The risk asset party continued unabated in March, with crypto witnessing relentless speculation, leading to a frenzy among the retail crowd.

Unprecedented liquidity flowed into risk assets in March as Central Banks in the West began to unwind the tightest monetary policy in decades.

Let us understand the cross-asset performance and the macro updates via intriguing charts.

Japanese stocks delivered a blistering performance in Q1 as they rose 24% in local currency.

On the other hand, commodities, primarily oil and Gold, stole the show in the first quarter of the historic year as HFs/CTAs remain underweight commodities.

Nonetheless, bonds continued their worst rout, with long-duration bonds being the worst performers.

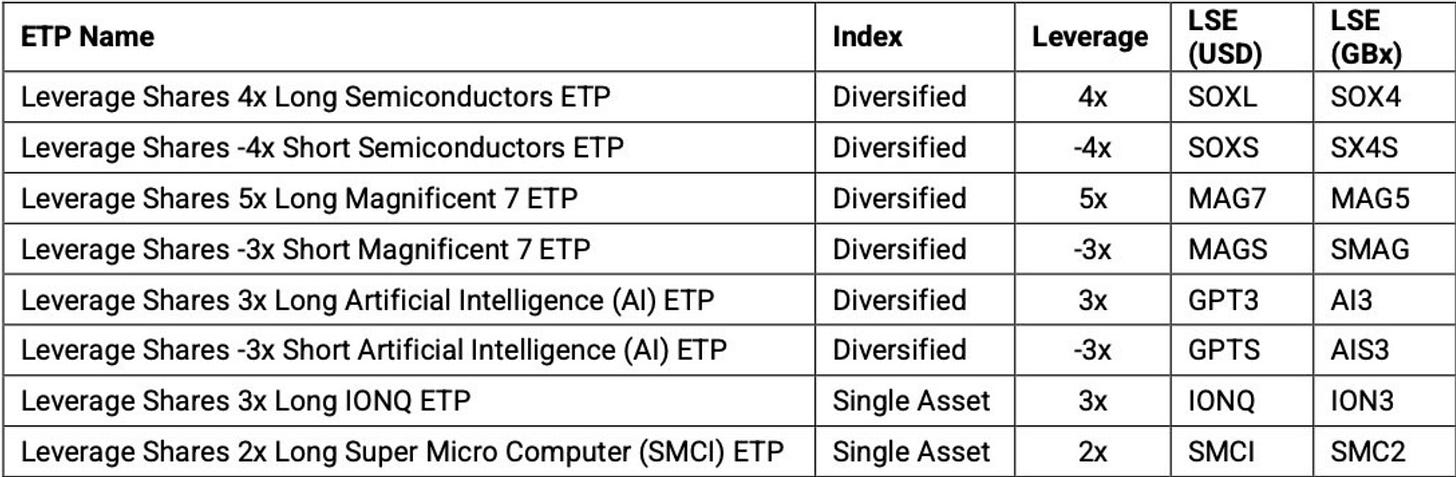

While sectorial rotation is underway, with overpriced tech witnessing cool-off and under-owned sectors (energy, utilities, etc) experiencing renewed investor interest, the retail guys are now enticed by some of the most leveraged tech ETFs.

As the NVDA(and semis) craze grips the world, European companies have launched ETFs with a 4X leverage.

All the talk of margin funding still off the peak is for a reason.

Who needs margin funding when you can now punt via highly geared ETFs?

Some people call it the “fiscal dominance” while other market participants call it the “fiscal reckless”.

The US Government’s debt binge has reached unprecedented levels, and if it’s not controlled in the next few years, we may see a parabolic rise in interest expenses.

T-bill issuances have skyrocketed while the US government has refrained from borrowing for longer tenors due to higher yields.

There is a reason precious metals are flying!

American consumers don’t feel too excited about lower inflation readings.

Want to know why?

Because if we add mortgage cost to CPI (excluded in '83) and car repayment (excluded in '98), then inflation peaked at 16% last year and is at 8% today.

The amount of wealth lost due to the inflationary spike (lower real wages) will take years to recoup.

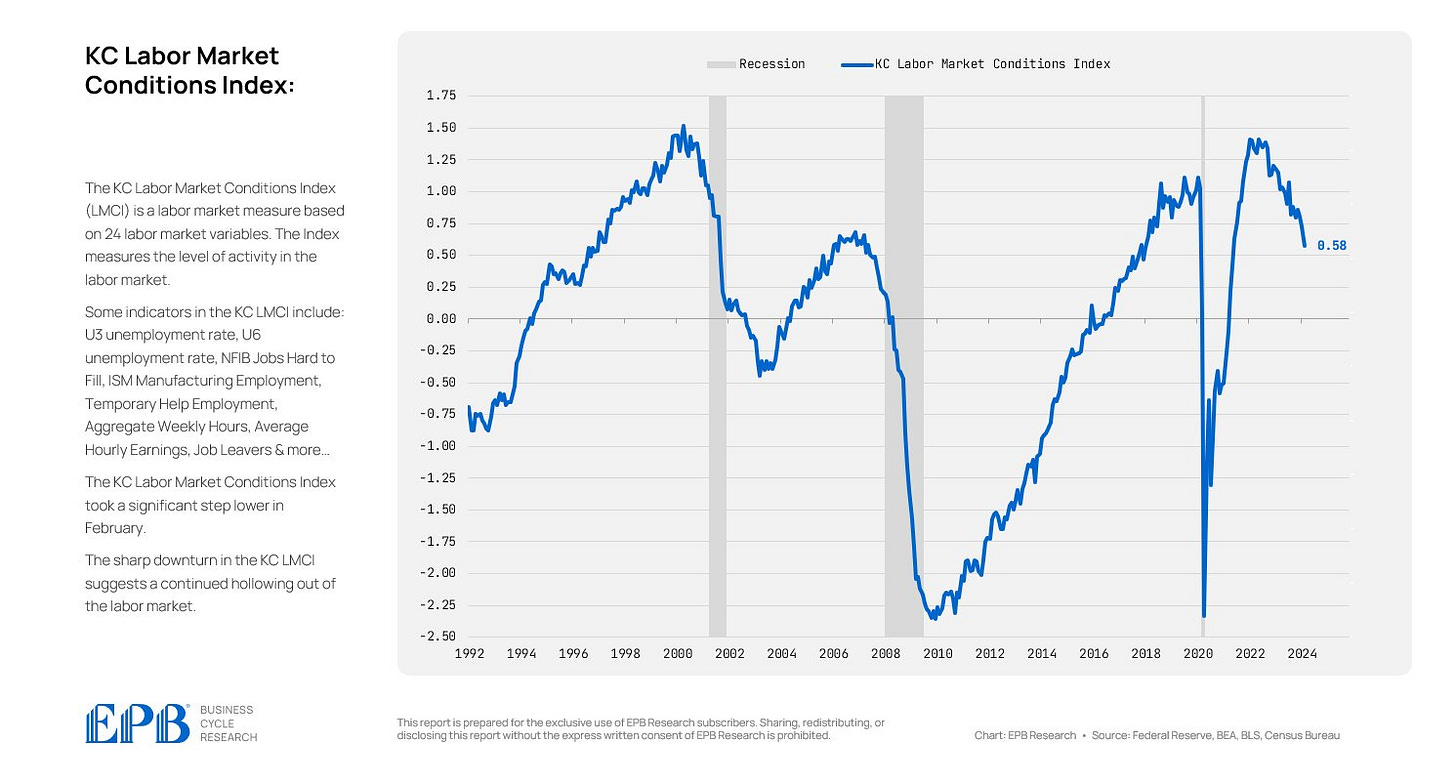

We discussed inflation, but the Federal Reserve has a dual mandate: Stable Prices And Maximum Employment.

While the inflation might have plunged significantly from the peak, the labour market, which witnessed historic tightness post covid, is cooling off rapidly.

Will the weaker labour market be the reason for the rate cuts by the end of June?

While there has been a chatter about froth in certain sections of equity markets, the Credit Market has also seen “bubbly” conditions.

The HY spreads are now significantly tighter than when the Fed began tightening monetary policy, as investors have poured billions of dollars into the corporate bond market.

Will this end well?

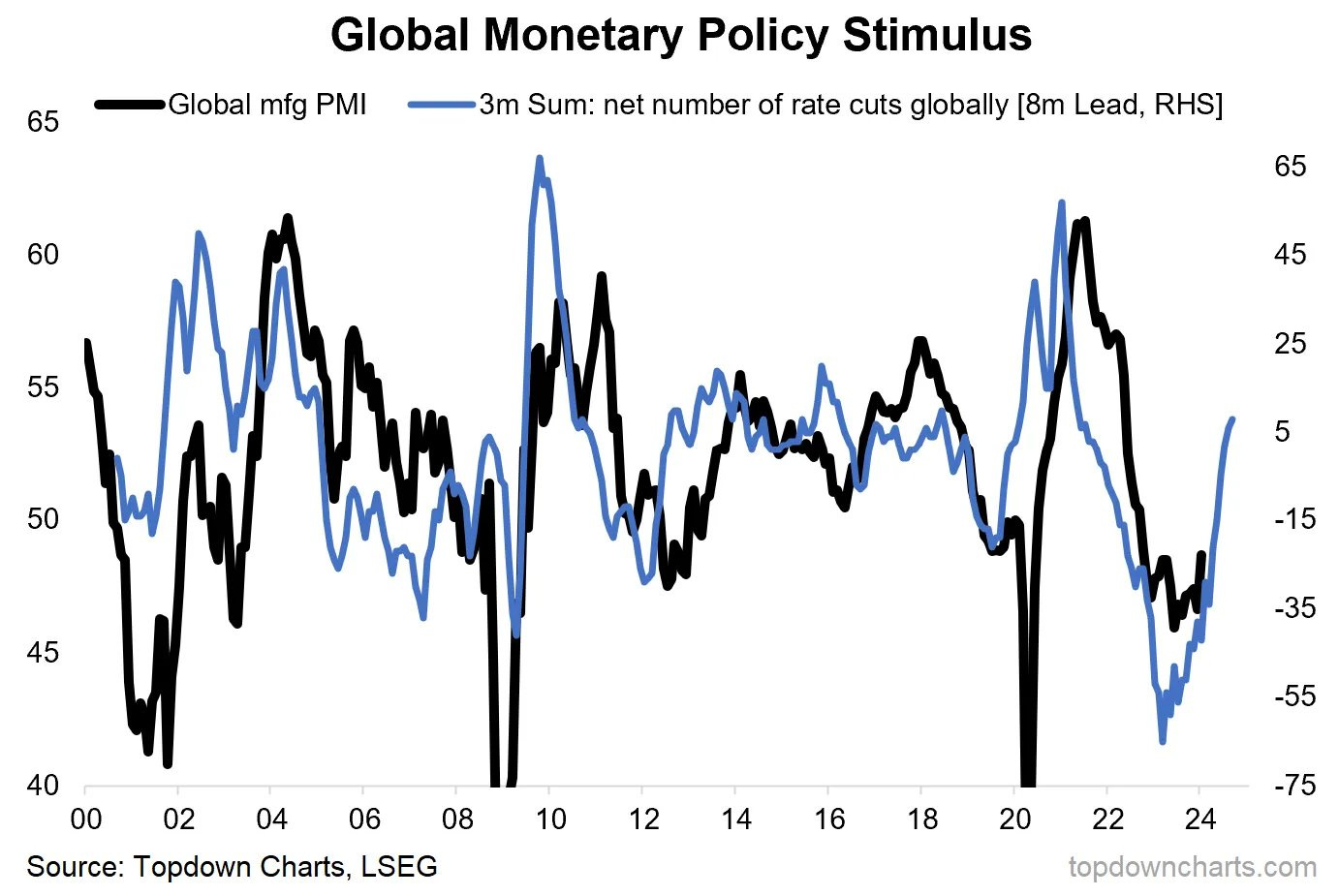

March witnessed hectic global activity as central banks began to cut rates aggressively.

The first developed-market CB to pull the lever was the Swiss National Bank (SNB), which surprisingly cut rates contrary to market expectations of the status quo.

Furthermore, Mexico and Brazil also cut rates as inflation cooled substantially from its peak.

The cyclical industry has suffered a big blow in Europe as weak Chinese demand and the energy crisis have made it challenging for the industries to survive.

As a result, industrial production has plummeted to the levels last seen only during COVID-19 and GFC.

We won’t be surprised if the ECB cuts rates this month!

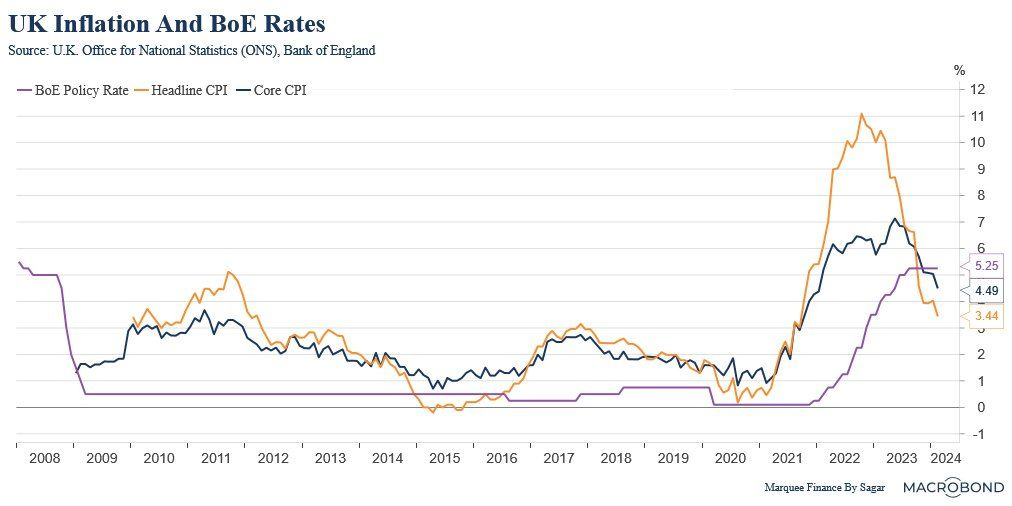

As the "surprise" disinflation advances rapidly in the UK, market participants are worried that rates are restrictive enough to prolong the growth slowdown.

Will the BoE act in sync with the ECB and maybe even the Fed?

Has the GBP peaked, and will we witness a "dovish" BoE?

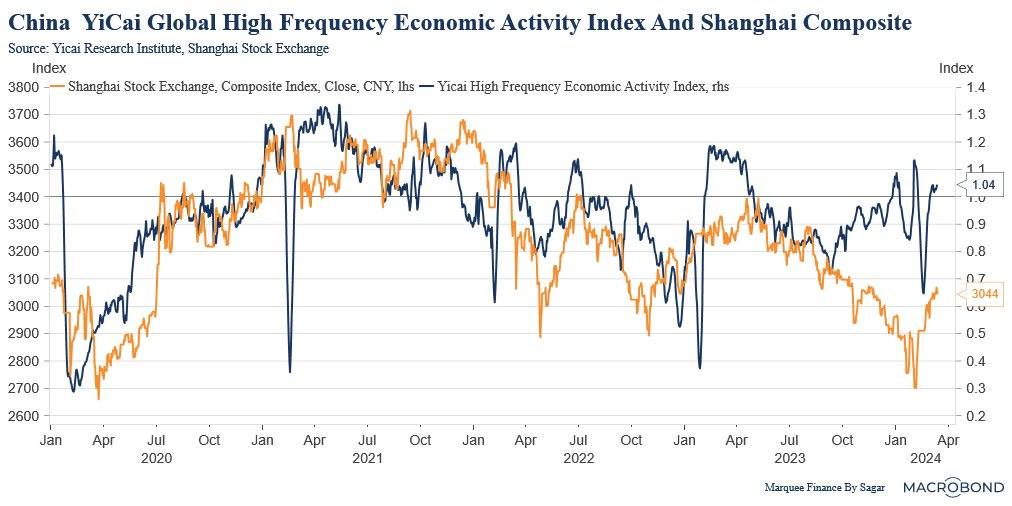

Chinese high frequency economic activity index has rebounded from its lows as the PBoC announced stealth QE (green light to buy Chinese Sovereign Bonds for the first time).

As a result, we may have seen Chinese equity markets bottoming out.

Chinese credit impulse is keenly tracked by macro invetors to bet on commodities.

While we saw some encouraging signs last year, the Chinese credit impulse has stagnated and even fallen last month.

If it fails to move higher, then this can be a tailwind for a further rally in commodities.

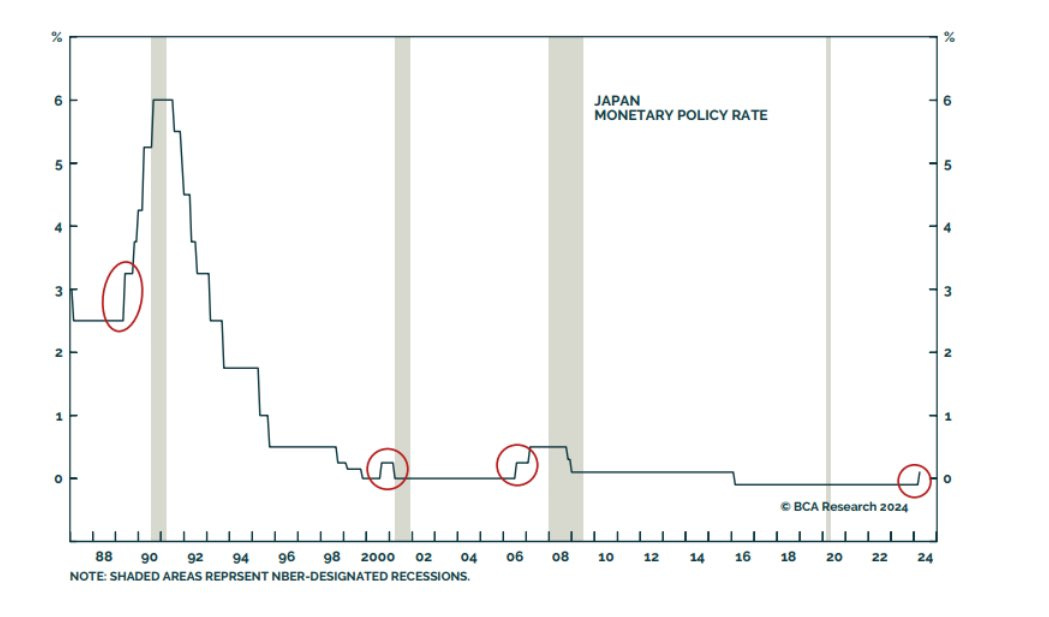

It’s the End of one of the biggest monetary experiments ever.

Yes, folks, March also saw the “Contrarian Central Bank” rasing rates albeit by a very small hike.

Undoubtedly, the last time Bank Of Japan (BoJ) raised rates in 1989, 2001 and 2006, the US along with the whole globe went into a recession.

Will this time be different?

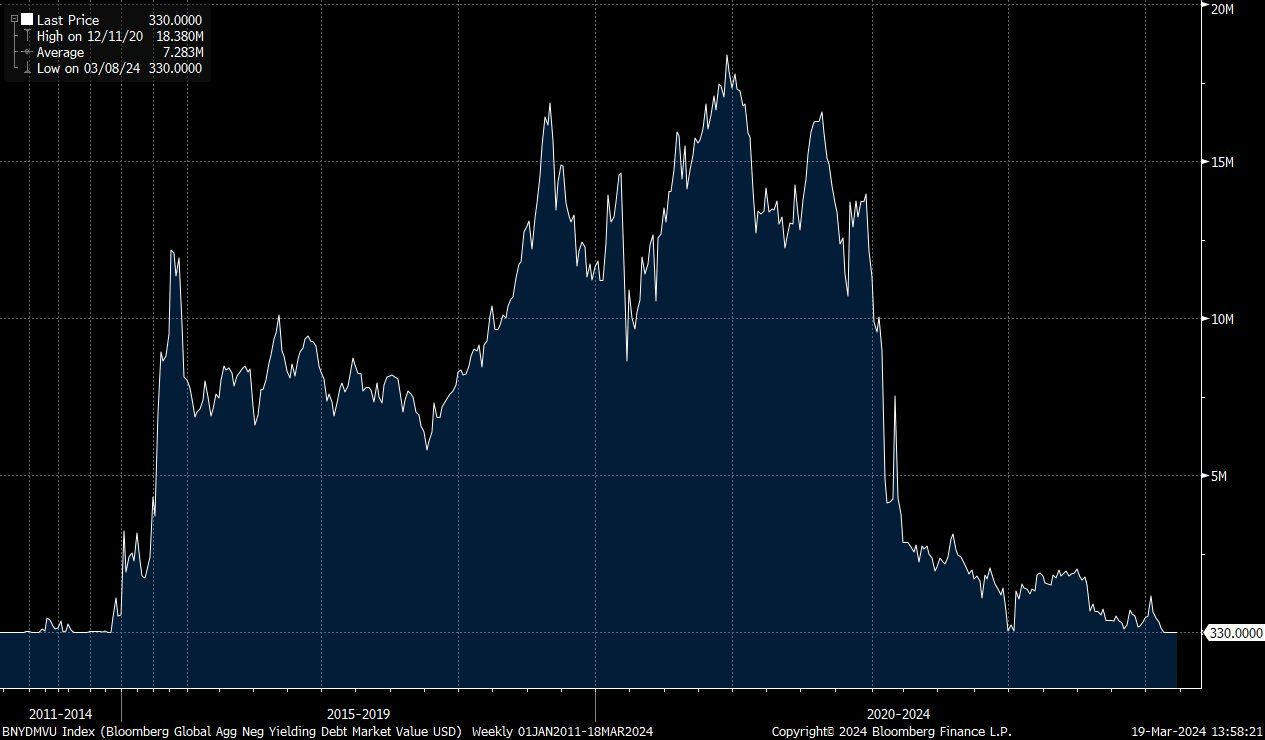

As the BoJ transitions from NIRP to ZIRP, the negative-yielding debt is now a thing of the past.

As per BBG, the current debt with <0 yield is only $330 million, which once reached an unprecedented $20 trillion as CBs across the world pursued preposterous policies to ignite inflation.

CHOCOLATE LOVERS BEAWARE: Well, if you thought February saw a crazy rally in Cocoa, then March was the month which will be remembered by chocolate lovers for their lifetimes.

Yes, folks, Cocoa Prices overshoot $10000/t for the first time ever and have now tripled in just a few weeks.

We can’t end the March Month In Charts edition without mentioning the shiny yellow metal.

There is a very popular saying:

“Gold Is A Hedge Against Political Stupidity”

Did we saw the biggest breakout of the last decade in Gold due to the political stupidity in the US?

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors either with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.