As the newly appointed US President announces draconian “tariffs” and uses the word “most beautiful” in the dictionary to negotiate favourable trade terms with countries globally, we will likely enter a chaotic world if the approach backfires.

Furthermore, the gush of global liquidity is exiting the global equity markets and entering into the US equities, with crypto attracting significant flows as the pro-crypto president sits in the White House, leading to insane valuations across the board.

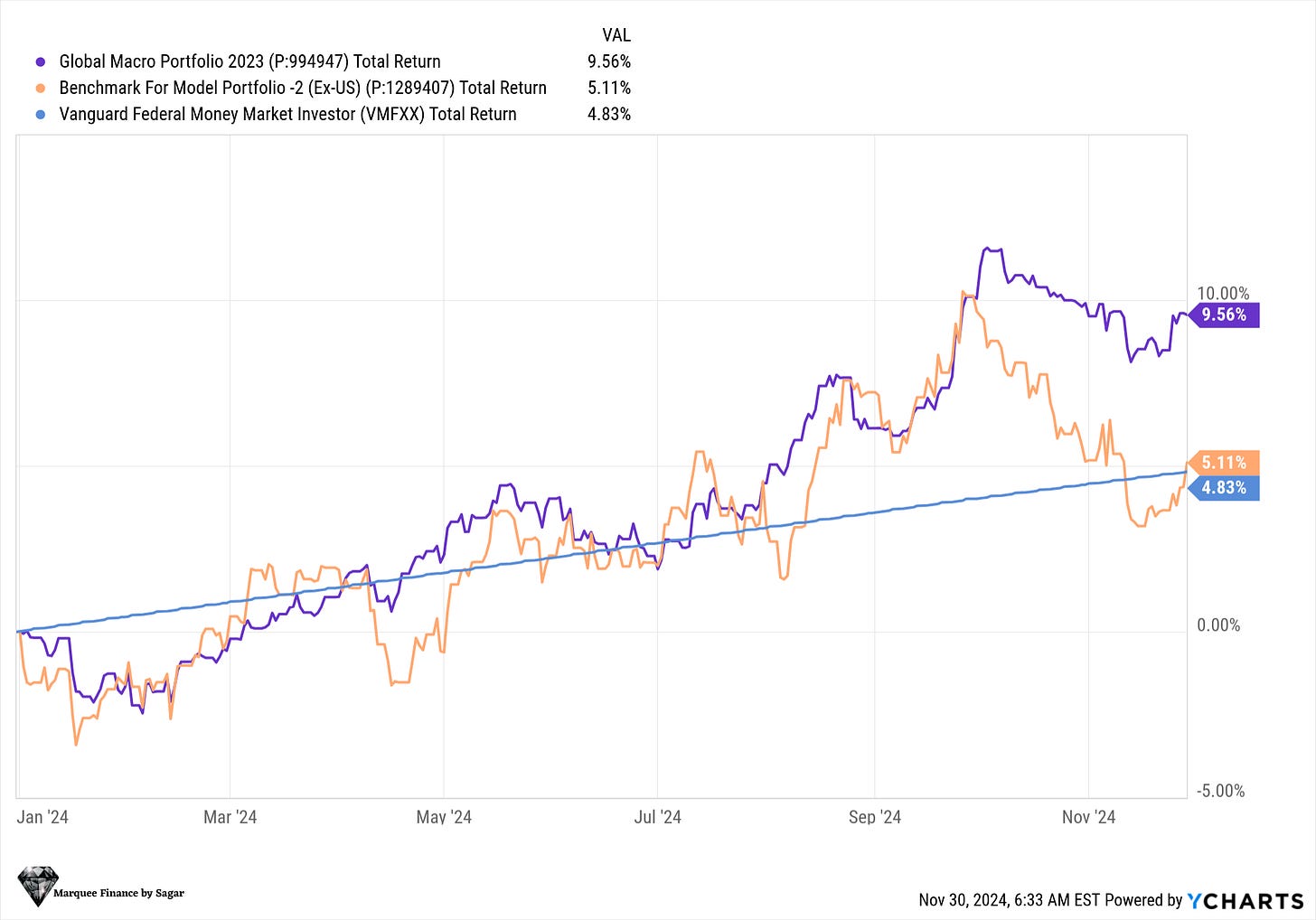

Despite our limited exposure to US equities, we have significantly outperformed the benchmark thanks to our highly profitable trades in the bond, PMs and FX markets.

Thanks to massive equity market gains for the second year, the 60:40 PF has outperformed cash (bonds have been in the bear market for the last 2.5 years).

Let’s look at our positioning (which changed a little this month as we were travelling for half of the month) and outlook for various assets.

Equities!

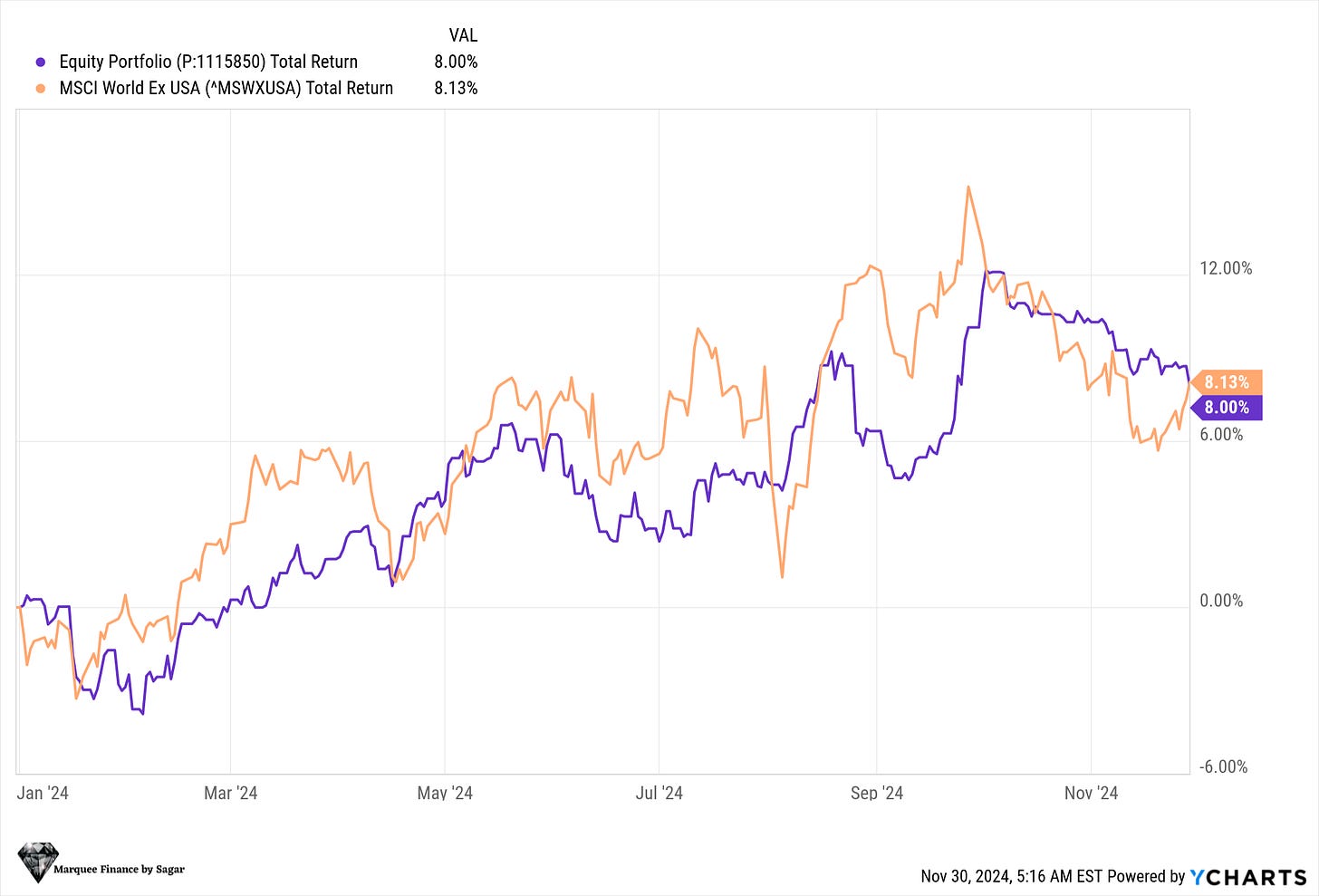

Equities performance has been in line with the benchmark.

Nonetheless, we haven’t been able to generate significant alpha due to our very high cash allocation (now reaching 40% of the equity portfolio). We find the equity markets (mainly the US) highly unattractive due to their astronomical valuations.

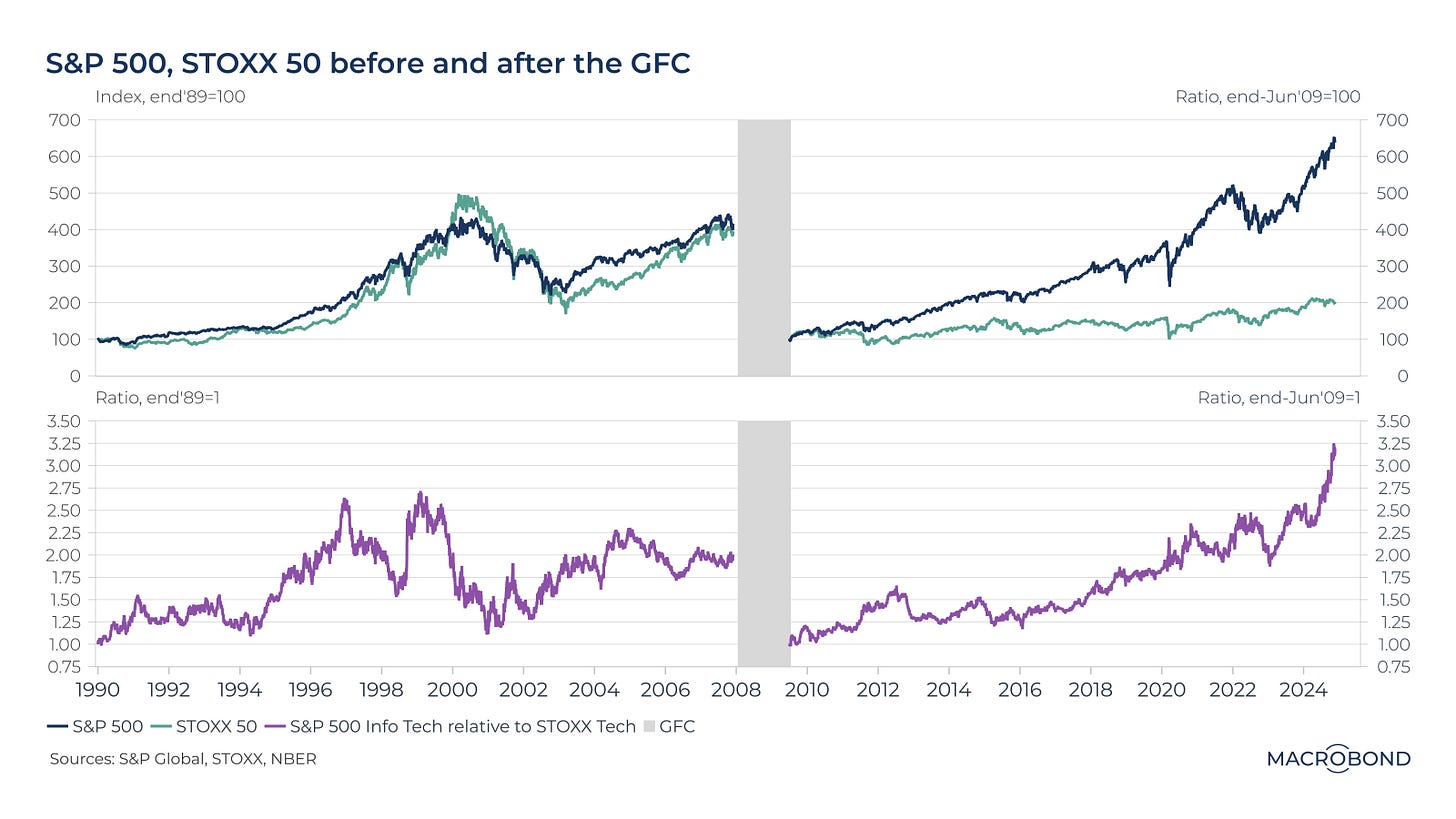

In fact, the US has been facing an unprecedented situation due to the global liquidity being sucked by the US equity markets, especially post the 5th November results.

In last month’s portfolio update, we explored in detail the various valuation metrics we used to track the US equity markets. Our stance has not changed, as multiples across the US markets have continued to rise.

In fact, the valuation gap to its peers has seen an astronomical rise due to the US tech supremacy and significant multiple expansion in the US, as Donald Trump promises to lower corporate tax rates and deregulate the industry.

Furthermore, the equity risk premium continues to compress and is now at levels last seen during the dot com bubble.

Moving on, we spotted a potential red flag this week.