The golden rule in the 21st-century financial markets is to avoid the narratives circulating like wildfire across social media.

As information arbitrage ends, the only way to make money in markets is to break the psychological barriers and avoid the ocean of narratives.

Since, the beginning of the year, we stayed away from the two major areas where the narratives were rife:

The AI frenzy that led to parabolic moves in the semis.

The duration trade which was the consensus at the beginning of the year.

As a result, we outperformed our benchmark significantly despite short-term underperformance at the beginning of the year.

In fact, since the inception of our macro portfolio (January 2023), we have experienced minimal drawdowns, and the PF is just 0.06% away from ATHs despite the severe correction in both bond and stock markets.

Today, we will explore the possible macro outcomes based on the economic data and examine our PF positioning for them.

Equities!

Equities performance has been fairly resilient with minimal drawdown.

While all the major global indices are down 5-7% from their highs, we are very close to our all-time highs (since inception: 1/1/2023) thanks to our cash holding, hedges and significant outperformance of Thematic Investing bets.

It was a hectic week regarding earnings, with the majority of S&P500 reporting earnings.

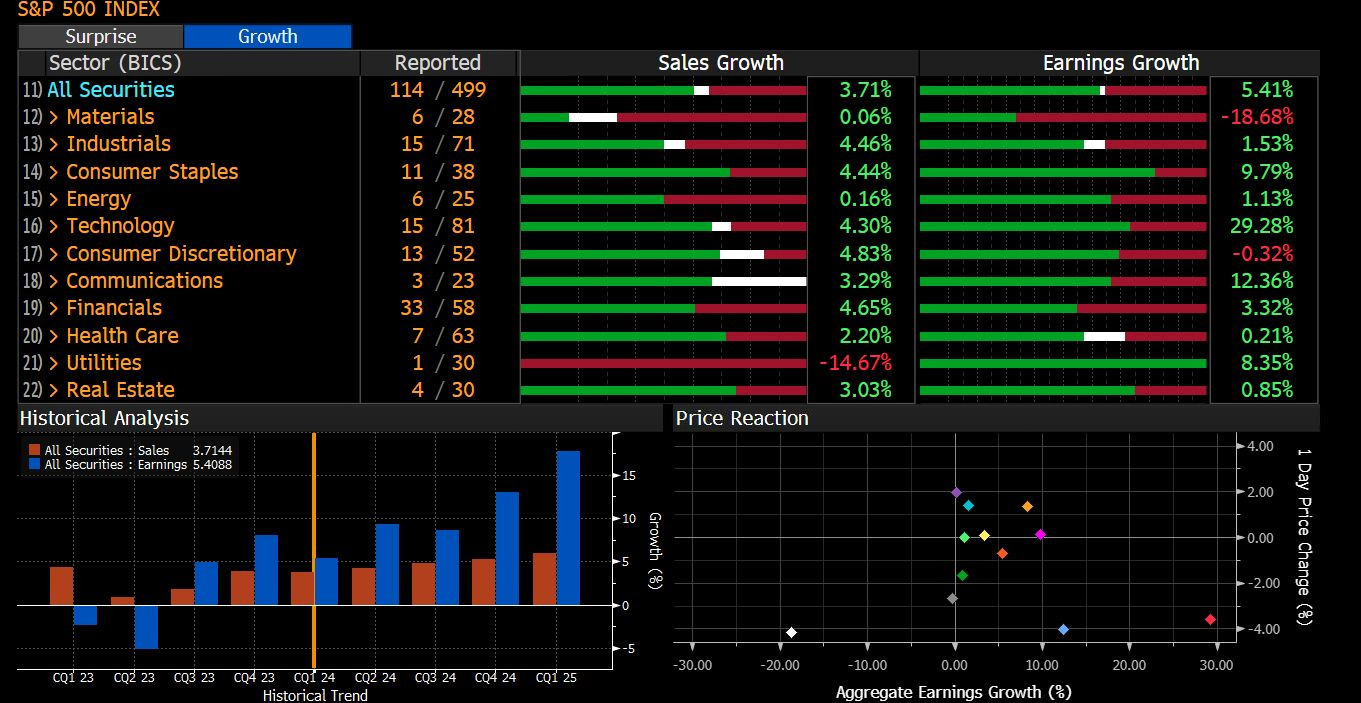

As of Wednesday, around 114 companies released earnings, and the companies related to the real economy disappointed(materials reported a decline of 18.68%).

Furthermore, while consumer staples grew earnings by 9.8%, consumer discretionary has faced immense pressure with a degrowth of 0.32%.

Tech has been an outlier, as has been the case for the past 12 months. Tech earnings grew by 29%.

The earnings season for small-cap (Russell 2000) companies was a howler as earnings fell by 18%.

Note that as the economy turns into expansion (ISM/PMI), contrary to market participants’ expectations, energy, financials, and value have outperformed the “expensive” tech stocks or growth stocks in general.

So, were the markets prepared for the hits and misses in earnings?

What lies ahead— Will we witness the rotation continue?

When we look from the macro perspective, the shift in market leadership or, in other words