Shaky Foundation?

Following the Global Financial Crisis (GFC), financial markets have become increasingly reliant on cheap and abundant liquidity.

Even a slight indication of liquidity evaporating leads to a drawdown as valuation multiples compress.

It’s a known fact that “excess” liquidity in the financial markets distorts the pricing of risk assets, especially if the momentum is strong, led by the retail euphoria.

We have seen immense participation by retail investors, which has led to a spectacular move in the US equity markets post-Liberation Day.

As a result, U.S. household ownership of stocks is at the highest ever at 49%.

The valuations of the market-weighted index have been hovering around the highs and are now again at the levels seen during the 2021 highs.

On the other hand, the equal-weighted index is fairly valued, indicating that the “expensive” mega caps have been driving the index higher, leading to concentration risks.

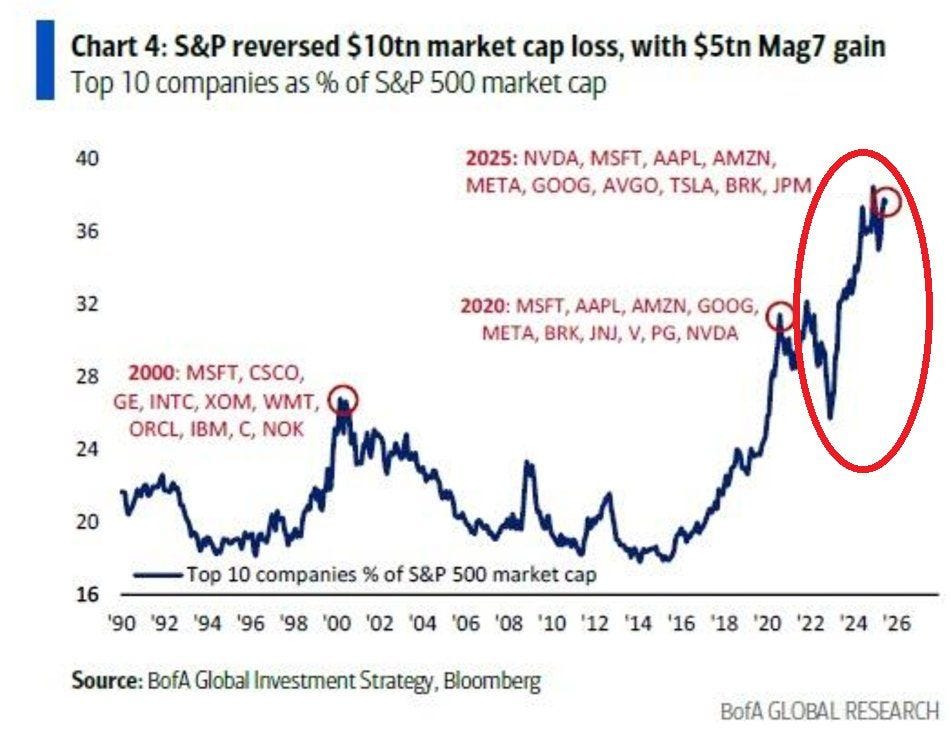

Interestingly, the top 10 companies, as % of the S&P 500 market cap, have now reached an unprecedented level of 38%.

Thus, various data points suggest that the foundation is shaky.

Furthermore, we are fast approaching the August 1st deadline, and with Trump adamant on similar/higher tariffs compared to Liberation Day, markets are underpricing the risk of the tariff shock.

Considering the overall volatile environment, our performance has been steady with a 16.5% YTD gain compared to 14.94% gains for the benchmark.

Let’s dig deeper into the macro universe and analyse the cross-asset moves.

US/Bonds/Equities/Gold/DXY/Ether

Let’s begin with the PPI data, which was a shocker as it came significantly below expectations.

While the headline came in at 0.0% MoM v/s 0.2% MoM expected, the PPI core came in at -0.04% MoM v/s expectations of 0.2% MoM.

Interestingly, the drag was from Services (exactly opposite of what transpired last month).

The CPI came in line with estimates, with a slight miss on the Core CPI.

While the headline came in at 0.3% MoM, the core came in at 0.2% v/s expectations of 0.3%.

Nonetheless, a closer examination reveals signs of inflation bottoming out.

Services Ex-Shelter, which was the preferred gauge for JayPo two years ago, also rose slightly.

While services form a large part of the CPI (where there is moderation), goods inflation has been moving higher, especially in categories that are highly sensitive to tariffs.

As a result, the million-dollar question remains whether the tariff pass-through has occurred or is yet to occur.

While market participants have differing views, with some suggesting that the tariff effects have already been factored in and that we won’t see higher inflation due to tariffs in the coming months, the empirical evidence….