July brought back the memories of the Meme Stock mania that ruled the equity markets in 2021.

With most shorted stocks (stocks with high short interest) soaring overnight, investors' greed and euphoria were unprecedented last month.

The Central Banks globally had a status quo as pressure builds in the US for Jerome Powell to cut rates despite macro indicating resilient economic activity and bottoming out of inflation.

PS: Before we begin, we will increase our paid subscription prices to $29.99/M or $ 299.99/Yr starting 1st September 2025.

Note that subscribers who are currently enrolled or will enrol by September 1st will be subscribed at the mouth-watering current prices ($24.99/$249.99) “FOREVER”.

Furthermore, those who have subscribed at the original price of $14.99/$149.99 two years back will see no change in their plans.

Therefore, anyone who wants to take advantage of a 16% lifetime discount can subscribe until midnight on August 31st at the current prices.

Let’s look at 13 charts to determine the global macro and cross-asset moves in the global financial markets!

As the US equity markets led by the AI megacaps enter stealth mode, it has a long way to catch up to the global markets. Chinese benchmark ETF: MCHI is up by more than 24.7% YTD, beating the yellow shiny metal, which is up by 24.3% and has been on a tear due to the trade war and geopolitical situation.

Furthermore, long-duration bonds have been a total disappointment for the third year running, as the US administration has no intention of reducing the deficits. Thus, investors are demanding higher term premiums. The benchmark TLT is up 1.62% YTD (total return).

After Trump struck trade deals with the EU, Japan and Korea, it becomes clear that the average tariff rates will be around 15%.

However, economists are puzzled about the lower-than-expected inflation prints in the last two months. Many market participants expected that tariffs would lead to higher inflation. However, there have been data quality issues.

Since May, the BLS (government) has been just estimating what they think inflation is.

With inflation well below 3% and a healthy labour market (though debatable), the Fed, led by JayPo, has refused to cut rates.

However, for the first time since the 1990s, we had dissidents yesterday with two Governors (Waller and Bowman) voting for a cut against the majority.

Are we witnessing a new era at the Fed?

As US equity indices touch ATHs, once again, there is chatter among market participants about the valuation multiples and equity risk premium. While equity risk premium is the lowest in more than two decades, valuations are at the highest ever.

However, the equal-weight, small caps, and mid caps are fairly valued as they have been stark underperformers.

The Non-Stop rally in the US equity markets is led by the semiconductors (primarily NVDA and AVGO).

As a result, the US Semiconductors are now at a whooping 11% of the US market cap, the highest in history and even surpassing the 2001 dot-com bubble.

An eye-opening macro chart: A larger share of total income is now flowing to corporations and landlords, away from employees and small business profits.

The trend has been particularly stunning since 1990, and has accelerated since the GFC, further demonstrating the rise of the top 1% and growing income inequality.

Until the middle of the month (July), DXY was having one of its worst years since the 1970s, and the positioning was skewed with Short US dollar, the most crowded trade. For the first time in the BofA Fund Manager’s survey's history, “Short US Dollar” was the most crowded trade.

Guess what happens when everybody is on the same side?

We got a face-ripping rally as the dollar bulls took the opportunity post the US-EU deal. Unsurprisingly, the DXY is up by more than 3.5% this month.

We are now witnessing dollar bears capitulating.

While there are signs that inflation is bottoming out in the US, as the tariff impact will be visible in the next few months, Europe has been able to bring down inflation closer to the 2% target.

In fact, some countries in the EU are below the 2% target, giving much relief to the consumers and making the job easier for the ECB.

There has been considerable deterioration in the UK’s macro data, especially the labour market.

There has been an alarming rise in the Unemployment Rate, while wage growth has eased significantly from the peak.

Will the BOE be a surprise dove in the coming months?

The Chinese government bond yields have been in a free fall.

In the opposite scenario of the US, the equity risk premium is relatively attractive in China.

Furthermore, loose monetary policy and actions taken by the Chinese government in the housing sector might finally yield results in the coming months.

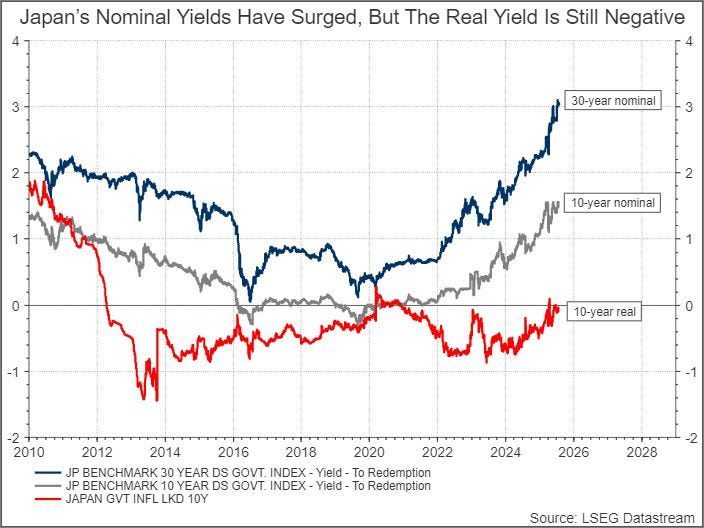

This month, we again saw super long-term yields surge in the land of the rising sun.

The move led to similar moves in global bond markets. While the nominal yields have surged dramatically in Japan, the 10Y real yields (adjusted for inflation) are below the levels last seen in 2020.

BONUS CHART: Rumours are swirling around that the big tech companies (hyperscalers) will have to curtail their capex due to energy constraints.

The nuclear renaissance is upon us, especially after POTUS signed the executive order to expedite and promote the production and operation of nuclear energy.

However, the critical metal required, Uranium, will be in short supply if necessary investments are not made to increase production.

Disclaimer

This publication and its author are not licensed investment professionals. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.