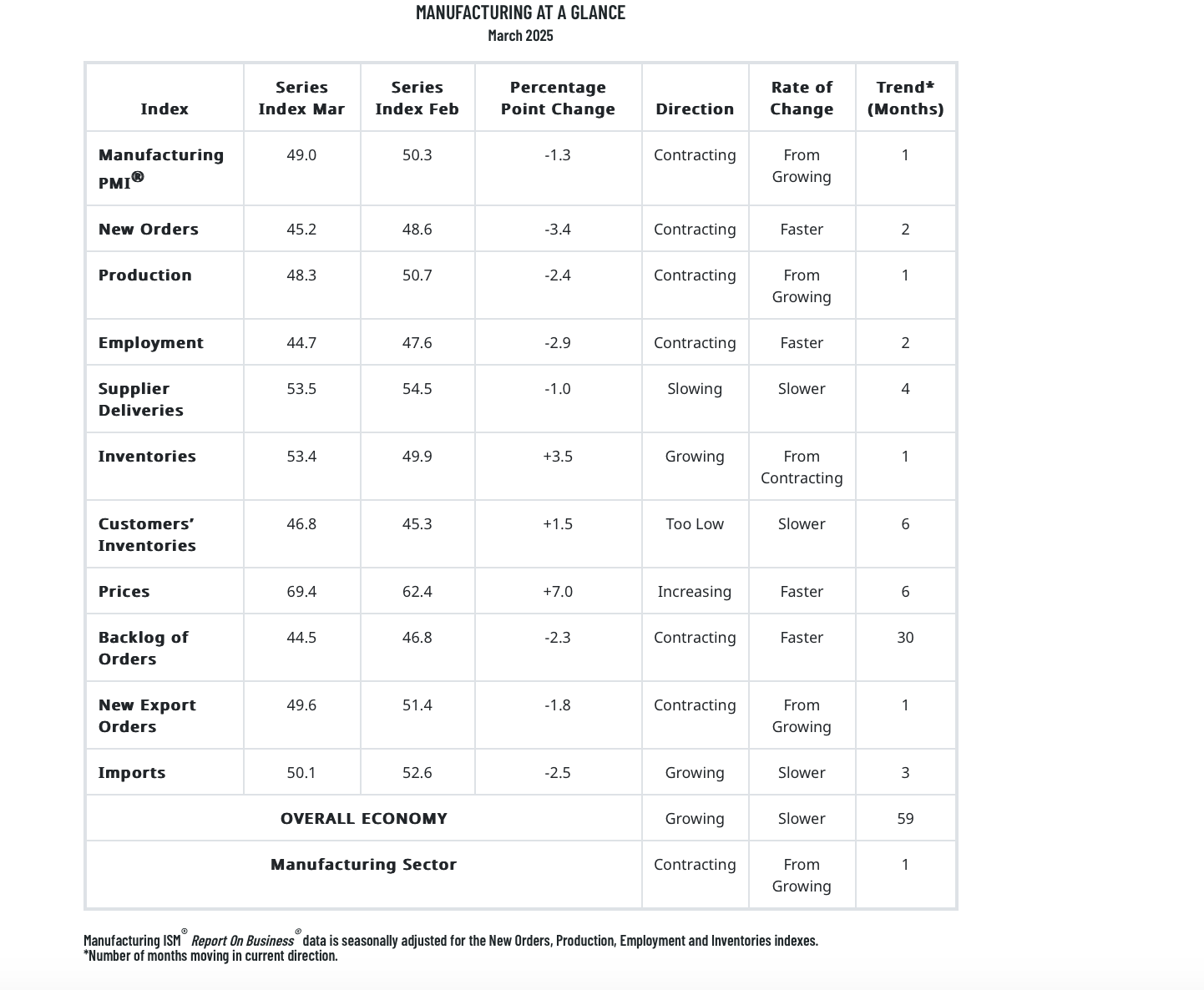

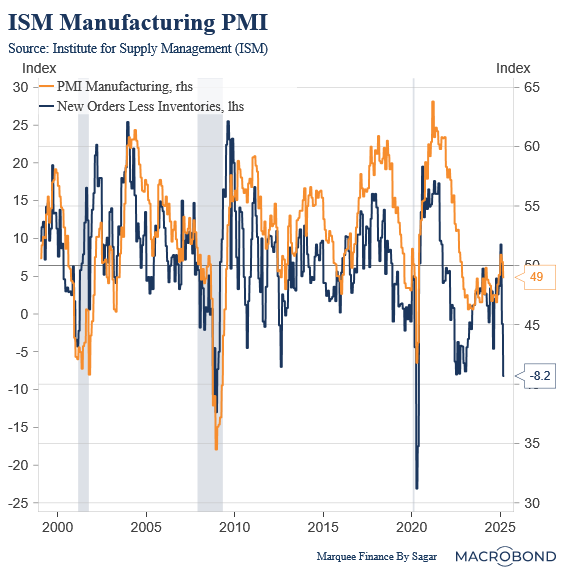

ISM Manufacturing has again slipped to the contraction zone with a reading of 49, which missed expectations.

Though the decline was broad-based, the data was noisy as there was front loading of goods due to tariff fears.

As a result of this, New Orders Less Inventories plunged to recessionary levels, shocking the street.

There will be a lot of volatility in the coming months due to the tariff uncertainty. Thus, one needs to be cautious before jumping to a conclusion and will need to connect the dots.

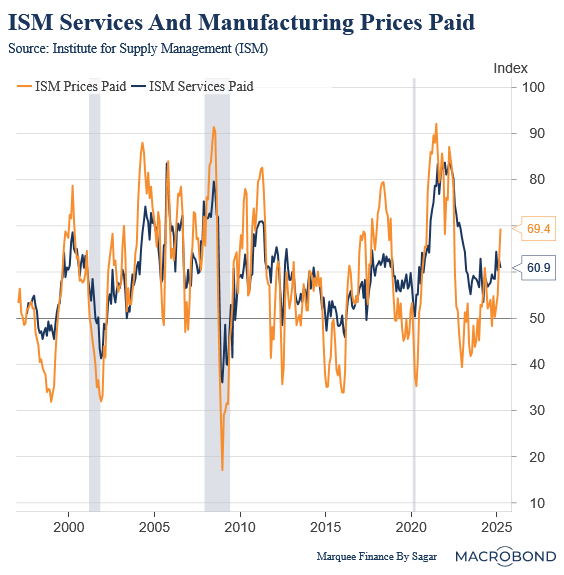

Similarly, the tariff frontloading also led to ISM Manufacturing Prices Paid skyrocketing to 69.4. Such a high reading is unsustainable and was only seen during the pandemic shock.

Nevertheless, it’s entirely possible that we will experience a COVID-19 supply chain shock if the trade war goes ugly (tit-for-tat) and there are no deals as the market participants expected.

We believe this is a high-probability event because Trump is adamant about executing his campaign promises, one of which is to abolish the taxes.

To do as promised, Trump needs hundreds of billions of dollars.

What Trump is doing is reverse calculation, and let me explain to you what he is thinking: