No Man's Land!

“But that dip is peanuts compared to what it’s gone up. And we have an unbelievable future in that stock. That stock market is going to double. We’re going to hit 50,000, and that stock market’s going to double in a relatively short period of time because of everything that’s happening.” – Donald J. Trump, Davos 2026.

As it’s been happening since the beginning of Trump’s Presidency, we once again saw a chaotic week across markets as the weekend tariff announcement, along with the move in Japanese bond markets (a 2-day, 6 SD move), led to sharp cross-asset volatility.

We again got a TACO from Trump on Wednesday, as he said a "framework of a future deal" was sealed on Greenland. Ironically, the European Allies still have no clue about the deal, as negotiations are ongoing.

Nonetheless, the biggest highlight of the week, according to us, was the greenback's price action yesterday.

We wrote last month that the precious metals (PMs) might be preempting the move in the dollar as they did last year as well.

However, the extent of the PM's move has stunned everybody; we will discuss it in detail later.

Furthermore, Carney’s speech at Davos was an eye-opener as a “new world order” is now becoming a consensus among the political leaders as well.

A must listen!

As the world gears up for an unprecedented shake-up in trade, defence spending, and how relationships are forged in the future, investing and trading financial markets will require a deep understanding of macroeconomics and geopolitics.

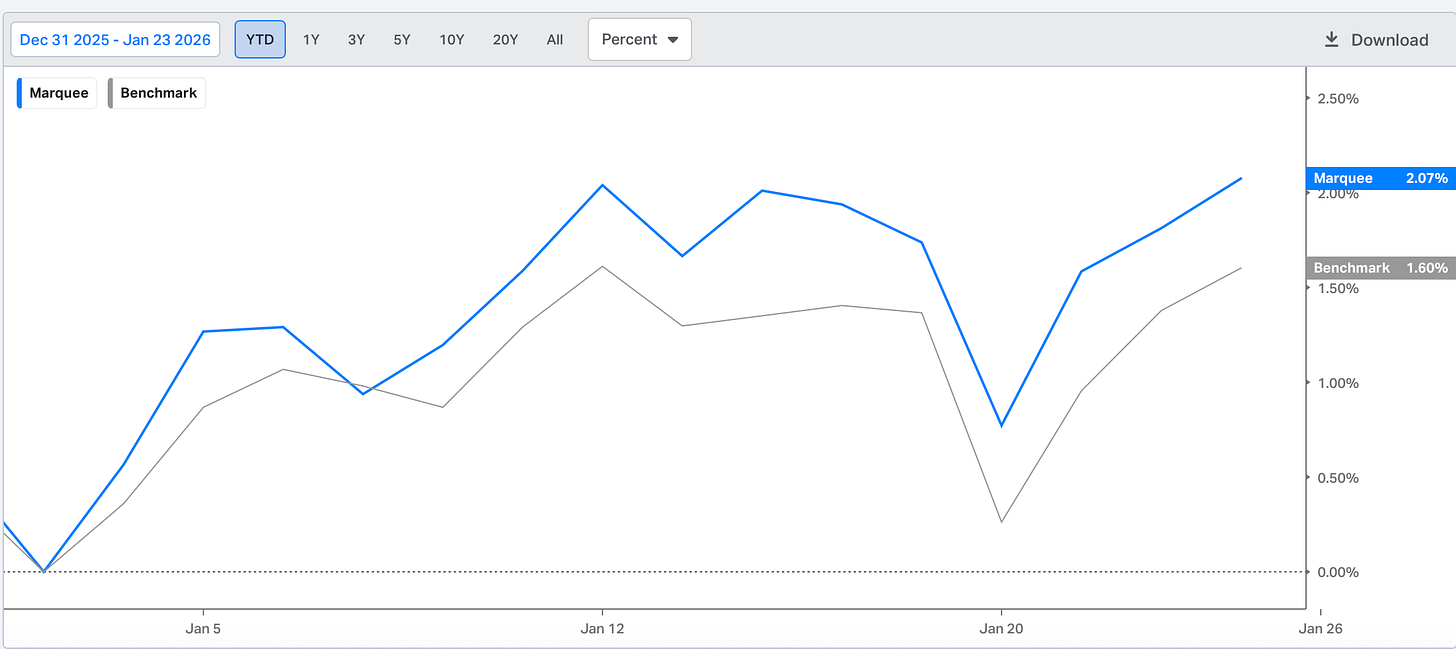

We are up 2.07% YTD as the lower dollar pumps our unhedged equity ETFs.

Furthermore, our bet on value outperforming growth has helped to generate alpha early in the year.

Let’s dig deeper into the macro universe and comprehend the cross-asset price action!

PS: We will be in Helsinki for a few days starting on Sunday. If anybody in Finland wants to grab a coffee, please DM on Substack/LinkedIn.

US/Equities/Bonds/Gold/Silver/Oil/Dollar!

It was a data-light week in the US as all the action shifted to Davos and Trump’s Greenland ambitions.

Nonetheless, we received the GDP data and the PCE, the Fed’s preferred gauge of inflation.

Although we are not a big fan of the GDP because of its lagging nature, we would analyse the breakdown to understand what’s driving real growth higher in the US.

Note that the last three quarters have been volatile due to front-loading of tariffs and a surge in net exports in Q3, driven by higher gold exports.

We saw a 4.37% YoY growth in GDP, driven by higher consumption.

However, a concern is that consumption is higher not because of income growth, but because consumers are drawing on their savings, which has led to a record-low savings rate.

PS: Note that there is also an element of higher-income consumers spending more due to the positive wealth effect as asset prices reach record highs.

When analysing income growth, real incomes net of transfers are up just 0.5% over the last 12 months, well below normal levels.

One interesting stat has been the “NET” Private Domestic Investment as % of GDP (subtracts the depreciation from the calculation).

We saw a surge in the last year of Biden’s presidency, driven by the CHIPS Act and the Inflation Reduction ACT (IRA), leading to higher investment.

However, due to high depreciation and a decline in manufacturing incentives, we are witnessing a decline in Net Private Domestic Investment as % of GDP.

Thus, the massive reshoring claimed by the Trump administration has not yet appeared in the numbers and is not aiding US growth.

Moving on to PCE, headline PCE came in at 2.8% YoY v/s Exp. 2.8% and the

Core PCE came in at 2.8% YoY v/s Exp. 2.8%.

Digging deeper, Cyclical components are PCE items whose prices are more sensitive to overall economic conditions, such as housing, recreation services, and food services. Cyclical components account for about 40% of PCE in the US.

Due to a free fall in rent inflation, we are now witnessing the cyclical component of inflation at its lowest since early 2022, when the “transitory” mistake led to a steep rise in inflation.

Nonetheless, the acyclical component is proving sticky and has been rising due to the tariff impact.

We can conclude this by digging further.