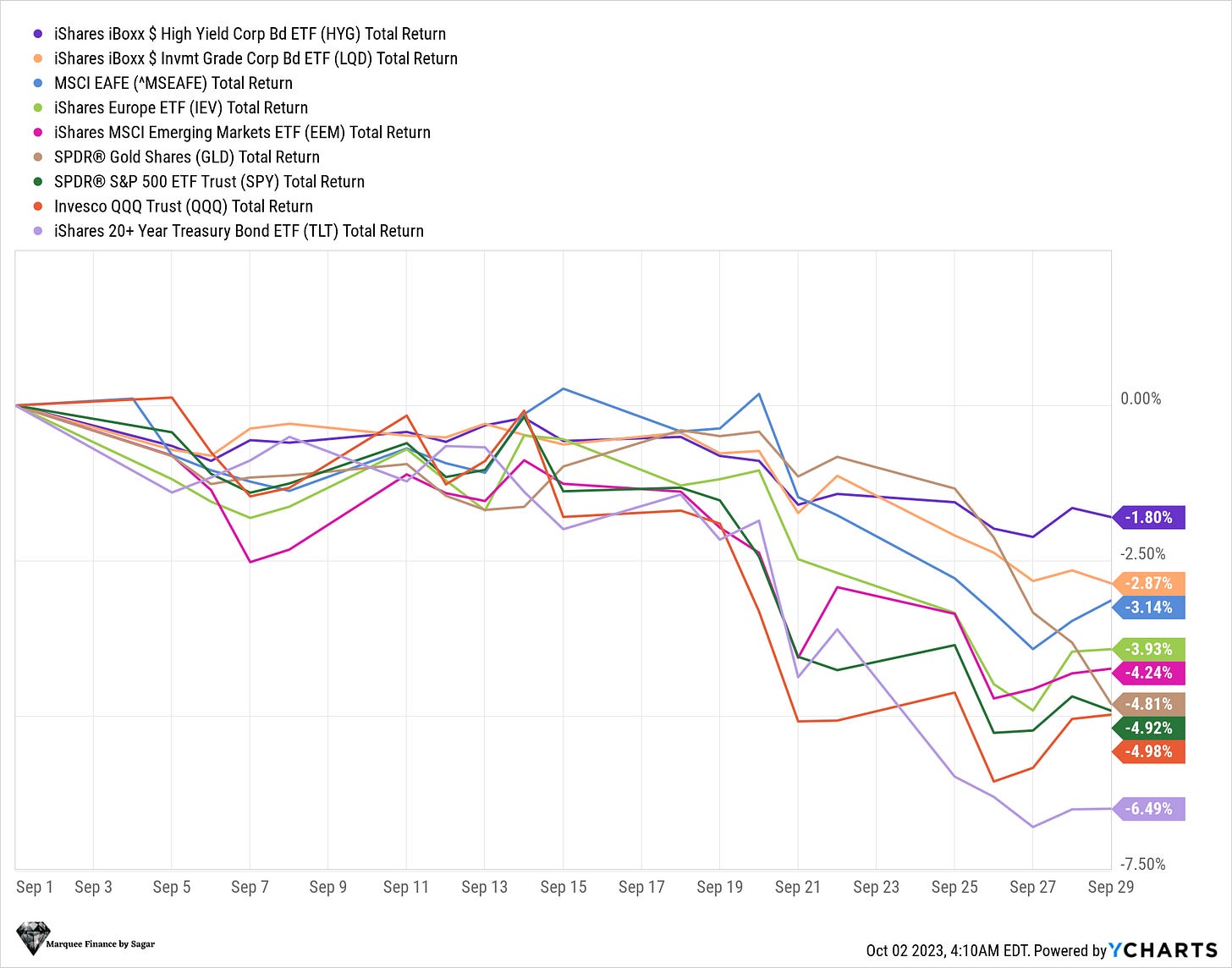

September is known as the seasonally weak month for equities.

Nevertheless, the major highlights were the carnage across the bond markets and the vertical rise in the greenback.

Let us understand via intriguing charts the cross-asset movement and the global macro developments!

One of the reasons for the relentless rise in the bond yields in the US has been the consistent negative term premium since the middle of 2021. A positive term premium was a long demand of the bond vigilantes who saw the 4% yield on the 10Y unattractive amid a second inflationary wave and a 5.25% Fed Funds Rate (FFR).

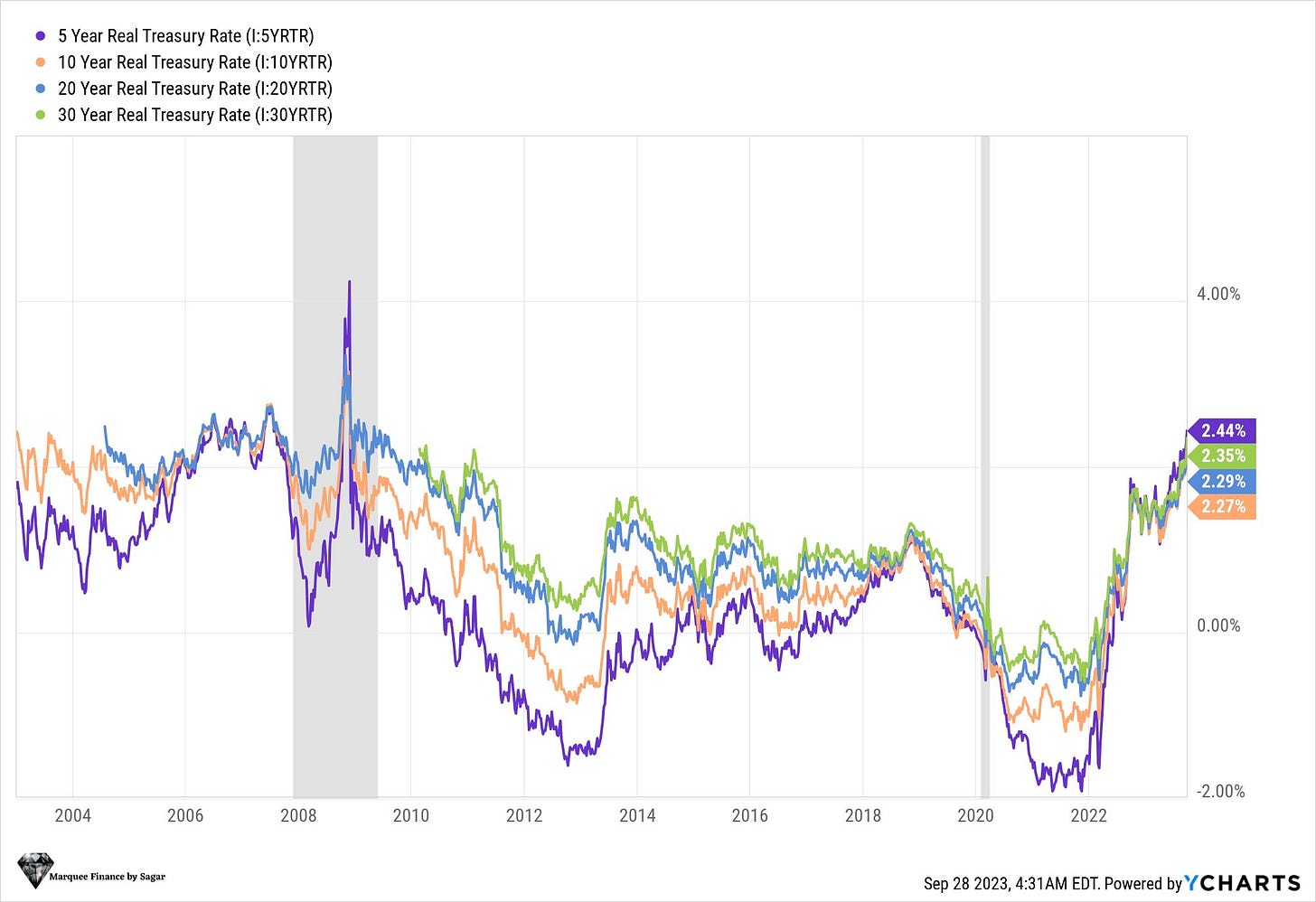

As a result of the higher yields, real rates have climbed to the highest since the GFC. Higher real yields are one of the many headwinds for “resilient” equities.

One of the consequences of higher real yields coupled with the higher dollar (DXY>106) is the tightening financial conditions which the Fed deems necessary to quell the inflation menace.

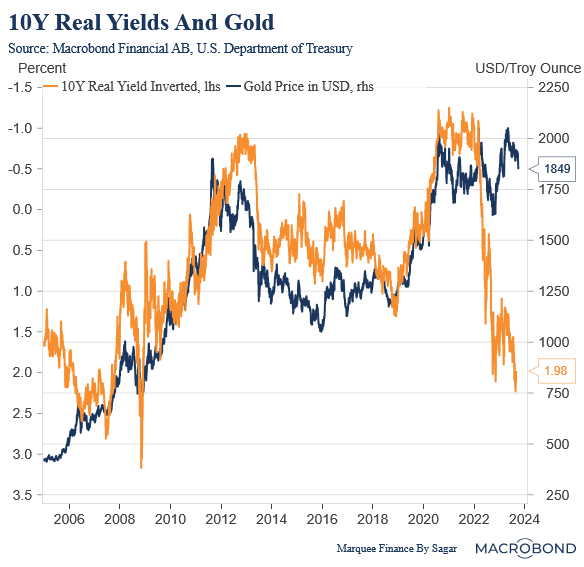

Sticking to the most formidable trend in September, higher dollar and higher real yields finally led to a crack in the Gold prices which share a negative correlation with the real yields. The Gold Bulls were running for cover in the second half of September.

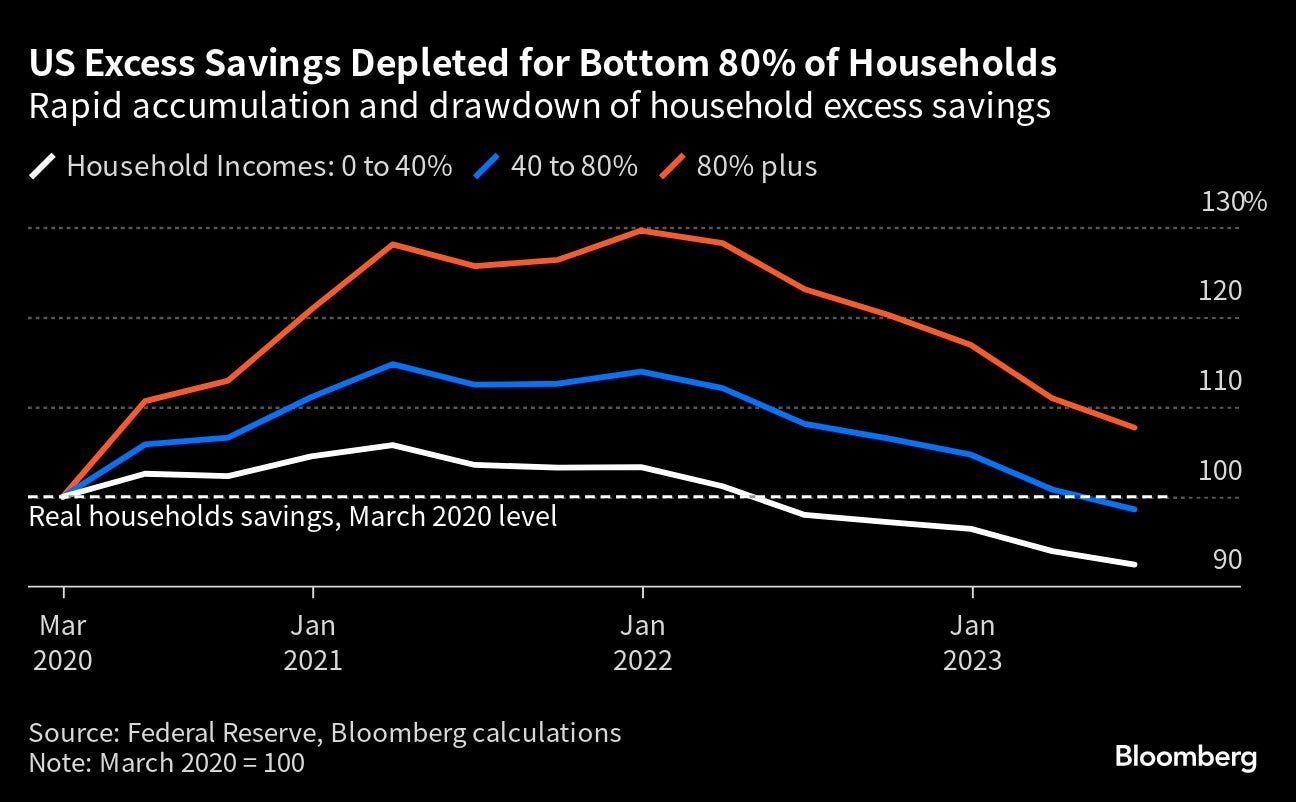

Amid economic uncertainties, the dark macro clouds are gathering on the consumption front as Americans run out of excess savings and student loan repayment begins after a long hiatus.

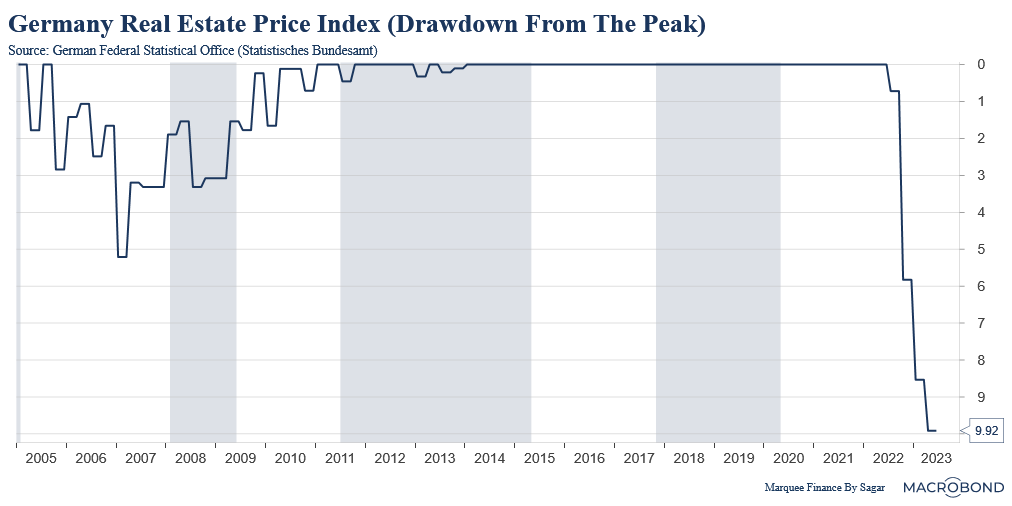

Europe is also in the doldrums as the cyclical activity continues to slowdown. The delayed transmission of higher rates is having a knock-on effect on the property sector.

Even though the economy grinds to a halt, the labour market remains tight across Europe. As a result of rampant labour shortages, higher wages continue to erode companies’ margins.

With the cost of living crisis engulfing the Eurozone and the UK, public’s anger is visible across the surveys conducted by various government agencies. Due to its failure to achieve its inflation mandate, the BoE has lost its credibility.

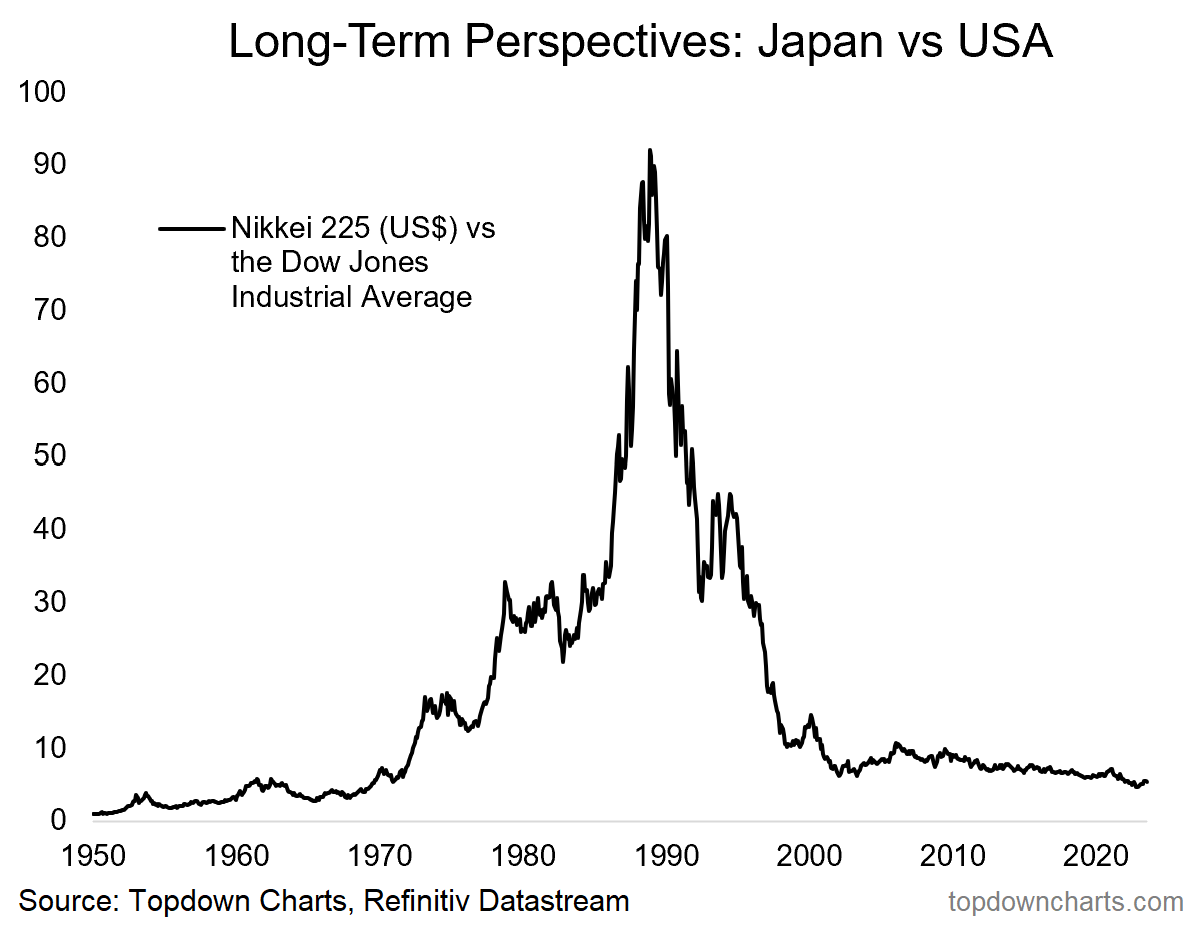

In the East, the black hole of the global financial systems seems adamant about continuing with the preposterous policy of the YCC. The result has been the free fall in JPY. Nonetheless, lower JPY has made Japanese stocks attractive as foreign investors pile into “cheap” Japanese equities.

The Chinese economy, marred by the wounds of epic property meltdown, has begun to heal. The monstrous liquidity injection by the PBoC and the recent fiscal measures by the Chinese government are leading to green shoots in the economy.

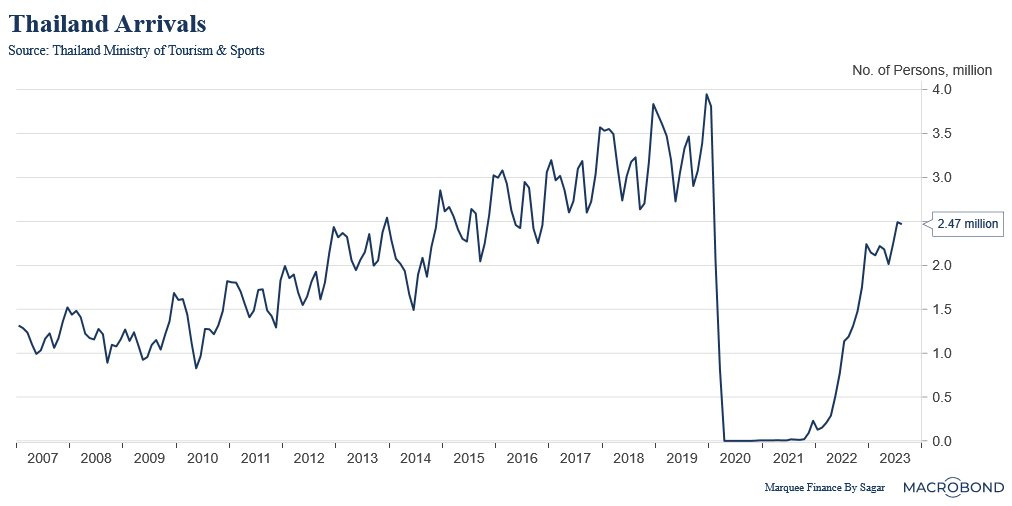

Thailand has performed poorly post-COVID as the country’s biggest sector: tourism failed to revive due to extended Chinese lockdowns. Nevertheless, Thailand recently granted visa-free arrivals for Chinese citizens, raising hopes of a massive influx of Chinese tourists. Definitely, a place to watch.

Regarding asset class performance, September was a total carnage across Bonds and Stocks—a worrying positive correlation trend for the famed 60:40 portfolio.

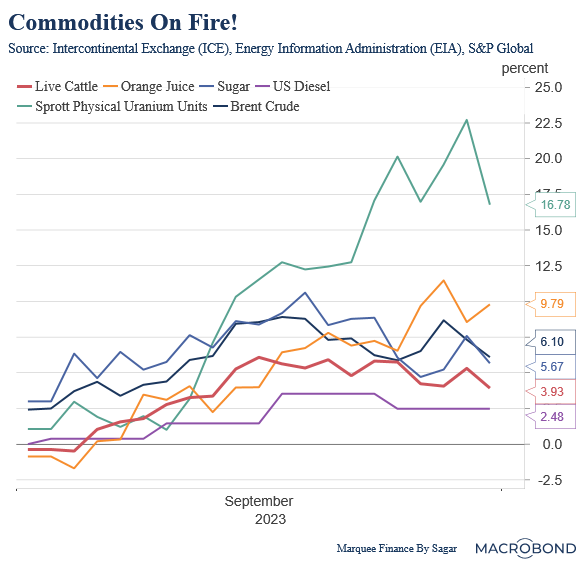

Commodities were the stark outperformer as stagflation fears rose across the West. Among commodities, Uranium was on fire, while crude marched higher and ended the month just short of the coveted $100/b mark.

BONUS FUN CHART: Draw your own conclusions! :)

PS: Do share and subscribe if you love reading!

Disclaimer

This publication and its author is not a licensed investment professional. The author & any other individuals associated with this newsletter are NOT registered as Securities broker-dealers or financial investment advisors either with the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, or any other securities/regulatory authority. Nothing produced under Marquee Finance by Sagar should be construed as investment advice. Do your own research and contact your certified financial planner or other dedicated professional before making investment decisions. Investments carry risk and may lose value; Marquee Finance By Sagar LLC, Marqueefinancebysagar.substack.com or Sagar Singh Setia is not responsible for loss of value; all investment decisions you make are yours alone.