As market participants returned from a long New Year holiday, there was a diverse set of reactions by the bond, equity, FX and commodity markets.

While the crowded trade of long the legendary 7 stocks continued its dream run (ex-Tesla), the bond markets saw an upheaval with Mr Market pricing out the March rate cut.

Nonetheless, geopolitical tensions were the talk of the town, with shipping rates across some of the major shipping routes (Suez and Red Sea) witnessing an insane rise of more than 2X in just a few weeks.

PS: Before we begin, we wish to inform you that we will increase our paid subscription prices to $24.99/M or $ 249.99/Yr starting 1st March.

Note that the subscribers who are currently enrolled or will enrol by 1st March will be subscribed at the mouth-watering current prices ($14.99/$149.99) “FOREVER”.

So, somebody who wants to take advantage of a massive 40% discount for a lifetime can subscribe till midnight on 29th Feb at the current prices.

Let us begin with the January Month In Charts edition

Once again, QQQ was the biggest outperformer YTD among bonds, stocks and commodities.

Nonetheless, commodities made a roaring comeback thanks to the Chinese stimulus hopes and resilient economic data in the US and the Middle East conflicts.

As Houthis stepped up the attacks in the Red Sea, the Global Freight rates skyrocketed, with some of the key routes witnessing a 2-3X rise.

This can lead to a rise in the core goods inflation, which has been on a downtrend due to various factors. As a result, a second wave may likely be brewing beneath the surface.

As we head to the first FOMC meeting of 2024, the financial conditions are the loosest since the Fed began to raise rates in 2022.

The BBG Financial Conditions Index has been inching higher (loosening) since the QRA announcement in October. Higher stock prices, lower yields and tighter spreads are the biggest factors contributing to loosening FCI.

One of the most significant risks the US economy faces in 2024 is from Commercial Real Estate.

In a mind-blowing statistic, America’s offices are emptier than at any point in at least four decades.

As per Moody’s, 19.6% of office space in major U.S. cities wasn’t leased as of 4Q, up from 18.8% a year earlier and above records set in 1986.

January saw an enormous bull run in Semiconductor and other AI companies. As a result, the markets in the US are now becoming extremely concentrated.

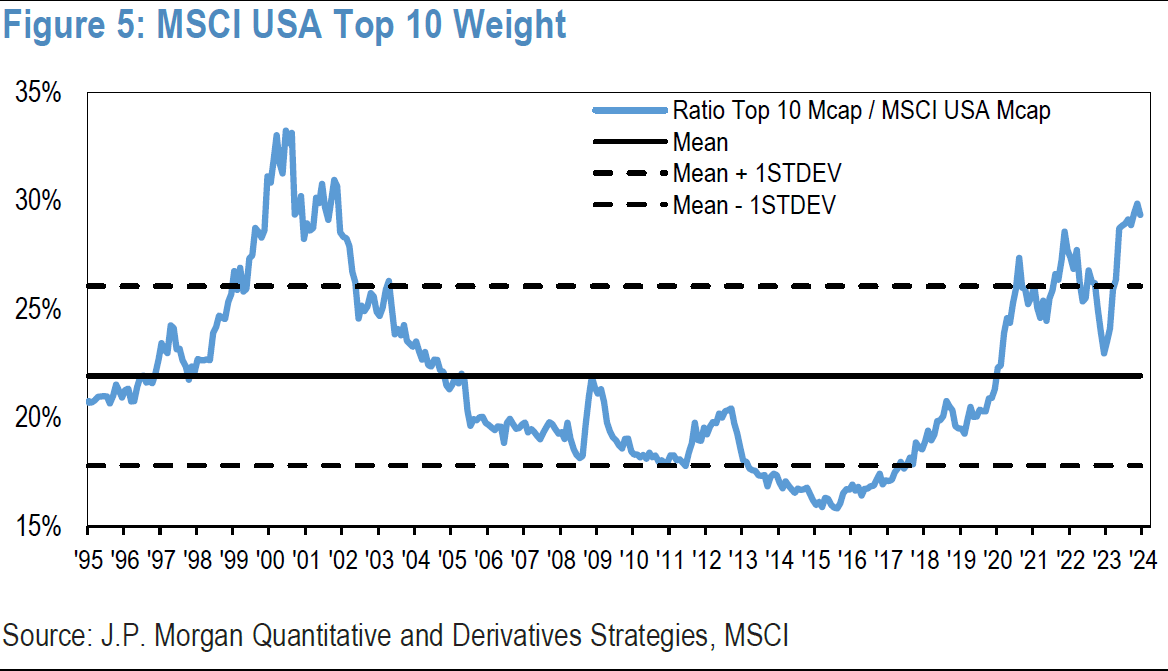

In fact, some market participants are now comparing the current market set-up to the dot com levels as the Ratio of Top 10 Mcap/ MSCI USA Mcap indicates.

Nonetheless, much of it can also be attributed to the gigantic liquidity flowing via passive funds.

The bull run in big tech was also due to the largest long positions ever by the speculators as per CFTC Data. Thus, the current rally can also be attributed to FOMO (Fear Of Missing Out) and extreme greed.

Time to be cautious?

The business outlook for the Euro Area has been significantly worsened as cyclical activity has faltered, and credit to the economy has dried up in the last year and a half.

To make matters worse, Europe will be one of the worst affected by the Shipping crisis in the Middle East.

The UK has been an outlier in Europe as real wages (adjusted for inflation) have been on a tear due to some of the highest nominal wages in the developed world.

As a result, the economy has been resilient and has seen a swift rebound. Nonetheless, it will be a challenging 2024 as the labour market cracks.

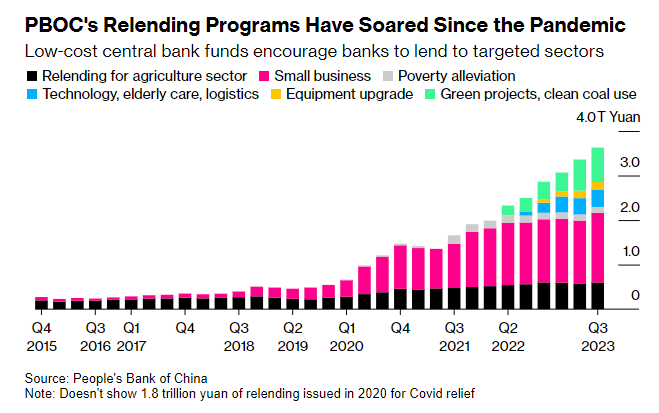

China’s troubled developer, Evergrande, with more than $300 billion liabilities, will finally be liquidated. As consumer sentiment turns extremely sour due to epic property meltdown, PBoC and the Chinese Government have resorted to unprecedented stimulus.

PBOC’s lending programs have now reached a mind-blowing 3.5 trillion Yuan. Nonetheless, the Chinese stock markets have failed to move higher as Hang Seng trades at multi-decadal lows.

The valuations are now at rock bottom, with a stunning development.

The Hang Seng P/E has now dropped below the Nasdaq’s P/B. If you believe in Meanineversion, then one thing has to surely give up, whether it will bevalued US Tech or the undlued Chinese Stocks.

As the land of the rising sun moves out of the three-decade-old deflationary trap, the Japanese housing cycle has also revived after a very long time.

The Japan Hone Price Index (Tokyo Area) is now up 30% since covid. This is likely due to the massive fall in JPY.

The Japanese CPI has been falling off a cliff due to lower utility prices thanks to the massive government subsidies.

Nevertheless, the Japanese Breakeven Inflation has once again begun to rise, signalling that inflationary pressures are intact in the economy, with the key Spring Shunto Talks just weeks away.

Renewable energy is one of the sectors we have been actively tracking and might invest soon.

It’s one of those sectors that has endured much pain since the Fed began raising rates and is now available at reasonable valuations.

FUNNY CHART: Chinese residents are buying Japanese stocks!

Japanese domestic investors are "selling" Japanese stocks and buying US stocks!

Koreans are buying Japanese and US stocks!

Institutional Investors Globally are selling Chinese stocks (before the stimulus news), while global retail investors are buying Hong Kong Stocks!

Intuitively, this is because Japan and QQQ have seen the biggest bull markets since Jan 2023, but it also indicates that domestic investors have lost faith in their equity markets.BONUS CHART:

The broader markets in the US are reeling under the pain of higher interest rates as earnings falter for companies ex-Mag 5.

The S&P 500 Equal Weight to SPY ratio has now fallen to its lowest level since the GFC.

The million-dollar question: Is this sustainable?

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors either with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.