Portfolio Performance YTD!

February was a big surprise as the risk rally reached unprecedented heights. The markets are now pricing in a Fed’s terminal rate at 5.25%, expecting a 25 bps hike in March and May and a 50% probability of a 25 bps hike in June; while pushing the rate cuts to 2024 instead of late 2023.

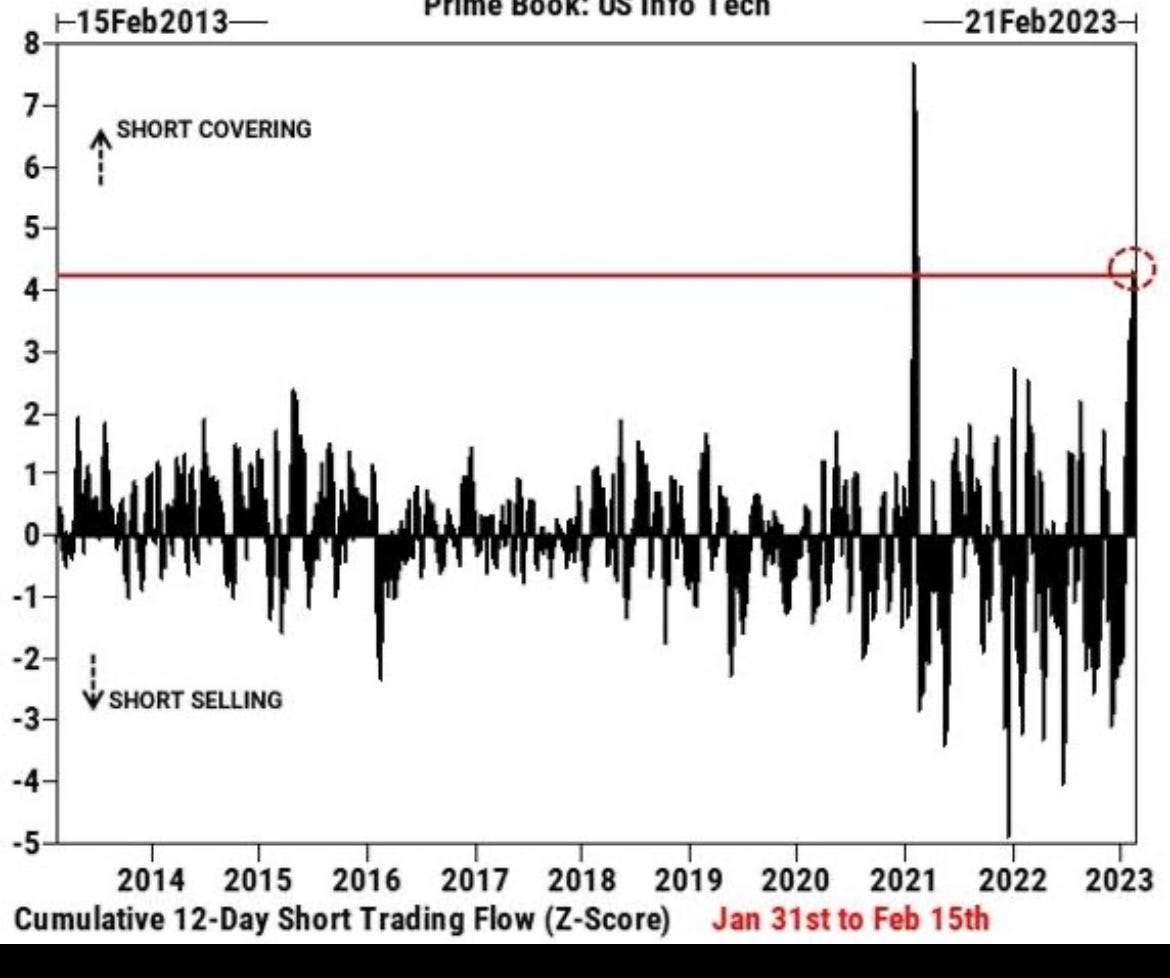

Even after the repricing, the NASDAQ has been flat, and the credit spreads have moved nowhere, thanks to the massive short-covering rally, which market participants believe is the highest in the last decade.

Since we have been “massively” underweight US Stocks, overweight EM and short the HY Credit, we underperformed the benchmark by roughly 125 bps.

PS: We have underperformed our benchmark 60:40 portfolio. The 60:40 portfolio comprises 60% allocation in MSCI World Index (equities) and 40% in Bloomberg Global Aggregate (bonds).