Status Quo!

One of the most significant lessons we have learned over our past 14 years of analysing, trading, and investing is that market participants come up with multiple reasons for the rise and fall in asset prices.

Due to the inherent human traits of greed and fear, markets invariably swing to extremes. This is particularly evident during bear and bull markets, where acute pessimism and optimism prevail.

While the mammoth rise in risk assets in the last year and a half was attributed to AI, liquidity, central bank intervention, earnings growth, etc., the plunge in the second half of July was blamed on excessive leverage in the system, reversal of carry trades, recession talks, AI bubble burst, earnings disappointment etc.

Due to the reasons mentioned above, smart money often creates narratives across social media and benefits from the innocence of dumb money. As a result, pump-and-dump is still active across the system, especially in highly volatile risk assets.

Nonetheless, since the beginning of the substack, we have remained focused on macro data and our long-standing belief in mean reversion.

There “will be” inevitable ups and downs in the journey, but what always matters is the end goal, which is generating alpha while rigidly following the process.

As markets recover from the “vol” shock of the BOJ hike, we today look at a slew of macro data releases and ponder what’s next for markets!

Let’s dig in!

US!

We got the most important macro release of the month this week: CPI data.

It was broadly in line with estimates as the headline number came in at 2.9% (below 3% for the first time since March 2021).

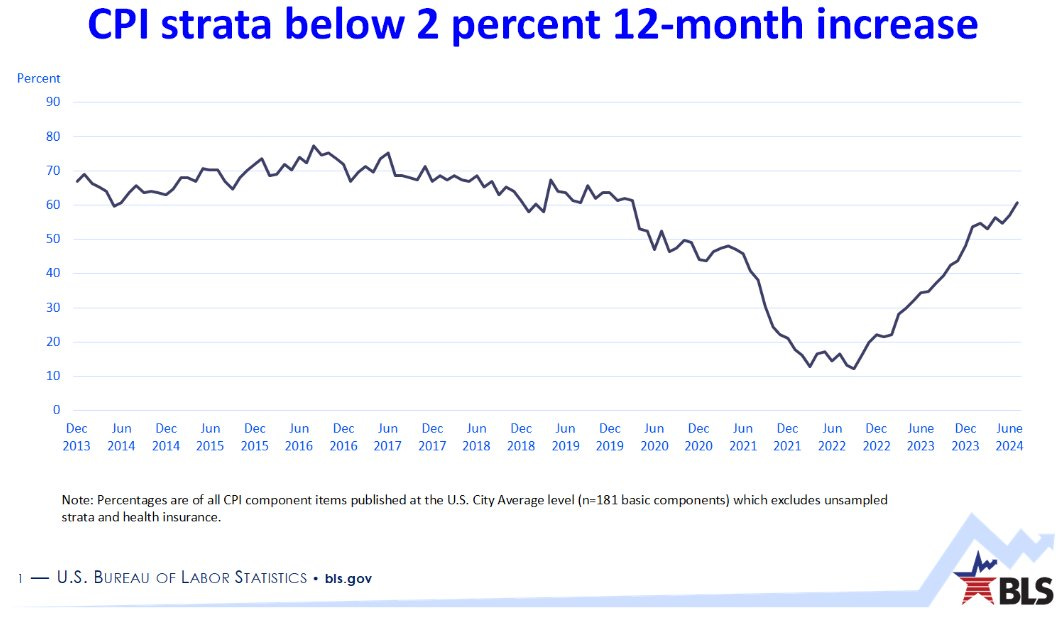

However, what caught our eye was the broad deflation that has now affected most goods and services.

According to BLS data, more than 60% of the CPI components are now trending below the 2% mark (annualised).

Well, it’s a significant achievement for the Fed. Nonetheless, one can’t ignore that it’s also a sign that the economy is slowing rapidly under the hood, as visible from the consumption trends.

Furthermore, JayPo’s favourite indicator, Supercore (Services-Ex Housing), saw a big bump this month (0.4% MoM rise).

Just to remind everyone, the Supercore had been trending down in the past few months, and thus, this month was an upside surprise.

Overall, the trend continues with broad deflation, while some service components demonstrate stickiness.

Updating our chart, we predict that the December CPI will be around..