The famous adage: “Sell In May, And Go Away” hasn’t materialised this year as the AI-led powerful rally decimated the bears.

Let us understand via charts the macro developments and the market action this month.

Let us start with the talk of the town. First, the mega rally in tech-heavy NASDAQ overshadowed the weakness in the broader markets as Russell 1000 remained a laggard.

This month, it was all about AI and Chips as semiconductor stocks rallied hard while S&P 500 equal-weighted index is down YTD.

We can’t have this month in charts without discussing the new $1 trillion baby. So yes, it was all about NVDA 0.00%↑ this month.

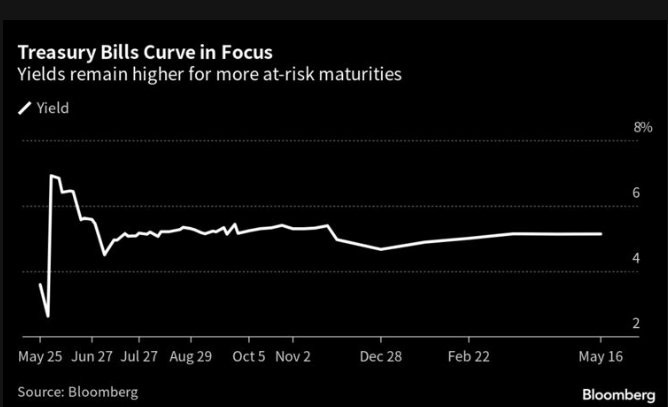

The debt-ceiling scare peaked this month, and the T-bill market was nervous as hell as the yields on the 1M paper reached an astronomical 7%!

The regional surveys point to bleak manufacturing data as the markets await the ISM data.

The labor market in the US is finally exhibiting signs of cracks as continuing claims continue to rise.

Nevertheless, PCE deflation remains sticky and financial conditions are loose. Furthermore, the housing market is indicating early signs of recovery. As a result, the bond markets are now betting on another 25 bps hike.

In Europe, Germany entered a “technical” recession as Q422 growth was revised lower, and Q1 GDP growth came in at -0.335%.

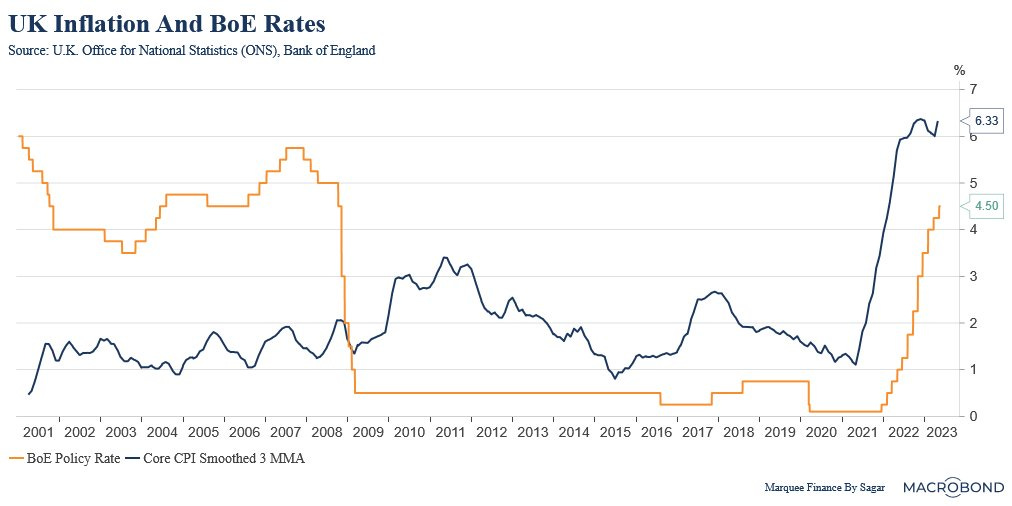

The UK is facing the worst inflationary crisis in the whole of Europe. While Spanish headline inflation fell off a cliff, the UK faces stubborn inflation.

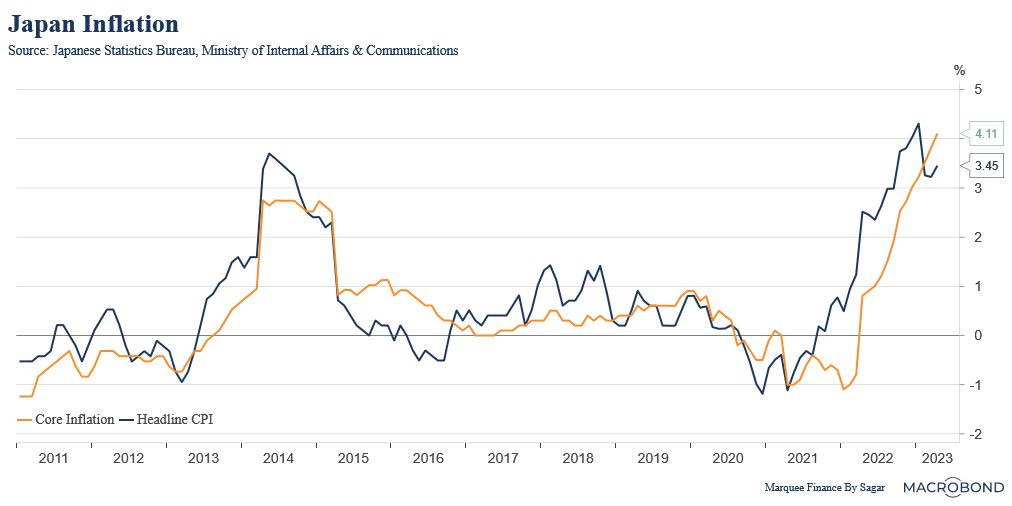

In Asia, Japan is witnessing a rebound in inflation as lower JPY fuels imported inflation. Furthermore, wage negotiations are surprising on the upside.

Japanese equities markets saw an unprecedented surge as Nikkei reached fresh 33-year highs in Yen while still down in $$$.

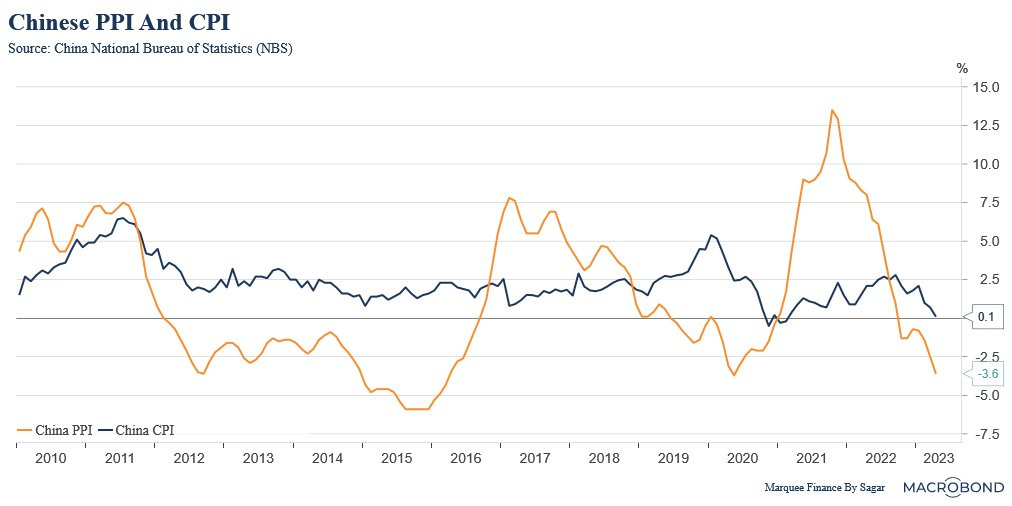

Elsewhere in Asia, China is on the verge of deflation and as the reopening disappoints and the meltdown in the property sector is weighing on consumer sentiment.

The Chinese problems and the slowdown in the West led to catastrophic consequences for commodities (primarily industrial).

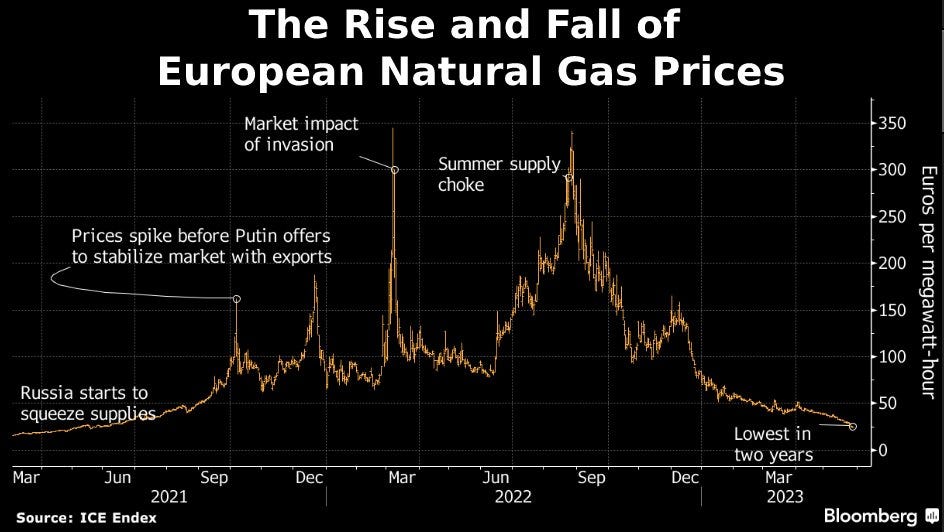

Natural Gas prices continue to plummet as higher inventories (storage) in Europe lead to lower demand, whereas Chinese demand remains muted.

Disclaimer

This publication and its author is not a licensed investment professional. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.

very well compiled