We are entering into the most pivotal week of the next 60 days.

As we head into the last week of October, we will have:

BOJ and Fed rate decisions next week.

Trump-Xi meeting likely as POTUS travels to South Korea for the APEC Summit.

Mega Tech (Mag 7) earnings ex-NVDA.

There are enough catalysts this week that could alter the direction of global financial markets for the rest of 2025.

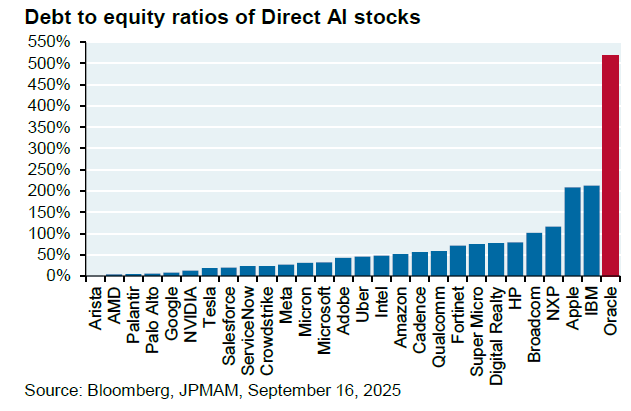

As AI capex heads towards max throttle, it’s imperative to assess funding for the enormous capex.

Even the most cash-rich companies are now taking on debt, raising fears about their health if returns on investment are subdued in the coming years.

In fact, banks will now finance $38 billion for Oracle’s data centres, despite Oracle having the highest Debt/Equity ratio among large tech companies.

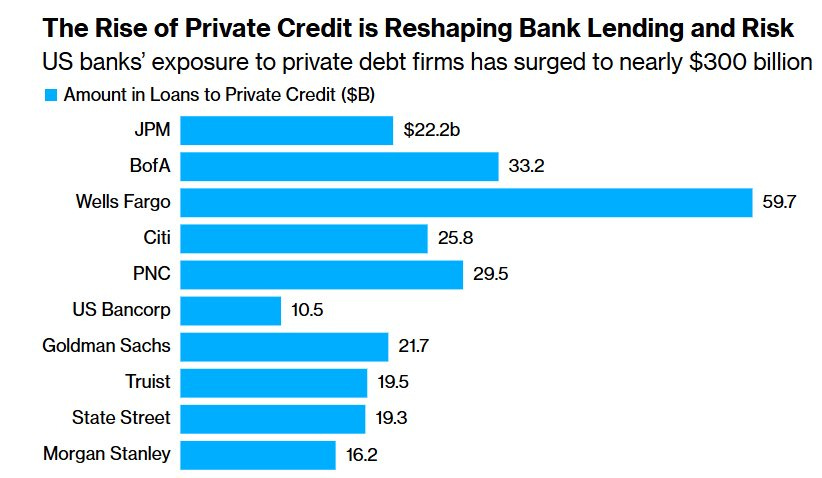

Furthermore, as the private credit cockroaches emerge, we finally have the exposure of individual banks to the private credit universe.

Although we believe there is nothing to worry about in the near term, the above data points undoubtedly indicate that risks are piling up across the banking sector and the AI Capex story.

Our PF hit ATHs yesterday, with a YTD return of 23.21%, beating the benchmark by over 150 bps.

Furthermore, the drawdown has been shallow, and we have successfully nailed the breakouts in Gold, Silver, Oil, Copper, and Ether over the last few months.

Overall, it is turning out to be a glorious year despite elevated volatility and extreme uncertainty.

Global Macro!

The most-awaited macro data of the month was released yesterday despite the US Government shutdown.

The headline and core CPI came in softer than expectations.

While the headline CPI came in at 0.3% MoM v/s expected 0.4%, the Core CPI came in at 0.2% v/s expected 0.3%.

When we analyse in detail, the shelter, as we have been mentioning for the past few months, has been the one which is putting downward pressure on the CPI.

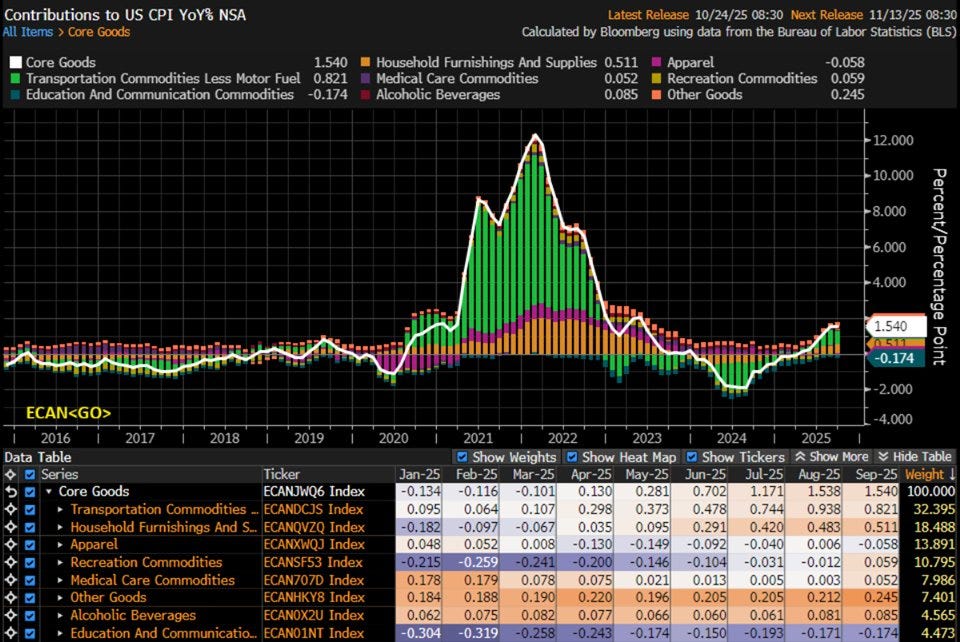

On the contrary, the overall trend shows that Core Goods have been moving higher over the past few months due to tariffs.

We expect the core goods to remain sticky as the old inventory replenishes and the full effect of tariffs materialises in the next few months.

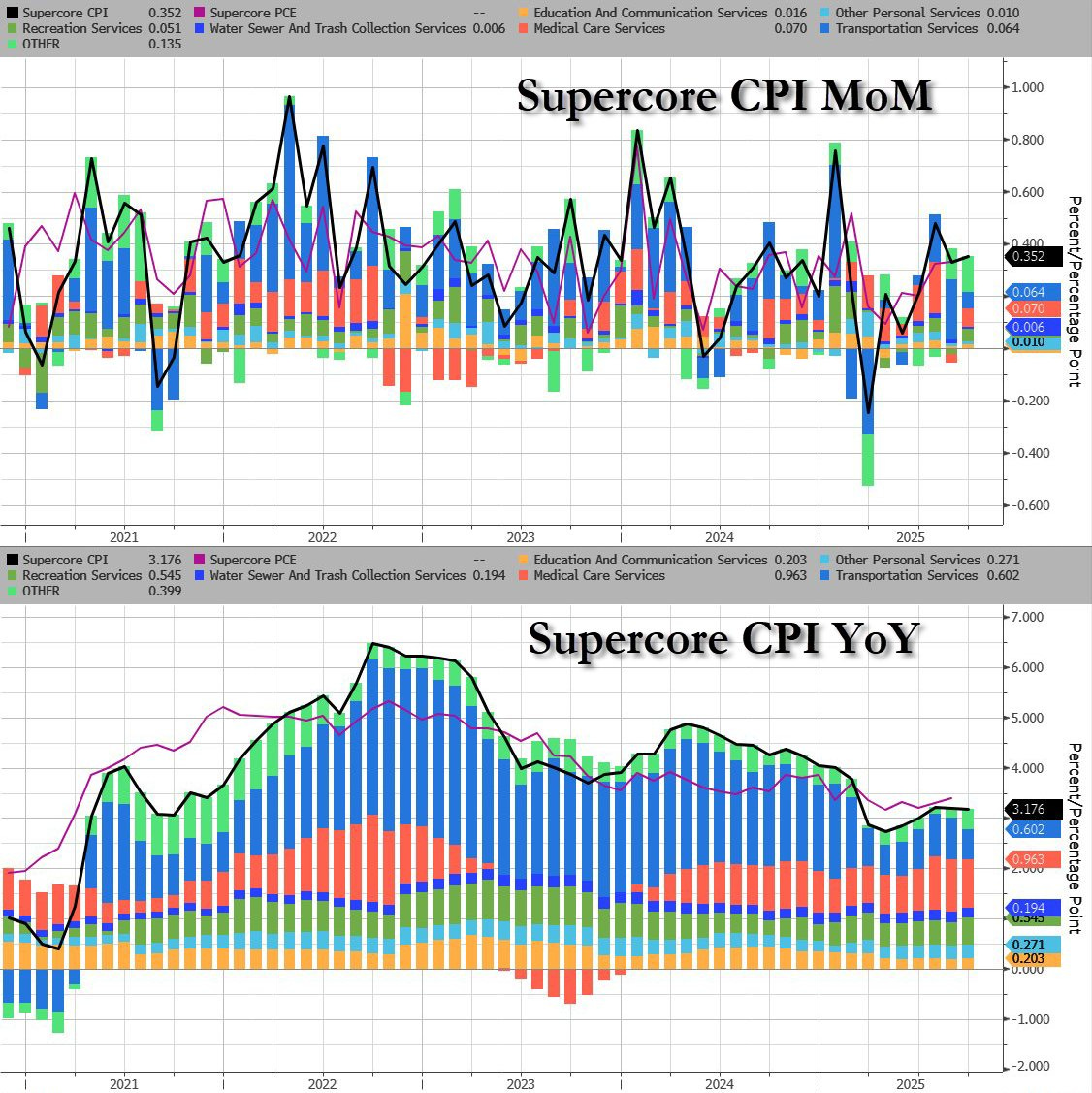

Further digging deeper, JayPo’s popularised measure, the Services-Ex Shelter or the Supercore CPI, moderated slightly but is still running at 0.352% MoM.

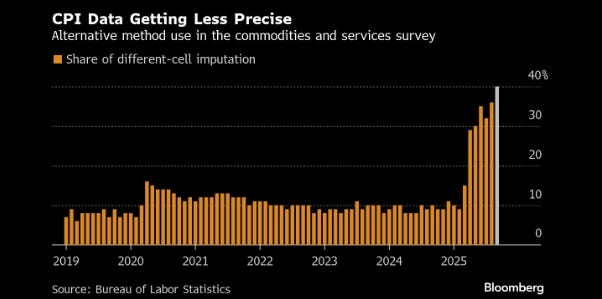

The one chart you don’t want to miss is the share of different cell imputation, or the chart that shows the CPI is becoming less precise with each passing day.

Despite enough evidence out there to portray that the data is being manipulated, according to our estimates, the CPI is going to print: