A Very Happy New Year to everyone reading this newsletter!

From the bottom of my heart, I am grateful for showering immense love and taking your precious time to read my passionate project. I hope this helps you to become a seasoned macro investor!

Let us begin with the December Month In Charts edition!

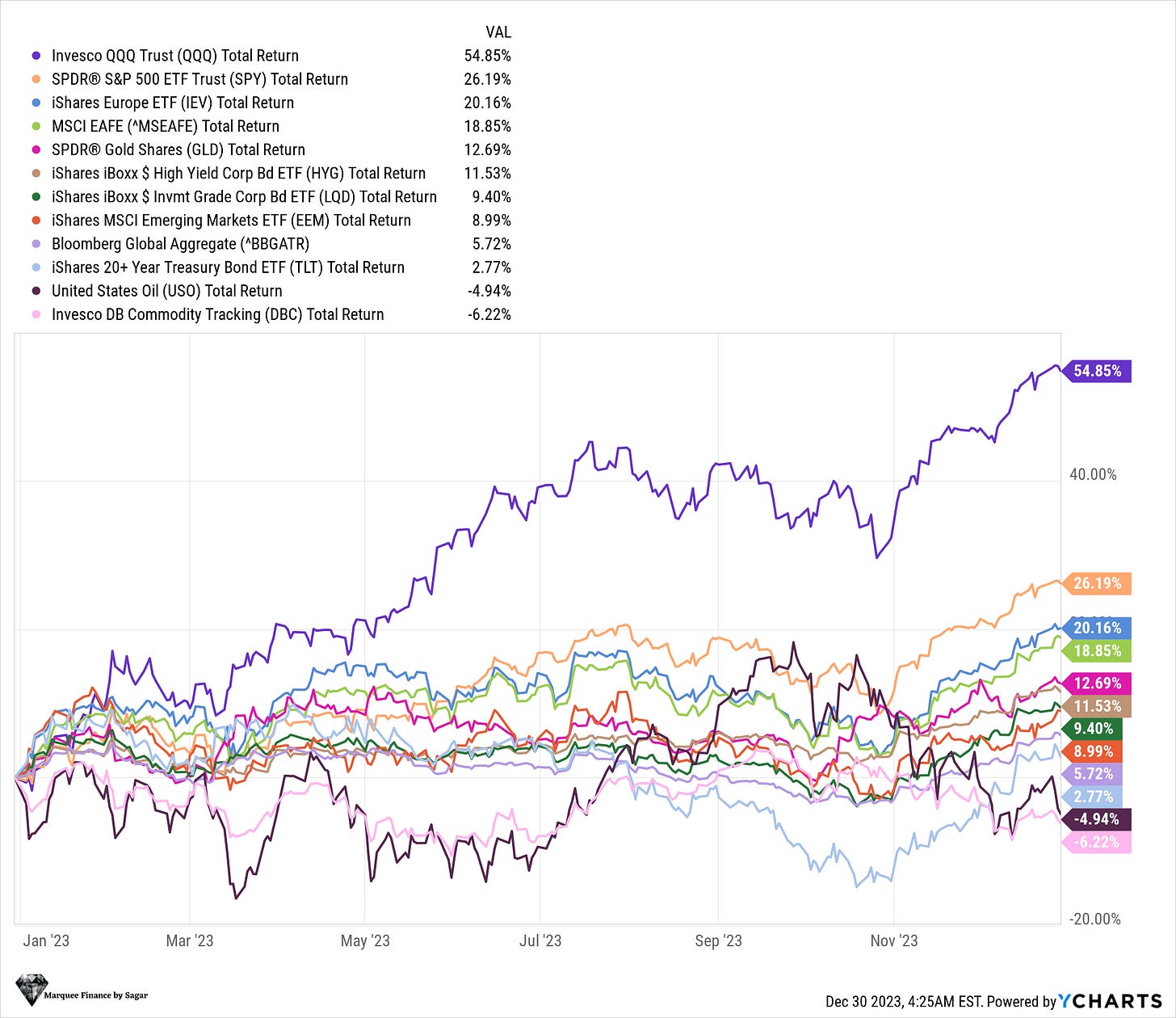

2023 saw fireworks across risk assets with the consensus call of a “recession” gone horribly wrong. As a result, the tech-heavy QQQ returned a spectacular 55%.

Furthermore, commodities disappointed with negative returns and long-duration bonds merely in green. The move was exacerbated in December as the Fed “pivot” became a reality.

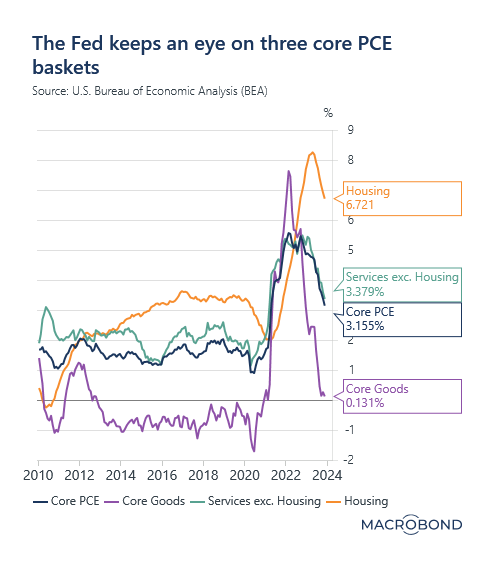

One of the reasons for the “soft landing” crew to declare mission accomplished was “immaculate” disinflation. The Fed’s preferred gauge of core PCE headed to 3% in November, with the core goods at a touching distance of turning negative.

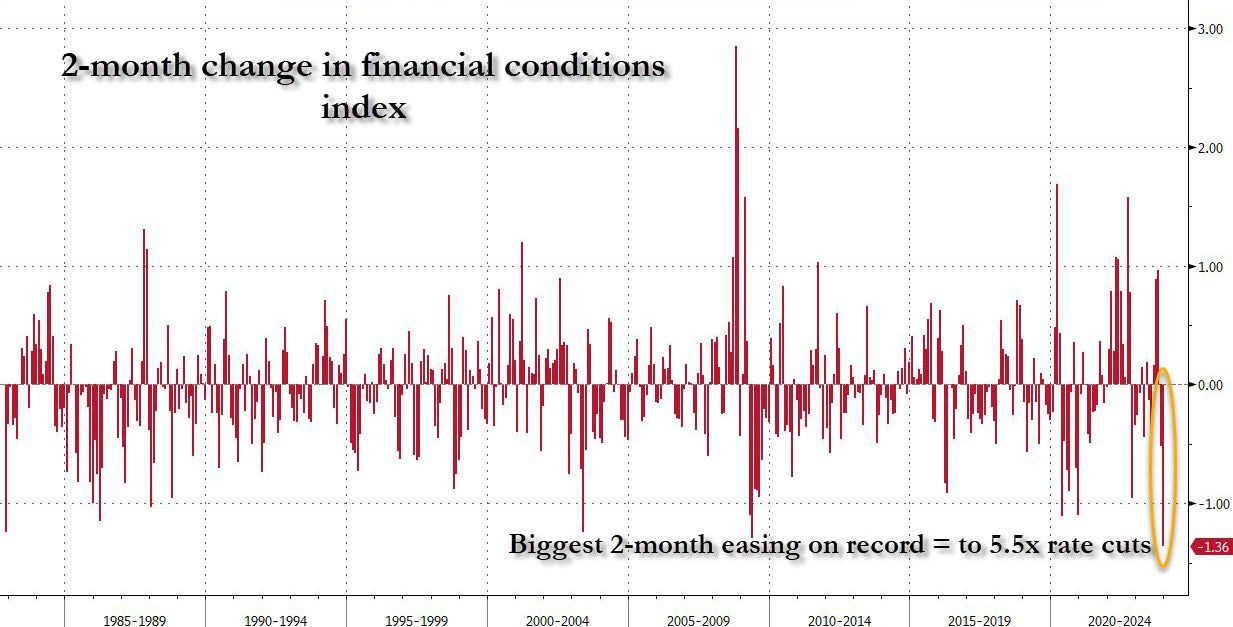

The soft landing hopes and the market’s anticipation of a dovish Fed in an election year led to an unprecedented easing of financial conditions.

November and December witnessed the biggest 2-month change in financial conditions (often seen during the QE period post-COVID and GFC).

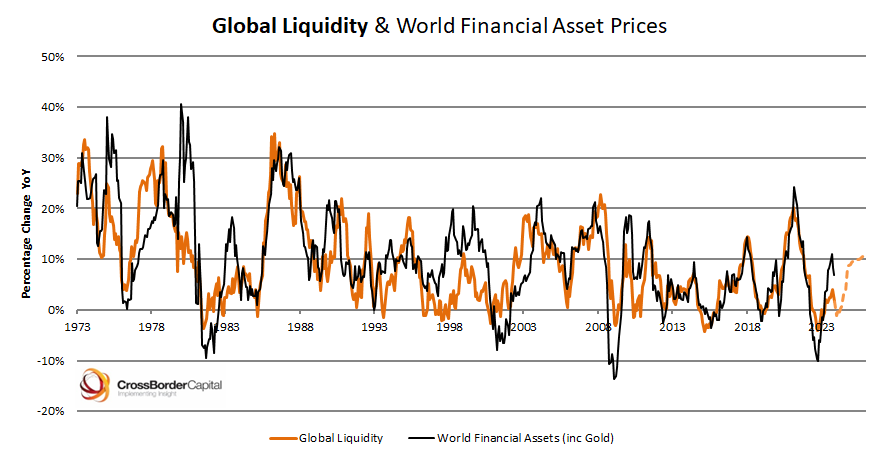

The easing of the financial conditions was also accompanied by record amounts of liquidity pumped by the world’s largest central banks (primarily Fed, PBoC and BoJ).

As a result, economic momentum remained strong, especially in the US, with higher asset prices leading to a positive wealth effect.

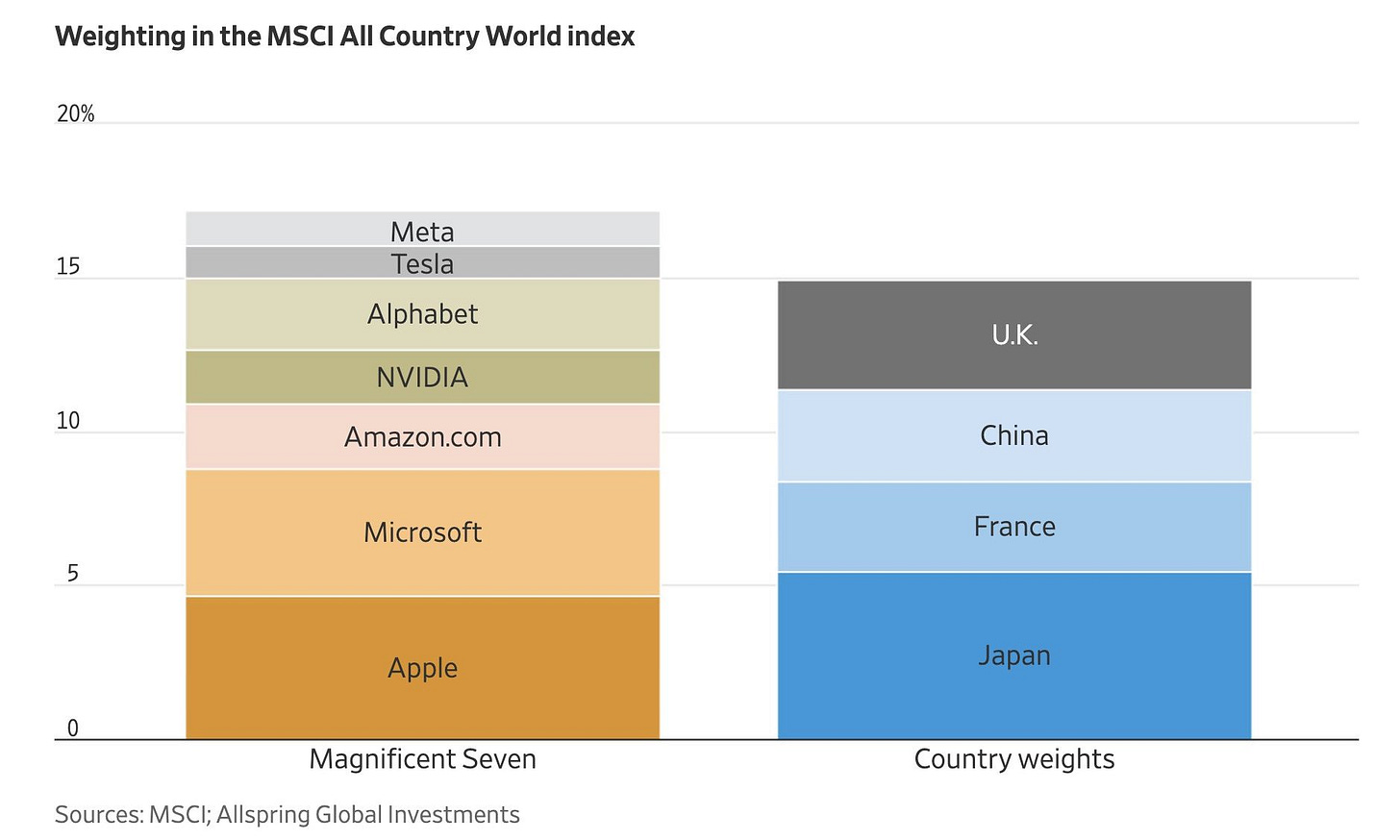

Nonetheless, as the Mag7 becomes bigger than countries entire stock market cap, the concentration risks in the US markets are increasing more than ever.

This might lead to a subdued performance by the Mag 7 in 2024 as the rest of the market catches up with a caveat that earnings do pan out as per the estimates.

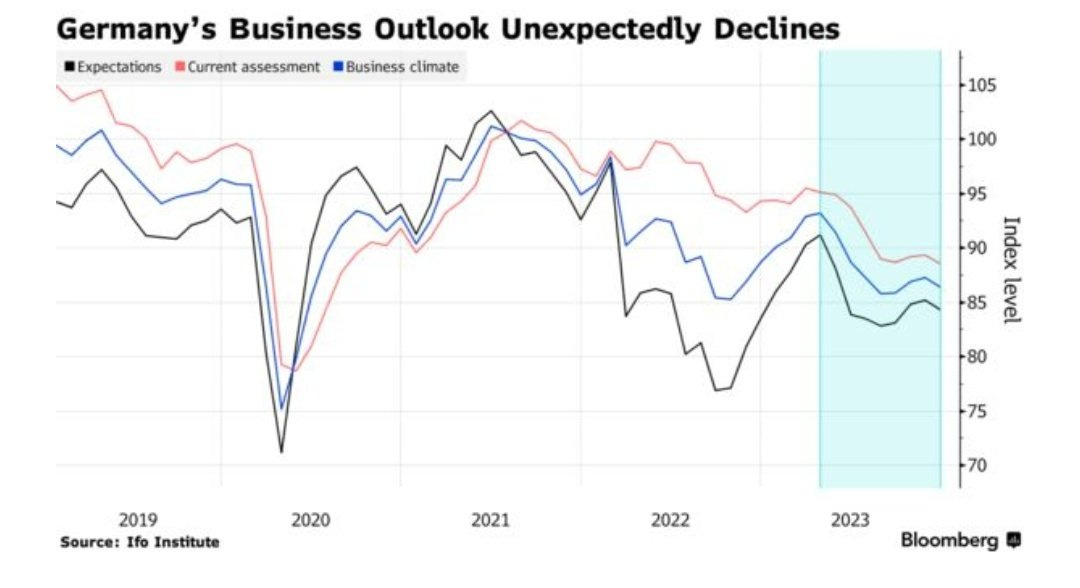

While 2023 ended on a high note in the US, the IFO business outlook in Europe, which is one of the best measures to gauge cyclical activity, plunged unexpectedly.

Do remember that half of Europe is already in a technical recession (two-quarters of negative consecutive GDP growth).

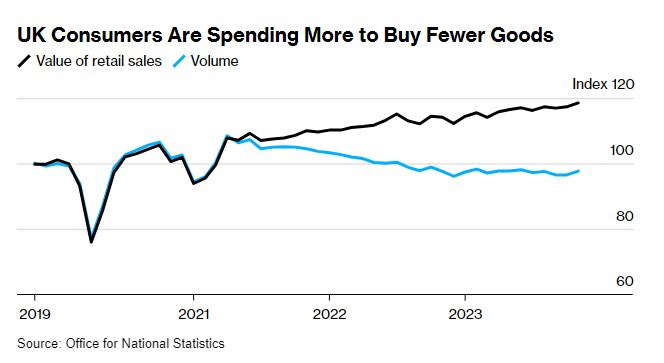

In the UK, which has been hardest hit by the energy crisis-led inflationary shock, the post-COVID period has been a kinda “lost decade”.

Retail sales volume has been negative over the last three years, even though value has risen by more than 20%. Undoubtedly, it has been a catastrophic scenario for the Brits.

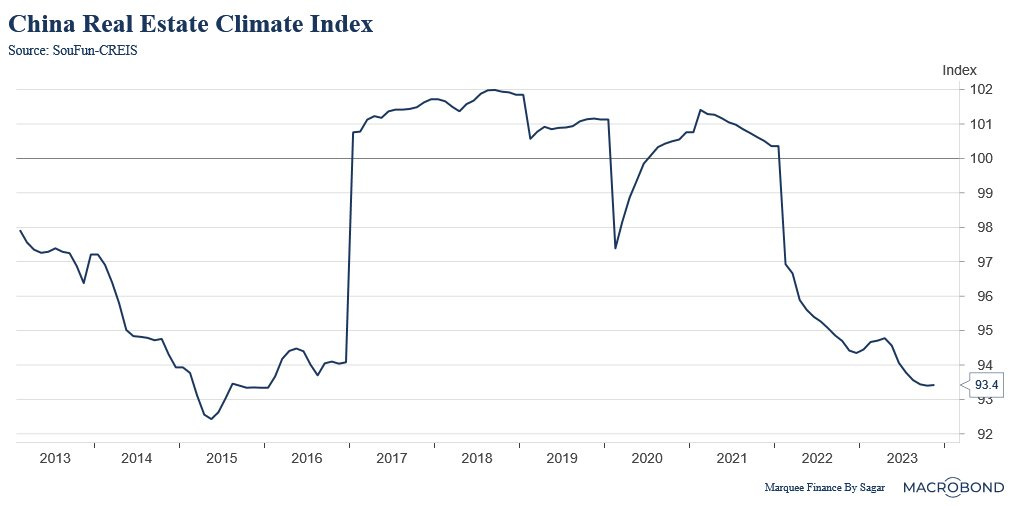

China’s property meltdown was again at the forefront in 2023, with the second-largest developer, Country Garden, going under. The fear of a balance sheet recession is rife as property prices have plunged by double digits in the last two years despite Chinese consumers hoarding trillions of yuan of excess savings.

However, the unprecedented stimulus measures by the PBoC and Chinese government might have begun to take effect with initial signs of sentiment bottoming out. Nonetheless, one needs to closely examine the upcoming data to assess whether the turnaround is real.

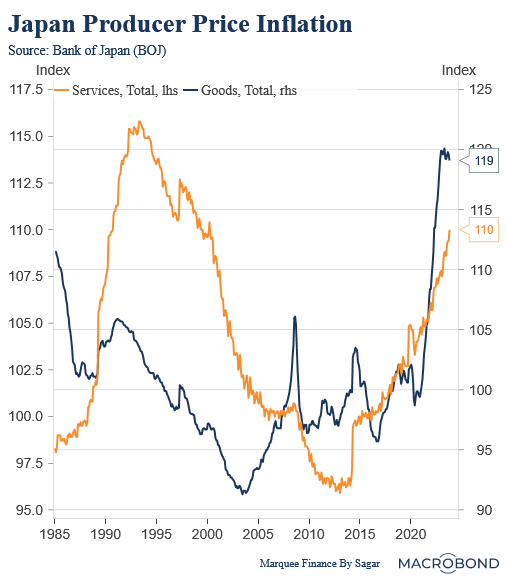

On the other hand, the land of the rising sun is moving out of the three-decade-old deflationary trap as services inflation skyrockets. The Services PPI is now at the levels last seen at the beginning of the 21st century.

All eyes are on the Spring Shunto talks, which will likely trigger the BoJ to exit the NIRP.

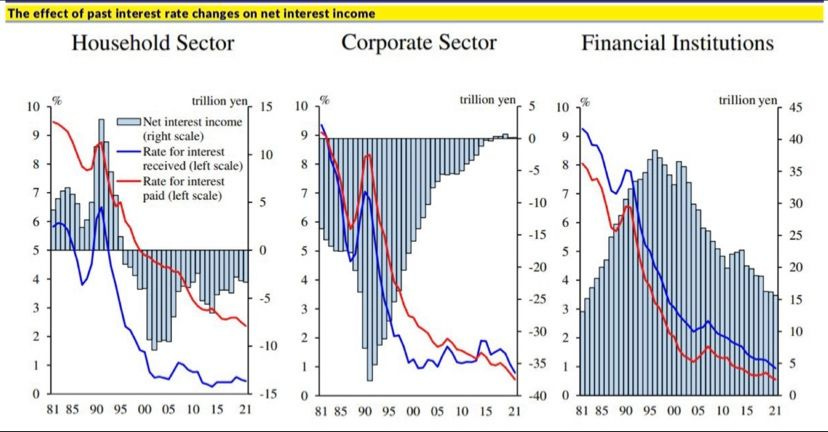

Once policy normalization happens in Japan, a flood of domestic liquidity earning nothing in bank deposits will chase higher yields- a phenomenon seen in the West.

This enormous liquidity will likely end in the JGBs or the Japanese stock markets, which are still below their 39-year peak.

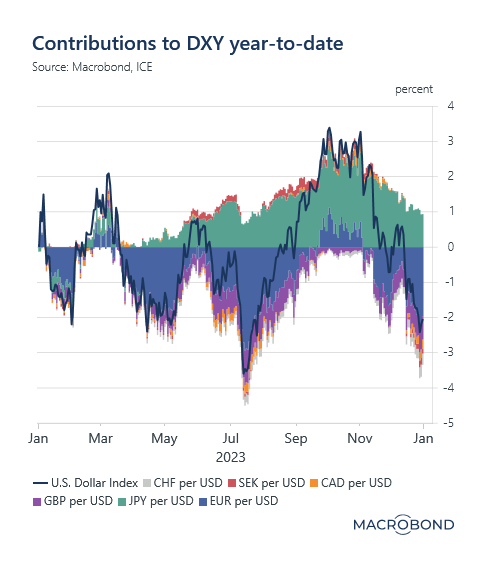

Coming to planet FX, the Dollar gave a negative return in 2023. While GBP and EUR gained due to the hawkishness of the ECB and the BoE, JPY’s weakness was the biggest contributor to the DXY's strength as BoJ maintained its ultra-accommodative stance of the Negative Interest Rate Policy (NIRP).

Furthermore, the Fed’s pivot in December FOMC put enormous pressure on the greenback.

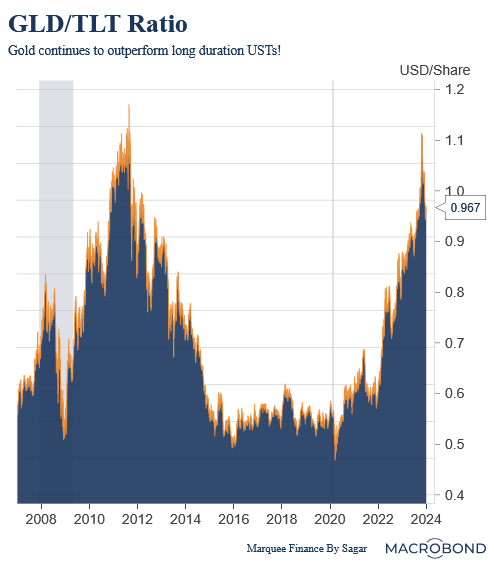

The Shiny Yellow Metal was the star of 2023 as it provided much-needed diversification in the portfolio, especially when long duration bonds suffered due to concerns around the US fiscal dominance.

The GLT/TLT ratio reached its 2012 peak as Gold massively outperformed the ultra-long bonds.

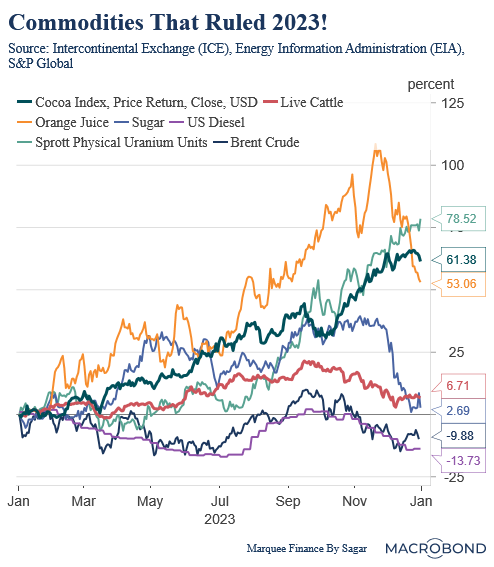

While the broader commodities had a terrible year, the stars of 2023 were Uranium, Cocoa and Orange Juice.

Yes, folks, as nuclear energy gains momentum and the Uranium markets remain tight, the radioactive metal witnessed one of its best years ever.

BONUS CHART:

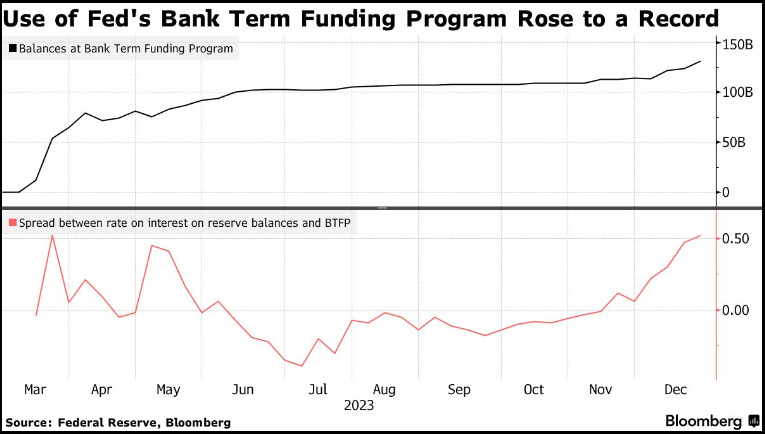

December saw a funny phenomenon where banks in the US entered into an arbitrage trade with record volumes. Taking the benefit of the record spread between reserve balance and BTFP, banks borrowed heavily from the BTFP facility and parked money at the Fed, earning risk-free profits!!

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors either with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.