While Wall Street was on holiday in August, the markets sprung up a negative surprise, and the global growth is now indicating further deterioration as the world’s second-largest economy grapples with an unprecedented slowdown.

Let’s look at what August had in store for us!

The shocker for me this month was that the High Yield (H.Y.) was the best-performing asset this month. While I didn’t incorporate BTC (as my chart looked pretty bad), it was the worst-performing asset this month.

The largest asset class is the Housing market, and it’s starting to tumble again (after a brief revival). The mortgage rates hit the highest since 2001, and as a result, it has become the least affordable to buy a home in the U.S.

This comes on the back of skyrocketing real yields (now 2%+), which has led to a risk-off environment with equities and long-duration bonds witnessing an enormous sell-off.

The tighter monetary transmission is not only transpiring via higher real yields, but also the inverted yield curve, discouraging lending. Banks continue to tighten lending standards.

In Europe, the resilient Services sector indicates early signs of trouble as Services PMI enters contraction all across the continent.

Nonetheless, the “Sick Man of Europe” title goes to Germany. The sentiment across the manufacturing industry returns to the COVID/GFC levels while ECB maintains a hawkish stance.

In the U.K., the cost of living crisis worsens as rent inflation hits a 25-year high. The average rent across the U.K. has now crossed a whopping £1,163 per month.

In Asia, August was dominated by the news flow from China. It all began with the horrendous CPI data.

As we reached the third week of the month, the bankruptcy of the third-largest developer in China sent ripples across the globe. The Chinese RE Sector has failed to revive.

The Chinese H.H.’s deleveraging spree continues as bank lending hits a roadblock. China is now officially a credit-starved economy.

There is no respite from inflation in the land of the rising sun as JPY is back to October 2022 levels despite the YCC tweak.

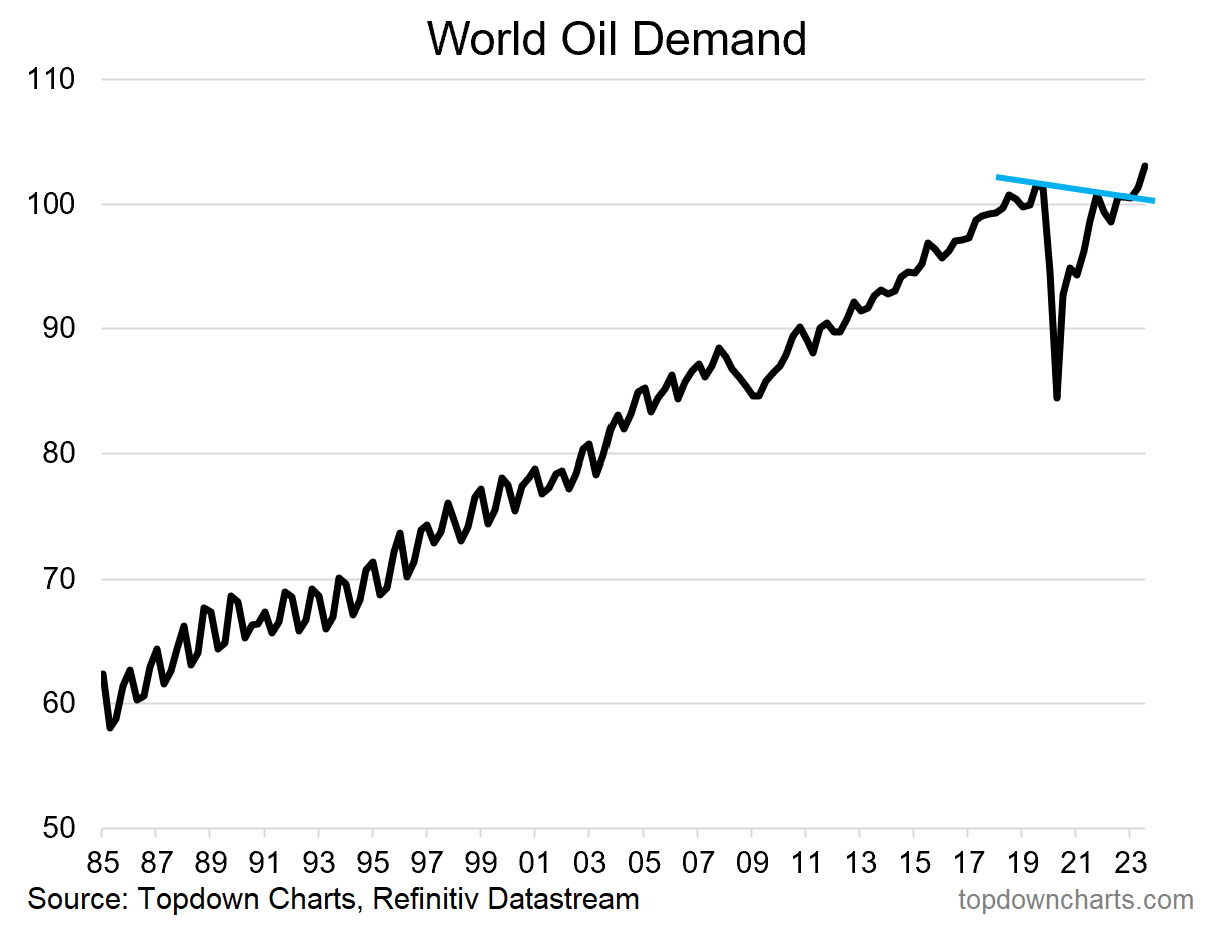

Coming to commodities, the world oil demand has surpassed pre-COVID levels and hit a new record high.

Higher products demand is leading to a rally in refined products as Gasoline and diesel skyrocket due to the refining shortages.

BONUS Chart:

Can’t end this month’s edition without mentioning the star of the month: NVDA. Here is the Price / Sales Ratio (Forward) for the magnificent 7.

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.