June marked the heights of FOMO as S&P 500 broke out of its multi-month resistance of 4200, and the most hated “tech” rally marched further.

Let us understand via charts the economy and the markets!

USA

As the markets rallied hard, the equity risk premium crashed. We are on the verge of a negative equity risk premium, last seen during the dot-com bubble.

Apple once again conquered the $3 trillion mark. Tesla is on the verge of the coveted $1 trillion mark.

As the equities rally gathered steam, the institutional investors got a FOMO and began to pump money into tech funds in early June.

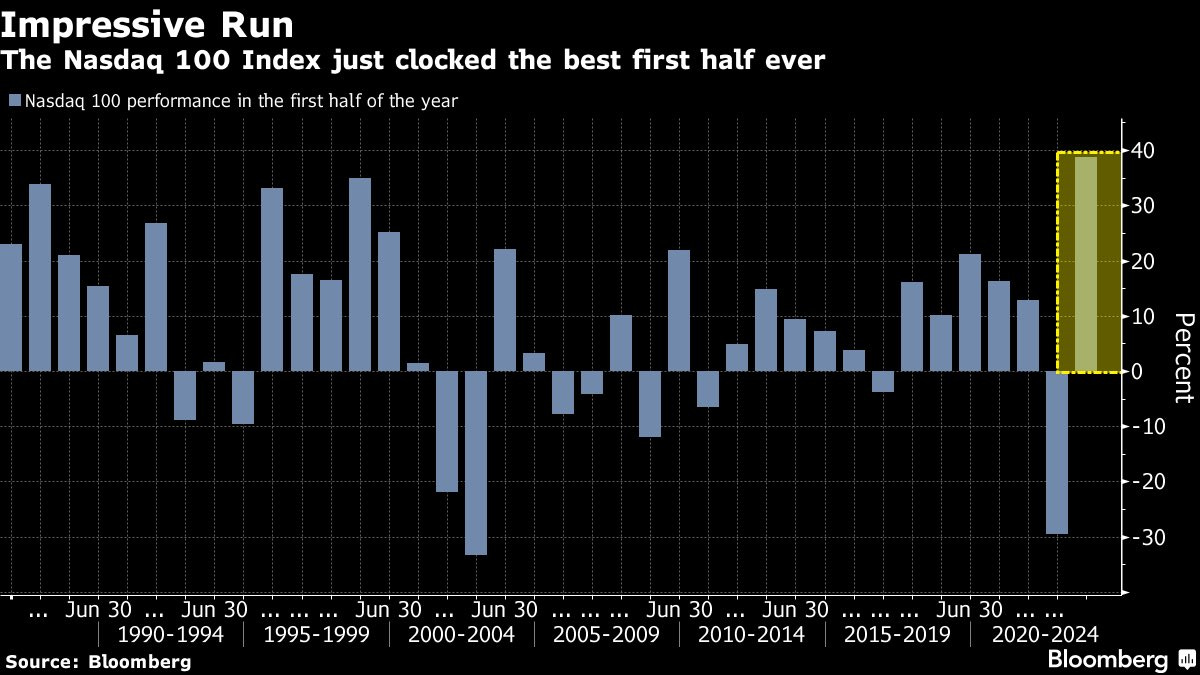

As a result of the market rally, the tech-heavy NASDAQ 100 clocked the best H1 “ever”.

Coming to the macro data, the disinflationary pressures gained momentum as supply chains continued to heal, and the Chinese reopening was a dampener.

Consumer spending remains resilient as Americans travel in record numbers during the 4th of July holiday week.

EUROPE:

Europe's Macro continues to weaken as Industrial Production weakens across the board. The Netherlands IP was a shocker.

Nevertheless, the labour market and wages remain resilient. The EA Unemployment Rate touched fresh all-time lows of 6.5%.

The “electricity” crisis is over as demand plummets and the storage levels remain higher at 80% across Germany. The 1day ahead power prices turned negative in the last week of June!

ASIA!

China struggles with deflation as the PPI tumbles to -4.6% and the CPI remains close to 0%.

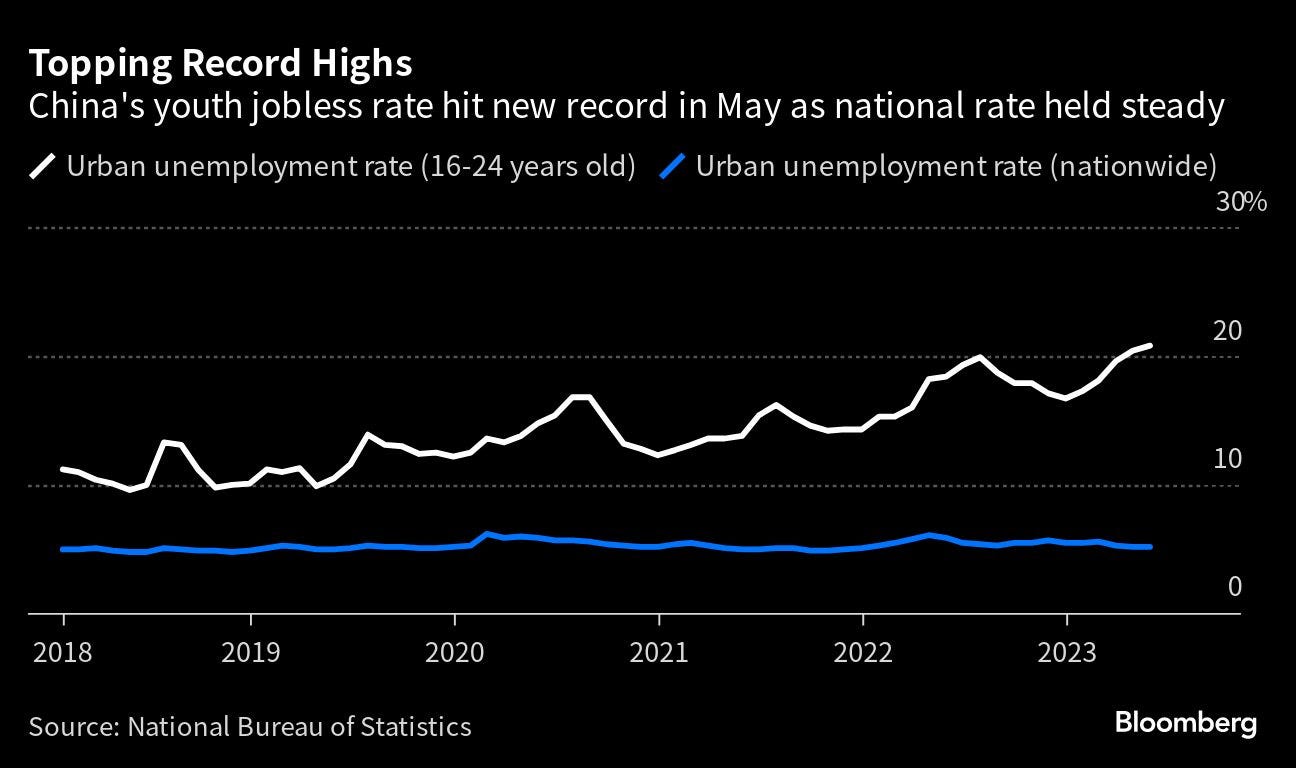

Problems compound for Xi Jinping as the urban youth unemployment rate crosses the 20% mark. Time is running out for China, and we can expect a flood of stimulus!

Japanese core inflation surpassed 4%, touching a new 42-year high while, BoJ remains adamant about its preposterous monetary policy.

Japanese stocks continued their dream bull run as the benchmark index touched fresh 33-year highs while USDJPY reached dangerous levels of 145.

Asset Returns!

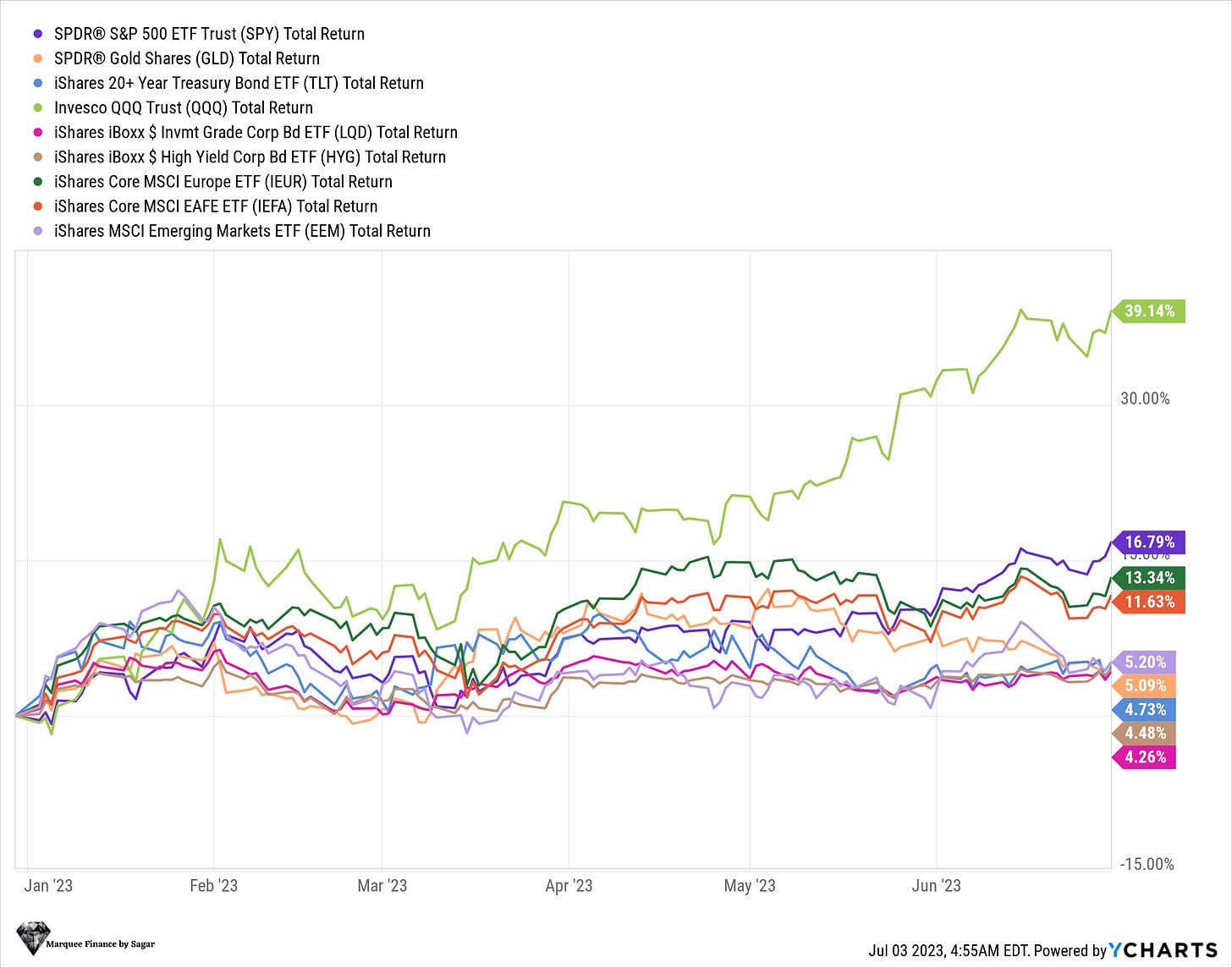

The first half (H1) was super interesting as the most anticipated recession didn’t arrive, and there were surprises.

BTC was the biggest gainer with an 84% return YTD.

Surprisingly, HY had similar returns as TLT!

QQQ was the biggest gainer in equities with an astounding 40% return!

Happy 4th of July to all those celebrating!!

Disclaimer

This publication and its author is not licensed investment professional. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.

Very good combination of charts presented giving a bird's eye view of financial condition. Most indicators related to China show a strong disinflation and slow down ahead, but some hedge fund managers like Ray Dalio is recommending China's shares.