Wishing Everyone A Happy And Prosperous New Year!

2025 in financial markets was marked by elevated cross-asset volatility as the world was stunned by a “Global Trade Reset”.

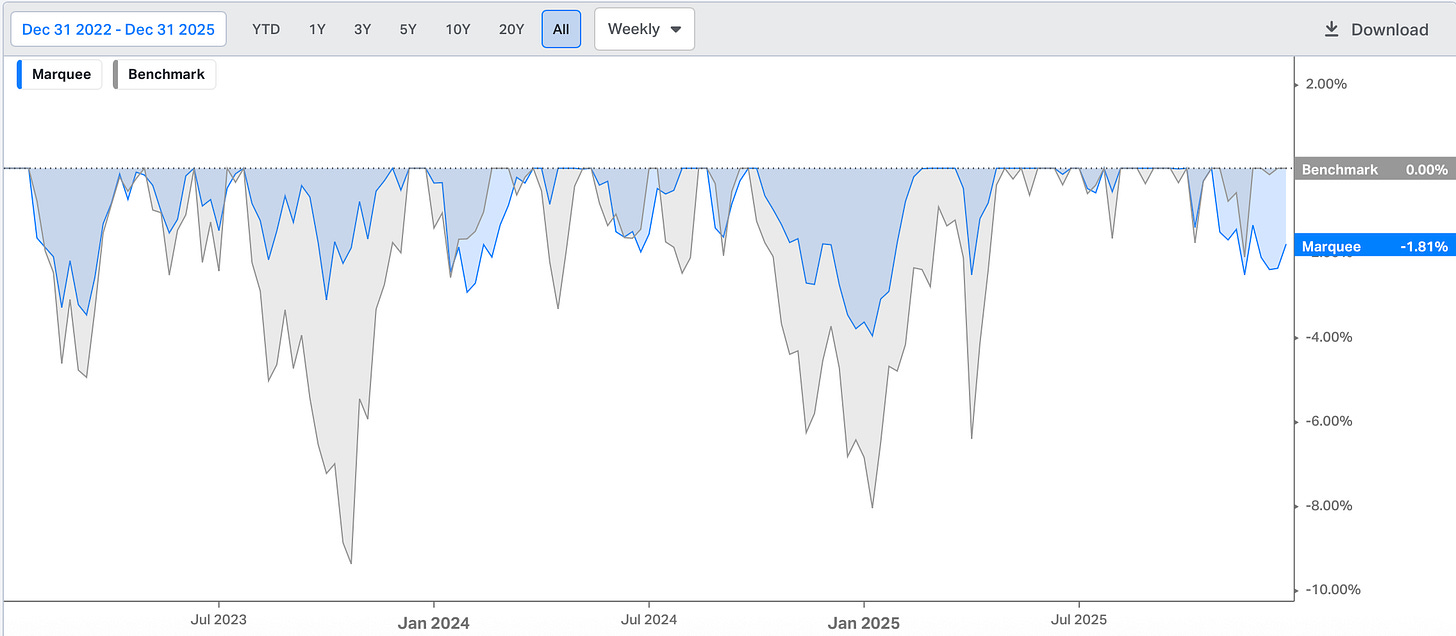

We successfully navigated the turbulent times by limiting the drawdown during the crash on Liberation Day.

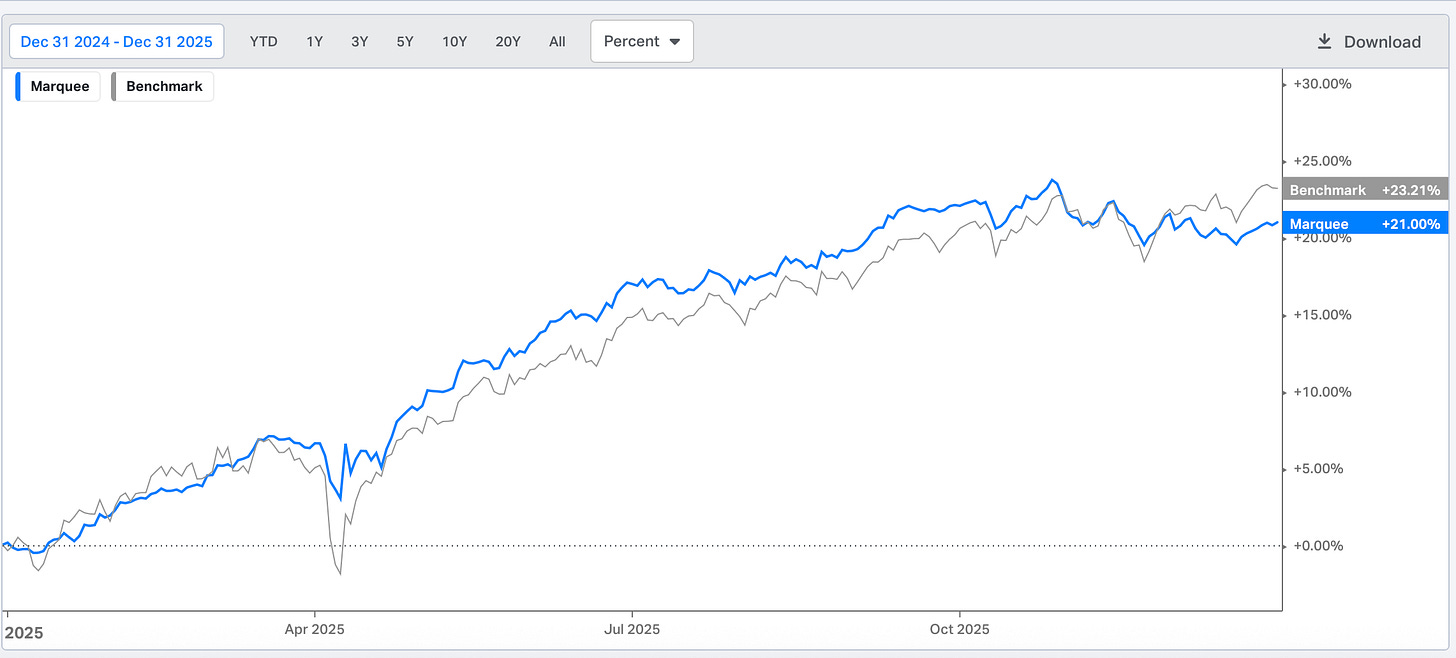

Although we outperformed the benchmark (60% MSCI ACWI and 40% Bloomberg Global Aggregate) for most of the year, in the last month, we underperformed as we raised cash significantly and protected the gains made throughout the year.

We ended the year with 21% YTD returns (the best year since the launch of our Substack).

We accurately predicted the cross-asset moves.

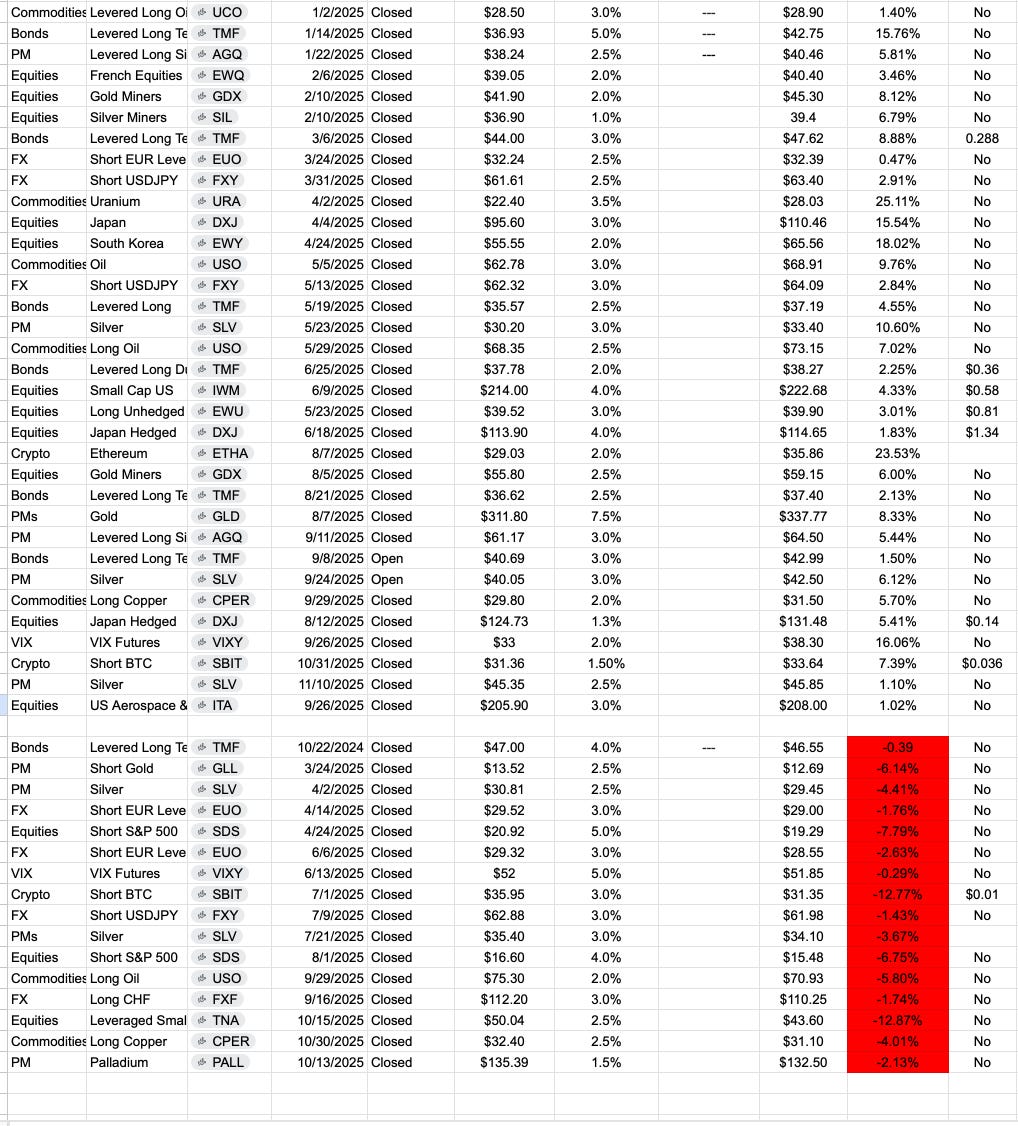

We had 34 winning trades and 16 losing trades.

Overall, a win rate of 68% with an average gain of 7.3% and an average loss of 4.66%.

Note that we have four open trades.

Furthermore, except for this trade book, we also booked profits in the thematic investing bets in our equity portfolio (stock names hidden).

Across these trades, the average gain was 60%.

We could have maximised the gains and ended the year up by more than 30% if we had held to our positions a little longer.

Nevertheless, with our proprietary momentum strategy ready to be deployed in 2026, we will likely address this weakness and further enhance our returns.

Winners!

Some of our best calls this year have been:

In Q1, we got the long-bond call right and made a massive gain by taking the bet through a leveraged ETF. We also traded long bonds multiple times with a hit rate of 80%+ (only one losing trade out of 7).

We were in cash (around 30%) during the liberation day crash and went all in in the first week of April. As a result, we nailed the bottom in global equities.

We predicted the massive breakout in Japanese stocks and took long positions thrice via DXJ in April, June and August. Glad we were able to capture 80% of the upmove in NIKKEI.

Out of the 90% gains in the South Korean ETF EWY this year, we were able to capture a quarter of the move. We exited early and could have maximised the gains here.

We caught the Gold breakout in August and captured the move to $3800. Furthermore, we also took long Silver positions multiple times last year.

We also took positions in Gold and Silver miners multiple times and exited each time with gains. We had been bullish on miners and PMs for most of the year.

We also got in early in URA (Uranium) as we have been big believers in the nuclear renaissance.

We called the top in USDJPY twice and made money by shorting the FX pair throughout the year.

We successfully traded the enormous Ethereum breakout in August and also traded BTC profitably by shorting it around $108k (called the top in BTC around $121k in October).

Despite a bear market in Oil, we had success with long positions, catching the bottom in May.

Open Positions/ Current Asset Allocation!

Equities!

PS: Note that paid subscribers can access the detailed portfolio via the spreadsheet (link in the end).