Before I begin, a gentle reminder that the special discount for students who want to upgrade to a paid subscription will be over by 15th November. Interested students can mail me their student IDs to avail the special discount at marqueefinancebysagar@protonmail.com!

The feedback about the monthly portfolio updates has been rousing, and we make sure that it’s released on the last Friday of every month so that we can showcase our monthly performance.

However, it’s a bit early this month, as we have churned a lot in the past few days.

I have always been a conservative investor (one can observe this via my holdings and churn), with a special rule in my playbook to cap the top holding at around 10-11% (except cash).

In rare instances, a super high conviction play with a high-risk reward and a limited downside/upside (long-short), I take the position to upwards of 15% with a cap of 20%.

Having said that, the sole focus remains on risk management with prudent position sizing, even if it means sacrificing short-term gains for superior long-term returns.

So, let us start with November’s portfolio update, where we will look at some of the recent additions and deletions in the portfolio.

Equities!

Overall performance of the equity portfolio remains robust, with the equity portfolio massively outperforming cash and in line with the MSCI World Total Return.

Nonetheless, the recent “stealth” rally caught us by surprise as it did others.

Initially, the euphoria was about the next year's rate cuts and, again, a soft landing narrative with the most shorted basket (example: ARKK) and small-caps outperforming others.

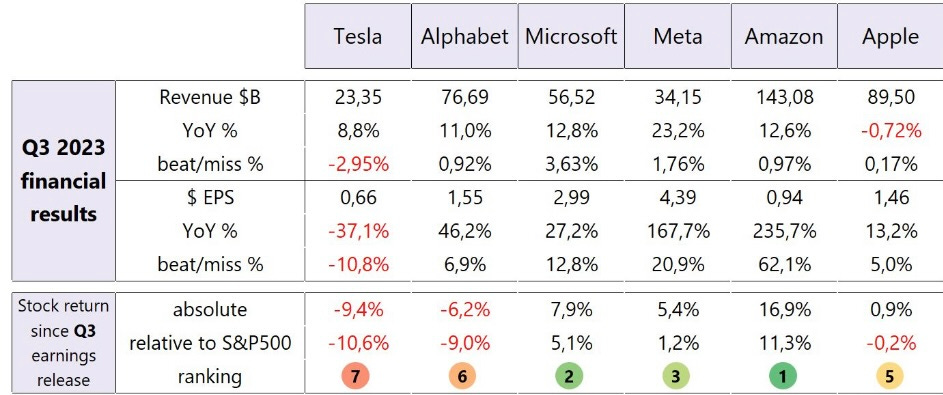

However, as transpired earlier, the rally in the small caps fizzled out, with the S&P 493 underperforming the Mag 7 massively. The Mag 6 has reported earnings, and the performance has been in line or a slight miss here or there.

Ironically, since the peak in NDX in July, Mag 7 has now been reduced