As we approach the end of a tumultuous 2025, there is a high probability that we will once again witness turbulence in the financial markets.

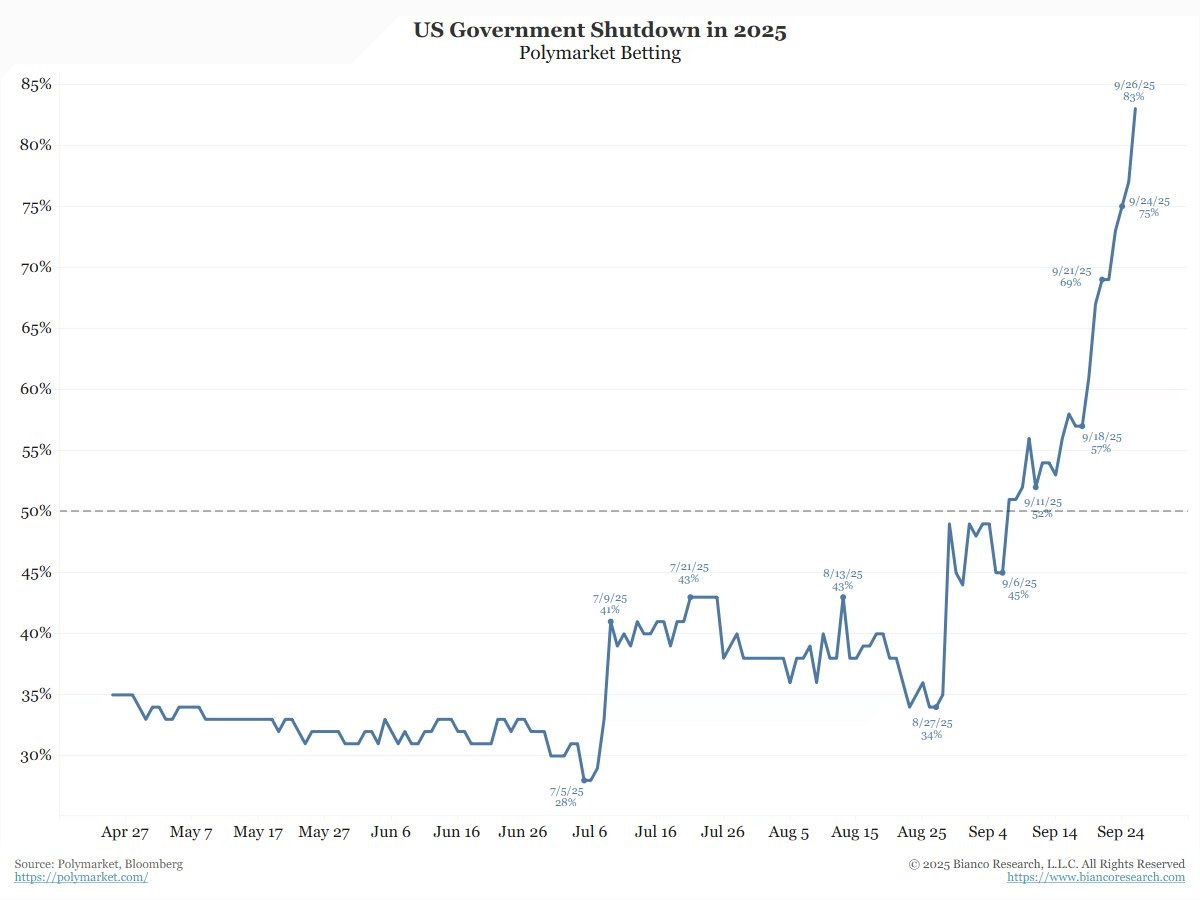

According to Polymarket, there is an 83% probability that a US Government shutdown will occur within the next 72 hours.

In the event of a government shutdown, the government operations deemed “nonessential” will be shut down, including the BLS and other government statistical agencies.

As a result, no government reports will be released during the shutdown, which might begin on Wednesday morning.

Note that the longest government shutdown was 35 days from December 2018 to January 2019 (Trump 1.0).

If a shutdown of similar magnitude transpires, there will be no NFP and CPI report and the Fed would have to decide the policy on 29th October without the key macro data causing chaos in the financial markets.

Furthermore, geopolitical tensions are escalating with every passing day as the peace talks appear to have stalled.

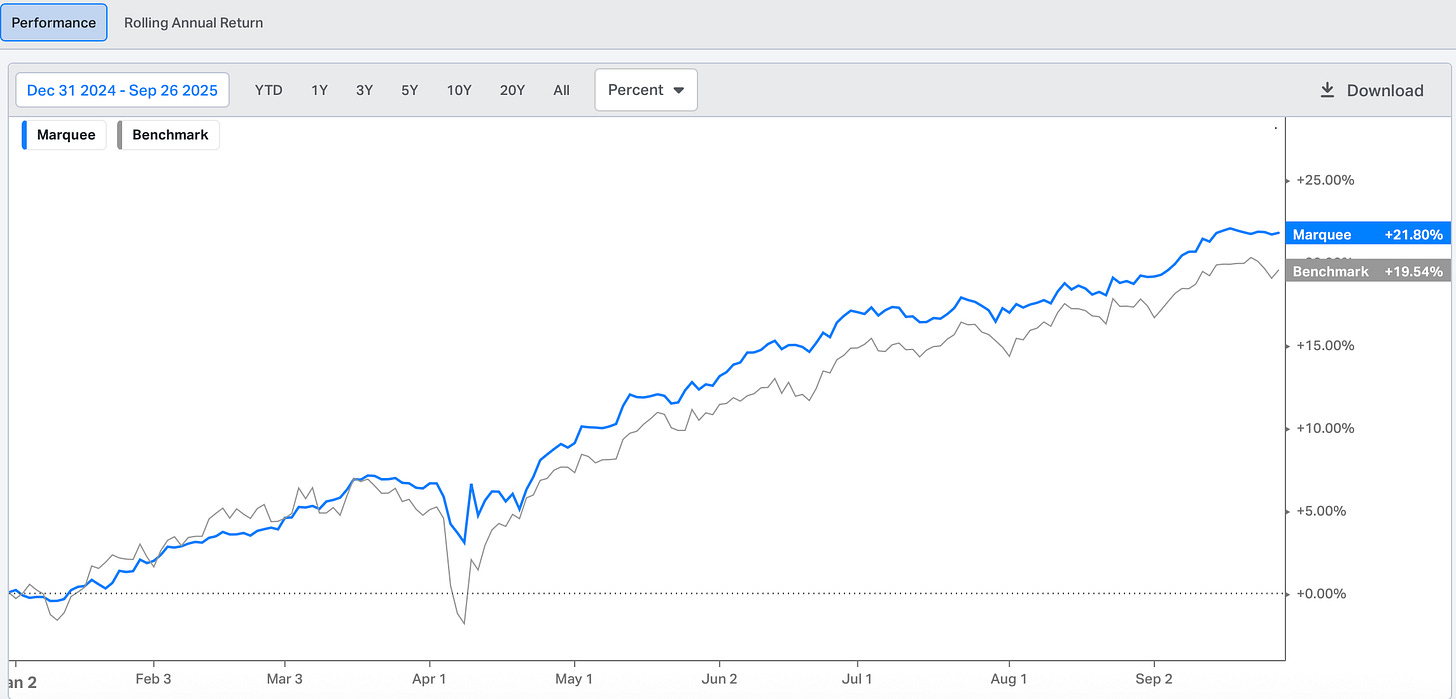

We have positioned our portfolio to weather any storm in the coming days and weeks.

We are glad to inform you that we are up by 21.8% YTD compared to a return of 19.54% for the benchmark (more than 240 bps of outperformance).

PS: Benchmark is 60% MSCI ACWI & 40% Bloomberg Global Aggregate.

Global Macro!

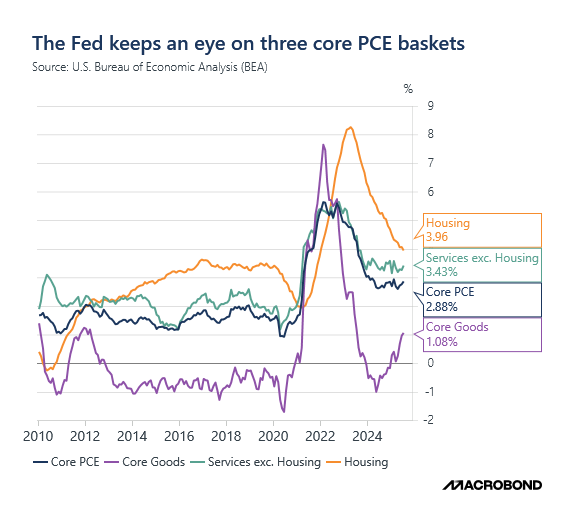

The Fed’s preferred inflation measure is the PCE, which was released yesterday.

US PCE and Core PCE came in line with expectations at 0.3% MoM and 0.2% MoM.

JayPo told us at the FOMC presser that the entire move up in inflation was led by Goods inflation.

We can see from the chart that Core Goods inflation has been rising relentlessly from the bottom.

Nevertheless, the silver lining has been the Housing Inflation, which has fallen off a cliff. Furthermore, with the immigration situation, we can expect a further fall in housing inflation.

The Supercore (Services Ex-Housing) and the Core PCE are once again on the rise. With the Fed's cut and elevated asset prices, expect inflation to rise further.

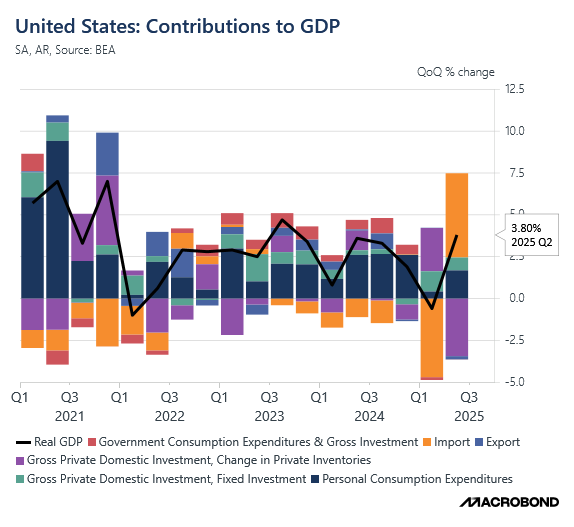

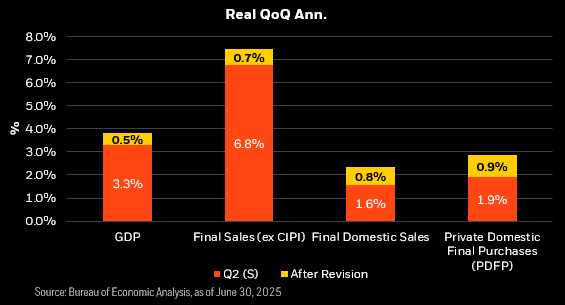

Although we are not a big fan of GDP due to its lagging nature and a lot of revisions, we would like to draw your attention to the volatility in the GDP data due to the trade data in the last two quarters.

Furthermore, a large drawdown in inventories was a significant drag this quarter.

Nonetheless, the private domestic final purchases (PDFP), JayPo’s favourite measure, was revised up by almost 100 bps.

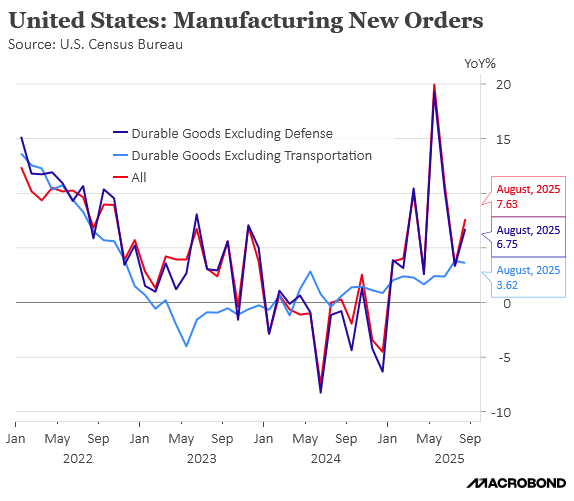

For us, the highlight of the week was the significant increase in durable orders.

Durables Ex-Transports came in at 0.4% vs expected 0%. If we analyse in detail, we can see that the trend here is strong and is likely due to the boost from the AI Capex.

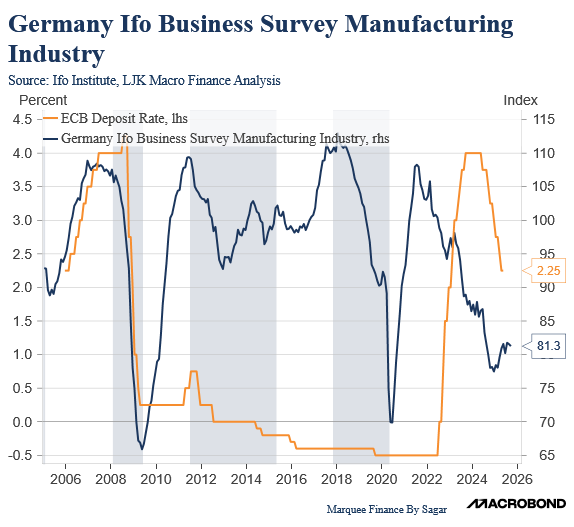

Moving on to Europe, the IFO Business Survey remains stagnant, having failed to move further higher after a sharp recovery in the last few months.

We believe that the transmission of lower rates aided the sentiment in the past few months.

We will closely monitor future readings to gauge the trend here.

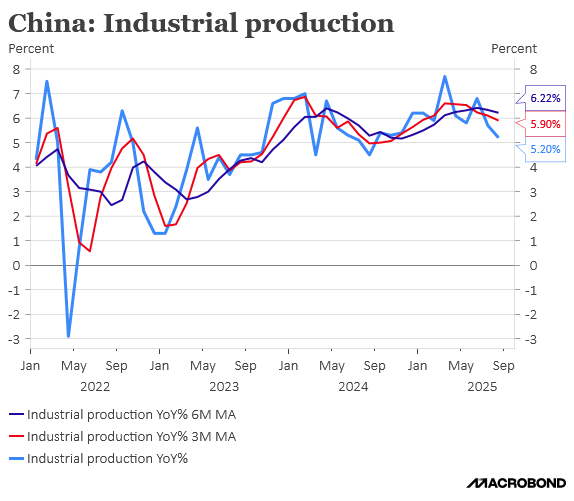

In the East, Chinese Industrial Production is off its peak and has fallen to nearly a 12-month low.

The data can be distorted due to the front-loading of the tariffs that took place in Q2 and

Nevertheless, if the downtrend persists, one should be cautious of the impending global slowdown.

Equities!

Total Equity Allocation as of today: