The highlight of November was the red sweep in the US elections, which led to insane moves across assets globally.

US “exceptionalism” was visible in November as US equity markets sucked liquidity from all the other markets globally, resulting in a mega rally led by small caps.

Furthermore, a pro-crypto US government led to euphoric moves in BTC and other cryptocurrencies. As a result, the overall crypto market cap crossed $3.5 trillion for the first time, with BTC touching close to $100k.

Let’s look at what transpired in the global financial markets in November!

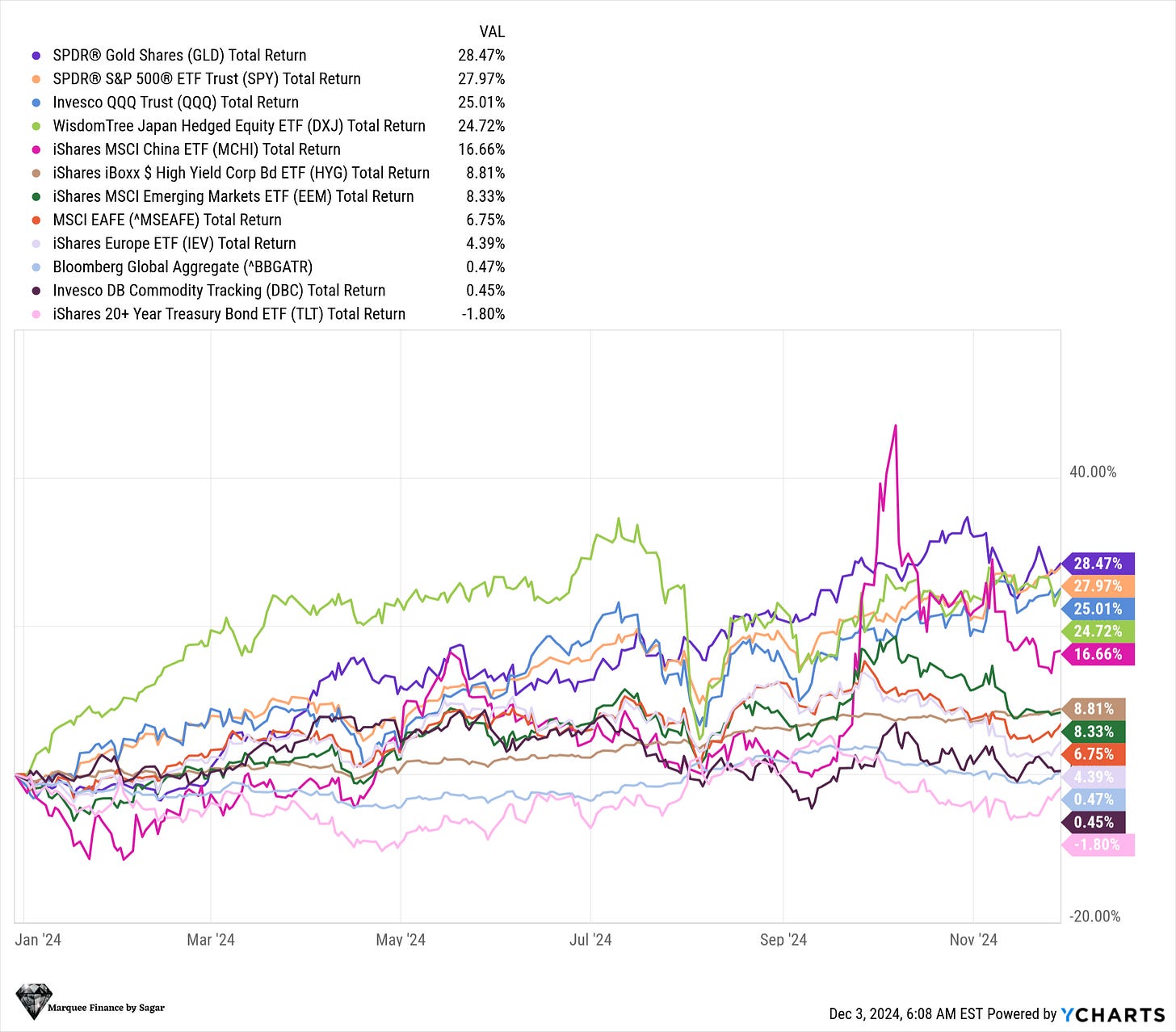

Despite a swift drawdown from the ATHs reached just before the US elections, Gold remains at the top (overall returns ex-BTC).

Nonetheless, the S&P 500 surpassed the crucial 6000 mark and has hit more than 57 ATHs this year as liquidity, and Trump's win cheered the equity markets.

On the other hand, Hedged Japan (DXJ) is up by 24.7%, which mirrors the US equity market returns.

Ex-Gold and Silver (PMs) commodities have disappointed as China’s macro data has failed to revive despite enormous stimulus. DBC has given a return of just 0.45% YTD, disappointing investors.

The most hated asset class: long-term bonds remain one of the biggest underperformers of YTD, hurting the performance of the 60:40 PF.

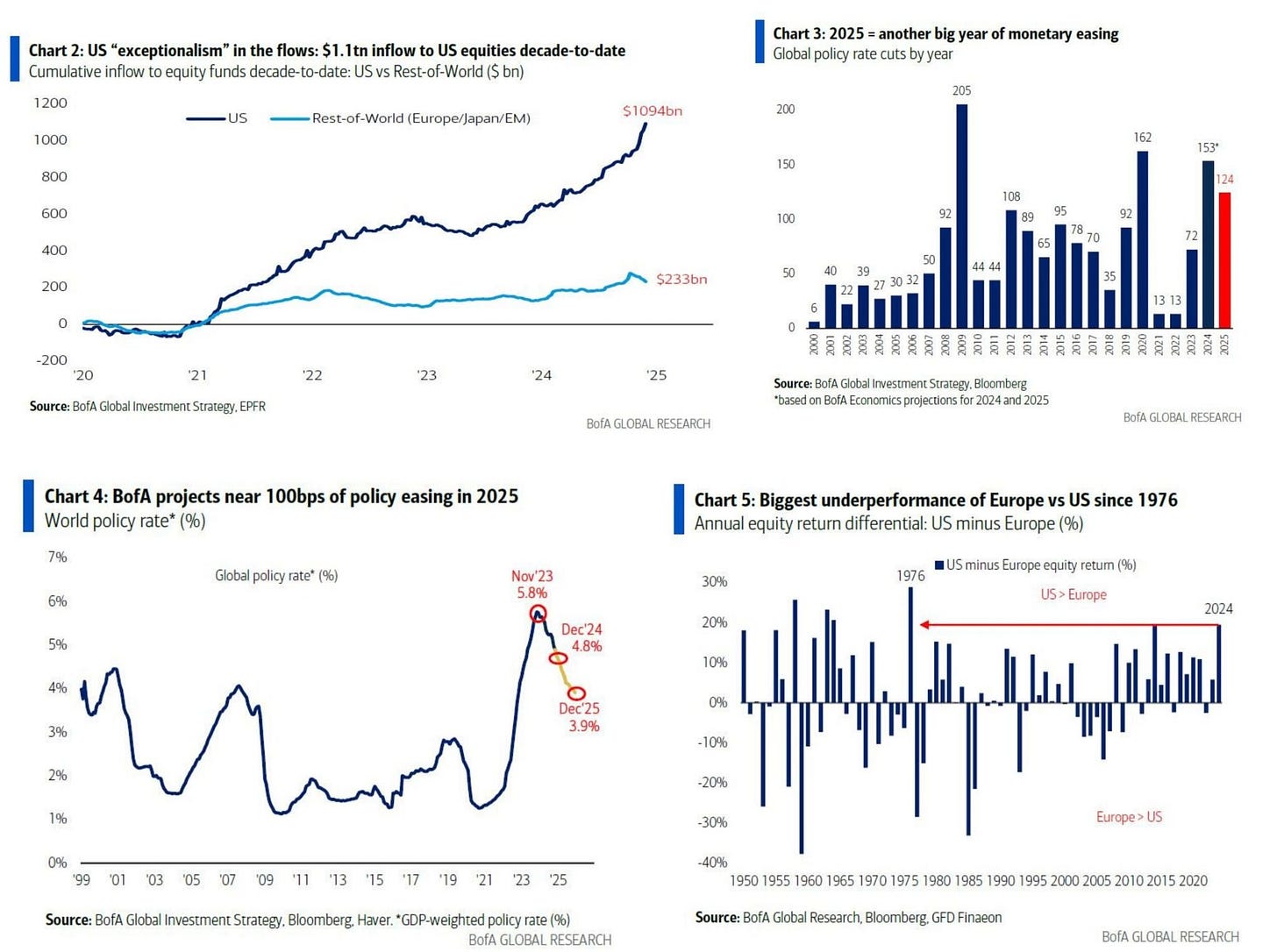

If we want to examine the US “Exceptionalism” closely, the charts by Michael Hartnett of BofA say it all.

More than $1.1 trillion has flowed into US equities in the last 5 years, resulting in exceptional performance compared to other global equity markets.

Unsurprisingly, Europe witnessed the biggest underperformance this year compared to the US since 1976!

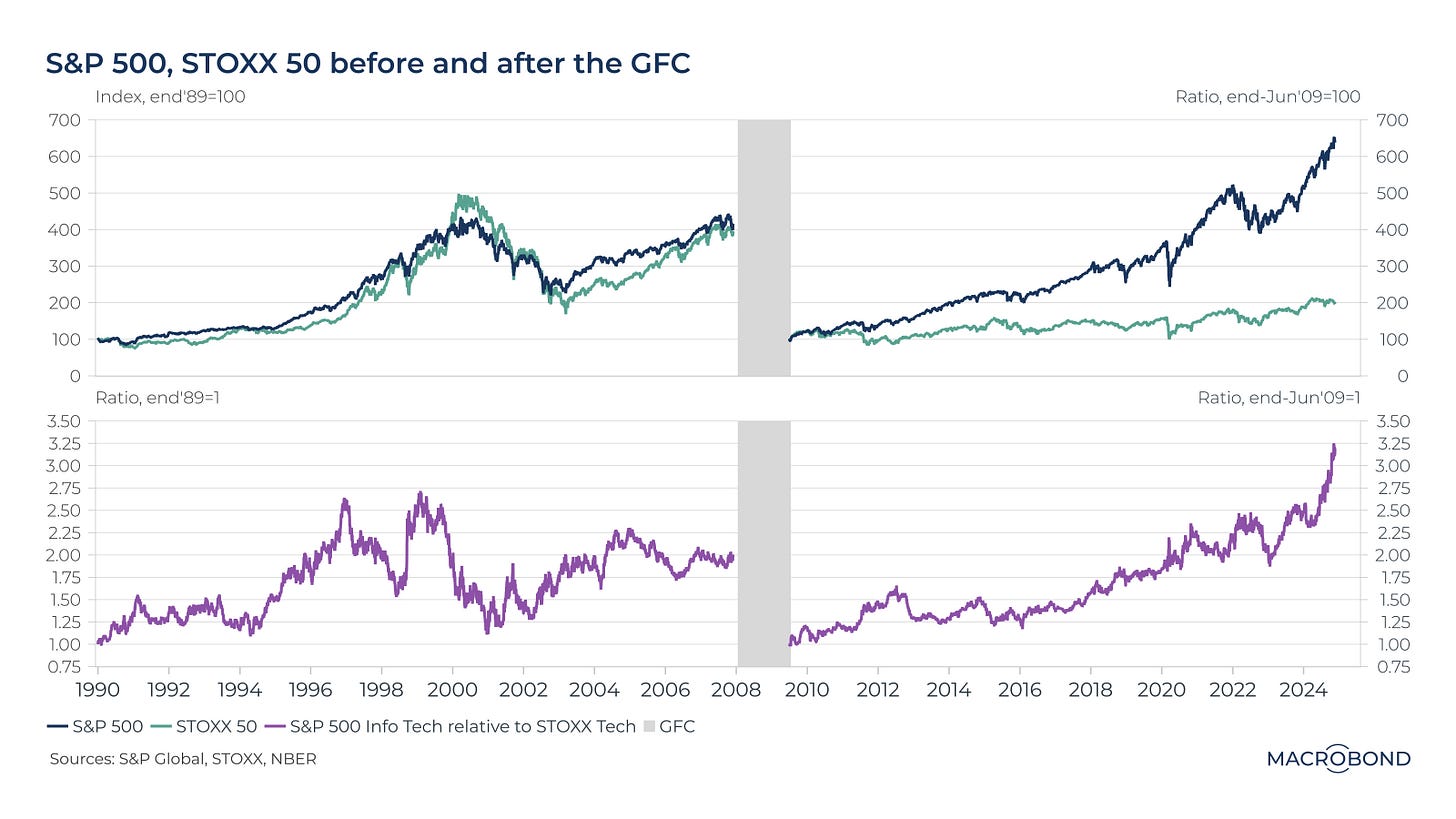

It’s not only the last five years; since the GFC, the S&P500 has outperformed the European markets by an enormous margin.

While multiple reasons can be cited for this, in our opinion, tech supremacy and the trillions of dollars of buyback post-2016 were the two most significant reasons for US “exceptionalism.”

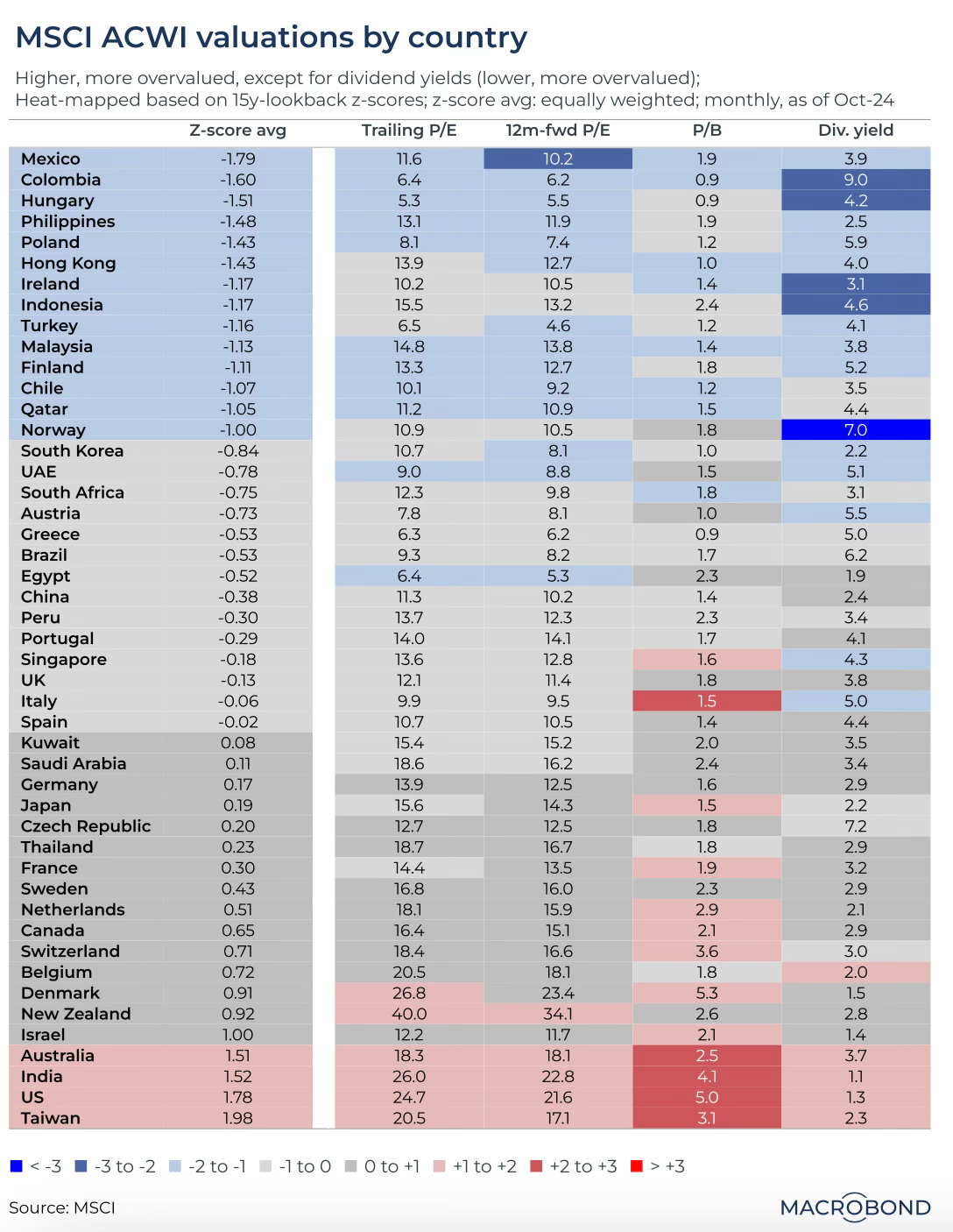

The “US Exceptionalism” comes at a significant cost as valuations are off the roof.

The US now accounts for more than 70% of the MSCI ACWI Index, and US equities trade at more than 25X, trailing PE with a P/B of more than 5X.

Always remember: “Markets can remain irrational for longer than you can remain solvent”!

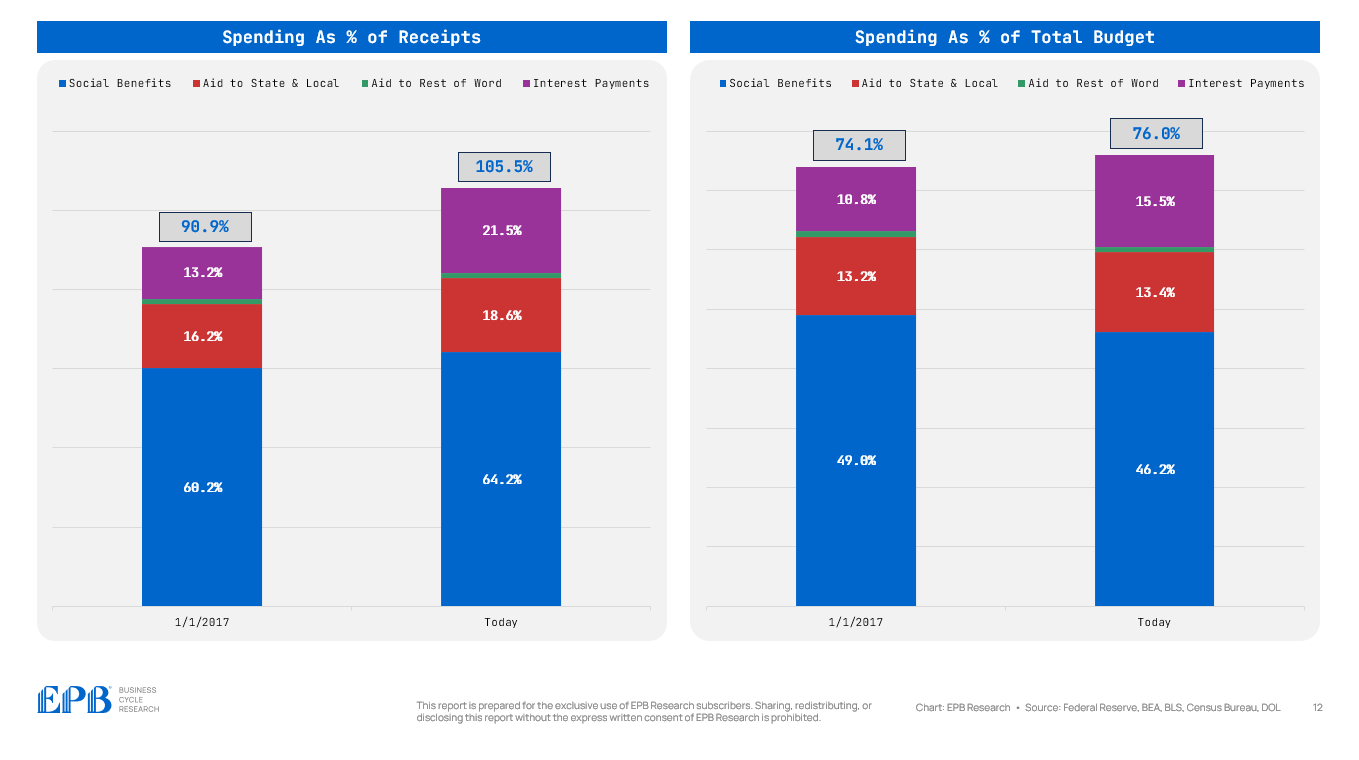

Elon Musk and Vivek have been optimistic about the DOGE and have promised to reduce government expenditure significantly.

However, digging deeper, one can comprehend that it’s an eyewash:

Total Federal Expenditures are ~$7.3T.

75% of expenditures are social benefits, state & local aid, and interest.

Add in defence spending, and it's roughly 90%.

Cutting all other spending to zero is only ~$700B.

So, the only way to reduce fiscal deficits and cut spending is to bring peace to the world and significantly cut defence expenditures.

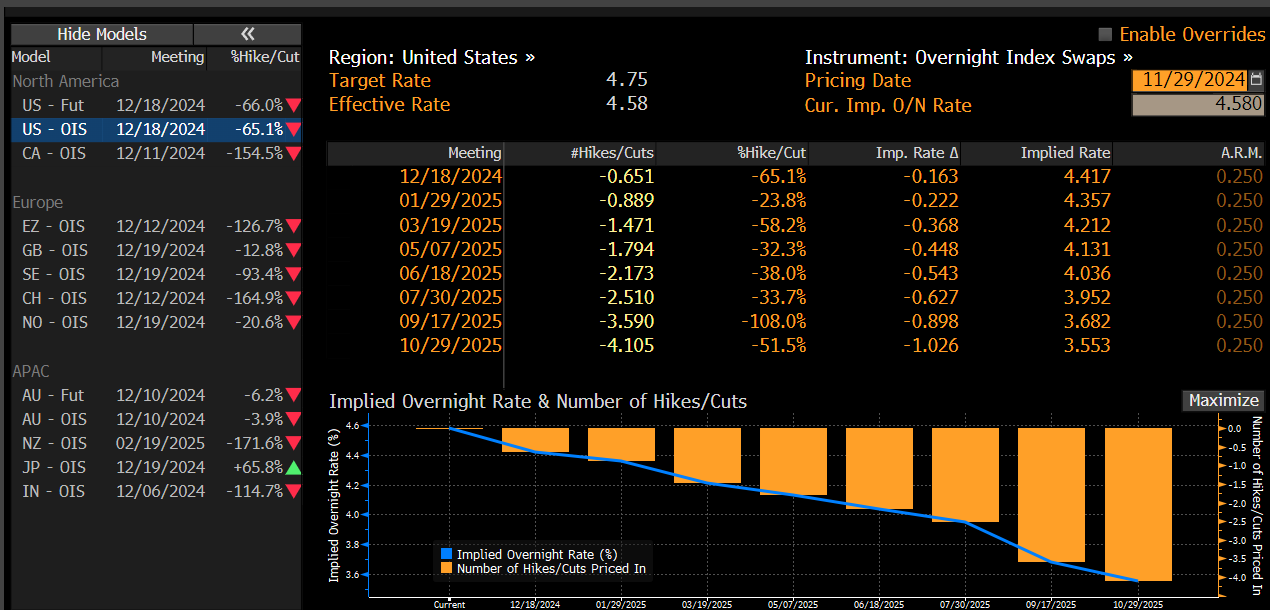

The market probability of a December rate cut by the Federal Reserve is 65%.

With euphoric sentiment everywhere and resilient macro data, has the Fed achieved the desired soft landing, or are there hidden time bombs in the global financial system?

2025 will be an interesting year!

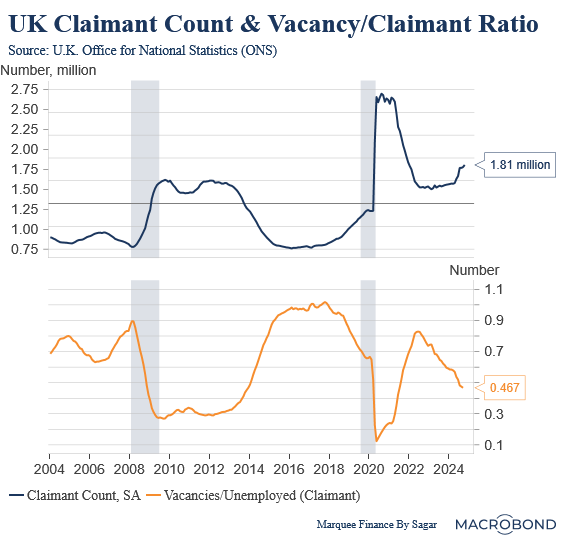

The UK’s labour market data is deteriorating as the Claimant Count continues to rise, and the Vacancy/Claimant Ratio is in free fall, indicating a significant loosening of the labour market.

With the US macro data resilient, we expect the Sterling to be under pressure as the BOE turns dovish and the Fed gradually cuts rates.

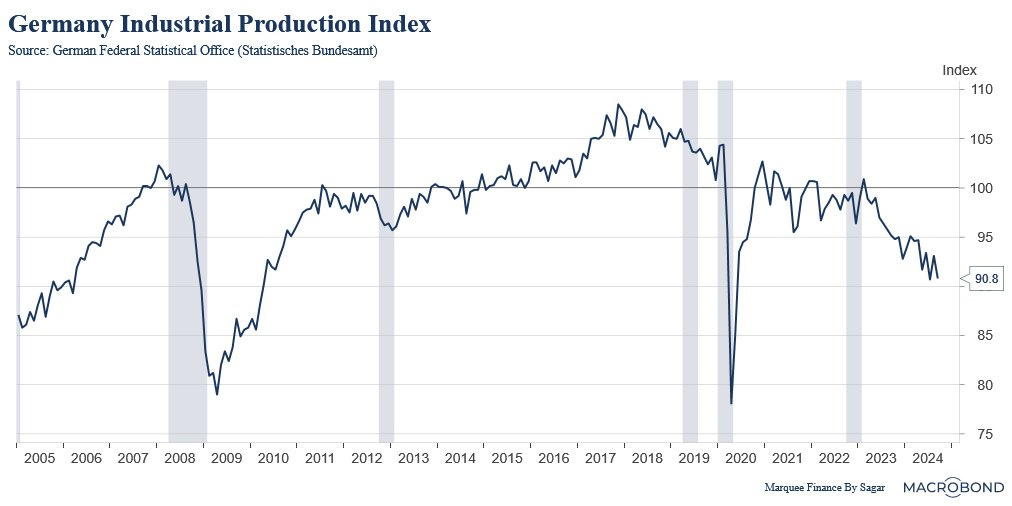

Germany continues to surprise every month with the epic decimation of its industrial base.

The twin shocks of the energy crisis and Chinese faltering demand have led to Germany losing its crown as Europe's manufacturing powerhouse.

The structural decline of Europe is in place, and unfortunately, the regulatory landscape is further accelerating it.

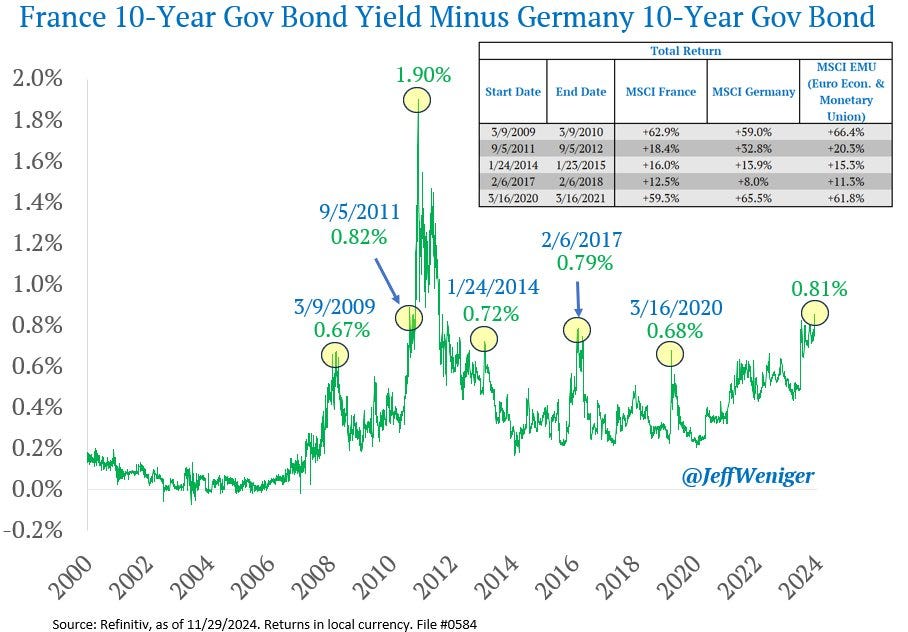

While everyone is worried about the political crisis in France, Jeff Weniger came out with a very interesting piece of research:

“When France's bonds blew out relative to Germany like they have right now, it was a signal to buy stocks in France, buy stocks in Germany, buy stocks in Europe in general. The spread between 10-year French bonds and German bunds is currently 81bps. This exceeds 3/9/2009, 1/24/2014, 2/6/2017 and 3/16/2020. It is also equal to where spreads stood on 9/5/2011, a date I marked on the chart because it was equal to the current level (before it went on to blow out further that winter). French stocks went on to return double digits in the year after each of these start dates, as did Eurozone equities in general.”

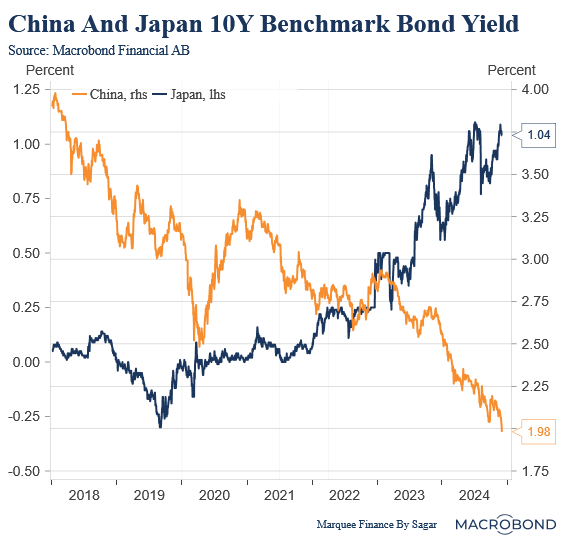

One reason for sub-par growth in China has been the low appetite for credit among Households (HHs) and the leveraged private sector.

Despite easy financial conditions, led by the lowest sovereign bond yields and enormous fiscal and monetary stimulus, consumption has failed to take off as consumer sentiment remains extremely depressed.

The balance sheet recession, led by an epic burst of the world's largest property bubble, has caused significant economic problems for China.

As China likely enters its lost "decade/s," the repercussions on global commodity demand and its effects on global manufacturing (especially Europe) can't be dismissed.

On the other hand, Japanese Government Bond (JGB) yields have been on a tear, with the 10Y comfortably above 1% as speculation mounts about a rate hike by the BOJ on 19th December.

Is Asia witnessing a sea change with divergent fiscal and monetary policies?

As the dollar rampage post-Republican sweep creates ripples across the globe and in FX markets, one FX pair that has surprised market participants has been the USDJPY.

In the last few days, mounting speculation about the impending BOJ rate hike has led to USDJPY moving down from 155 to below 150 and the key moving averages.

Will we see a follow-through, or will the BOJ disappoint on the 19th?

Place your bets!

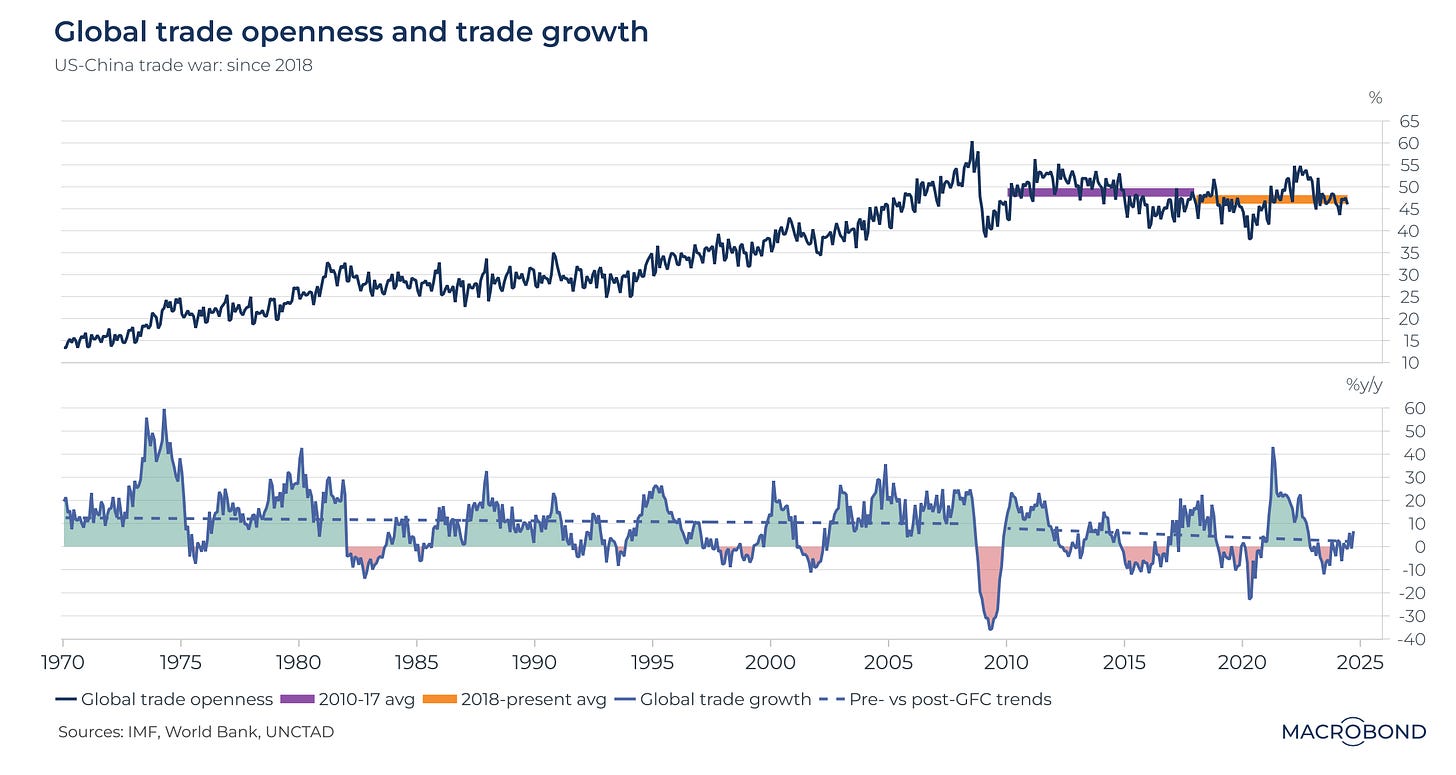

BONUS CHART: As Donald Trump threatens to impose draconian sanctions, the long-term data suggests that “slowbalization” (increased regionalization and slower growth) has been in process since 2009.

Trade growth has slowed significantly since 2018 as US-China trade tensions rise and we head towards a multipolar world.

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.