While August didn’t experience the same level of cross-asset volatility as we witnessed last year (remember the panic triggered by the Japanese), Trump’s decisions continue to create ripples across the market.

The Fed’s independence was called into question when Lisa Cook, a Fed Governor, was fired by Trump. This was the first time in history that the US President fired a Federal Reserve Governor.

The US is ready to launch an all-out attack on Venezuela, which will lead to a rise in geopolitical risk premiums for various assets. The attack appears imminent, given the significant military buildup.

Since the Russia-Ukraine war began in 2022, US and Russian relations have been extremely strained. However, that changed this month as the Russian delegation, led by Putin, met Trump in Alaska, raising hopes of a ceasefire. However, there has been no progress since.

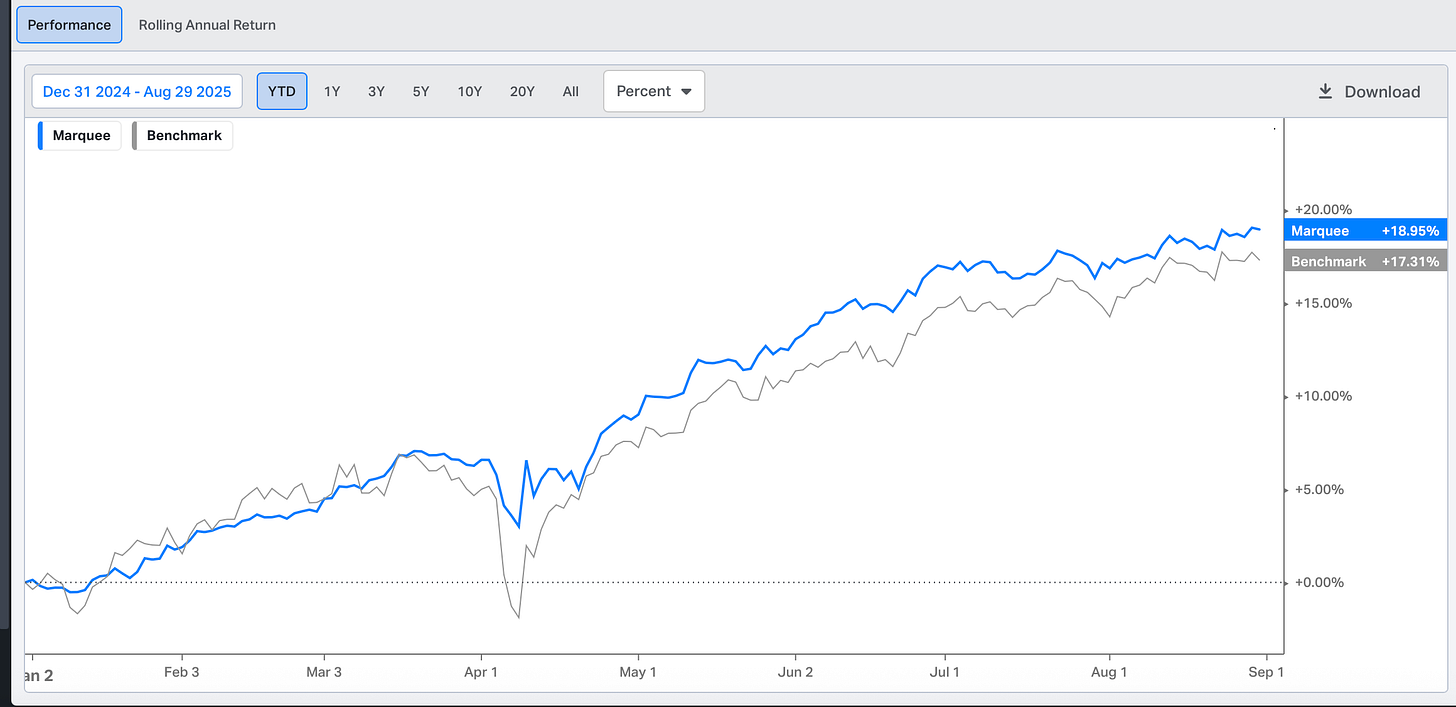

Despite the chaos, our outstanding performance continues, with the PF now up 19% YTD and outperforming the benchmark by more than 150 basis points.

PS: Before we begin, we will increase our paid subscription prices to $29.99/M or $ 299.99/Yr starting 1st September 2025.

Note that subscribers who are currently enrolled or will enrol by September 1st will be subscribed at the mouth-watering current prices ($24.99/$249.99) “FOREVER”.

Furthermore, those who have subscribed at the original price of $14.99/$149.99 two years back will see no change in their plans.

Therefore, anyone who wants to take advantage of a 16% lifetime discount can subscribe until midnight on August 31st at the current prices (last 48 hours).

Let’s examine 16 charts to analyse the global macro and cross-asset movements in the global financial markets.

As we near the end of Q3, Gold remains the undisputed king this year as the shiny yellow metal has given a return of 25.12% YTD.

In the equity universe, Chinese equity markets, for the second consecutive year, continue to surprise and remain the top performers. LATAM America (ILF) and European ETF (IEV) are up 21% YTD but have underperformed in the last two months. The US erased some of the underperformance in the last month, but is still up only 9-11% YTD.

Due to various headwinds, long-term bonds remain the biggest underperformers, with the flagship TLT up only 2% (total return). Commodities (ex-PMs) have also lagged as oil has been in a bear market.

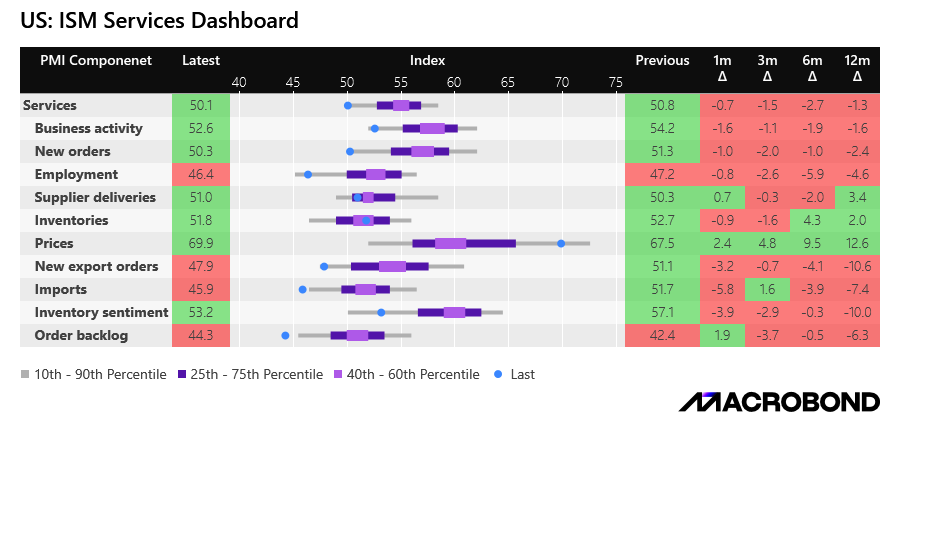

The macro data in August has confirmed the worst fears of market participants as the probability of stagflation has increased dramatically.

The ISM Services Dashboard indicates that while the prices component has skyrocketed to 70 (one of the highest readings in recent years) and has remained persistently high, the Employment component has been below 50 (and is falling), indicating contraction.

While we can’t infer the macro outcome from one dataset, most of the indicators are signalling a high probability of stagflation.

Since more than 60% of the US economy is based on consumption, any dent in consumption will be a drag on growth.

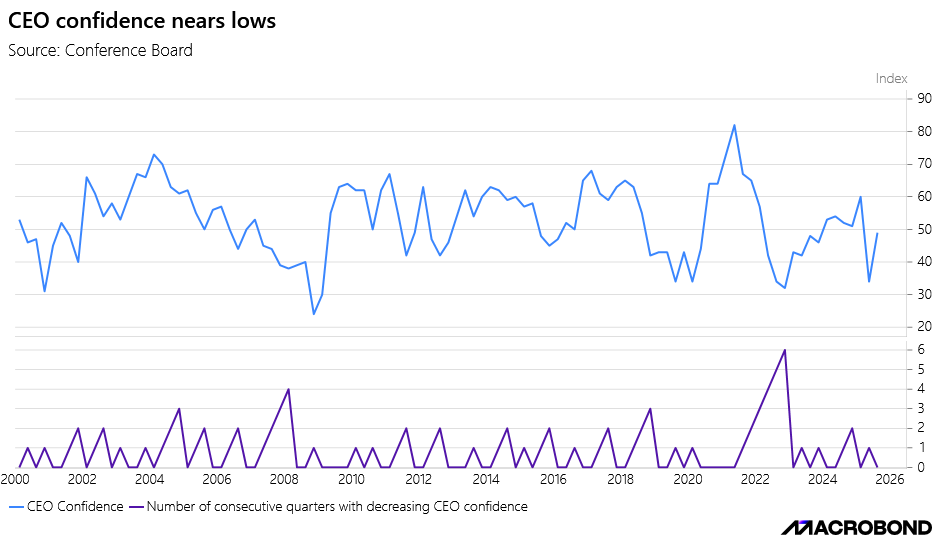

The CEO Confidence is often a good indicator of how corporate America feels about the consumption story. Whenever we have experienced a “growth scare” in the past, the CEO Confidence has plummeted dramatically.

We are now witnessing a rebound in the CEO Confidence after the tariff saga led to a sharp fall. Thus, no alarming signal here.

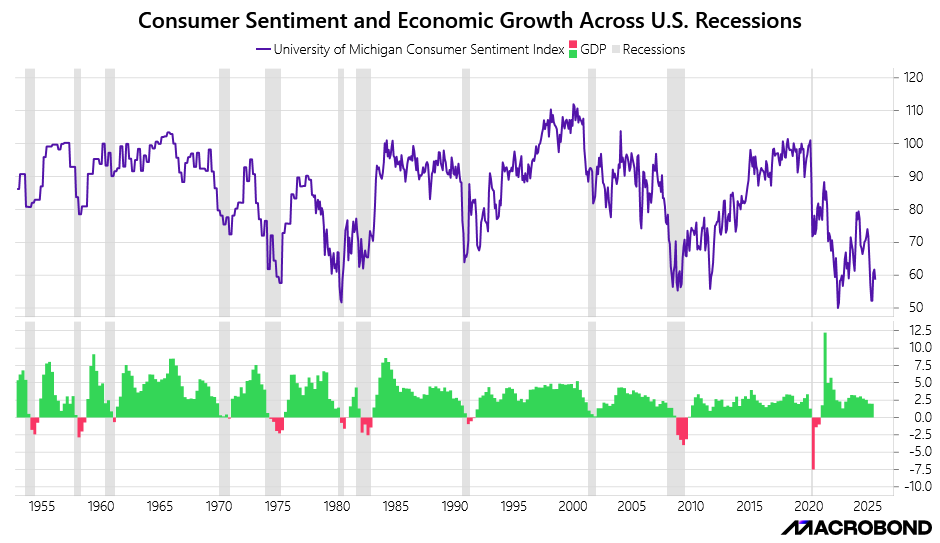

Another measure to gauge consumer sentiment is the University of Michigan Consumer Sentiment Index. Historical data suggests that whenever the consumer sentiment has dropped below 60, we were in a recession or an extremely low growth period.

When the April equity crash occurred, consumer sentiment dropped to levels last seen during the 2022 bear market. However, it has since rebounded but remains in the danger zone.

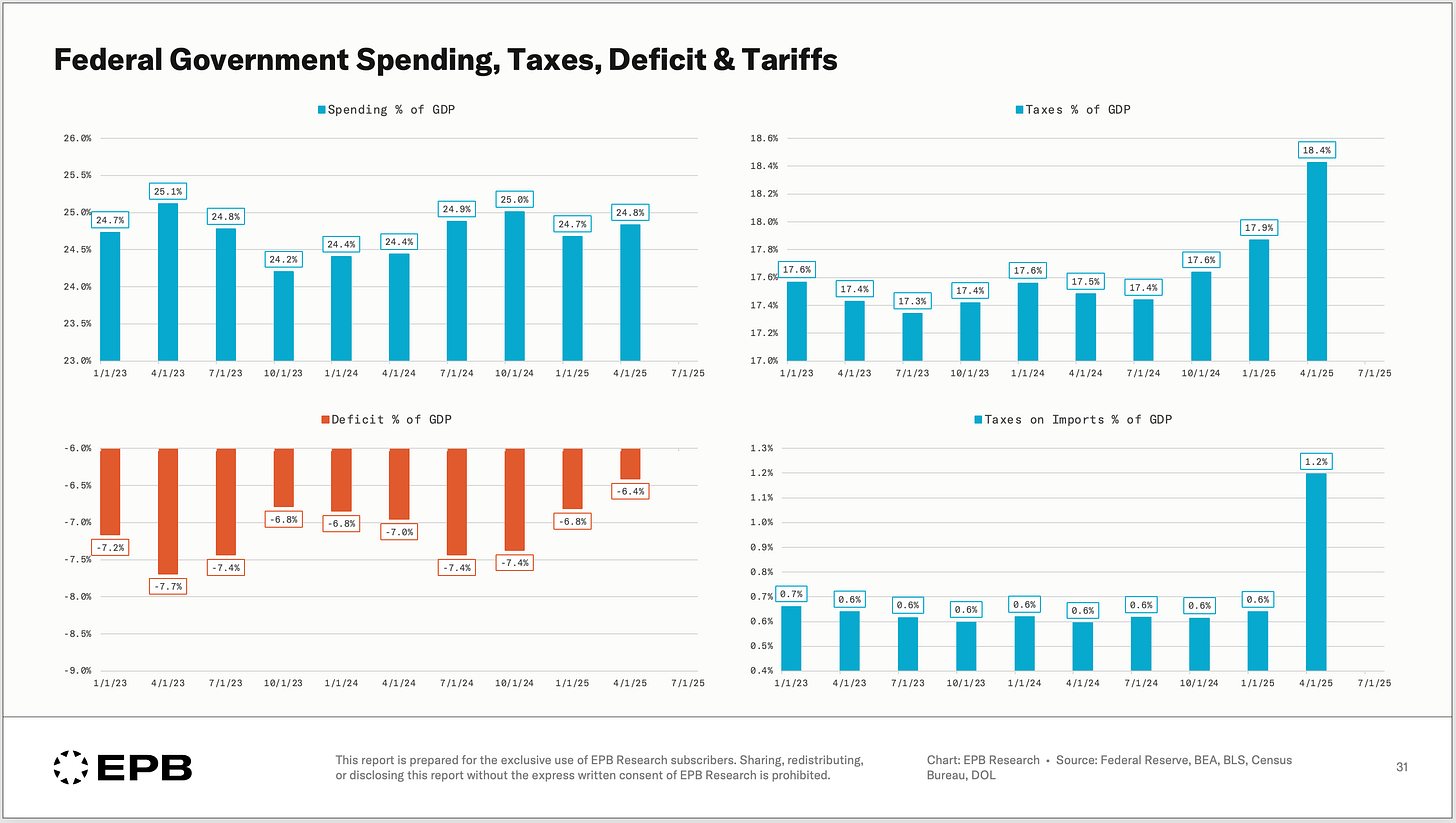

The strength in the US economy in the past few years has been due to the high “peacetime” fiscal deficits that the country has been experiencing.

Although the spending pattern has remained unchanged, the deficit has decreased in recent quarters as tariff revenues began to materialise. As a result, the tax rate as a % of GDP has increased to more than 18%.

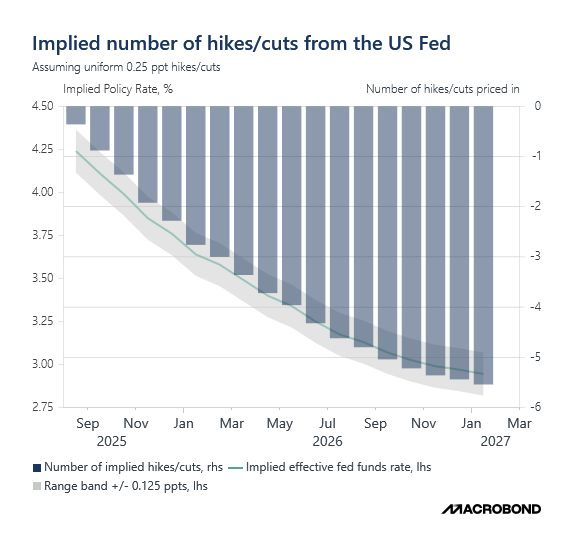

In a dull August, we witnessed a significant market shift when JayPo delivered his Jackson Hole speech.

However, despite a knee-jerk reaction in risk assets, the rally faded as confirmation from JayPo emerged that the neutral rate in the coming years will be significantly higher than it was in the last decade, due to conditions that were not within the Fed's control.

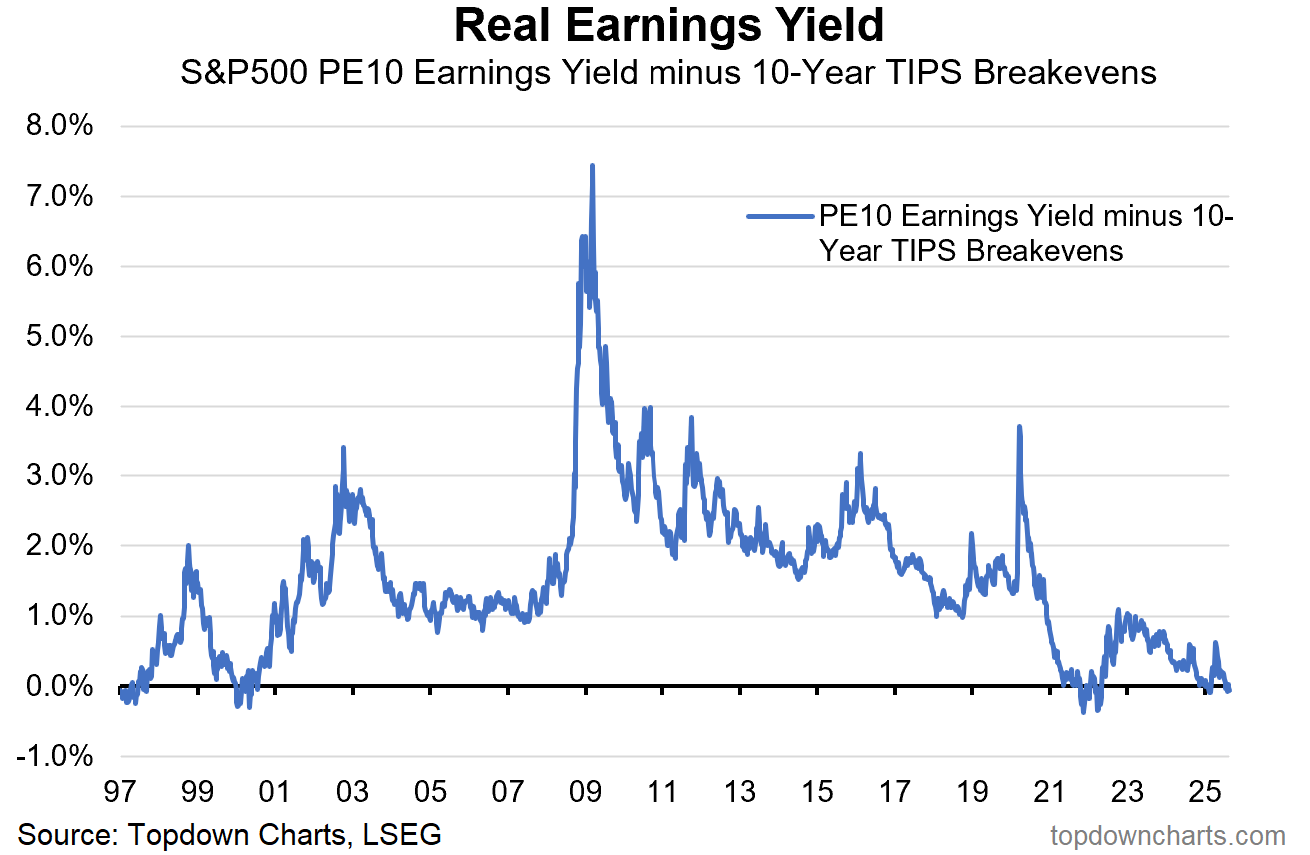

Moving to markets, there has been a huge uproar on social media in the past few weeks about the valuation.

Certain valuation indicators, such as the Price/Sales ratio and the CAPE Ratio, suggest that we may have surpassed the valuation levels of the dot-com bubble.

When we look at the Real Earnings Yield (calculated at S&P500 Earnings Yield - 10Y TIPS), we are nearly reaching the extremes that we witnessed in the euphoric 2021 heights.

Due to the policies (and vision) of Trump’s administration, the healthcare sector has taken an enormous beating this year.

Once favourites among conservative investors and those who love defensive stocks, the healthcare sector's weight as a percentage of the S&P 500 has dropped to multi-decadal lows.

Has the time come to bottom fish, or are we headed lower?

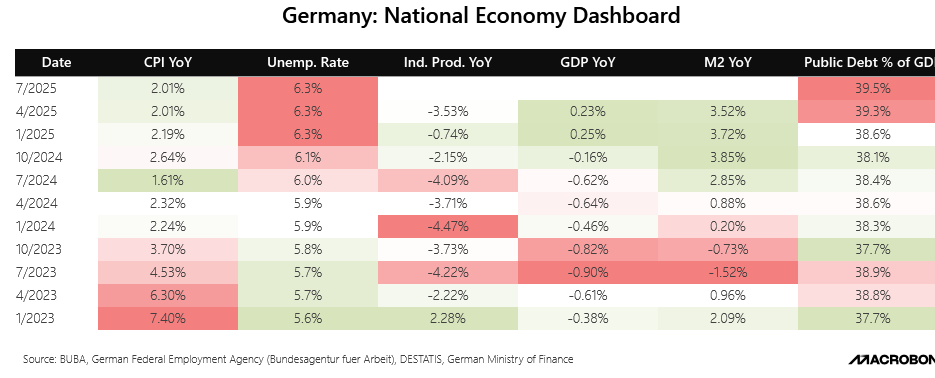

Europe’s manufacturing hub has experienced a decline in the past few quarters.

Germany has been unable to recover from the 2022 energy crisis that paralysed its industrial base. While the CPI has moved down considerably to the 2% target, industrial production has failed to recover, and the unemployment rate has jumped sharply over the last 24 months.

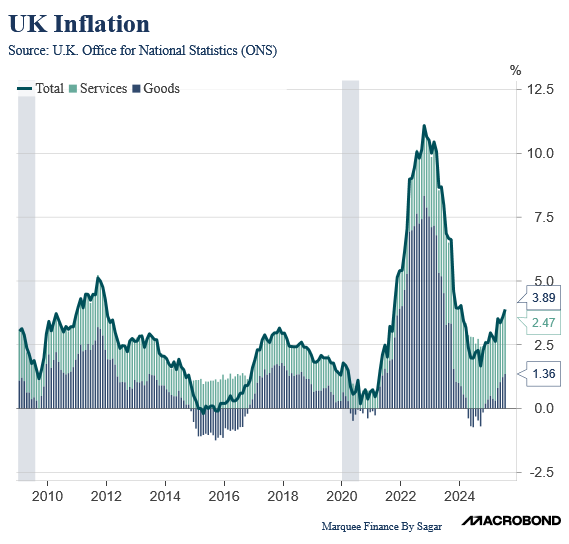

Unlike the Fed, the BOE has a single mandate of stable inflation (2%).

Nevertheless, the UK has been facing a rise in inflation in recent months.

Despite the CPI coming in hotter than expectations, in a historic revote, the BoE cut rates this month.

However, don’t expect a rate cut now in 2025 as the inflation menace needs to be controlled.

The UK 30-year bond yields jumped to the highest levels since 1998 and are now higher than 100 bps from the famous Liz Truss episode when Sterling touched parity.

Note that this is an unusual development, as yields typically fall when the Central Bank cuts its benchmark rates. Fiscal policy is primarily responsible for this anomaly.

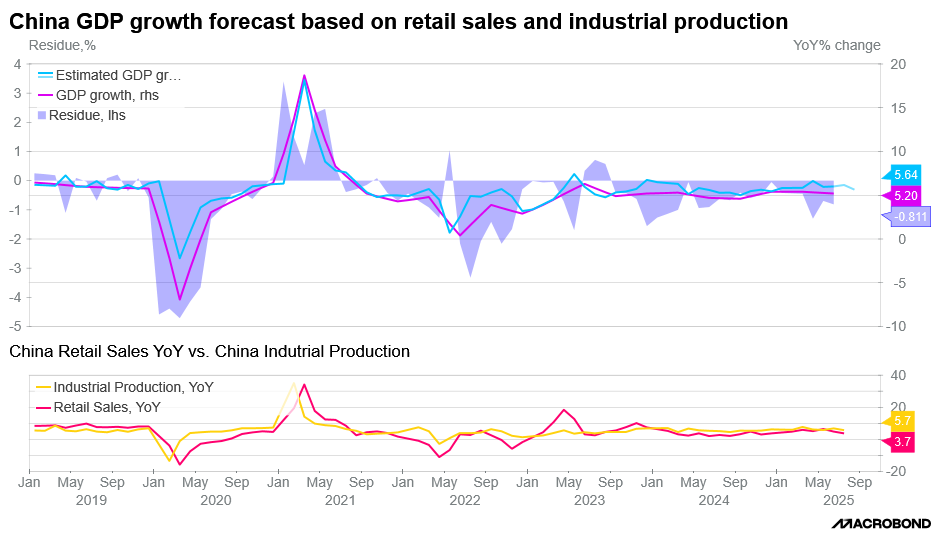

The Chinese macro data has failed to rebound despite a promising mild recovery in early Q2.

Due to tepid retail sales and industrial production data, we expect slower GDP growth.

After 4 years, the Chinese Money Supply, as measured by M2 growth YoY, is in a strong uptrend, a change that's transpiring after a long time.

In previous episodes of double-digit Chinese M2 growth, commodities have outperformed significantly.Despite weak macro data, the Shanghai Composite has broken out and closed this month at its highest levels since 2015.

As record amounts of domestic liquidity flow to the Chinese equity markets, we believe that there is a high probability that we will get fresh ATHs in the Chinese markets in the next few months.

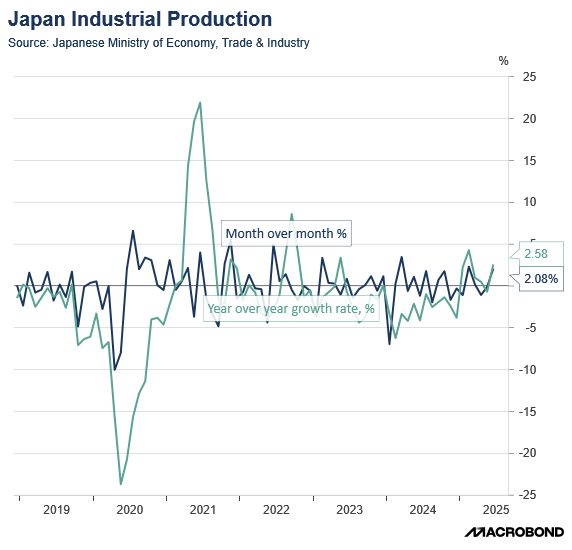

In the land of the rising sun, industrial production had a strong rebound.

The data have been volatile as tariff front-loading led to a spike in late Q1.

However, if the trend continues, expect positive “global” economic momentum.

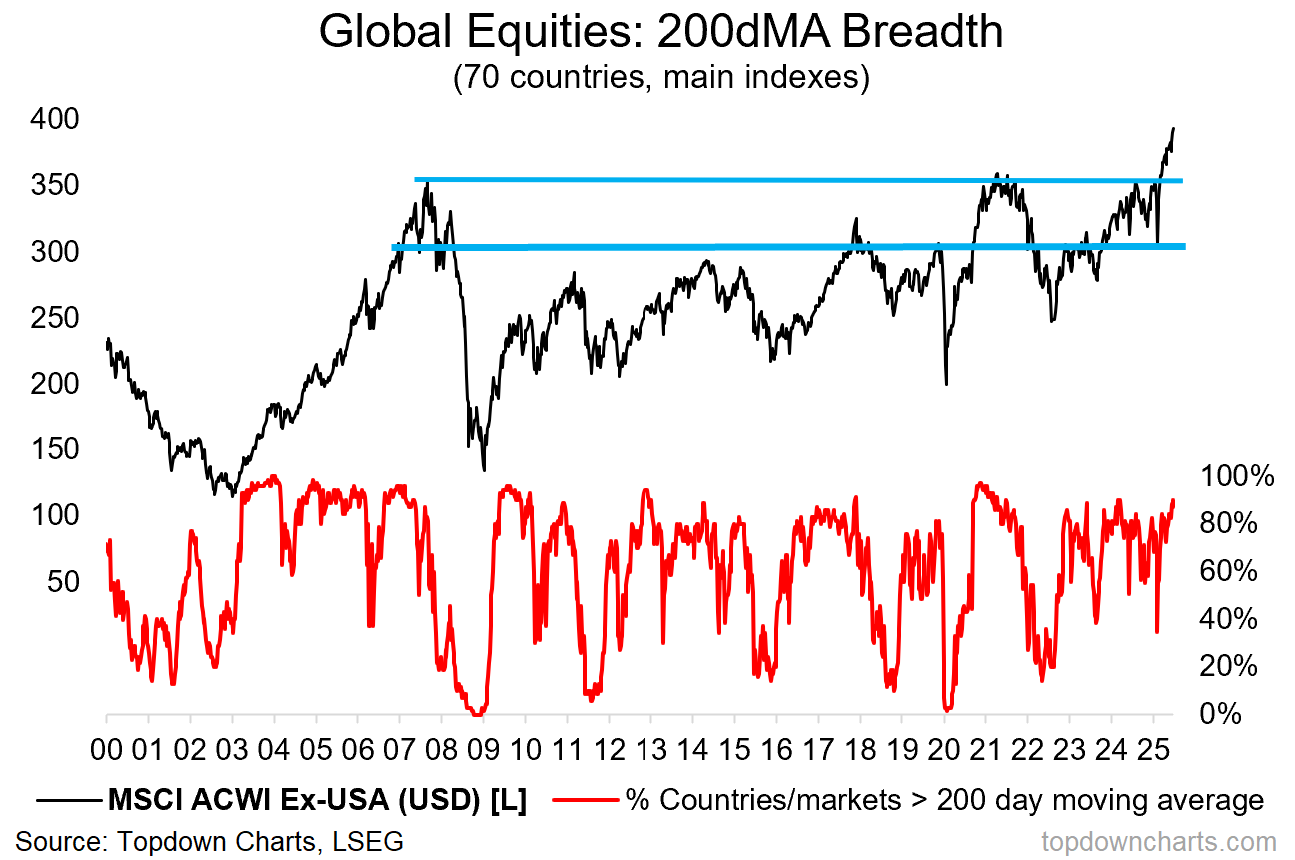

BONUS CHART: Global ex-US equities have broken out through a major long-term overhead resistance level to new all-time highs, with strong (and improving) breadth.

The tailwinds have been the greenback entering a bear market and the valuations, as every country in the world is trading at least 20% cheaper than the USA.

Disclaimer

This publication and its author are not licensed investment professionals. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and consult with your certified financial planner or other dedicated professional before making any investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.