Panic Attack!!

“Credit is the air that financial markets breathe, and when the air is poisoned, there’s no place to hide”- Charles R Marris.

This week, the global financial markets were in awe and shock as the melt-up in the long-term Japanese Government Bond (JGB) yields stunned market participants.

For those new, we have been writing about Japan and the BOJ since the beginning of this newsletter three years ago.

Thus, it was unsurprising when the Japanese Prime Minister announced that Japan’s fiscal position was worse than Greece’s.

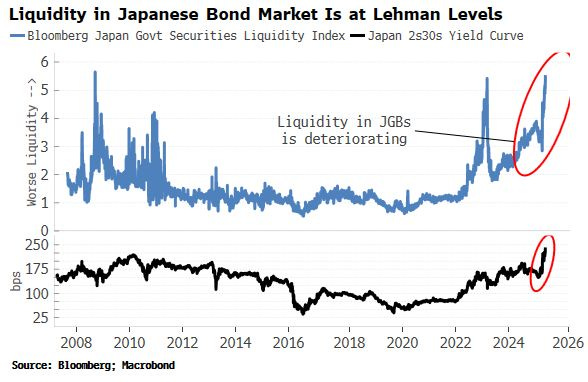

The insane rise in yields was accompanied by the deteriorating liquidity in the JGB market, the second episode in the last three years.

The Japanese bond moves led to a panic attack as the long-end across the developed markets went on a rampage.

We will discuss in detail today's (the East Section) repercussions of the move in the JGB markets.

Moving on, the portfolio continues to perform exceptionally well despite a turbulent environment. Furthermore, our bet on uranium also paid off after Trump’s nuclear “emergency.”

As a result, we once again hit YTD highs yesterday.

Let us begin today’s newsletter and discuss the cross-asset moves in detail!

US/Gold & PMs/Oil/Dollar!

This week was data-scarce. However, don’t expect a dull week anytime soon during the Trump tenure. It will be a hell of three and a half more years.

Nonetheless, we have not shared the housing data in a long time (it has been all about tariffs since early last month).

We want to remind you that the H.O.P.E model, developed by Kantro, is the one we use and are true believers in, as someone using macro research to predict market movements.

Housing→ Orders→ Profits→ Employment.

Housing weakness is the first to appear when a business cycle turns.

Due to its high multiplier effect, housing remains the sector to watch when analysing the business cycle's troughs and peaks.

Today, we have only two charts (don’t want to go into detail today) to share:

Sentiment and Affordability: In Real Estate (RE), sentiment drives the buyers (speculators, especially) to the asset class. Thus, one can’t ignore the fact that NAHB Sentiment (builder sentiment) dipped to one of the lowest levels since 2022. This will likely affect the future projects (slowdown expected). The affordability index is stagnant but at lower levels, as even with Fed rate cuts, the mortgage rates are super high, thanks to higher bond yields.

Units Under Construction: We have Permits→ Starts→ Units Under Construction. Unsurprisingly, units under construction have plummeted for Multi-Family Housing and Single-Family Housing. The plunge is stark in Multi-Family Housing, as we have mentioned in recent months, permits and starts have had a notable decline (as completions get expedited, we will see a further fall). In simple terms, the construction boom with all the PE money that began post-COVID in 2021 is ending. This will lead to a fall in construction jobs, which will appear in the jobs data in the coming months.

Now, we will discuss one of the alarming situations arising in the economy that has been a hot topic on social media.