For those invested in AI names and semiconductors, H1 was among the best in their investing journey. So, congratulations to all those who made money.

All those who were long precious metals had a stroke of luck in H1 as these were among the best-performing asset classes.

Nonetheless, long-term bonds remain in a bear market and gave negative returns in H1, thus hurting the returns of the coveted 60:40 portfolio and millions of pensioners.

Thanks to investors' underweight positioning at the beginning of the year, Silver, Gold, and other commodities such as Copper and Oil are the top-performing assets YTD, beating equities and bonds.

US equities have outperformed RoW (ex-Japan), led by the Mag3/4, as the AI mania generated superior returns for investors.

On the contrary, bonds continued their worst rout, with long-duration bonds being the worst performers.

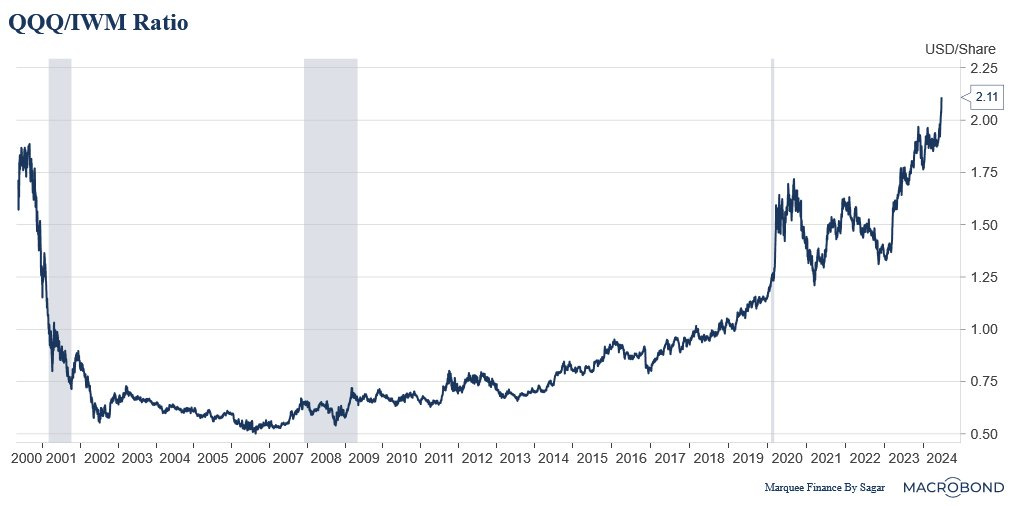

Before we jump to Macro, the equity chart of the month was the parabolic rise in the QQQ/IWM Ratio.

The AI Euphoria and the zombie nature of small caps have led to QQQs outperforming IWM by a gigantic margin. As a result, the QQQ/IWM ratio has crossed the dot-com bubble levels.

When Mean Reversion?

It’s not only the QQQ/IWM ratio but also the remarkable performance of the Mag5/6 that has led to the stark underperformance of RSP (Equal Weight S&P500).

The RSP/SPY ratio has fallen to the GFC levels due to the mega tech rally of the last 18 months.

Beginning in May, we saw a deterioration in US growth. While some market participants termed it transitory, the streak of “negative” growth surprises continued in June.

In fact, the Bloomberg Economic Surprise Index plunged to decadal low levels. As macro traders/ investors/ enthusiasts, we need to watch this space closely.

It’s not only growth that has been surprising on the downside; ironically, inflation, which exhibited signs of resurgence in the first few months of 2024, has cooled off.

In fact, the fall in headline CPI is led by none other than the core goods inflation. The May reading of -1.7% was last observed two decades ago in 2003/04.

Is the inflation story over, or do we get another move higher in H2?

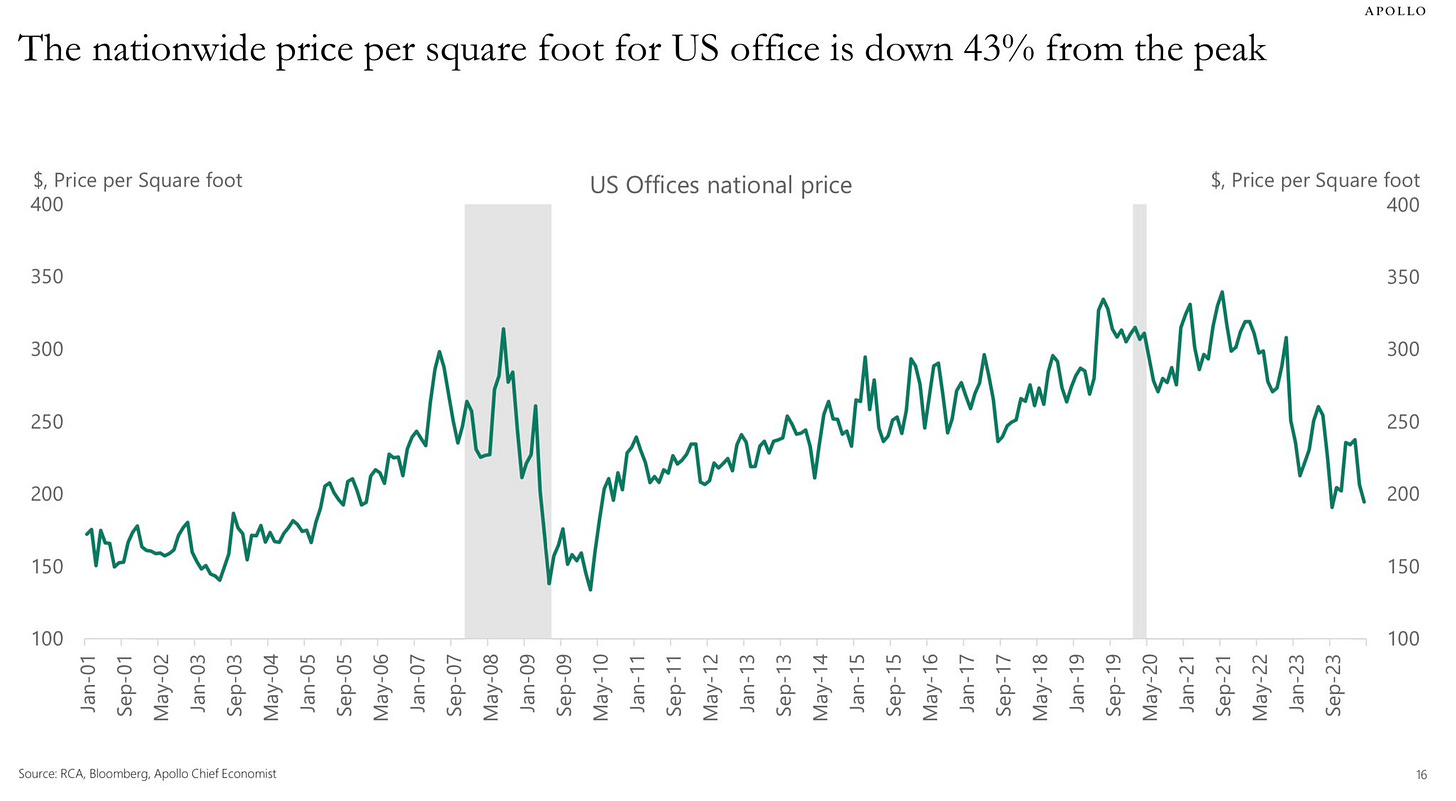

Undoubtedly, trouble is brewing in the US Commercial Real Estate Market.

As the maturity wall hits in the next 18 months, most loans will end up non-performing, as the asset value (CRE office space) has collapsed.

The nationwide price per sqft for the US office is now down 43% from the peak, with vacancy rates at multi-decadal highs.

The pain is not yet over here.

One of the bubbles that formed after the launch of unprecedented monetary and fiscal stimulus in response to the COVID pandemic by the world’s largest economy was the surge in used car prices.

Guess what?

Manheim Used Vehicle Index is now down a whopping 23.4% from the peak!

Retail investors have piled into Mega Tech stocks like never before.

Furthermore, the casino is “house” full as options gambling has taken over.

Net call volumes in mega-cap growth and Tech surged to record highs, surpassing even pandemic boom levels and completely disconnecting from those in the rest of the market.

Let that sink in!

Though the ECB cut was baked in the markets, the surprise came from SNB, which cut rates by another 25 bps after the political crisis in France.

As a result, ECB has now cut by 25 bps and SNB by 50 bps. However, all eyes will be on the further trajectory of monetary policy by the G7 CBs.

UK has become the first developed country to report a 2% headline CPI reading thanks to the base effects and sharp cuts in electricity prices.

Markets now believe the BOE will cut the rates in its next policy in the first week of August.

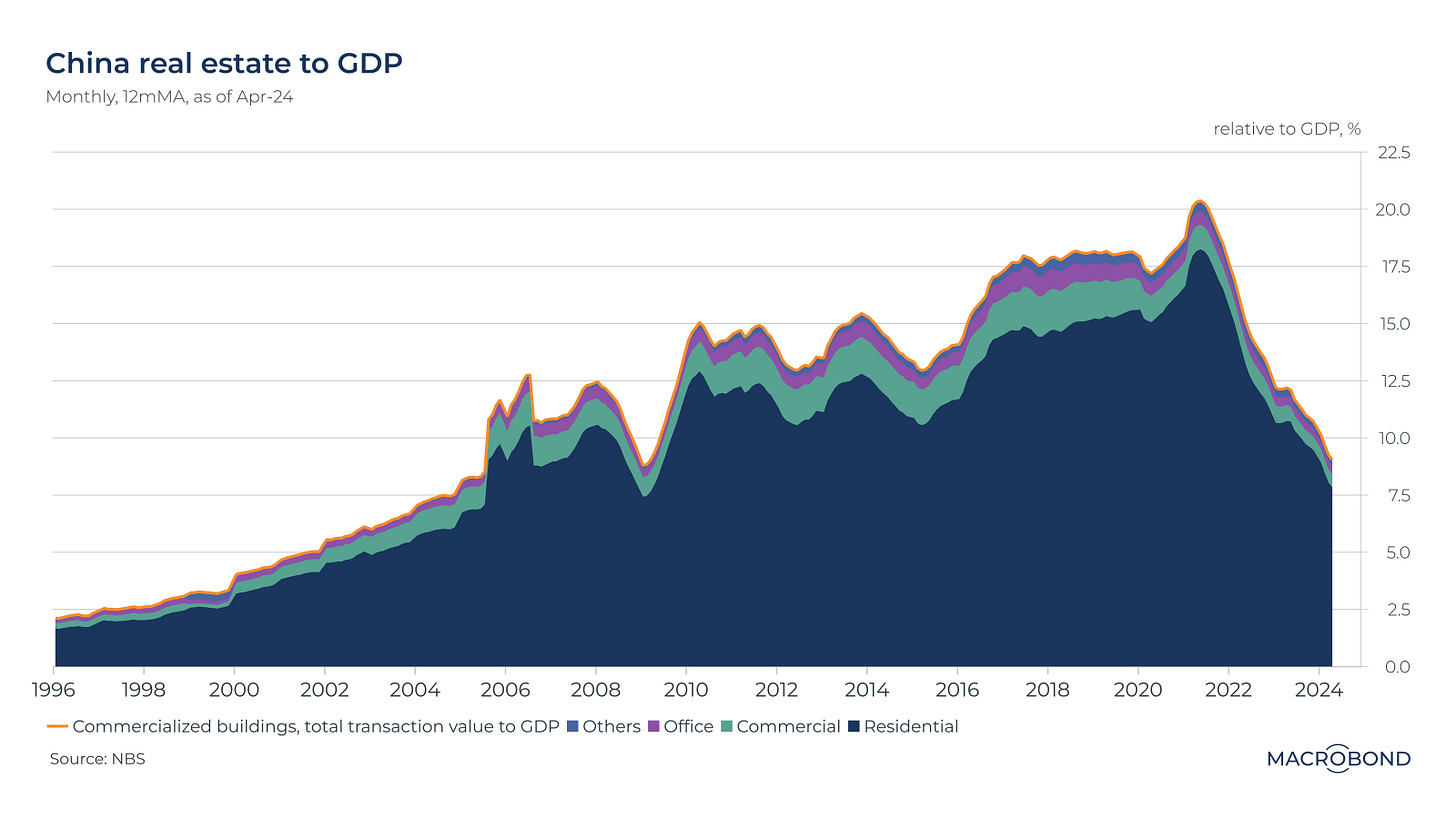

China’s property debacle will take years, if not decades, to correct.

The RE clearance time in Tier 1 cities has reached the highest levels as demand remains subdued and prices are in free fall.

Furthermore, Tier 2 cities face extreme challenges, with clearance time now crossing 50 months or more than four years!

Xi Jinping has aimed to transform the Chinese economy and control the blatant speculation in the RE sector.

The good news is that the Chinese RE-to-GDP ratio has moved sharply lower as prices fall and speculative demand crashes.In the long term, this is a healthy sign for the Chinese economy.

In what could be termed the “biggest” surprise of the year, the Japanese Yen (JPY) has underperformed the Argentine Peso and Turkish Lira.

The unusual weakness in the JPY indicates that the FX markets do not believe in a hawkish BOJ and fear Japan's enormous debt pile.

It will be super interesting to witness how this ends.

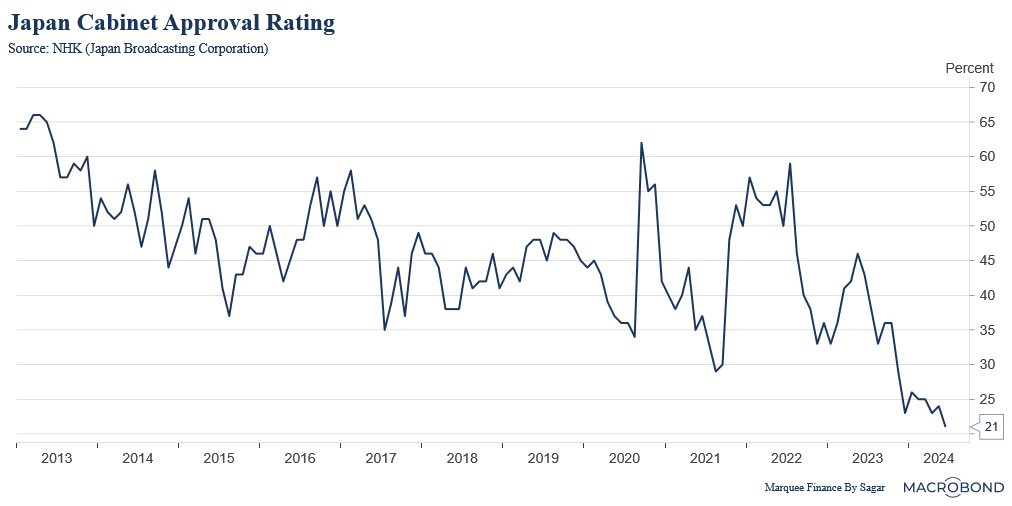

With imported inflation creating havoc for the Japanese problem, the Japan Cabinet Approval rating is at its lowest level.

We know that June saw a political Tsunami with shocking results in Mexico, India, and South Africa.

One can’t ignore the implications of higher inflation on the consumers.

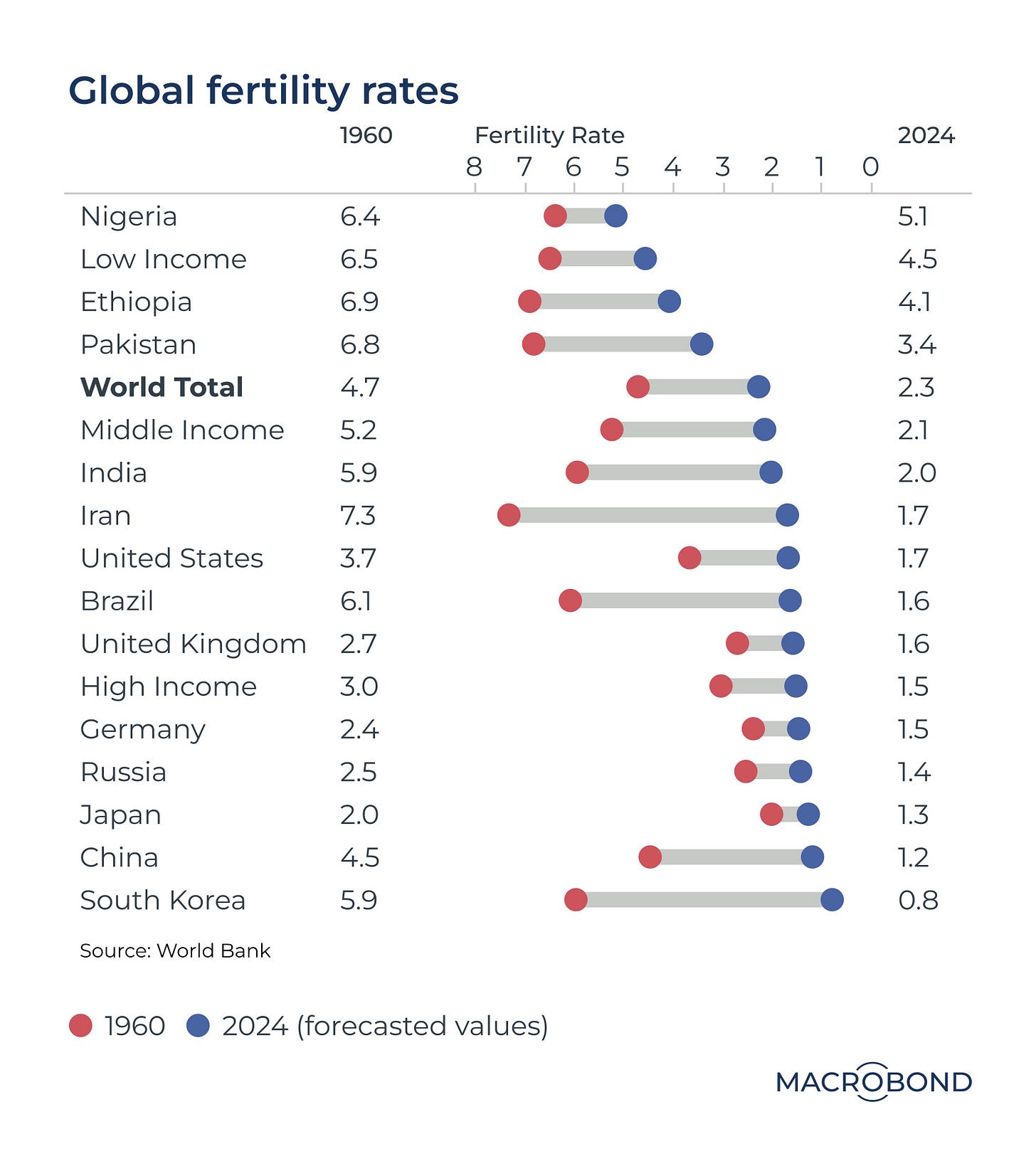

BONUS CHART: The world is on the verge of “Japanification” as many countries now have a total fertility rate (TFR) of less than 2.1, the replacement level for maintaining a stable population in most developed countries.

Furthermore, according to the UN, more than half of the projected increase between 2022 and 2050 is expected to come from just eight countries: the Democratic Republic of the Congo [DRC], Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and the United Republic of Tanzania.

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors either with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.