Playing With Fire?

“Too Late and Wrong... Powell’s termination cannot come fast enough!”: Donald Trump

“Our independence is a matter of law.”: Jerome Powell

In what could be the inflection point in the way the world’s largest central bank Chair/Governor is appointed/fired, Donald Trump has made his plans public to “fire” Jerome Powell, as JayPo has been adamant about his “hawkish” stance due to the uncertainty about the tariffs (and its implications on inflation) and resilient macro data.

The Fed Chair has decided to commit an act of defiance to preserve the Fed’s independence. This would result in an intense standoff between POTUS and the Fed Chair.

If the episode transpires as the market participants expect (e.g., a court battle if JayPo refuses to step down), then we can expect an enormous sell-off in the US bond markets, as the credibility of the US will be ruined.

PS: This interview is a must if you want to hear JayPo’s views on the Fed’s independence and the tariff situation.

Some people believe that the standoff will be a replay of Trump's first presidency, when similar threats were made, but remember that the market participants have forgotten that people believed that tariffs would be a negotiating tool before 20 January.

In fact, Trump was not joking. He had sinister plans to garner resources by imposing insane tariffs to fulfil his poll promises of ambitious tax cuts.

Moving to markets, those who have long been in equity markets know that markets always need a reason to revert.

For the past one year, we have indicated multiple times that the equity markets were insanely valued and were in the euphoria/mania stage as the AI “New Paradigm” was not substantiated by multi-year earnings growth prospects, which the greedy Wall Street analysts had pencilled in.

Furthermore, while there is a prevalent social media narrative that stocks fell due to Trump's “tariff” imposition, we believe everybody will be stunned by the upcoming earnings (we got our first shocker yesterday with UNH 0.00%↑ ). There is no way that 28X PE at the index level was/is justified.

We are still in the process of the mean reversion as we are somewhere between a bull trap to return to “normal” (see chart) with the enormous buying the retail crowd has been undertaking in the past few weeks.

Remember, the market bottoms when " capitulation " occurs across the system.

In the last month or so, we have seen massive deleveraging by large hedge funds in the bond, FX, and stock markets.

Let’s begin this week’s newsletter by digging deeper into the macro universe and making sense of the cross-asset moves.

US/Gold/FX/Oil!

The shortened week was data-light, with retail sales being the only major data point released.

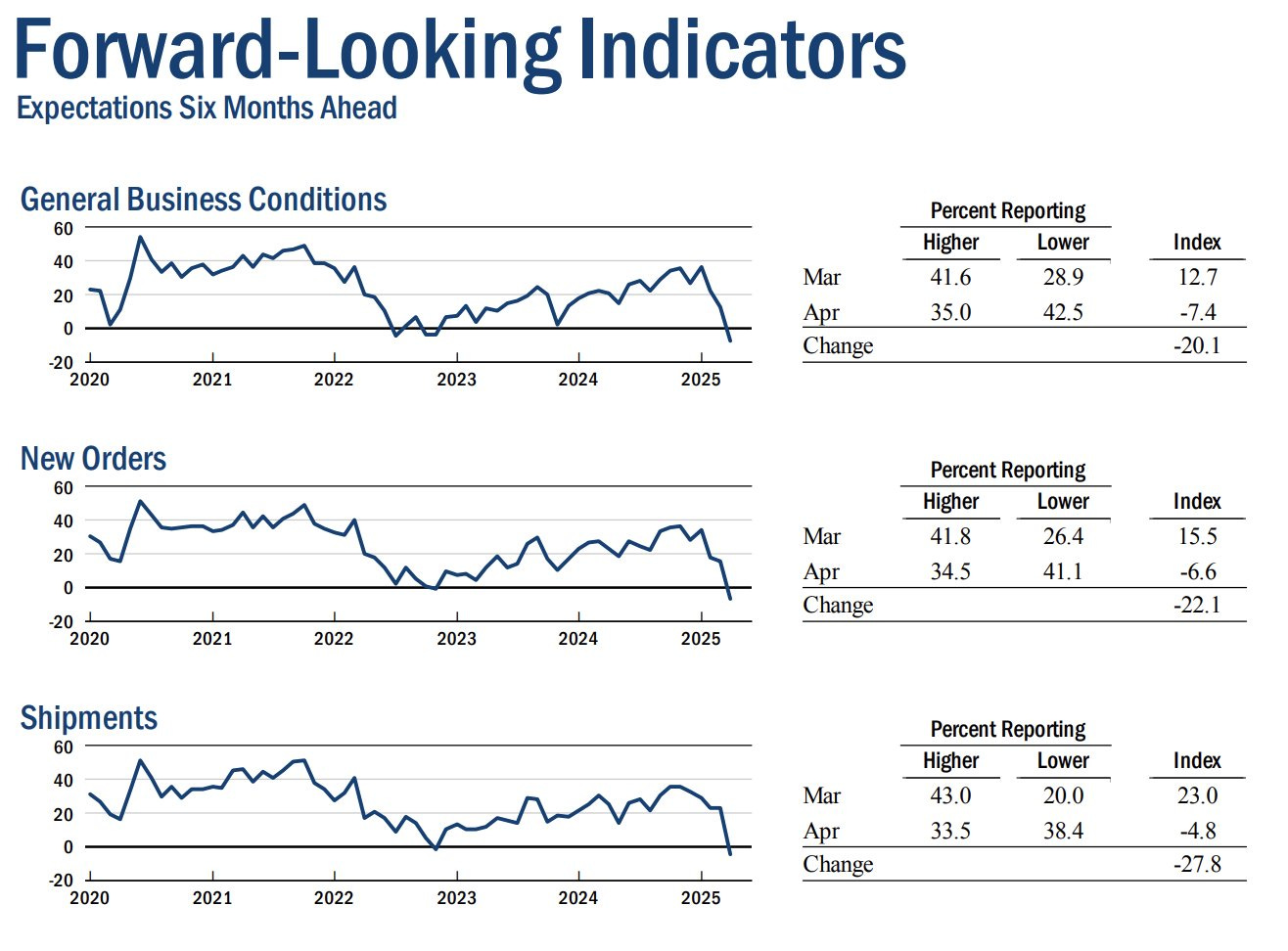

Nonetheless, though we don’t consider Philly Fed Survey in our macro framework, this week’s numbers were horrendous.

According to the Philly Fed Survey, "New orders fell sharply, from 8.7 in March to -34.2, its lowest reading since April 2020.”

The data is comparable to a global shock akin to the GFC/ COVID-19.

As the front-loading of goods gets over and the 245% tariffs make it nearly impossible to import goods from China, small businesses are feeling the heat and facing the worst conditions since the pandemic.

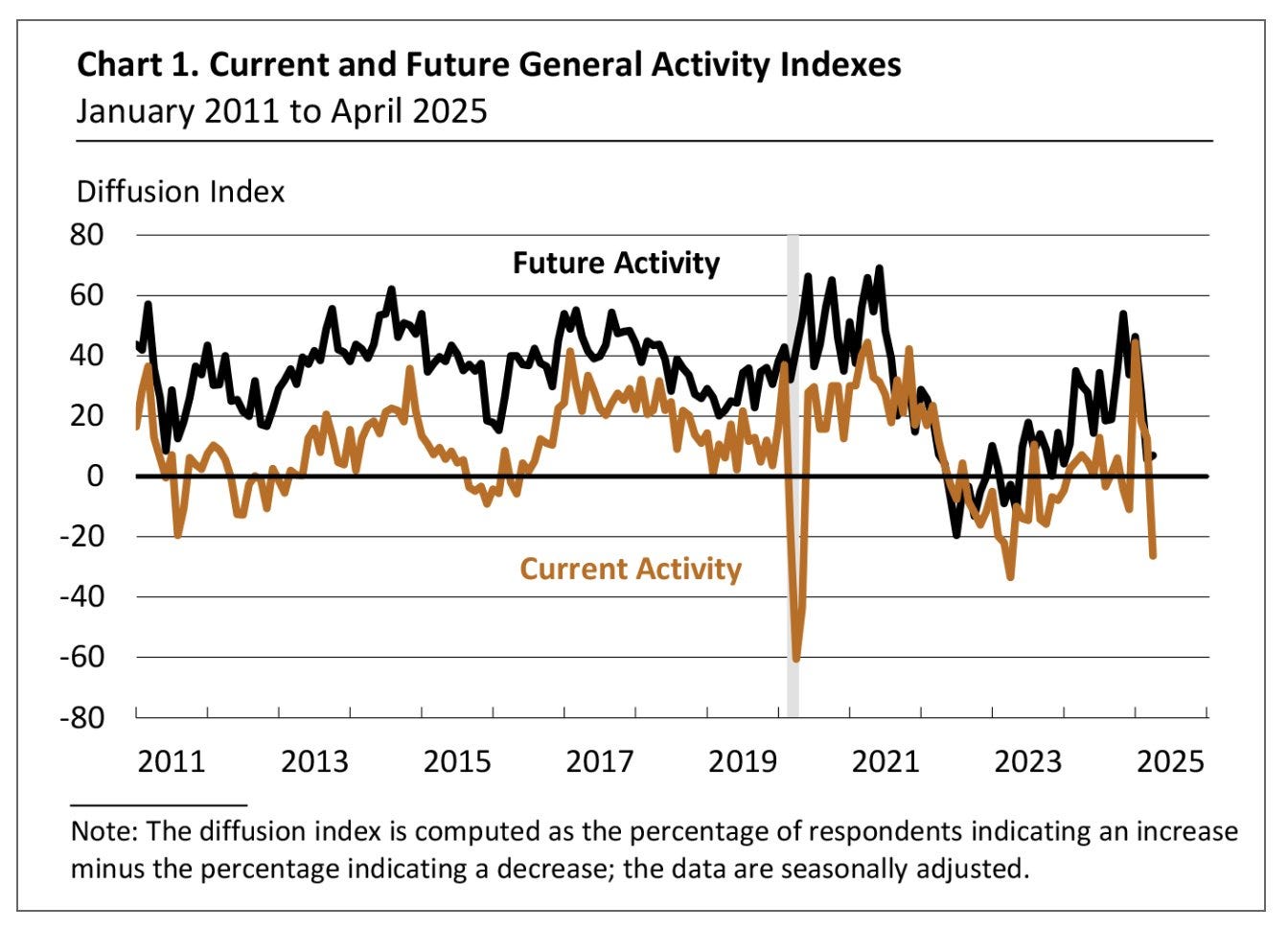

The current activity has moved sharply lower to levels last seen in 2022, when Wall Street economists made a “unanimous” recession call.

Furthermore, future activity is still resilient, but we anticipate it will plunge into negative territory, mirroring the fall in current activity, if the situation remains status quo in DC.

One would argue about the discrepancy between the soft data (surveys) and the hard data.

Nonetheless, in the past few weeks, we have demonstrated that the macro data (hard data) is unreliable because of the front-loading caused by the tariffs in the past few months.

One must be cautious and join the dots, as these types of headlines emerge only when the profound