As we end Q12024, uncertainty on various fronts looms large.

The geopolitical scenario is boiling as the world’s largest economy has once again proved that its global leadership position is diminishing with the cancellation of Israel's diplomatic trip, proving a foreign policy blunder.

War rages on various fronts as the multi-polar world is inundated with supply chain disruptions and spikes in commodities due to underinvestment in capex in the last decade.

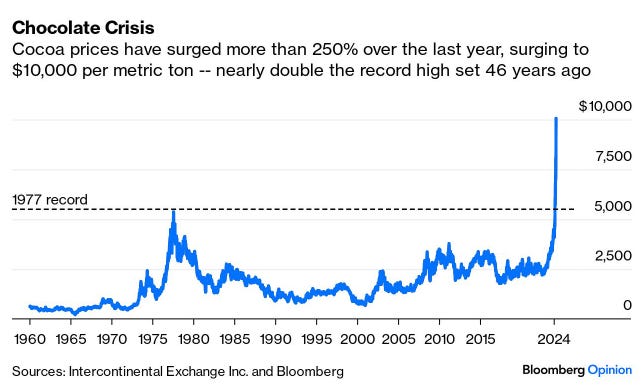

While last year it was uranium, this year it has been the parabolic rise in cocoa which has stunned chocolate lovers.

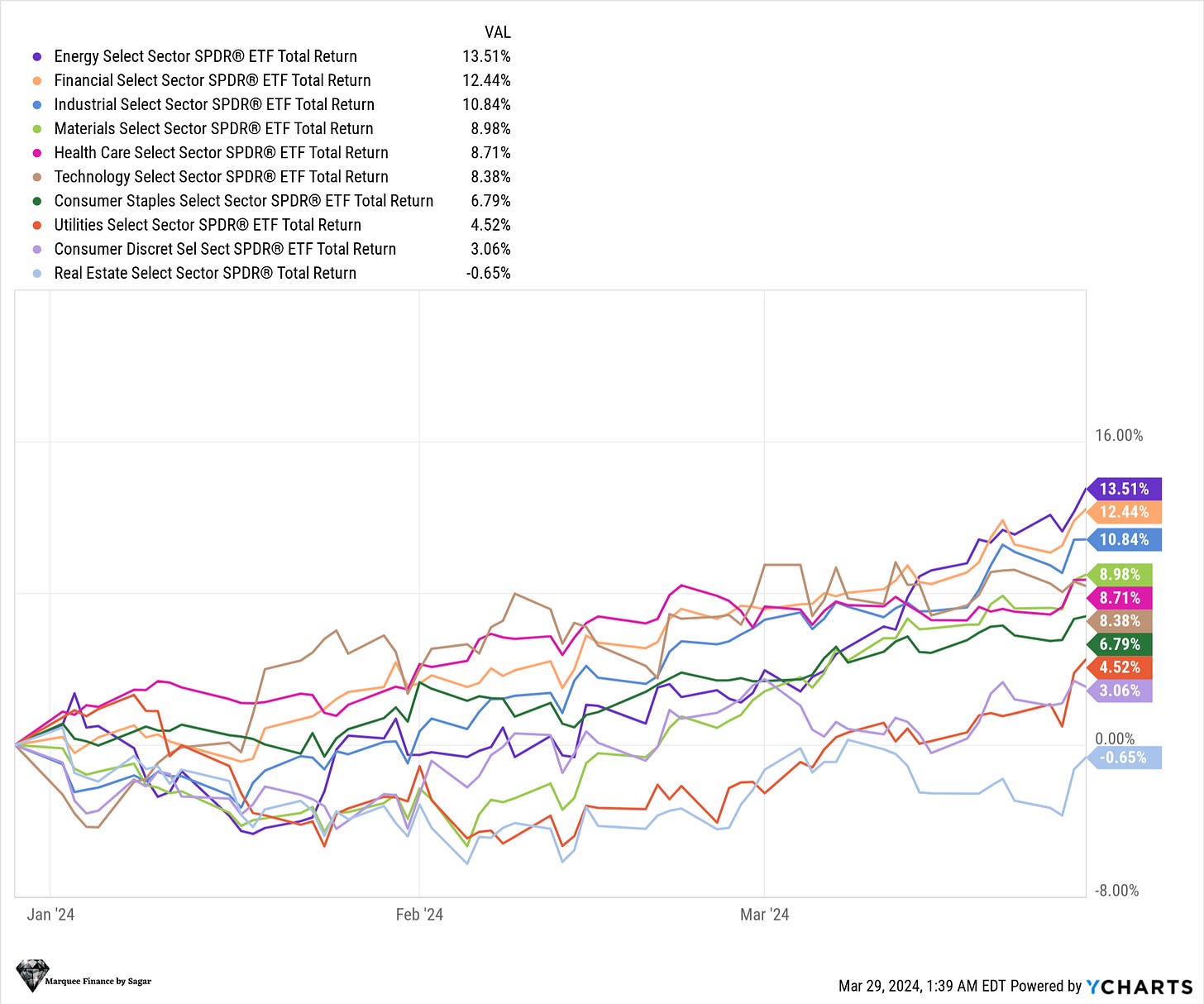

As indicated last month, equity markets have witnessed a silent rotation beneath the surface.

While the chip stocks are in their own universe, sectorial performance has been encouraging as markets are shouting clear and loud that the economy is reaccelerating.

Energy is the best-performing sector in Q1 as oil prices rallied significantly on various tailwinds.

Furthermore, financials, industrials, and materials have made a comeback in the hopes of a normalisation of the yield curve (steepening) and Fed interest rate cuts.

Nonetheless, the underperformance of staples and discretionary demonstrates the companies' challenges as the American consumer is undoubtedly struggling (especially at the bottom of the pyramid).

Today, we will examine how we construct our portfolio, dividing it into long-term positions, short-term macro trades, and hedging one’s portfolio for left tail risk.

In fact, it’s really challenging to have a balanced view when markets move in a straight line, defying gravity.

Furthermore, CB’s quest to artificially depress vol in major asset classes to meet their objectives (primarily stable sovereign debt markets) has resulted in various asset bubbles across the global financial system.

Let’s dig deeper!

Equity!

We have an exposure of around 7 active stock picks and 8 ETFs in our equity portfolio.

Of the 7 picks, three are from the Thematic Investing baskets, and the rest are the country-specific / macro picks.

Overall, Thematic Investing 1&2 has returned 38% since its inception in September last year, and Thematic Investing Part 3 has returned 43% since its inception in November.

While the whole investment community has been jumping back and forth to invest in the tech names, around 80% of our active picks have outperformed the S&P 500 and QQQ in Q1, thus proving that opportunities lie outside the tech universe as well.

The Q1 performance of the active picks is below: