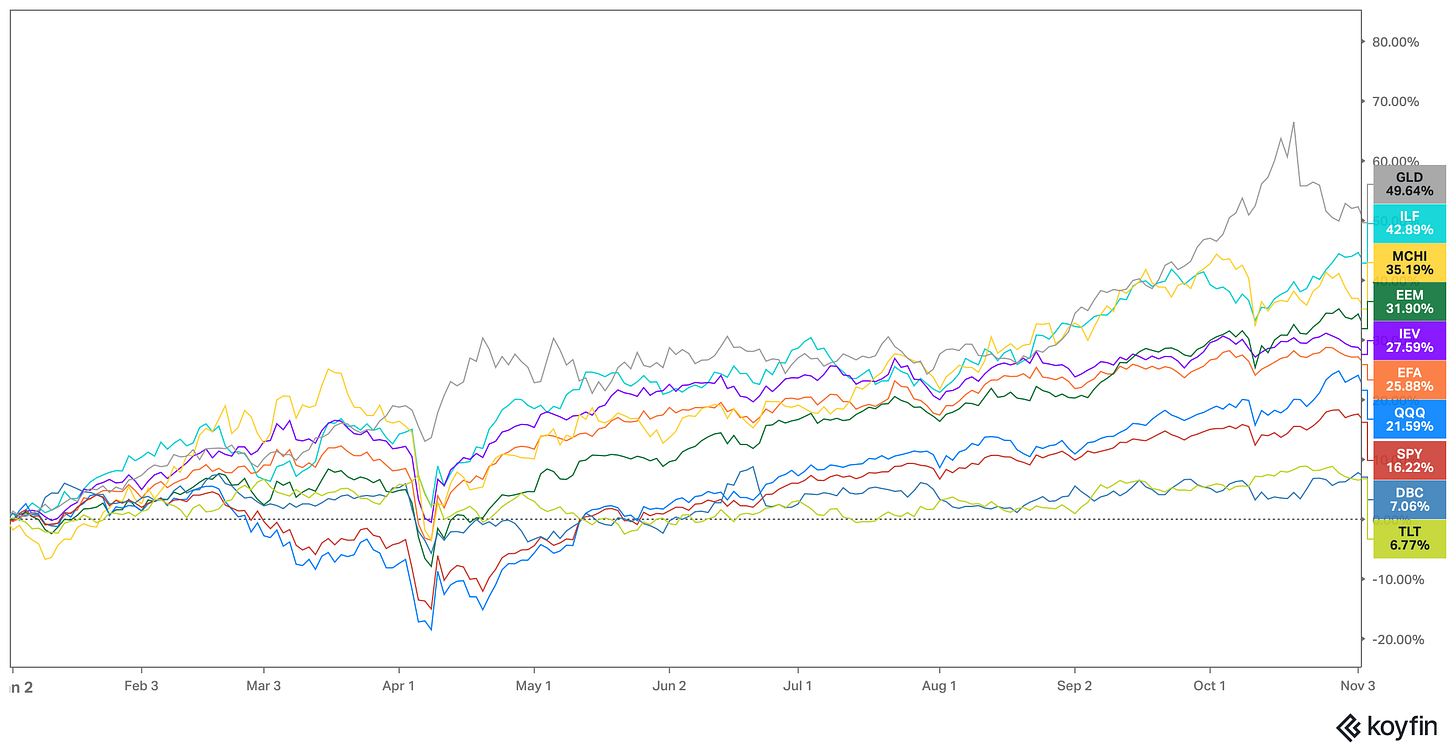

As we approach the end of one of the craziest years ever, the pundits got the cross-asset moves incorrect throughout the year, missing some of the most ferocious rallies in equity and precious metals.

Let’s examine 17 charts to analyse the global macro and cross-asset movements in the global financial markets.

The shiny yellow metal continues to shine with stellar returns of 50% YTD.

In the equity universe, the surprise has been the much-ignored LATAM equity markets, as they have become the top-performing equity markets this year. The benchmark ILF ETF is up 43% YTD.

Chinese equity markets, for the second consecutive year, continue to surprise and outperform the developed market peers. In the last two months, the benchmark Emerging Market ETF EEM has seen a scorching rally led by the Korean stocks. As a result, EEM is up 32% YTD.

Although the US erased some of the underperformance in the last month, it is still up only 16% YTD (S&P 500).

Due to various headwinds, long-term bonds remain the biggest underperformers, with the flagship TLT up only 7% (total return).

Commodities (ex-PMs) have also lagged behind, as oil has been in a bear market.

As the official government data was unavailable due to the US Government Shutdown, today we will focus on various metrics of the equity markets.

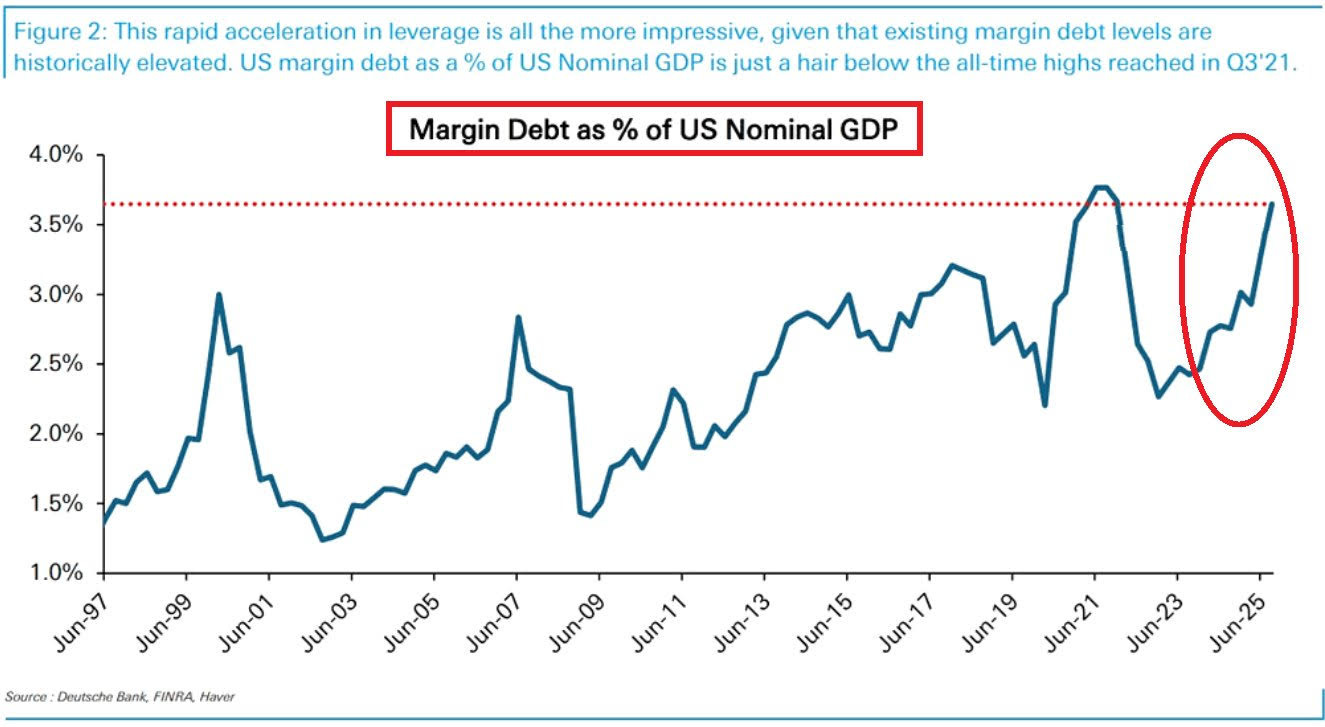

One of the indicators that has historically been accurate for marking the top in equity markets is the margin debt. Although the nominal margin debt has risen to historical levels (also taking into account levered ETFs), margin debt as a % of Nominal GDP is still below the 2021 peak.

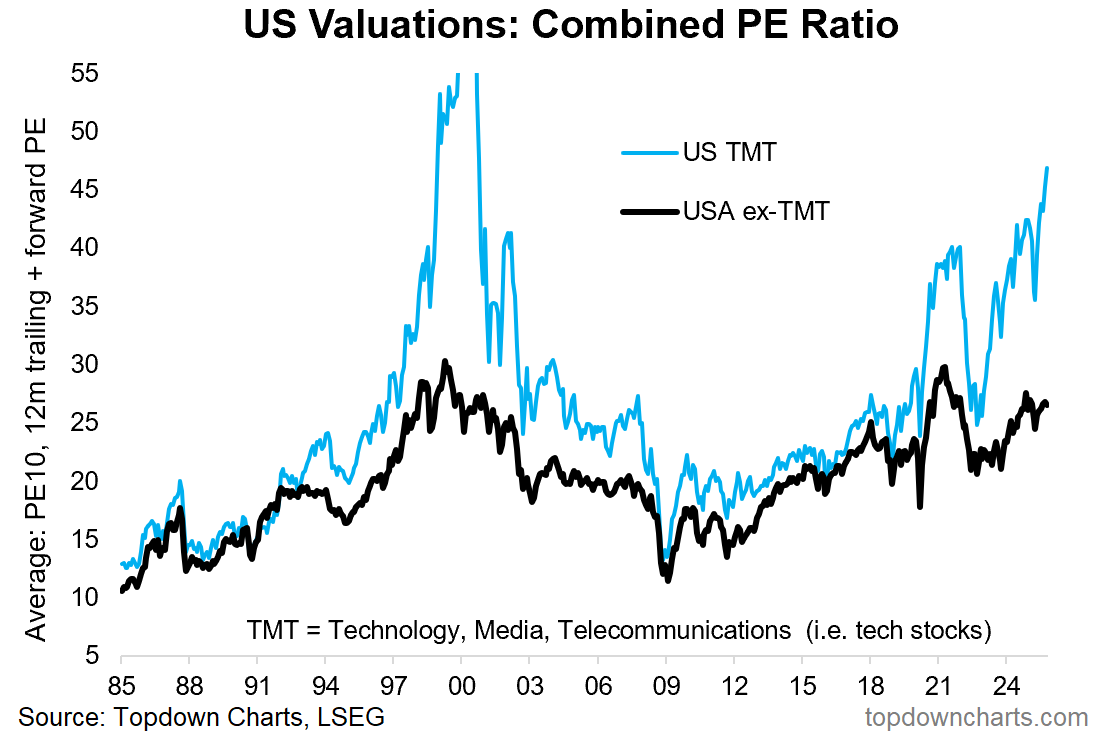

When we closely examine the valuations, tech valuations have surpassed the 2021 peak but remain below the levels of the dot-com era. On the contrary, the rest of the markets are fairly valued. Note that, due to the K-shaped economy, the earnings of select companies, especially those in consumer staples, have been disappointing.

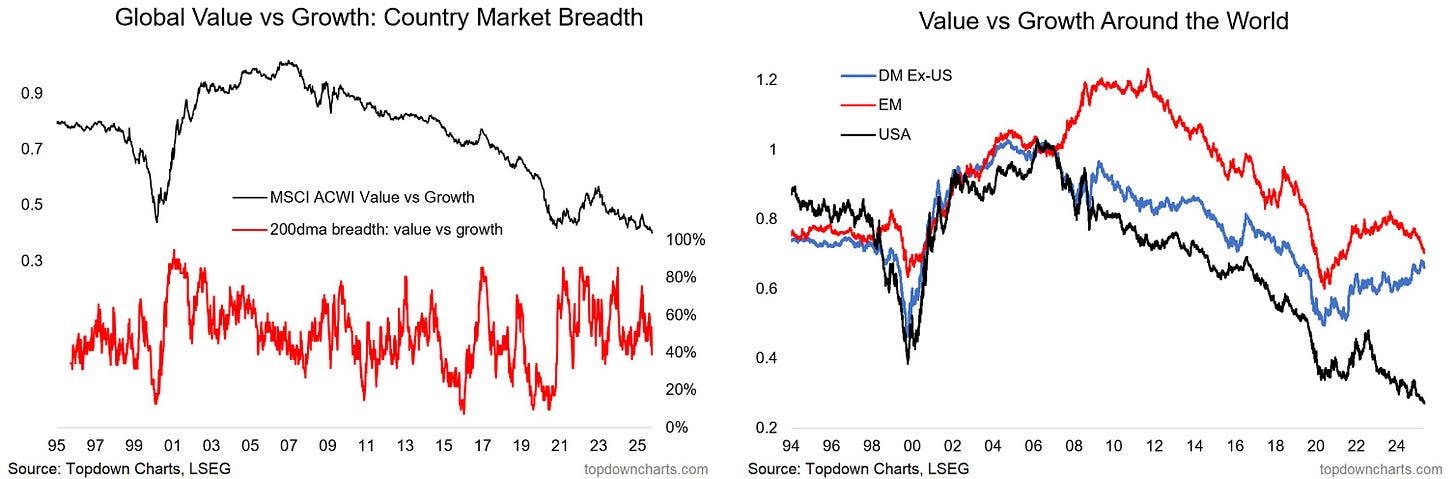

In the US, due to the Mag 7 explosive growth, the Growth has outperformed value stocks by the widest margin on record.

However, when we examine the DM Ex-US and the EMs, we observe an opposing trend, with Value outperforming Growth, especially post-COVID.

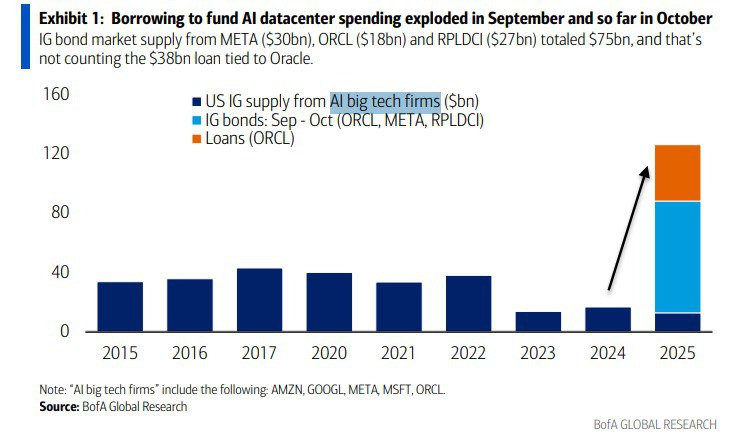

As the hyperscalers’ cash flow dries up, they have now tapped the bond markets to raise billions of dollars of capital for their gigantic capital expenditure needs.

The issuance in Investment Grade markets has hit record highs this year and is on track to eclipse the supply of the last few years combined.

Something you can’t miss if you trade fixed-income markets.

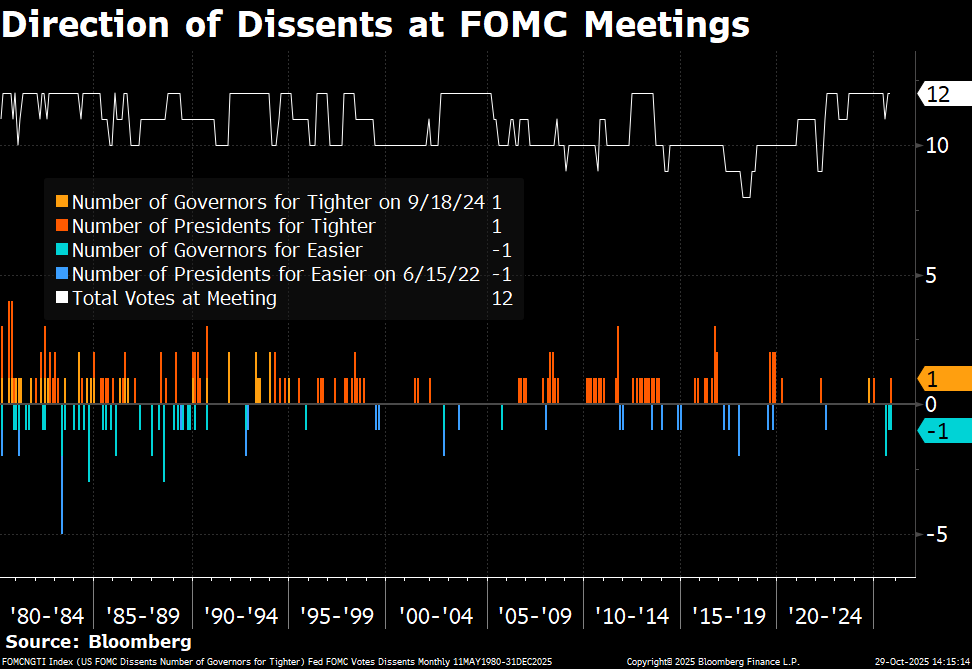

We received two opposing dissents in last month’s FOMC, as Schmid voted against a cut, while Miran, as expected, voted for a 50-basis-point cut.

As a result, we are witnessing the most divided Federal Reserve in history, as it becomes increasingly challenging to achieve its dual mandate.

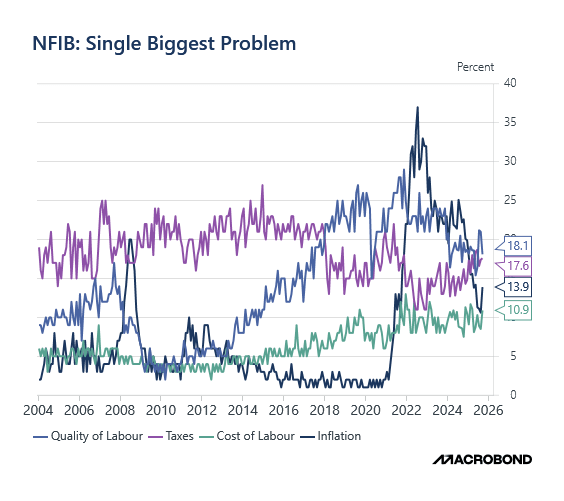

NFIB Survey indicates that inflationary concerns are once again rising among small businesses.

As we have mentioned, tariffs will eventually hurt, and with the Fed on a cutting spree, the inflation story is not over yet.

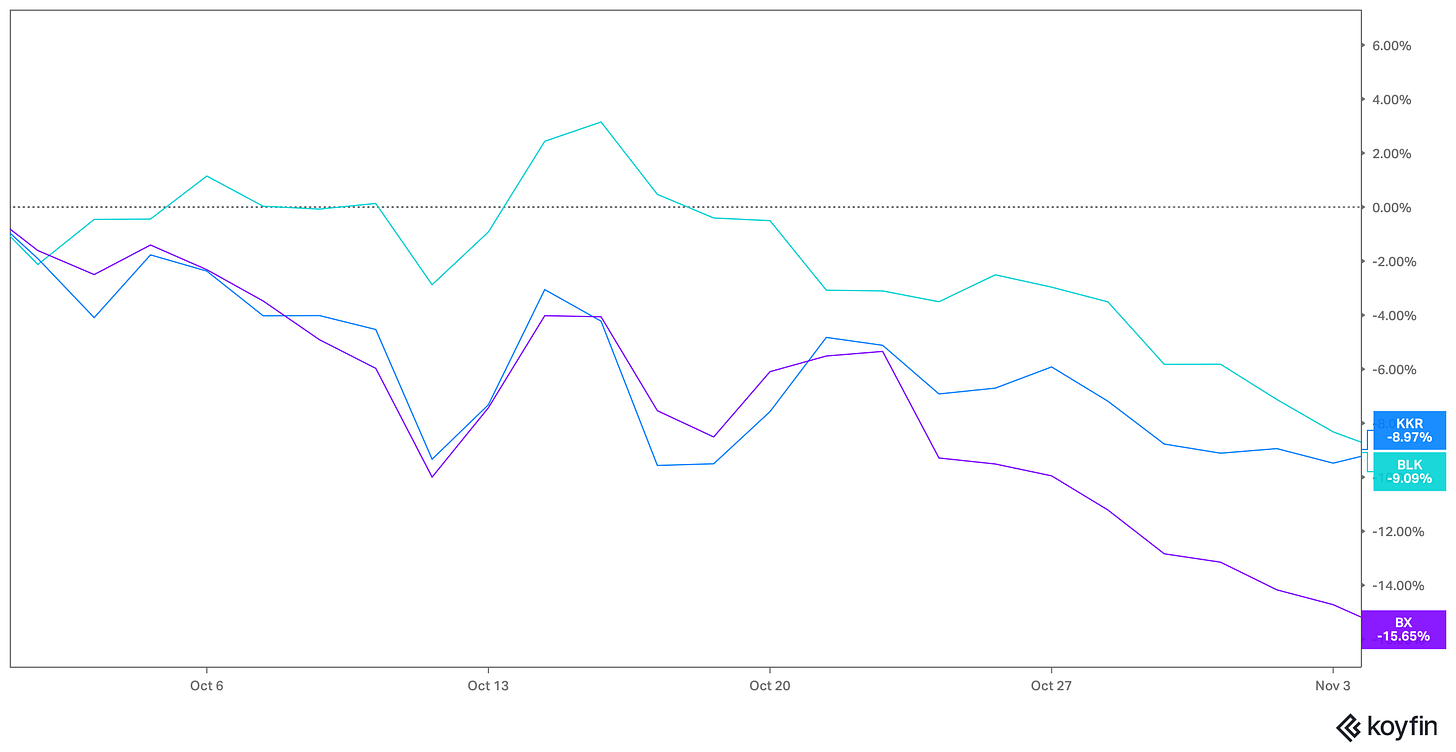

The stress is rising alarmingly in the private credit universe, with desperate measures being undertaken by firms to avoid defaults.

As the “cockroaches” emerge rapidly, the top 3 listed private equity firms have been facing significant pressure since last month.

Across the Atlantic, the market expects the next ECB action to be a hike in 2027.

Inflation has returned to the ECB’s 2% target, and the macroeconomic data suggest that the ECB has successfully engineered a soft landing, despite the unthinkable.

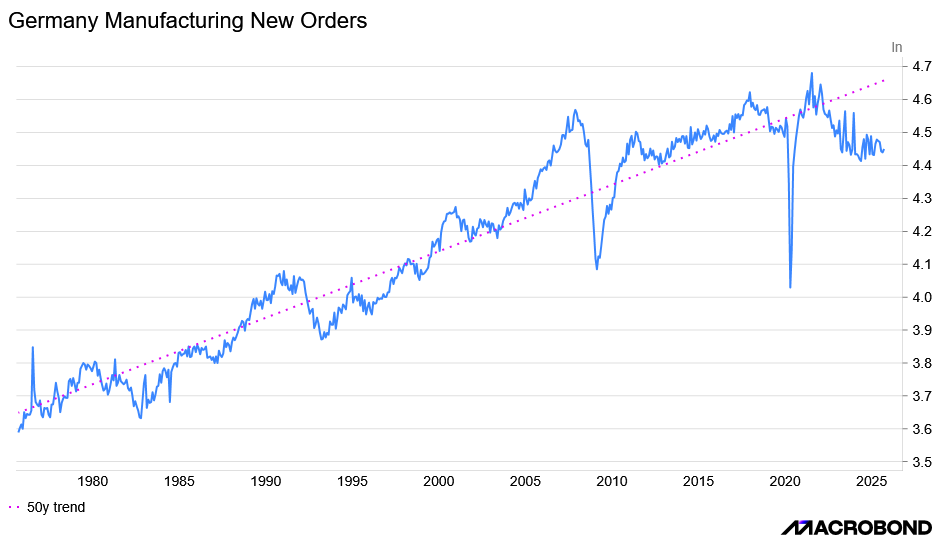

One of the casualties of the Russian-Ukrainian war and the preposterous energy policies of the German Government (Energiewende) has been industrial production.

Europe’s manufacturing powerhouse has been in a secular decline, as evident in the Manufacturing New Orders.

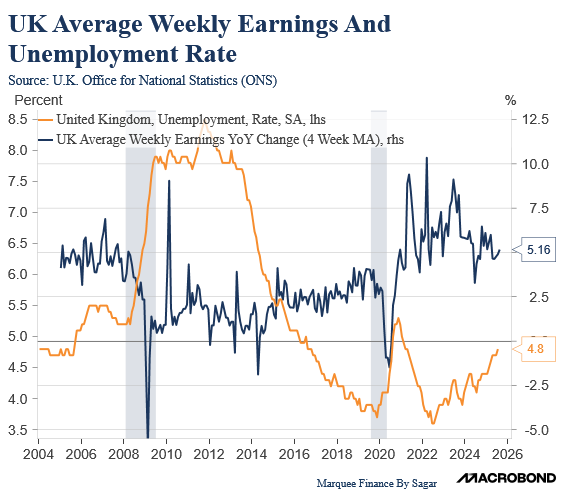

The UK’s labour market softened further as the Unemployment Rate has now risen to 4.8% and is alarmingly close to the 5% mark.

With inflation still running above 3%, the stagflationary conditions are building up in the UK.

Over the last two months, the FTSE has been an outperformer in the European equity universe, as momentum has been strong following the enormous breakout.

We believe 10k is on the cards, as a lower GBPUSD acts as a tailwind for British equities.

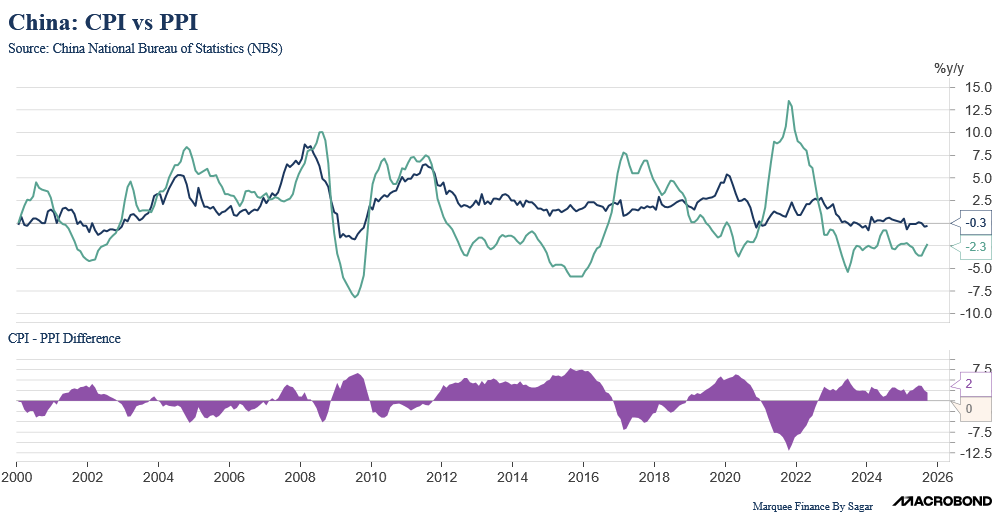

The deflationary bust in China continues unabated, as the PPI has been in negative territory for the last three years, and the CPI has been languishing at 0%.

Nevertheless, this will prompt the PBOC and the Chinese government to ease policy further and undertake fiscal measures to boost consumption.

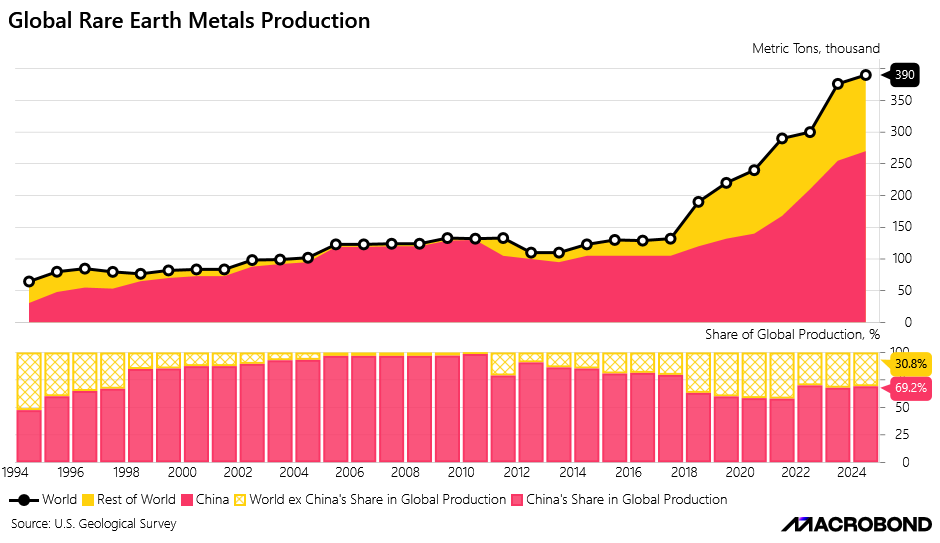

Unsurprisingly, China has a lion’s share of the Rare Earth Global production.

As the US awakens from a deep slumber, it will take years before it catches up, especially in the refining stage, which is the one where China nearly holds a monopoly.

Thus, the leverage that China holds globally will remain for at least a decade.

Kospi (South Korea’s benchmark index) underwent a monstrous breakout and was up nearly 20% last month, the highest since April 1999.

However, the concerning part was that only a handful of stocks led the majority of the upmove, a phenomenon also witnessed in NIKKEI.

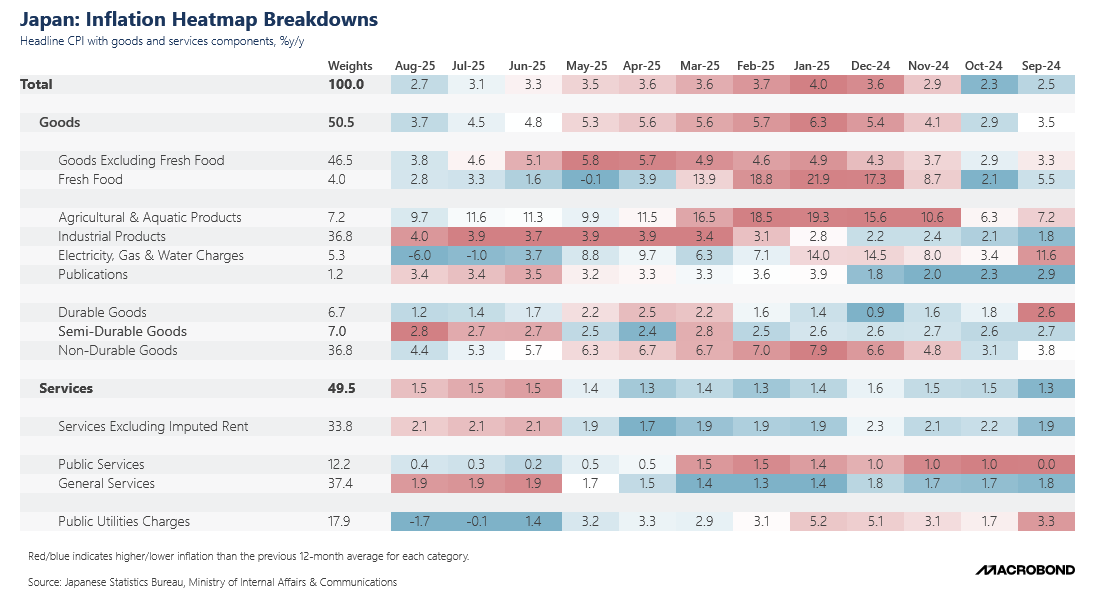

In the land of the rising sun, inflation has cooled significantly from its highs, as rice prices have declined considerably from their peak.

Furthermore, as the BOJ refrains from raising rates and fiscal purses are set to loosen under the newly appointed PM, there is a risk that USDJPY may surprise FX traders and breach the coveted 155 mark.

BONUS CHART: One of the biggest buyers of Gold has been Central Banks, as they have been accumulating Gold in hordes post the Russia-Ukraine war.

However, certain countries, such as India (RBI), which have been the biggest buyers, have reduced their purchases in the past few months as Gold went parabolic. On the other hand, Poland and Kazakhstan have been steady buyers.

Disclaimer

This publication and its author are not licensed investment professionals. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your research and consult with your certified financial planner or other dedicated professional before making any investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone