2026 began on a chaotic note as Trump once again stunned the world with his policies and tariff threats.

The biggest risks for 2026 are giving jitters, as BTC, private equity giants, and software names are witnessing an unbelievable bloodbath.

Let’s examine 16 charts to analyse the global macro and cross-asset movements in the global financial markets.

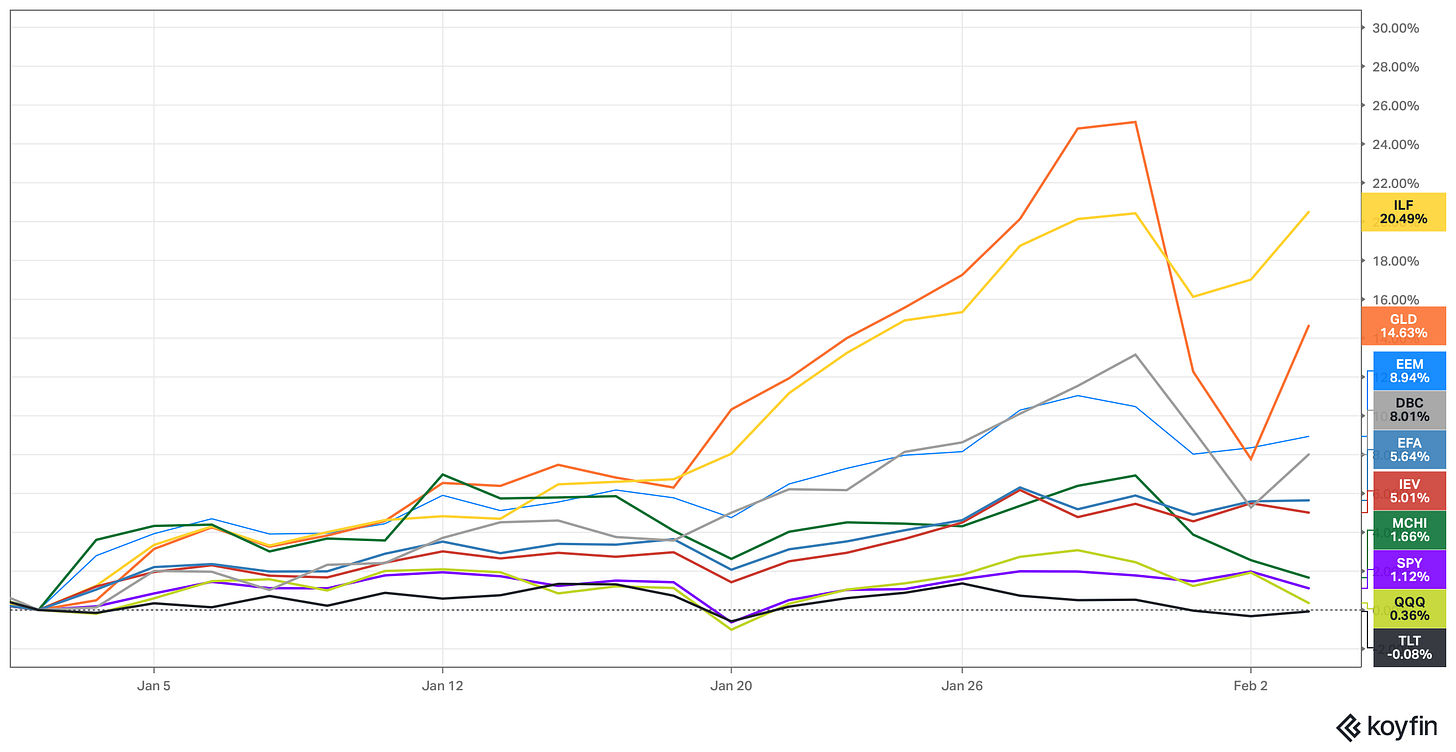

In continuation of the 2025 trend, Gold, along with LATAM equities, has been ripping since the beginning of the year.

While the LATAM benchmark ETF: ILF is up 20.5% YTD, Gold is up by more than 14%.

The US continues to underperform both its DM and EM peers. While the Emerging Market ETF EEM is up 8.94% YTD, the MSCI European ETF IEV is up 5% compared to the 1.1% gain in SPY and the 0.3% gain in QQQ.

Thanks to the JGB rout, long-term bonds remain the biggest underperformers, with the flagship TLT flat YTD.

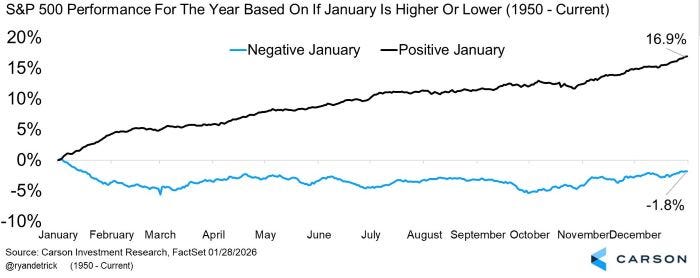

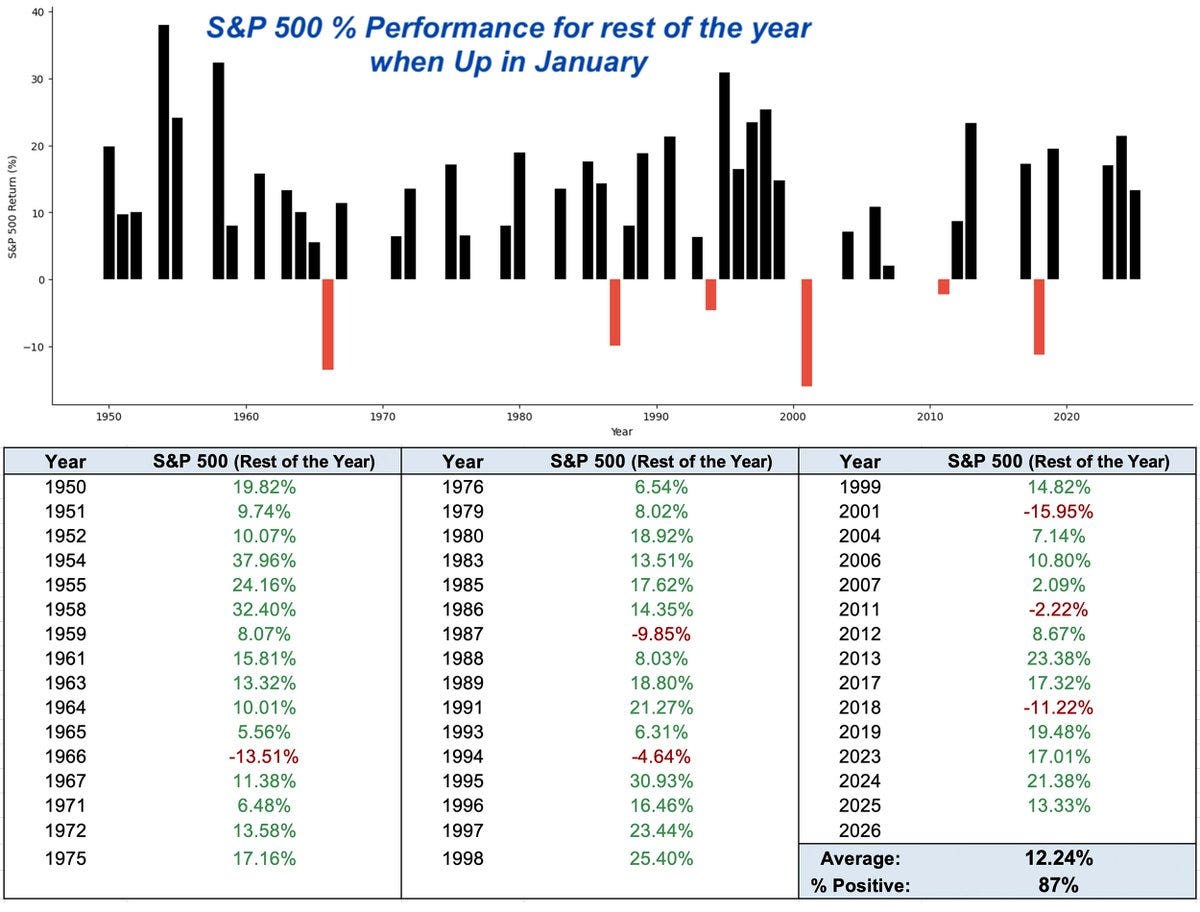

Historical data suggests that 87% of the time when January yielded positive returns for the S&P 500, the year gave a positive return.

Furthermore, the average gain was 12.24%.

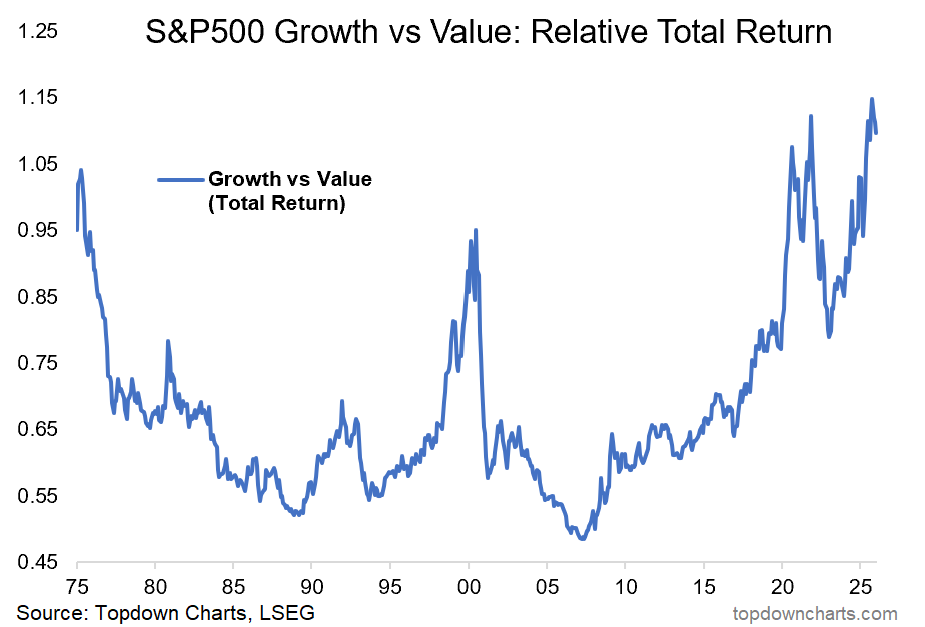

When we dig deeper into the equity market internals, we can see we hit an inflection point in October last year, as value has outperformed growth since then.

We can cite multiple reasons for the same, ranging from weakness in tech, earnings recovery in value stocks and valuation comfort.

Looking at sovereign bonds, the data indicate that positioning has become extremely light as USTs have been in a bear market.

Moreso, the valuations are now attractive. Thus, we won’t be surprised by a “rally” in bonds.

While USTs are unloved, corporate bonds have been witnessing massive inflows.

The Global Corporate Bond spreads, as measured by the BBG Global Corporate Statistics Index, have reached pre-GFC levels.

Even the High Yield (HY) spreads are at post-COVID lows and can’t get any tighter than they are today.

Coming to macro, we are witnessing a contraction in real disposable personal income as incomes have failed to grow despite higher GDP growth.

On the contrary, the Real PCE has been trending higher, suggesting that lower-income consumers are drawing down their savings, while the spending is buoyant in the high-income consumers due to the wealth effect.

Nothing moves the needle at the Fed as a weaker labour market.

While the labour market remains in a low-fire, low-hire paradigm, JayPo’s favourite indicator (Vacancies/Unemployed) has plummeted to 2017 levels.

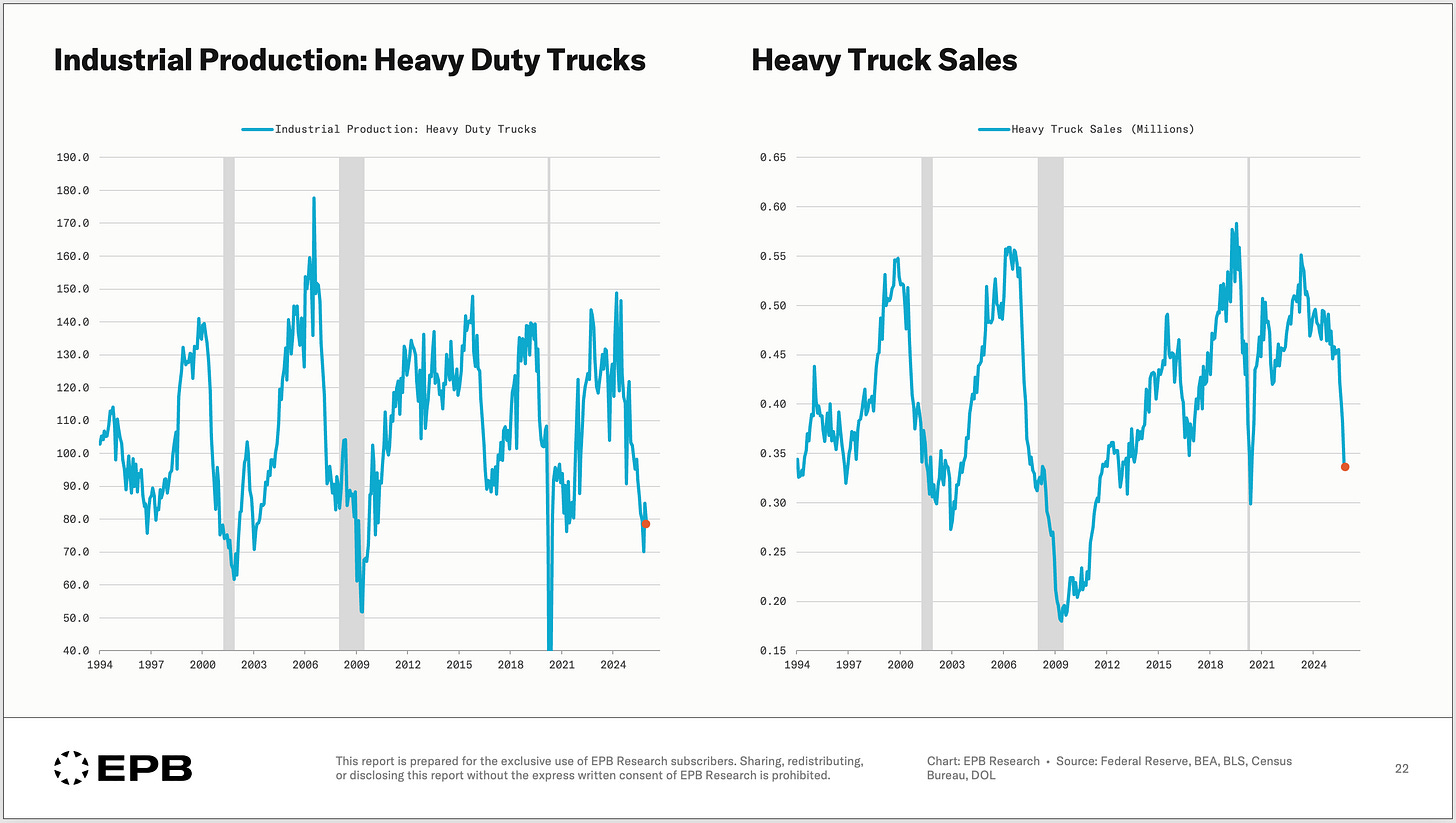

Undoubtedly, there has been a cyclical recovery in the US economy, as the recently released ISM data portrays; however, the Heavy Truck Sales have fallen off a cliff.

While a deeper investigation into the reasons is needed, some market participants believe it’s online sales that have eroded demand.

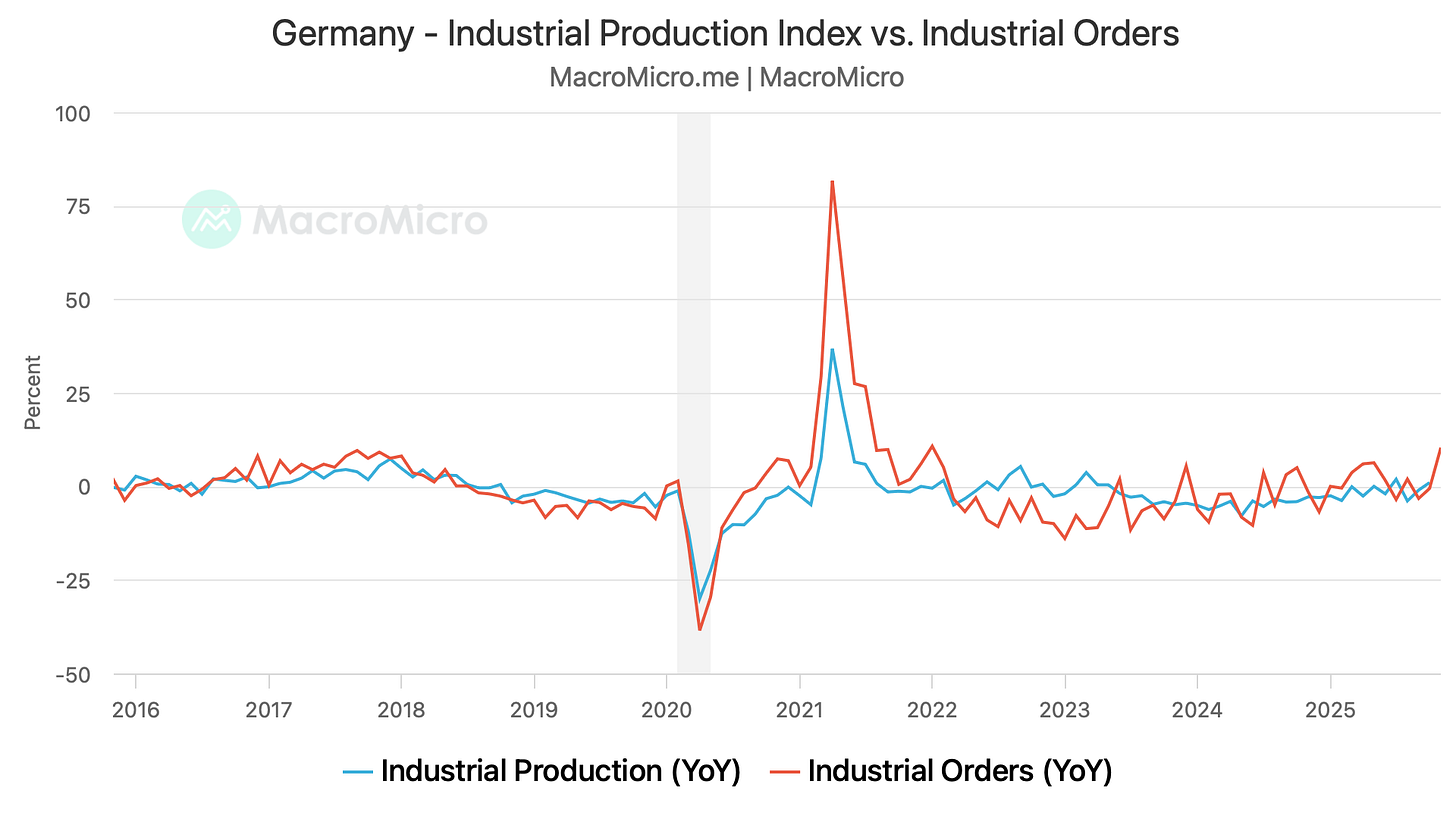

Across the Atlantic, industrial orders in Germany climbed by a whopping 5.6% MoM, led by large defence orders.

If the uptrend remains intact, we expect the German economy to enter a gradual recovery path.

While growth seems to be recovering, CPI is back below 2%, confirming that the ECB engineered a soft landing.

The UK has been facing a deterioration in the labour market and a slowing economic activity, led by weak consumption.

However, there is a ray of hope, as the UK PMI future output expectations have surged to a multi-year high, suggesting a recovery might be on the horizon.

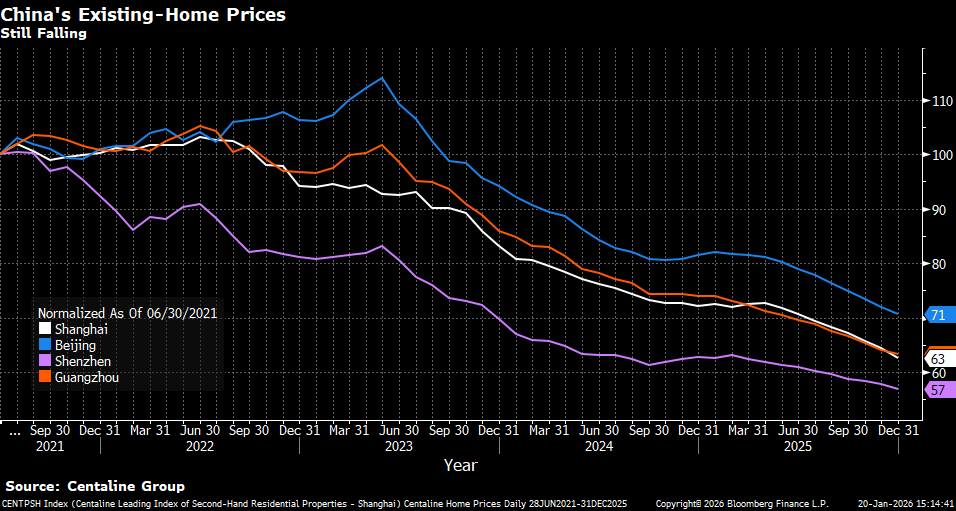

There is no end to the Chinese property crisis, as the balance-sheet recession and the massive overbuilding of the past decade, coupled with worsening demographics, are leading to a freefall in home prices.

Unsurprisingly, the existing home prices are down 30 to 40% since mid-2021 in the 4 main cities.

The Japanese Government Bond (JGB) market once again led a global bond sell-off after Japanese Prime Minister Takaichi announced a snap election.

The two-day move in the 30Y JGB was a 6SD move, prompting Bessent to call his counterpart to soothe nerves.

For the stability of global financial markets, moves in the Far East matter more than ever.

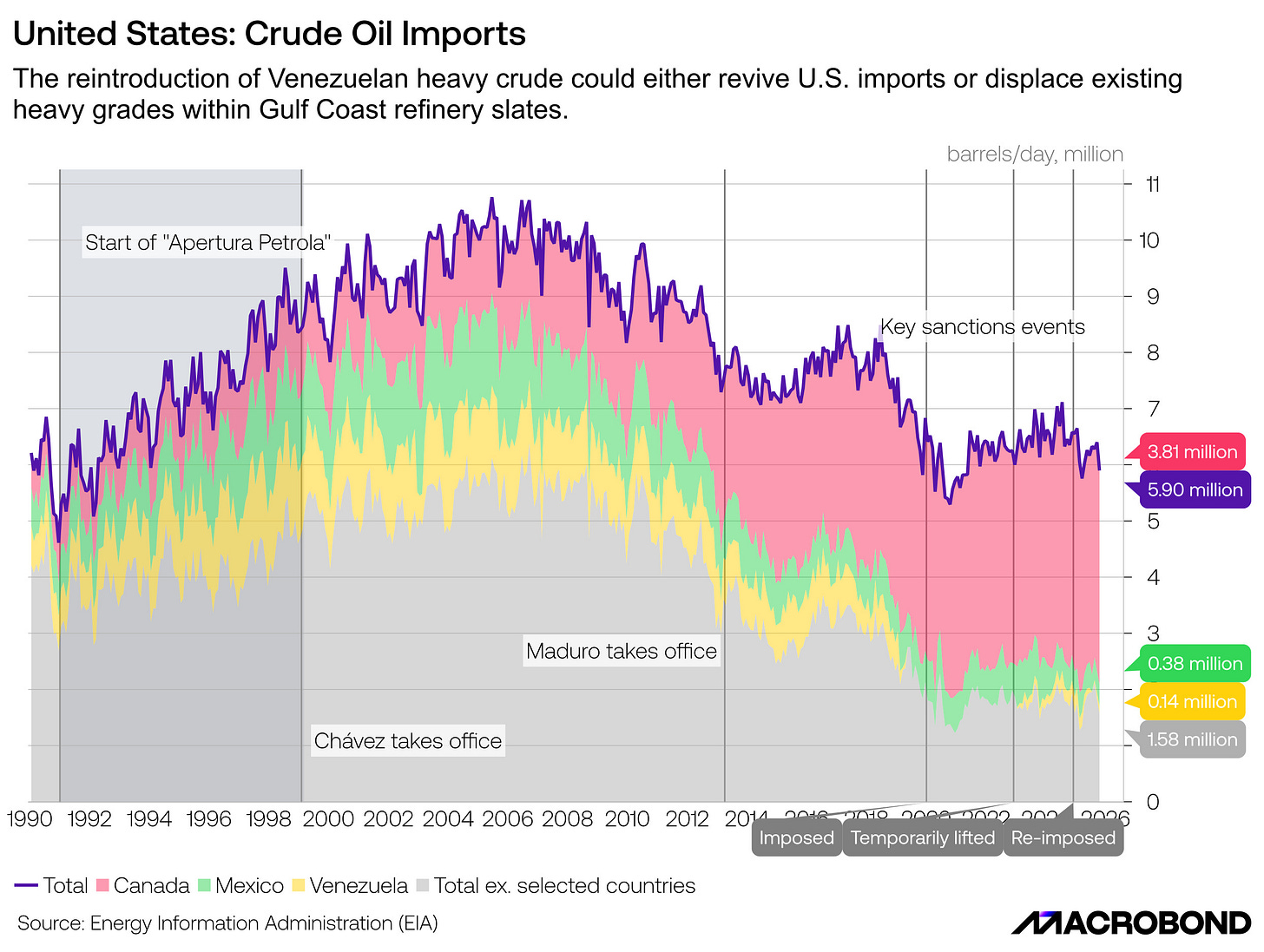

January saw the US take an unprecedented action by arresting Venezuelan President Maduro and his wife from their home in an unimaginable operation conducted by the elite Delta Force.

Behind the geopolitical win, the motive was to tap the billions of barrels of heavy crude that Venezuela possess, which will be beneficial for US refineries.

Silver saw extremely historic moves in January, and at one point, it was up more than 45% (the highest monthly gain since the Hunt Brothers squeeze).

Nevertheless, despite an enormous 40% fall from the peak, Silver closed the month 19% up, and created history with 9 consecutive green candles and 6 consecutive closings above the upper Bollinger Band.

It was mayhem for traders as traditional technical analysis completely failed.

It was not just Precious Metals and base metals that witnessed insane moves; natural gas, notorious among traders as the most volatile asset class on the planet, had the biggest move in the last 35 years.

The US benchmark natural gas price rose 75% over just five trading sessions as the US was hit with one of the worst snowstorms of the last five decades.

BONUS CHART: While deterioration in demographics has been a significant concern in South Korea and Japan, it’s China which is undergoing a rapid population decline. Due to the infamous one-child policy, deaths have exceeded new births for the last 4 consecutive years. As a result, China’s population has plunged, leading to unforeseen consequences for the government, people and corporations.

Disclaimer

This publication and its author are not licensed investment professionals. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and consult with your certified financial planner or other dedicated professional before making any investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone