October saw chaos globally, led by geopolitical tensions in the Middle East, the UK’s surprise budget, Japan’s election shocker, and rising volatility across asset classes.

Nonetheless, the most significant events are lined up for November as the world awaits the fate of the US elections.

Let’s look at what transpired in the global financial markets in October!

Shiny Yellow Metal is the undisputed king of all asset classes (ex-BTC) this year. As concerns mount about US fiscal dominance and geopolitics tensions rise in ME, Gold has given a whopping 32% YTD (till 31st Oct) return.

China and Hedged Japan (DXJ) have outperformed the US indices and the broader Emerging Markets Indices.

Ex-Gold and Silver (PMs) commodities have disappointed as China’s macro data has failed to revive despite enormous stimulus.

Furthermore, long-term bonds remain one of the biggest underperformers of YTD, hurting the performance of the 60:40 PF.

When we look at the internals of the US markets, one sector that has been on a tear is semiconductors, led by the world’s largest company, NVDA.

Nonetheless, one needs to revisit and ask the question whether we are in a bubble and mean reversion will happen sooner rather than later or whether the party will go on forever.

Euphoria is present not only in the equity markets but also in the credit markets, where High-Yield (HY) and Investment-Grade (IG) spreads are shattering records.

The IG spreads are now at the tightest levels since 2005!

The face-ripping rise in 10Y yields after the Fed’s September rate cut, which caught the street by “surprise,” has led to real yields bouncing off sharply.

Real yields (adjusted for inflation) has now crossed 2%, which will likely put intense pressure on risk assets and lead to tightening of financial conditions.

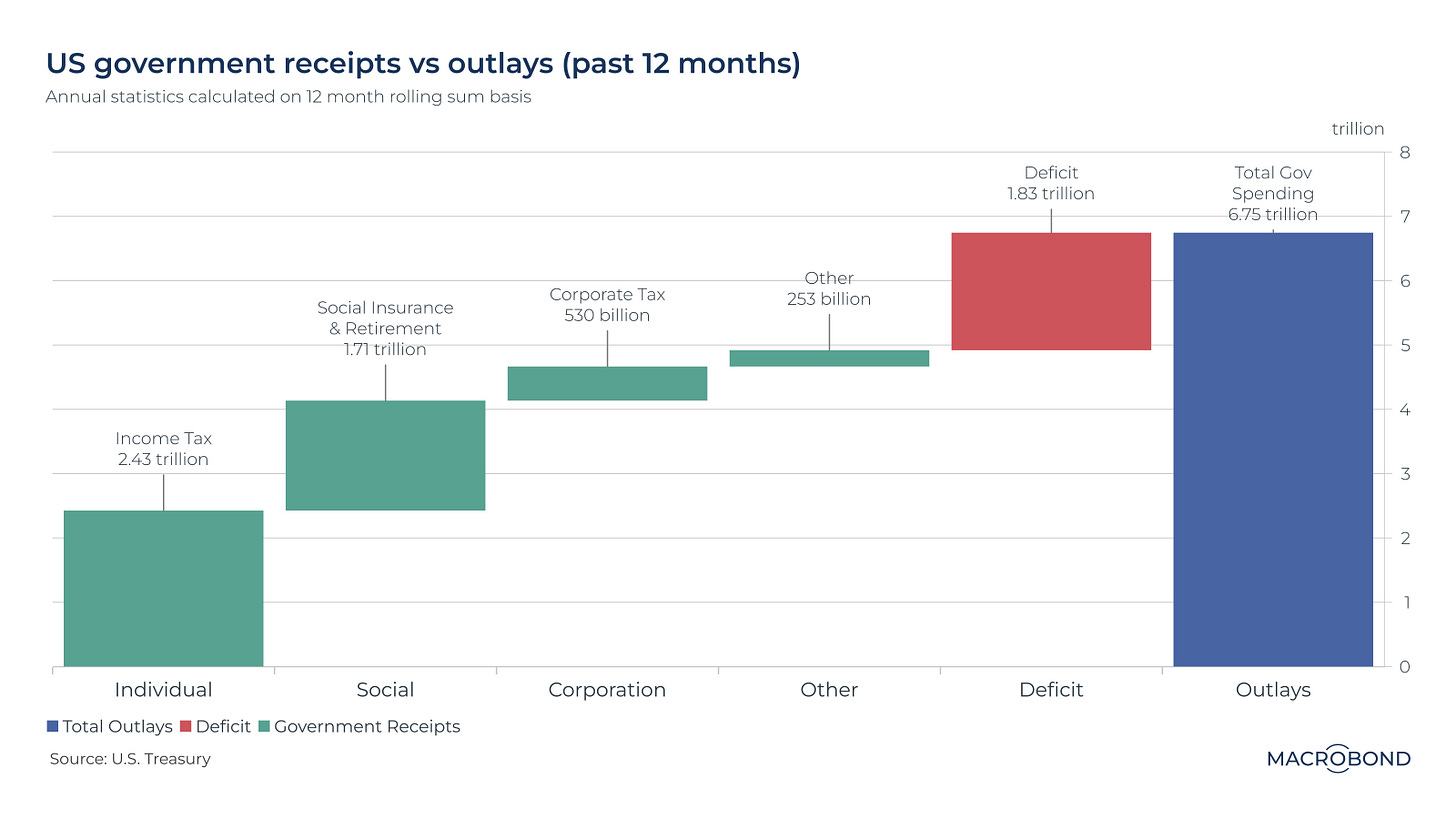

One reason the 10Y is on an unimaginable rise is that bond vigilantes are taking note of the US government's unsustainable spending.

Furthermore, none of the Presidential candidates has addressed the issue of ballooning fiscal deficits and spending.

Will we witness a repeat of Liz Truss's episode in the US?

All In?

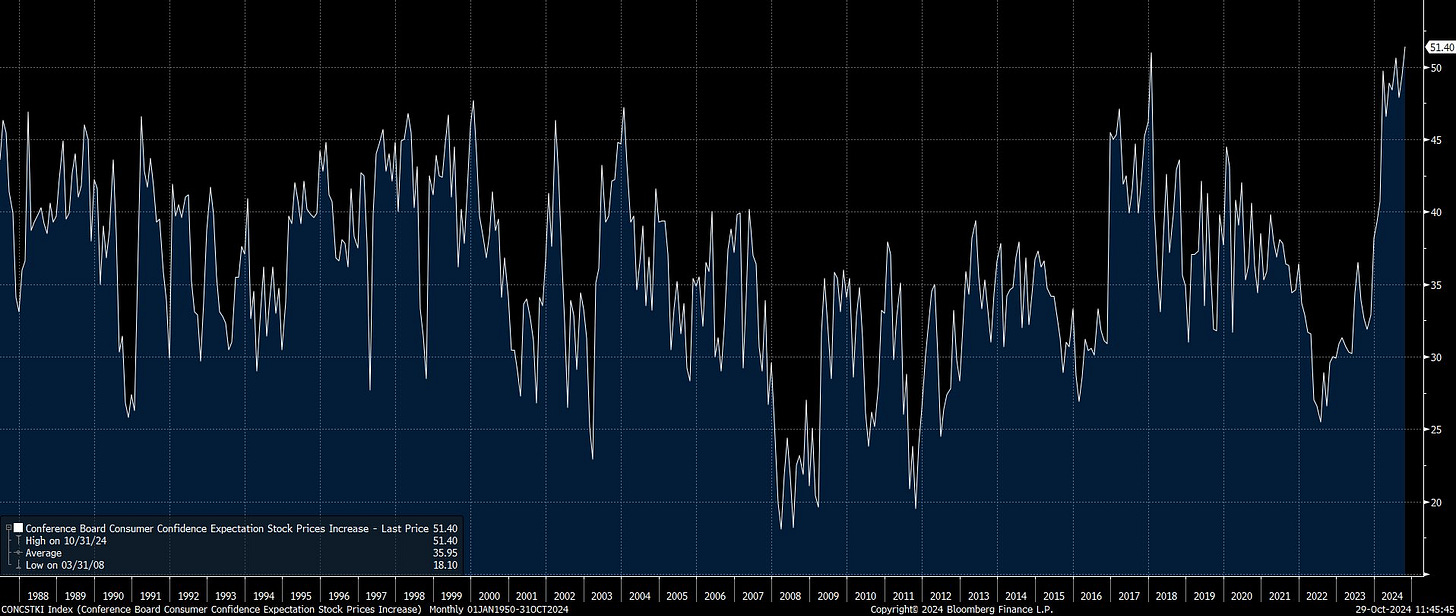

Yes, folks, about 51.4% of consumers expected stock prices to increase over in the year ahead, the highest reading since the question was first asked in 1987 in the Conference Board Consumer Confidence Survey.

Furthermore, this indicates that American consumers are heavily invested in equities, as household allocation is also at all-time highs (risk of negative wealth effect in case of a black swan event?).

What can go wrong?

In the last week, the UK faced a moment of truth as the first Labour budget in 15 years led to dramatic tax increases and elevated spending, raising concerns about higher borrowings in the coming years.

As a result, GILTs saw a massive sell-off, and Sterling witnessed a knee-jerk reaction, moving lower to 1.28.

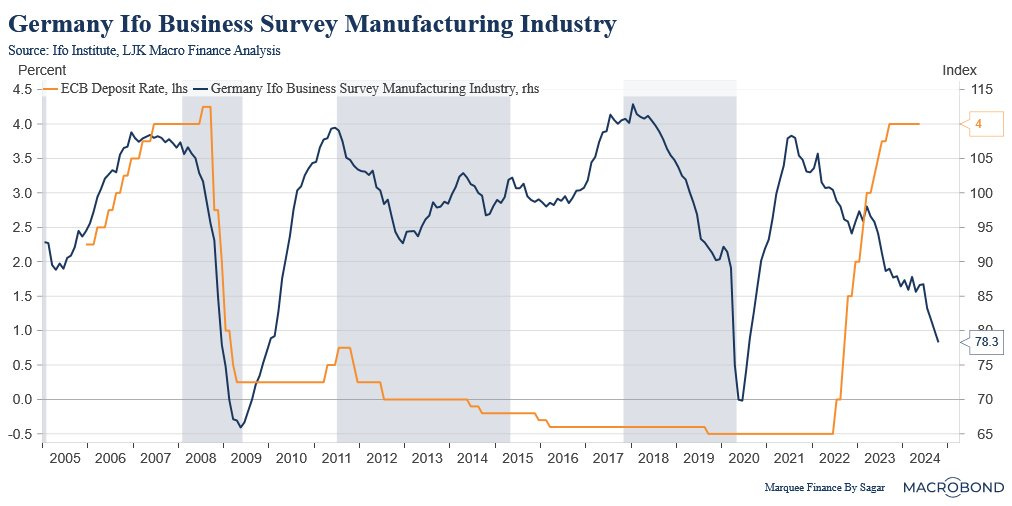

Germany was again in the news in October for all the wrong reasons. Volkswagen has begun shutting its car factories in Germany as demand slumps, laying off thousands of employees.

As a result, Germany’s Industrial Confidence Indicator plunged to the levels last seen only during the GFC, COVID-19, and the 1992 recession.

Last time, when Germany was undergoing such devastation in cyclical activity, the ECB was panicking and resorted to jumbo cuts.

Germany’s IFO Business Survey, one of the oldest and most reliable, fell to 78.3 (the lowest since COVID and GFC), exhibiting that the energy crisis and subdued Chinese demand have led to the deindustrialisation of the manufacturing powerhouse of Europe.

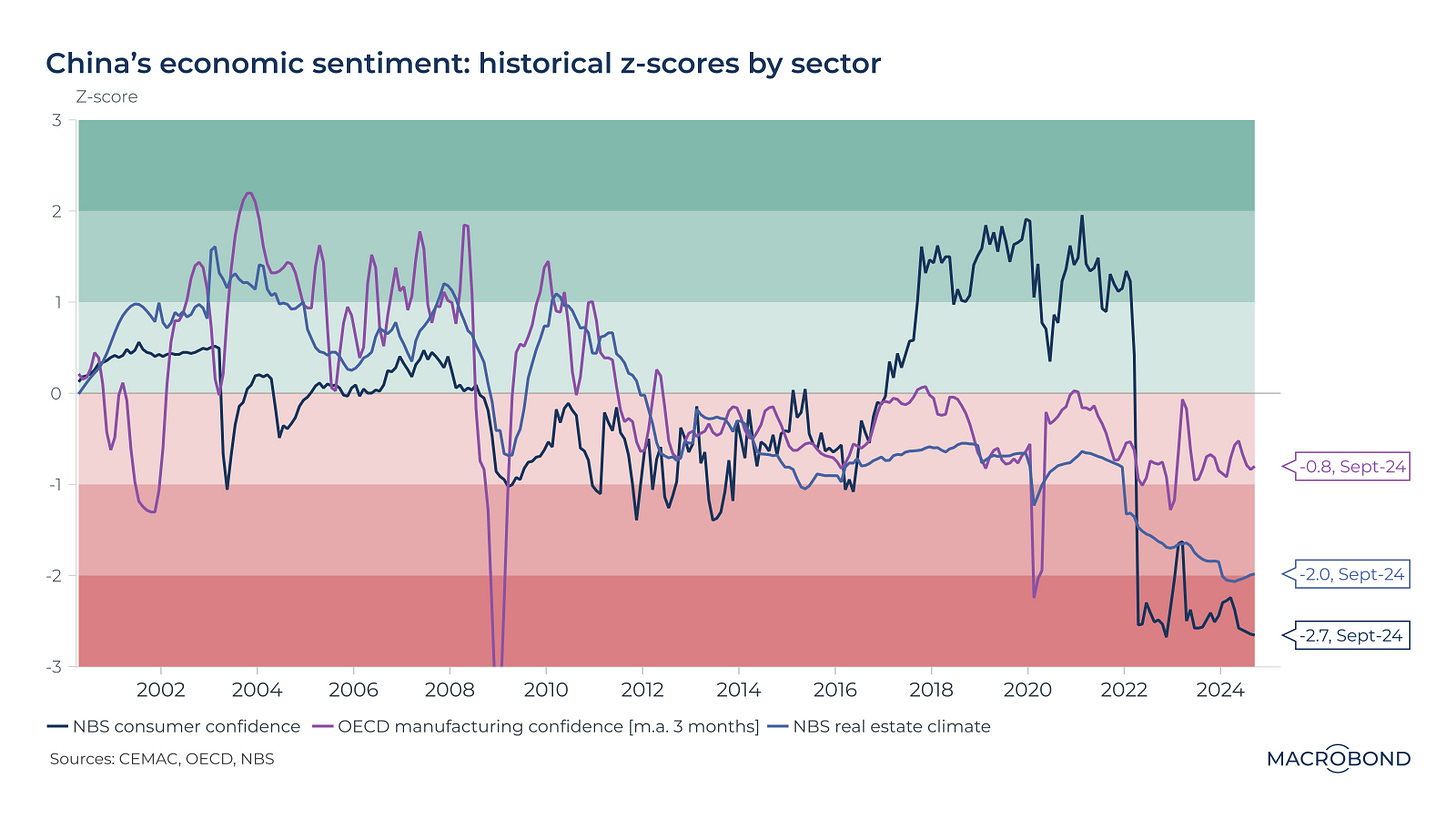

Sentiment in China’s leading economic sectors—consumer, manufacturing and real estate—remains pessimistic and at historic lows.

Although consumer spending and manufacturing activity are expected to be primary growth drivers, sentiment indices suggest that confidence has yet to recover as the property market debacle weighs heavily on consumer sentiment.

Though China’s recent monetary easing led to a stock market rally, it has reduced the earnings yield gaps.

Despite this, the equity risk premia remains above long-term averages. Note that the risk premia is up to +2 SD, yet Chinese stocks look attractive compared to bonds.

The Land of the Rising Sun surprised the world in October when the ruling LDP coalition lost elections, leading to a fractured mandate.

A non-LDP multi-party government is now running Japan, which will prove costly as policy paralysis will marr Japan in the coming months and years.

Markets took note, and USDJPY witnessed a sell-off before reversing the turn as Ueda was “surprisingly” hawkish in the BOJ policy.

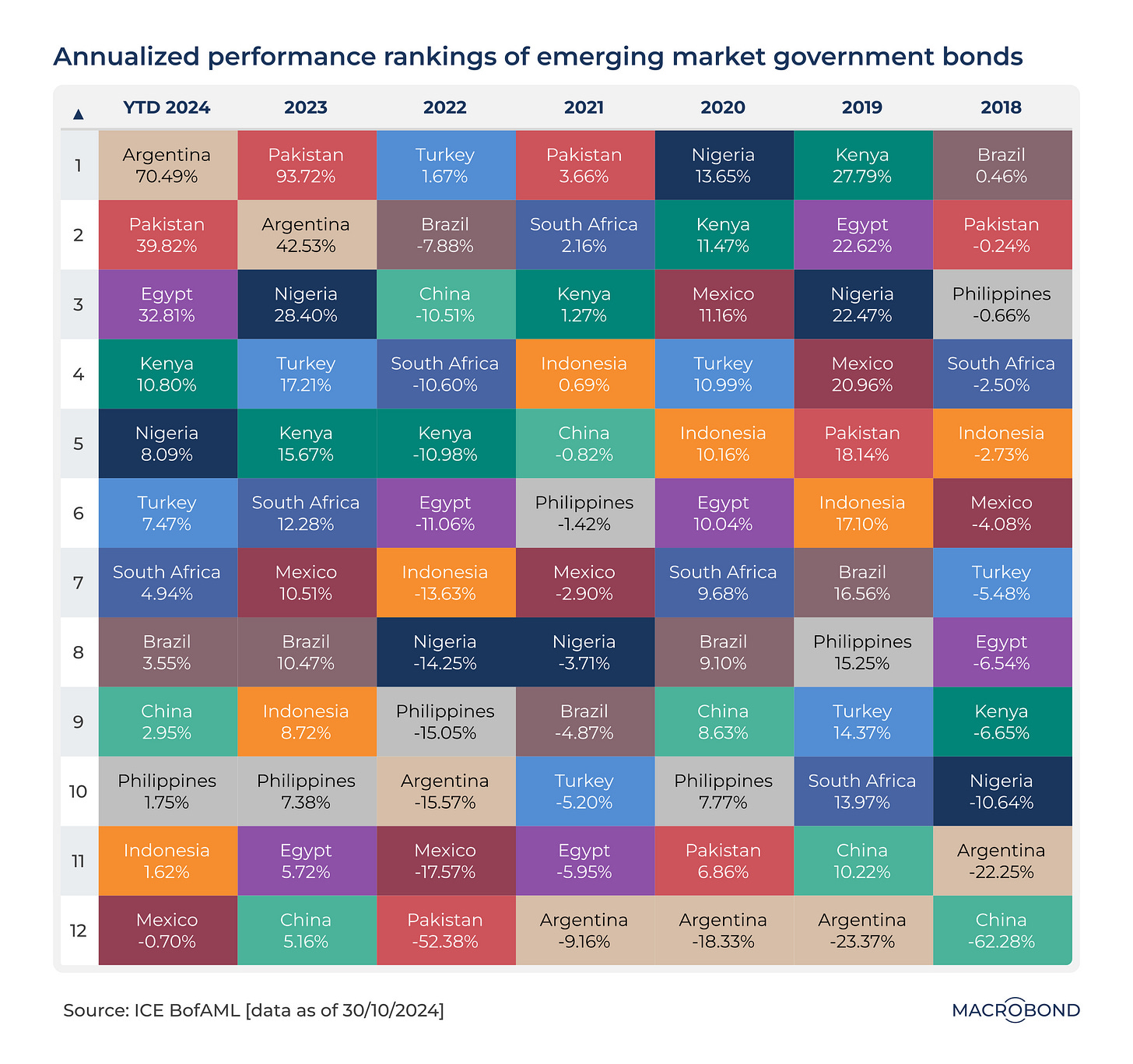

If you are an Emerging Markets (EM) bond investor, you lost big money this year by not betting on the fabulous turnaround story of the year: Argentina.

Argentina's bonds have recently surged to the top, reaching a critical psychological threshold for international investors with a remarkable 72% YTD. President Javier Milei has implemented several reforms to curb government spending, narrow the fiscal deficit, and foster a more investor-friendly environment.

BONUS CHART: One of the most famous narratives on social media has been that the bull rally in Gold is sustained due to unprecedented demand by Central Banks. However, the data indicates that the Q3 consumption by the CBs was the lowest since Q323.

In fact, we are now at pre covid levels!

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.